Input Service Distributor Mandatory Registered Section 24(Viii) CGST ACT 2017

Input Service Distributor stands for Input Service Distributor and has been defined u/s 2(61) of the CGST/SGST Act. It is basically an office meant to receive tax invoices towards receipt of input services & further distribute the credit to supplier units (having the same Permanent account number) proportionately. According to the Section 24 of CGST Act,2017, an Input Service Distributor (ISD) whether or not separately registered under the Acts, is required to get registered. the appliance for obtaining registration is required to be made in Form GST REG-01.

Input Tax Distributor (ISD) can issue Tax Invoice.

As per Rule 54(1) of CGST Rules, 2017, states that an Input Service Distributor invoice or because the case could also be, an Input Service Distributor credit note issued by an Input Service Distributor shall contain the subsequent details:

- Name, addresses, and GSTRIN of the Input Service Distributor.

- A consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters like hyphen or dash and slash symbolized as “-“.”/” respectively, and any combination thereof, unique for a twelvemonth.

- Date of its issue.

- Name, address and GSTIN of the recipient to whom the credit is distributed.

- Amount of the credit distributed, and Signature or digital signature of the Input Service Distributor.

Provided that where the Input Service Distributor is an office of a financial organization/bank/banking concern/financial institution/financial organization/financial organization} or a financial institution including a non-banking company, a tax invoice shall include any document in lieu thereof, by whatever name called, whether or not serially numbered but containing the knowledge as prescribed above.

Input Tax Distributor (ISD) Not Applicable

ISD cannot distribute the input credit within the following cases:

- Supplies, where ITC is paid on inputs and capital goods. for example, raw materials and machinery purchased.

- ITC cannot be distributed to outsourced manufacturers or service distributors.

Purpose of registering as ISD - The concept of ISD may be a facility made available to businesses having an outsized share of common expenditure and billing or payment is finished from a centralized location. The mechanism is supposed to simplify the credit-taking process for entities and therefore the facility will strengthen the seamless flow of credit under GST.

|

BASIS |

PRE GST-REGIME |

POST GST REGIME |

|

ELIGIBLE PERSON |

AN OFFICE OF THE MANUFACTURER OR PRODUCER OF FINAL PRODUCTS OR DISTRIBUTOR OF OUTPUT SERVICE |

AN OFFICE OF THE SUPPLIER OF GOODS AND/OR SERVICES |

|

DOCUMENTS REQUIRED |

RECEIVES INVOICES ISSUED UNDER RULE 4A OF SERVICE TAX RULES, 1994 TOWARDS THE PURCHASE OF INPUT SERVICES |

RECEIVES TAX INVOICES ISSUED BY SUPPLIER TOWARDS RECEIPT OF INPUT SERVICES |

|

PROCEDURE FOR DISTRIBUTION |

ISSUANCE OF INVOICE, BILL OR CHALLAN FOR DISTRIBUTING TO SUCH MANUFACTURER OR PRODUCER OR DISTRIBUTOR. |

ISSUANCE OF AN ISD INVOICE FOR DISTRIBUTING TO A SUPPLIER OF TAXABLE GOODS AND/OR SERVICES REGISTERED UNDER SAME PAN |

|

TAX THAT CAN BE DISTRIBUTED |

THE CREDIT OF SERVICE TAX PAID ON THE SAID SERVICES |

THE CREDIT OF CGST (OR SGST) AND/OR IGST PAID ON THE SAID SERVICES |

|

ELIGIBLE RECIPIENT OF CREDIT |

TO ITS UNITS AND OUTSOURCED MANUFACTURERS |

TO SUPPLIER HAVING THE SAME PAN. I.E CREDIT CANNOT BE DISTRIBUTED TO OUTSOURCED MANUFACTURERS OR SERVICE DISTRIBUTORS. |

Thus, on looking into the highlighted differences between the 2 regimes, distribution of credit is restricted to the office having the identical PAN. the rationale may be because of the shift of taxable event from manufacture to produce. The liabilities would arise at the time of supply which might be ultimately paid by ISD on the utilization of accessible input decrease.

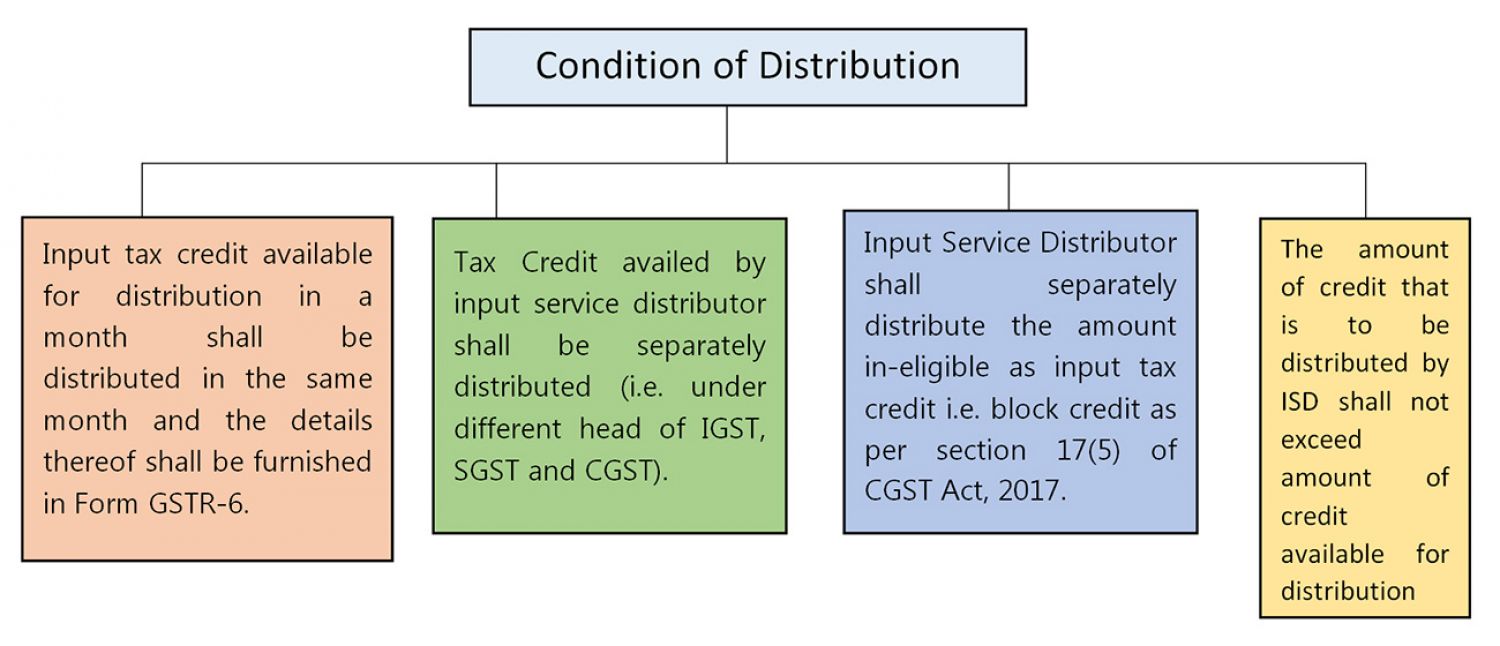

CONDITIONS TO BE FULFILLED BY INPUT TAX DISTRIBUTOR (ISD)

- Input Service Distributor should compulsorily register as “ISD” except its registration under GST as a traditional taxpayer. Such taxpayer must specify under serial number 14 of the REG-01 form as an ISD. They shall be ready to distribute the credit to the recipients only after this declaration.

- ISD can distribute the number of diminutions to recipients as earlier stated by issuing an ISD invoice.

- The amount of decrease distributed mustn't exceed the quantity of decrease available with the ISD as at the top of a relevant month to be filed in GSTR-6 by the 13th* of succeeding month by ISD. The ISD can get the knowledge of the ITC from the GSTR-2B return.

- The recipient of the decrease can view the step-down so distributed by ISD in GSTR-6A that's auto-populated from the supplier’s return. In turn, the recipient branch can claim the identical by declaring it in GSTR-3B. An ISD needn't file annual returns in form GSTR-9.

- Restriction within the distribution of Input Tax credit: The credit of tax paid under the reverse charge mechanism isn't available for distribution to the recipients. So, the ISD needs to utilize such credit only as a traditional taxpayer.

MANNER OF DISTRIBUTION OF CREDIT

The ISD should maintain arithmetical accuracy and make sure that the credit distributed doesn't exceed the credit available with it for distribution.

- The credit regarding Input Service should be distributed only to the actual recipient to whom that input service is attributable.

- If the input service is a result of over 1 recipient, the relevant ITC should be distributed to such recipients within the ratio of turnover of the recipient during a state/territory.

- Credit regarding input services which are common for all branches should be distributed to any or all the recipients within the ratio of turnover as described in (b) above.

- Both ineligible and eligible ITC should be distributed separately.

- The credit of CGST, SGST/UTGST, and IGST should be distributed separately.

In case your business is providing services across various geos, branches, would really like to optimize and lift the accountability, consider chatting with Team GST Compliance, facilitate you be compliant, and obtain the most ITC possible.

The credit available against any specific input services used entirely by one in all the recipients may be allocated only thereto recipient for utilization of such credit and to no other recipients.

The credit available against the input services availed commonly by all the related recipients shall be allocated to all or any the recipients on a proportionate basis in respect of the ratio of the turnover of each recipient earned during a particular financial year.

Read more about: What is core Business Activity GST

Read more about: Important decisions made at the 43rd GST Council meeting