Table of Contents

GSTN: Features of Quarterly Return Filing & Monthly Payment of Taxes (QRMP) Scheme

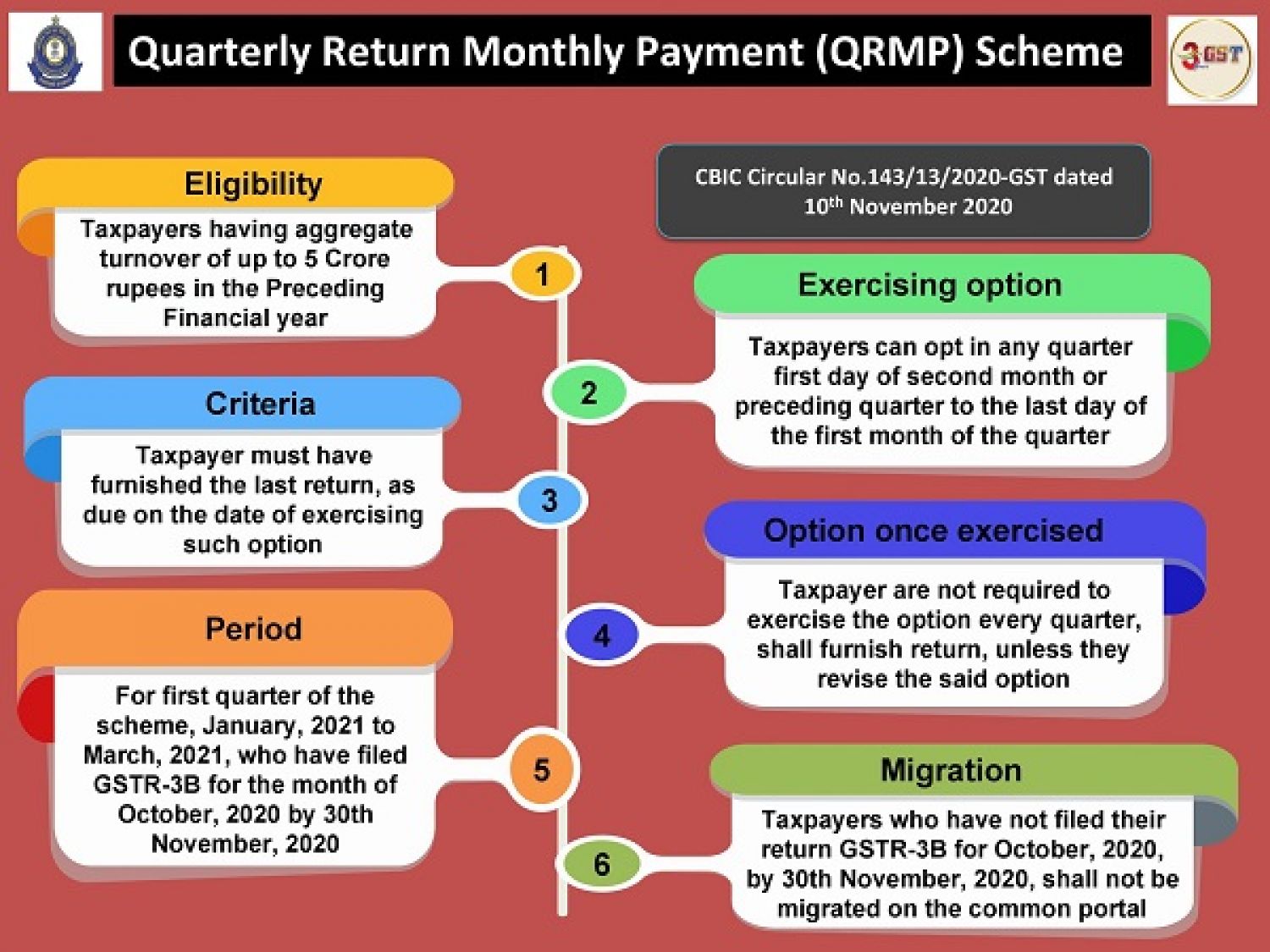

1. Who could choose for the scheme: With effect from 1st Jan 2021, Below Registered Persons can opt to submit Qtrly GSTR Returns & Pay tax on a monthly basis:

- A Registered person’s required to file Form GSTR 3B with AATO of up to INR Five Crore in the last financial year is eligible. If INR Five Crore. is crossed by AATO, then the Registered person will become in-eligible for the QRMP Scheme from next quarter.

- If any person who makes a new registration or chooses a Composition Scheme can also choose this QRMP Scheme.

- GSTIN can be used wisely to make use of this system. As a result, few GSTINs for that PAN may choose for the Scheme and the rest GSTINs can stay outside the QRMP Scheme.

2. Modification in Goods & Services Tax Portal: For the 4th quarter January to March 2021, all registered people with an AATO for the FY 2019-20 up to INR Five Corer. & have submitted the form GSTR-3B return for the month of October 2020 by 30th Oct 2020 will be migrated by default to the GST system as follows.

Sl. No. |

Class of registered person’s with AATO of |

Default Return Filling Option |

|

1 |

Up to INR 1.5 Crore, who have furnished Form GSTR-1 on monthly basis in Existing Financial Year |

Monthly |

|

2 |

Up to INR 1.5 Crore, who have furnished Form GSTR-1 on Qtrly basis in Existing Financial Year |

quarterly |

|

3 |

More than INR 1.5 Crore & up to INR 5 Crore in Last Financial Year |

quarterly |

3. When a person can choose for the QRMP Scheme:

- This facility can be used in all quarters during the complete year,

- Once exercised, the QRMP Scheme option will proceed until Registered Person modifies the option or its AATO reaches the limit INR Five Crore.

- Registered Person’s migrated By default itself will opt to remain to stay out of the QRMP Scheme by exercising their option between 5th, 2020 to 31st Jan. 2021.

4. The Invoice Furnishing Facility (IFF) may be used by the Registered Person’s opting for the QRMP Scheme so that the outward suppliers to the registered Person are appearing in their Form GSTR 2B & GSTR 2A.

5. Tax Payment under the QRMP Scheme:

- Registered Person’s required to make the payment of tax due in each of first 2nd months (by 25th of next month) in the Quarterly, by selecting “Month wise payment for Qtrly taxpayer” as the reason for creating GST Challan.

- Registered Person may use either the Fixed Sum Method (pre-filled challan) or the Self-Assessment Method (actual tax due), after changing the Input Tax Credit, for monthly tax payment for the first 2 months.

- If there is NIL tax liability if no deposit is required for the month.

- To change liabilities for the quarter, tax deposited for the first two months should be included. Form GSTR-3B cannot be used for any other purpose until the quarterly return filing is finished.

Notes : Clarification in respect of applicability of Dynamic Quick Response (QR) Code on B2C invoices and compliance of notification 14/2020- Central Tax dated 21st March, 2020- Clarification on applicability on QR Code Notification 14/2020

Now GST payments can be made through 21 banks.

GSTN has enabled 21 banks to make GST Payments. This Newly added bank changes the total number of banks that accept GST Payments. Now GST payments can be made through 21 banks. Below is the Complete list of all the Banks:

- Axis Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- City Union Bank

- Federal Bank

- HDFC Bank

- ICICI Bank Limited

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- Jammu and Kashmir Bank Limited

- Karur Vysya Bank

- Kotak Mahindra Bank Limited

- Punjab and Sind Bank

- Punjab National Bank

- State Bank of India

- UCO Bank

- Union Bank of India