Table of Contents

Mandatory compliances applicable to UAE companies at a Glance

Mandatory UAE Compliances

Corporate Tax Registration Deadline: Corporate Tax Registration is compulsory to be applied for within 90 days of the license issuance. In case, we fail to apply within the stipulated time, then there is a heavy penalty of AED 10,000. Within 90 days of license issuance. In case of a penalty for delay in case of failure to get corporate tax registration: AED 10,000.

Normal Service Fee: AED 1,500 (one-time).

General UAE taxation Rules

- Profits up to AED 375,000 → 0% Tax

- Profits above AED 375,000 → 9% corporate tax on incremental profits.

Corporate Tax Return Filing Frequency:

Corporate Tax Returns Filing & Updations on the Federal Tax Portal regarding the changes in license on a timely basis—Annually, which includes updates on the Federal Tax Portal for license changes.

Normal Service Fee: AED 2,000 onwards/year.

Penalty Waiver Assistance: Additional AED 500. And in case filing is mandatory even for zero profit, loss, or zero turnover.

UAE Co. Audit Reports Requirement:

Audit as per Corporate Tax Law is mandatory only in case the turnover crosses AED 50 million in a year; however, free trade zone authorities, mainland authorities, or bank authorities may demand for the voluntary audit during the license renewal. The clarity on this will start coming from next year's license renewals of the entities.

Normal audit service fee: AED 3,000 onwards/year. However, Freezone/Mainland authorities or banks may request voluntary audits.

UAE VAT Registration Thresholds:

it is mandatory to apply for a Corporate Tax Number and file a Corporate Tax Return even if you have zero profits, losses, or Zero Turnover. Return formats & filing formats depend on your financial statements, but its mandatory to file the corporate tax returns annually with the audit report to be filed if mandated by law or the free zone in your UAE entity case.

- Voluntary: AED 187,500 turnover in the last 12 months.

- Mandatory: AED 375,000 turnover in the last 12 months.

Norma Service Fee: AED 1,500 onwards (one-time).

VAT Returns Filing Frequency:

We can voluntarily apply for VAT registration once the company has a sales turnover of AED 187500 in the last 12 months. If the company has a sales turnover of AED 375000 in the last 12 months, then it is mandatory to register for VAT. Once you have the VAT number, then VAT returns are to be filed on a quarterly basis. VAT Rate is 5%

Normal Service Fee: AED 1,500 onwards per quarter.

VAT Rate: 5%.

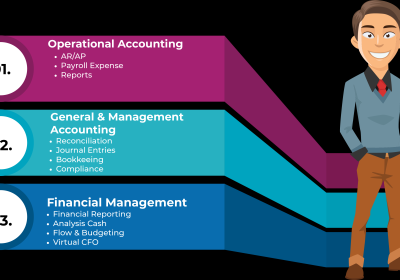

UAE Co. Bookkeeping & Accounting Requirement:

Since the corporate tax has become effective from 1st Jan 2024, you need to maintain books of accounts. We can discuss the charges on call depending on the visits required, volume, and business of the company. So bookkeeping is mandatory since the corporate tax is effective from Jan 1, 2024. And the fee is based on financial volume and visits.

License & Visa Renewal Frequency of visa reviewal is annual. Which includes third-party government approvals. Annual License Renewal, visa renewals, and third-party government approval renewals are to be done. Generally, all customers are already aware of this fact.

Transfer Pricing (Related Party) Provisions and AML Compliances—Applicable on a case-by-case basis, not applicable to everyone. Transfer Pricing & AML Compliance - Applicability: Case-to-case basis. Any kind of compliances and submissions as required and demanded by the free zone or corporate tax authority from time to time anytime in the future. Being a tax-friendly country, please note that there is no personal income tax on individuals. There is no wealth tax and no inheritance tax as well in the UAE.

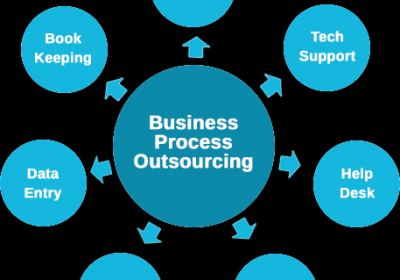

Other Regulatory Submissions—Includes: Any compliance demanded by the Free Zone or Corporate Tax Authority. Outcome for UAE Companies to Seamless India-side regulatory compliance, Optimised fund flow & tax structure, Reduced litigation & penalty exposure & End-to-end advisory under FEMA, RBI & Income-tax laws

IN India-Side Advisory for UAE Companies :

Indian regulatory and tax compliances become applicable when a UAE company has investments, transactions, or economic presence in India. Our India-side advisory ensures end-to-end FEMA, RBI, and income-tax compliance, while also focusing on efficient fund structuring and tax optimisation.

FEMA & RBI Compliances Applicability Required where a UAE entity:

- Invests in an Indian company (FDI)

- Receives investment from an Indian resident

- Has a branch/liaison/project office in India

- Has cross-border fund flows with Indian entities

Funds structuring advisory related to FEMA is objective to legally compliant, tax-efficient, and audit-proof fund movement. We advise on structuring inbound and outbound funds in compliance with FEMA, 1999, and RBI regulations, covering:

- Entry route analysis (automatic vs. government route)

- Permissible instruments (Equity, CCPS, CCD, loans, guarantees)

- Sectoral caps & pricing guidelines

- Repatriation planning (dividends, capital repatriation, fees, royalties)

- ODI/FDI structuring for tax and regulatory efficiency

UIN Generation (Unique Identification Number) :

We handle Documentation preparation, FIRMS portal registration, Successful UIN generation & linkage, and

- Mandatory for Indian entities with foreign investment or overseas direct investment

- Generated on the RBI FIRMS portal

- Acts as a permanent identifier for all future RBI filings

Annual RBI Filings – APR & FLA Returns (FLA Return (Foreign Liabilities & Assets))

- Who files: Indian entities having FDI / ODI involving UAE entities

- Due Date: 15 July every year

- Purpose: Reporting foreign shareholding, loans, and investments

APR (Annual Performance Report) : We ensure Accurate financial data reconciliation, Timely filing to avoid RBI penalties & compounding proceedings

- Who files APR : Indian entities with ODI in UAE companies

- Due Date of APR : 31 December every year

- Purpose of Filling of APR : Reporting financial performance of overseas UAE entities

Income Tax Advisory—India

Applicability & triggered when UAE company transacts with Indian group entities, Payments such as fees, royalties, interest, dividends flow between India & the UAE, and the UAE entity has Permanent Establishment (PE) risk in India

Transfer Pricing Compliance: Advisory and documentation in line with Indian Transfer Pricing Regulations, including Identification of international transactions, Arm’s Length Price (ALP) analysis, Benchmarking studies, Preparation of TP Documentation (Local File), and support during TP audits & assessments

Income Tax Structuring & DTAA Advisory (India–UAE): Income Tax Structuring & DTAA Advisory (India–UAE) for the objective to minimize tax leakage while ensuring full treaty compliance. We design structures considering the Indian Income Tax Act, 1961 & the India–UAE Double Taxation Avoidance Agreement (DTAA). Coverage includes:

- Withholding tax optimisation

- DTAA benefit eligibility & TRC compliance

- Avoidance of double taxation

- Capital gains & dividend taxation planning

- PE exposure evaluation & mitigation

Risk Mitigation & Compliance Assurance: Our advisory helps prevent FEMA violations & RBI penalties, Disallowance of expenses under Income Tax Act & Transfer pricing adjustments, DTAA benefit denial, Prolonged scrutiny, assessments & litigation

India-side Advisory for UAE Companies

For the India side, related to the UAE company, the Indian company is required to follow FEMA regulations and RBI compliances, which include fund structuring advisory as per FEMA guidelines. UIN number generation & filing of APR and FLA returns on an annual basis in India.

Income Tax : Transfer pricing, ideation, and fund structuring considering all provisions of the Indian Income Tax Act and the DTAA between the UAE and India.

FEMA & RBI Compliances: Funds structuring as per FEMA, UIN generation & filing APR & FLA returns annually.

Income Tax Advisory: Transfer Pricing & Structuring under the Indian Income Tax Act & DTAA (UAE-India).