Table of Contents

GST Inspector will visit at Business Premises of all dealers during special drive from 16th May to 15th July, 2023

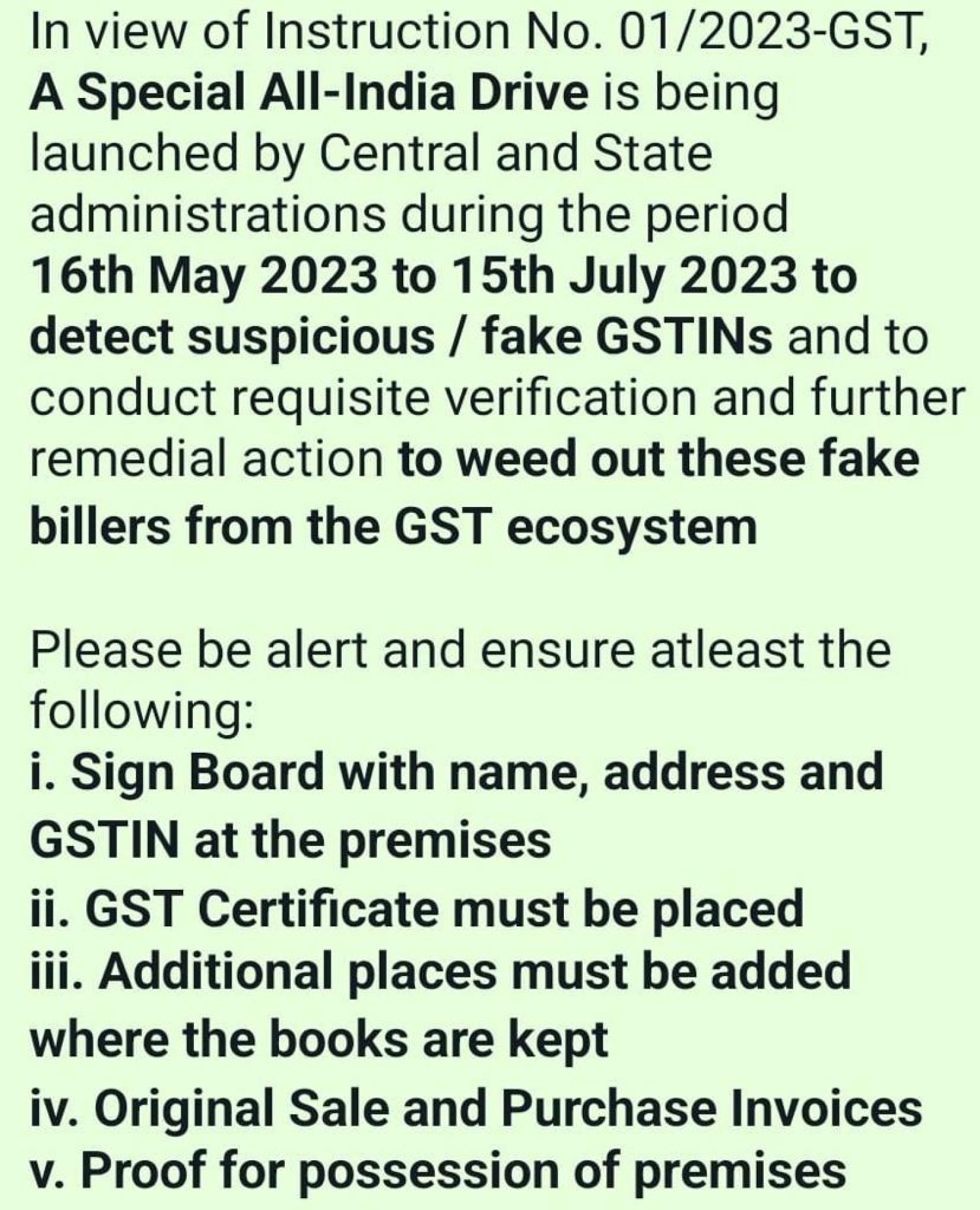

The issue of unscrupulous participants utilising the identities of others to obtain fake/bogus GST registration was discussed during the National Co-ordination Meeting. Fake/non-genuine registrations are being utilised to pass on ITC to unscrupulous recipients by producing invoices with no underlying supply of goods, services, or both. This threat of false registrations and bogus invoices for passing of counterfeit ITC has become a severe problem, with fraudulent people engaging in dubious and complex activities, causing income loss to the government.

Guidelines from the CBIC for a Special All-India Drive Against GST Fake Registrations The Central Board of Indirect Taxes and Customs (CBIC) has published Guidelines for an All-India Special Drive Against Fake Registrations. On April 24, 2023, at the National Coordination Meeting of State and Central GST Officers in New Delhi,

Sign board showing following details must be displayed at the premises:

- Name of the Firm

- Address of Additional place

- Address of Principal place

- Mobile No.

- GST No.

GST Special All-India Drive against fake registrations from 16th May 2023 to 15th July 2023

Please keep following records ready :-

- Board at gate of Business Place

- PAN Aadhaar of Proprietor or Partner or Director

- Latest Electricity Bill

- GST Certificate affix at Office

- Bill Book

- Rent Agreement or NOC

Traders condemn GST Dept verification special drive

- Many traders in the state's industrial hub have been protesting the GST the Department's verification drive.

- The department officials, on the other hand, assert that they are not randomly reviewing premises, but rather have a list of units/premises given to them by the GST Council, according to which they are visiting industrial units and physically confirming paperwork.

- "If your records are up to date, there is no need to panic," a GST Department official told The Tribune. On the topic of alleged employee corruption, the official stated that it has considerably decreased now that everything has been recorded and the guilty can be easily located.

- Traders in the state's industrial hub like United Cycle and Parts Manufacturers’ Association (UCPMA) & the Punjab Pradesh Beopar Mandal have condemned the GST Verification drive.

- Industrialists term the visits by officials harassment and claim that if there is any suspicion, the department can summon the suspect to their office with all records and check them there.

- During the GST verification drive effort, the department discovered that many people had submitted false workplace addresses. Physical verification is required to crack the whip against such fraudulent activities, according to an official.