Table of Contents

Limitations/ drawbacks you should know before Choosing the QRMP Scheme.

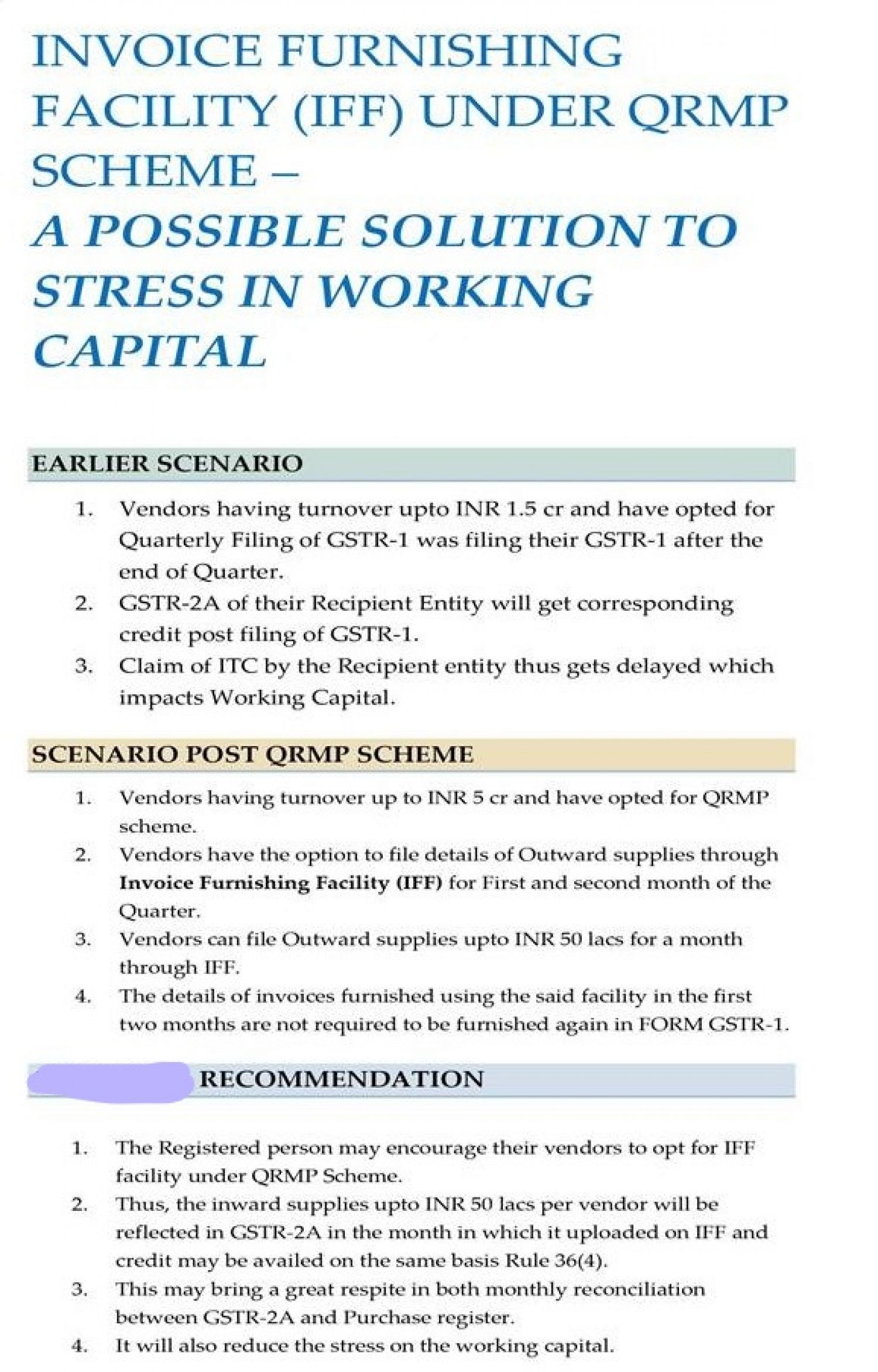

In order to benefit small taxpayers whose revenue is less than Rs.5 Cr, the Central Board of Indirect Taxes & Customs (CBIC) launched the Quarterly Return Filing and Monthly Payment of Taxes (QRMP) scheme as under Goods and Services Tax (GST). The QRMP scheme allows taxpayers to file GSTR-3B on a quarterly basis and pay a tax per month started from 1st January 2021.

At present, every business person registered under GST with a turnover of up to Rs 5 crores wishes to opt for the QRMP Scheme because it has given the impression that under this scheme the number of return filings would be substantially reduced.

However, we learned that the QRMP Scheme and the Normal Scheme don’t differ significantly. Like You still have to maintain account books, file an Invoice Furnishing Facility (IFF) monthly instead of GSTR 1, and pay tax monthly via PMT 06 rather than GSTR 3B.

It is a common fact that in the case of small and medium-sized enterprises, business complexity is limited and, in many other cases, the maximum column of returns does not need to be filled. So make a decision after having full information.

Limitations you should know before choosing the above scheme are as follows:

- Furnishing the B2B Supply details

(a) For each of the first and second quarter months, the selected taxpayer shall be allowed to upload the B2B Supply between the 1st day of the following month and the 13th day of the following month. This facility for furnishing the IFF(Invoice Furnishing Facility) for the previous month will not be available after the 13th of the month.

(b) Details of outward supplies shall not exceed the amount of INR 50 lakhs per month.

- Monthly Tax chargeable

Taxpayers who have chosen this option will have to pay GST from PMT 06 until the 25th day of the month following that month, in each of the first two months of the quarter

In addition, the taxpayer also has to be alert in choosing the alternative.

(a) Fixed Sum Method

(b) Self-Assessment Method

However, Reconciliation should be conducted every third month. This is an excellent relief. Not just this, the scheme is a blessing for those who still file late returns for some excuse since there is no late charge or interest for the first two months.

Clarification in respect of applicability of Dynamic Quick Response (QR) Code on B2C invoices and compliance of notification 14/2020- Central Tax dated 21st March, 2020 - Clarification on applicability on QR Code Notification 14/2020