Table of Contents

How do I create an eWay Bill?

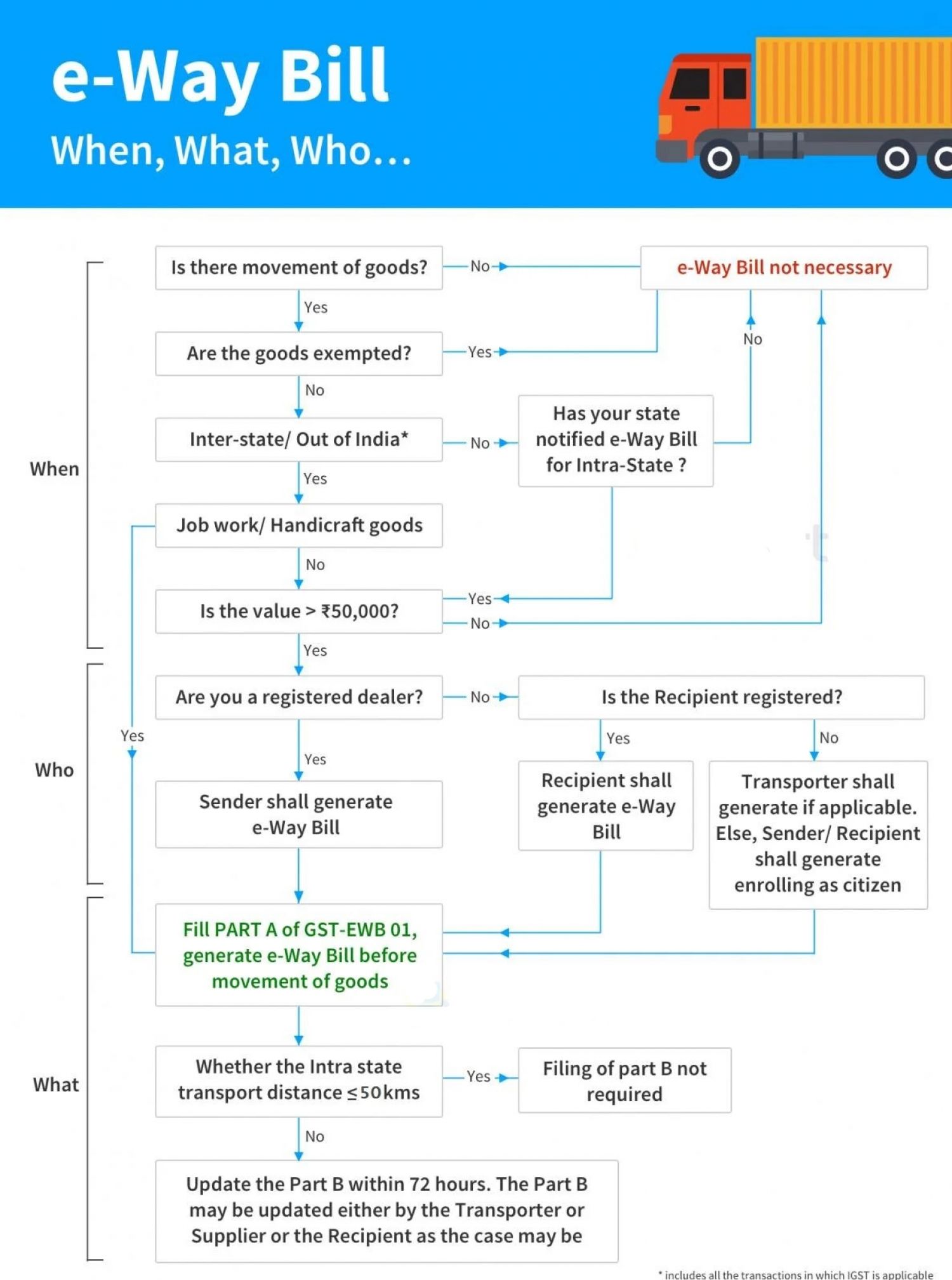

On the e-Way Bill Portal, you can generate an E-Way Bill. All you need is a Portal username and password. Check out our article – Guide to generate e-Way Bill online – for a comprehensive step-by-step guide on e-Way Bill generation.

When unregistered transporters register on the e-way bill portal, companies will be given a Transporter ID, after which Eway bills can be generated.

|

When |

Who |

Form |

Part |

|

Before movement of goods |

Registered person is consignor or consignee and goods are handed over to transporter of goods |

The registered person shall furnish the information relating to the transporter in Part B of FORM GST EWB-01 |

Fill Part B |

|

Before movement of goods |

Every Registered person under GST |

Form GST EWB-01 |

Fill Part A |

|

Before movement of goods |

Transporter of goods |

Generate e-way bill on basis of information shared by the registered person in Part A of FORM GST EWB-01 |

|

|

Before movement of goods |

Registered person is consignor or consignee (mode of transport may be owned or hired) OR is recipient of goods |

Form GST EWB-01 |

Fill Part B |

|

Compliance to be done by Recipient as if he is the Supplier. |

An unregistered person under GST and recipient is registered |

1. If the goods are transported for a distance of fifty kilometers or less, within the same State/Union territory from the place of business of the consignor to the place of business of the transporter for further transportation, the supplier or the transporter may not furnish the details of conveyance in Part B of FORM GST EWB-01. 2. If supply is made by air, ship or railways, then the information in Part A of FORM GST EWB-01 has to be filled in by the consignor or the recipient |

|

Note: If a transporter is conveying many consignments in a single conveyance, the form GST EWB-02 can be used to generate a consolidated e-way bill by supplying the e-way bill numbers for each consignment. If neither the consignor nor the consignee has established an e-way bill, the transporter can do so * by completing PART A of FORM GST EWB-01 using the invoice/bill of supply/delivery challan provided to them.

List of Documents/details required to issue of eWay Bill

- Transporter ID or Vehicle number- Transport by road

- Bill of Supply/ Invoice/Challan related to the consignment of goods

- Transporter ID, Transport document number, and date on the document- Transport by rail, air, or ship

How to comply Eway Bill conditions requirements?

Following are the steps laid down by GST law:

- Before the first consignment is dispatched, the supplier must issue a complete invoice.

- The supplier must send separate delivery challans for each consignment (for the rotor blade, shaft, and generator – in this case, 3 DC) with a reference to the invoice.

- Each consignment, i.e. the rotor blade, shaft, and generator, will require a separate Eway bill (hence 3 E way bills to be generated for 3 delivery challans)

- Along with the last consignment, the original copy of the invoice must be delivered.

- For each consignment, the person in charge of the conveyance must carry the Delivery challan, a copy of the fully certified original invoice, and an Eway bill.

E-Way Bill Validity

An E-Way Bill is valid for periods as specified under, which is based on the distance travelled by the goods. E-Way Bill Validity is calculated from the date & time of creating of e-way bill-

|

Kind of conveyance |

Validity of E-Way Bill |

Distance to be made |

|

For Over dimensional cargo |

One Day |

Less Than 20 Kms |

|

Extra One Day |

For every Extra 20 Kms or part thereof |

|

|

Other than Over dimensional cargo |

One Day |

Less Than 100 Kms |

|

Extra One Day |

For every Extra 100 Kms or part thereof |

Eway bill Validity can be extended. Issuance of Eway bill has to either 4 hours before expiry or within 4 hours after its expiry can extend validity of Eway bill.

List of the cases where eWay bill is Not needed?

In the below cases it is not needed to issue E-Way Bil:

- When Empty Cargo containers are being transported

- Consignor transporting goods to or from between place of business and a weighbridge for weighment at a distance of 20 kms, accompanied by a Delivery challan.

- Goods specifed as exempt from E-Way bill requirements in the respective State/Union territory GST Rules.

- Mode of transport is non-motor vehicle

- Transit cargo transported to or from Bhutan or Nepal

- Goods being transported by rail where the Consignor of goods is the Central Government/ a local authority/, State Govt.

- Goods transported from Customs port, airport, air cargo complex or land customs station to Inland Container Depot (ICD) or Container Freight Station (CFS) for clearance by Customs.

- Movement of goods caused by defence formation under Ministry of defence as a consignor or consignee

- Goods transported under Customs supervision or under customs seal

- Transport of certain specified goods- Includes the list of exempt supply of goods, Annexure to Rule 138(14), goods treated as no supply as per Schedule III, Certain schedule to Central tax Rate notifications.

- Goods transported under Customs Bond from ICD to Customs port or from one custom station to another.

Note: If the distance between the consignor or consignee and the transporter is less than 50 kilometres and the transportation is within the same state, Part B of the e-Way Bill does not need to be filled out.