Table of Contents

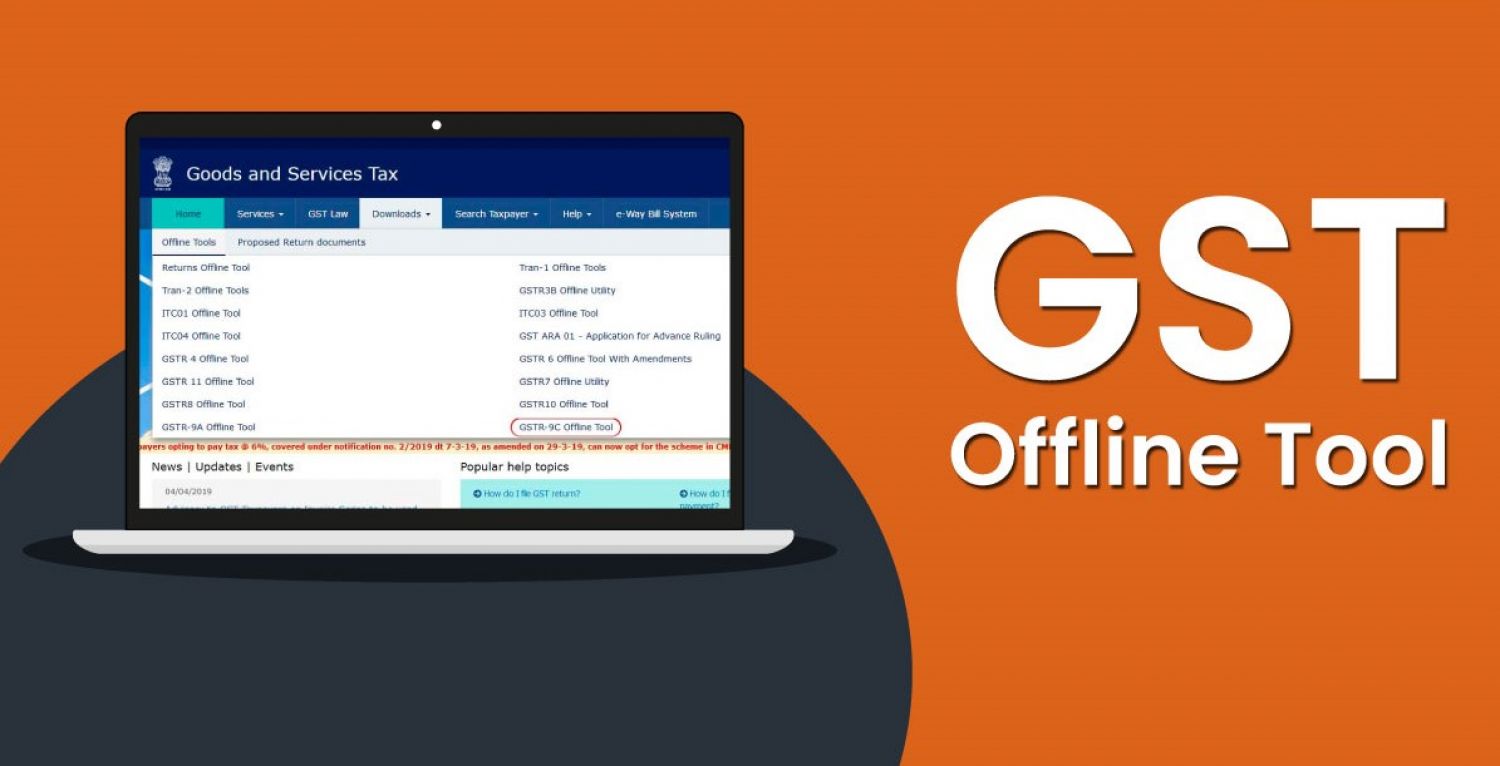

GSTN Issue GST Offline Tools for Download and Prepare GSTR Returns Offline

- Under GST regime various activities related to GST to be done online like GST registration, GST refunds, GST filing, GST application & lot of other.

- GST taxpayers must go to the GST site online and fill out the necessary paperwork.

- However, the government has made it simple for those who have restricted access to online tools. GST portal provides a variety of GST offline tools for them.

- They're downloaded and may be completed in the comfort of your own home.

- GSTR Return must be uploaded immediately to the GST portal after they have been filed offline in order to complete the filing procedures online.

- They're free & you can file GST Return even if you don't have access to the internet.

- GST offline tools cover a wide range of tasks which including GST return submission.

GSTIN Issue FAQs & User Manual – Matching Offline GST Tool

GST Offline filling Tools of GST Return

Different kind of returns can be filed with various offline GSTR tools that can be downloaded & used for generate for preparation with the support of GSTR 1 return. The Returns Offline Tool can be downloaded for free. GST toolkit for filling of GST Returns Offline which includes below list of documents :

- Section-wise CSV format files

- GST Offline Tool Application

- GSTR 1 & GSTR 2 Excel Workbook Template

- User manual

The GST offline application is available for Windows 7 and above. Mac OS and Linux do not support it. Additional software, such as Microsoft Excel and an appropriate browser, such as Mozilla Firefox Google Chrome, or Internet Explorer, is needed to use above GST offline filling tools.

Conclusion

All assessees can file numerous returns offline for a more convenient filing process. On the GST portal, you can get free tools for each return. After filling out the details in the offline document, taxpayers must convert it to Json. and upload it immediately to the portal.The procedure of filing the return is complete after the paperwork is uploaded to the portal.