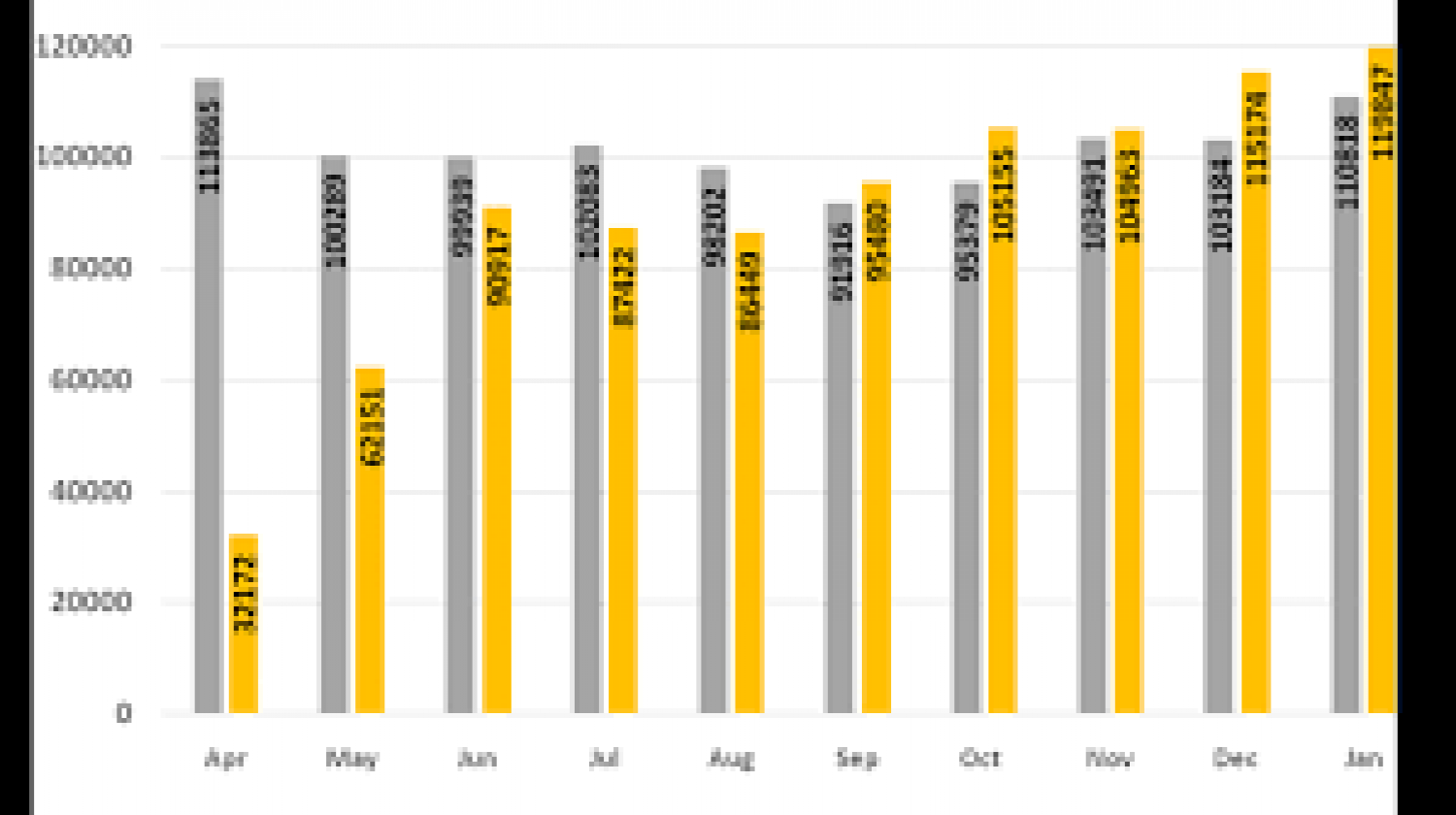

In January, GST revenues hit a record of Rs 1.20 Lakh Crore: Great news on Budget Eve:

Goods & Services Tax collections for January reached an all high of around Rs 1.20 lakh crore, the Finance Ministry said.

According to the Finance Ministry, in line with the recovery trend in Goods & Services Tax Revenues over the previous 5 Months, Revenue for the month of January 2021 is 8% higher than that for the same month Previous Year.

"The total Goods & Services Tax revenue collected in the period of January 2021 till 6 PM on 31st January 2021 is Rs 1,19,847 crore, of which CGST is Rs 21,923 crore, SGST is Rs 29,014 crore, IGST is Rs 60,288 crore (including Rs 27,424 crore collection on import of goods) & Cess is Rs 8,622 crore (including Rs 883 crore collected on import of goods)," said the Ministry of Finance in a statement.

The amount could be further increased as more GST sales returns were filed.

Goods & Services Tax Revenues were topped by INR 1,00,000/- Crore in Nine of the 12 months of the fiscal year 2019-20. However, in the Current Financial Year, Revenues have been impacted by the COVID-19 pandemic.

April 2020 GST Revenue were Rs 32,172 crore, followed by Rs 62,151 crore in May, Rs 90,917 crore in June, Rs 87,422 crore in July and Rs 86,449 crore in August. Collections in September included Rs 95,480 crore, Rs 1,05,155 crore in October, Rs 1,04,963 crore in November and Rs 1,15,174 crore in December.