Table of Contents

GSTR-9 and GSTR-9C(i.e GST Annual Return) are Available for filing Now

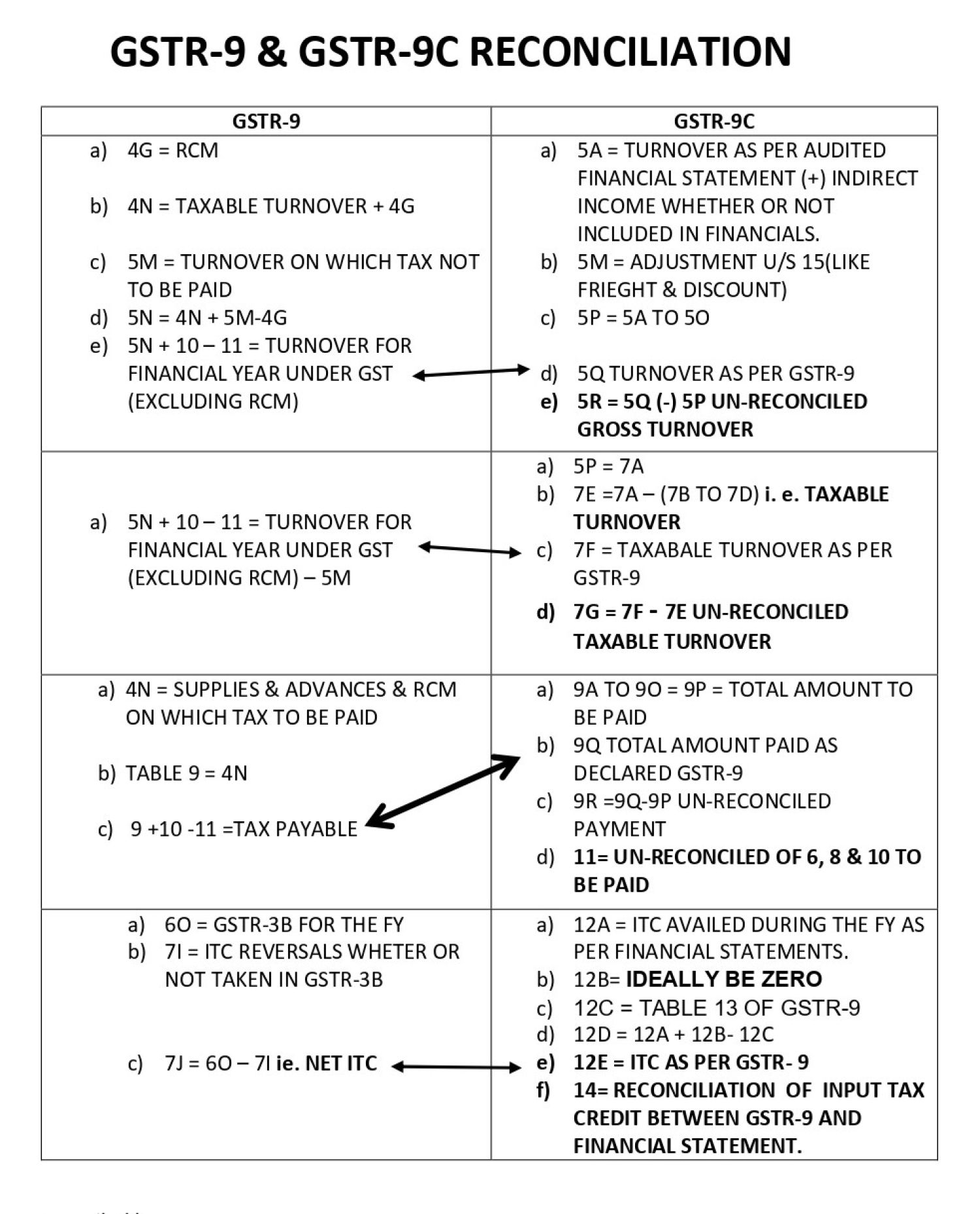

- GSTR 9C is a statement that reconciles the information from the yearly returns filed under GSTR 9 for a given financial year with the data from the taxpayer's audited annual financial statements.

- A cost accountant or chartered accountant must prepare and certify GSTR 9C. It must be filed by the taxpayer in Form GSTR 9 along with other paperwork including a copy of the audited financial statements and an annual report via the GST portal or a facilitation centre.

- GST annual return forms i.e GSTR-9 and GSTR-9C are now accessible on the GST portal for filing the annual statement of GST. GSTR 9 is a Return Form and GSTR-9C is a Reconciliation Statement of relevant financial year.

- The Deadline for annual statement and return under GST annual return forms are 31st Dec 2022.

- Annual statement & GST annual return forms GSTR-9 form is an annual return that has to be filed by all registered taxable persons under GST. Annual Audited Return GSTR-9C is the GST reconciliation Statement for a specific FY on or before 31st Dec. 2022.

- GST reconciliation shall require to be certified by a Chartered Accountants for Firm having a received/sale of Exceeds than 5 crores.

- CBIC on the basis of GST Council recommendations has GST taxpayers exempted in case they having Receipt/Sales up to 2 Cr from the filing of annual statement forms GSTR-9 & GSTR 9A as annual returns.

- In the GST Council’s 47th meeting decided to exempt the small GST taxpayers from annual returns compliance.

- GSTR 9 is an annual return to be filed yearly by taxpayers registered under GST.

- It consists of details regarding inward supplies or the outward received/ made during the Respective FY under various tax heads i.e. IGST, CGST, SGST & HSN codes. It is a consolidation of all the quarterly/ monthly returns (GSTR-3B, GSTR-2A, GSTR-1,) filed in that year.

ICAI issue a book and guidance on Annual Return under GST

- Rajput Jain & Associates is a prominent business platform and a forward-thinking concept that offers clients in India and worldwide end-to-end incorporation, compliance, advisory, and management consultancy services.

Complete Overview about the GST Annual Return

- We provide the GSTR Annual return supports in the Complete reconciliation of data for 100 percentage transparent disclosures to Authorities via Return,

- To learn more about the GST Return filing process, contact Rajput Jain & Associates. Find out when to file a GST return by contacting a GST return filing service provider for an online GST return. For a consultation, contact our compliance manager at 09555 555 480 or singh@carajput.com.