Table of Contents

Key highlights of 45th GST Council Meeting : GSTN

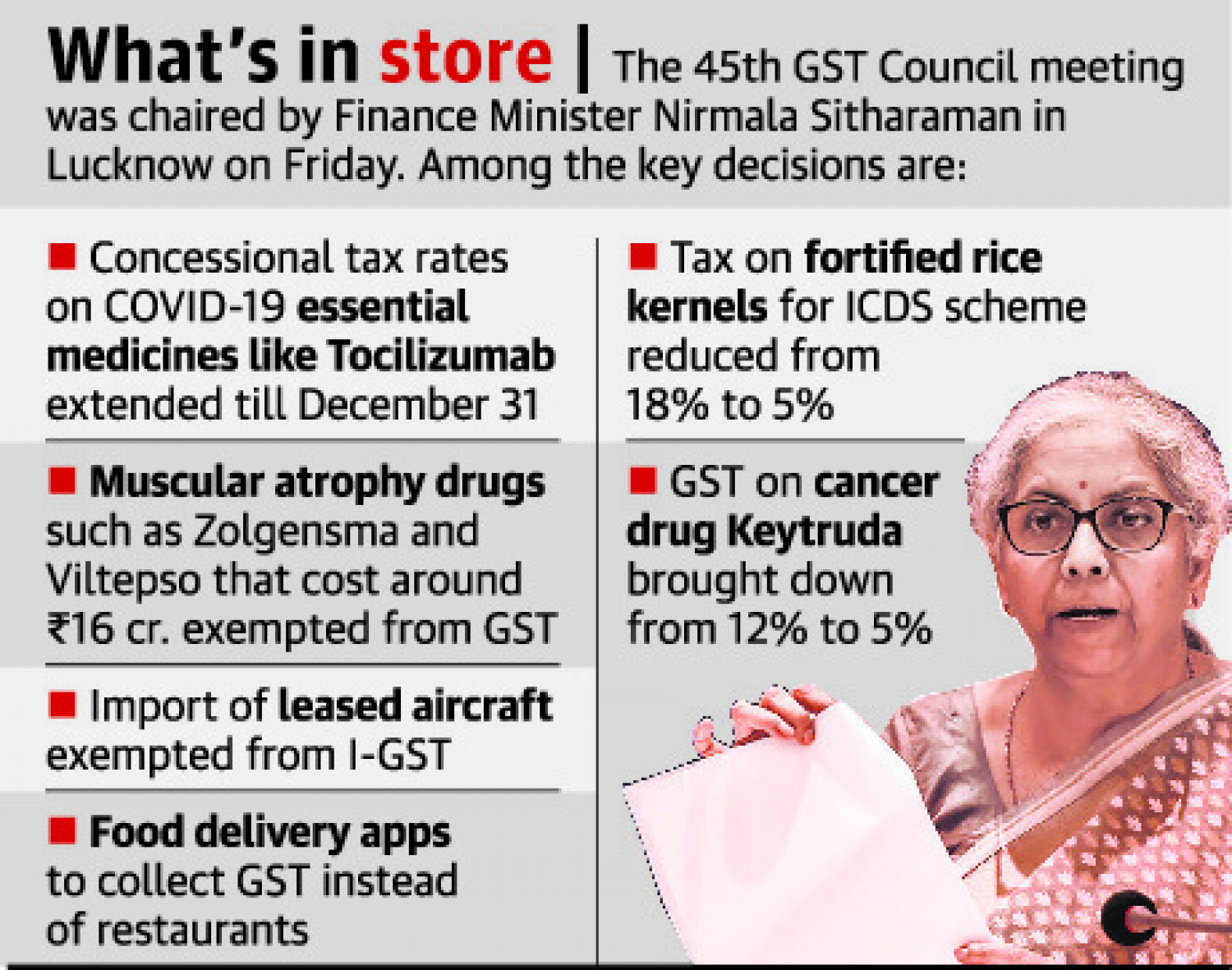

the GST Council had its 45th meeting On the 17th of September 2021. This meeting, which took place in Lucknow, was keenly anticipated by the taxation community. It's interesting to note that this was the first time the two of them had met in person in the last 2 years. Let's take a look at the figures of the 45th GST Council Meeting, that takes place on September 17, 2021.

The CBIC has update about implementation of decision of 45th GST Council Meeting & update that the relaxation in needs of filing Job Work declaration in Form GST ITC-04 would be with effect from Oct 1, 2021.

"Recommendation of Implementation of 45th GST Council Meeting. Relaxation in requirements of filing Job Work declaration in Form GST ITC-04 w.e.f 01.10.2021," The Central Board of Indirect Taxes and Customs tweeted.

Relaxation as under:

|

Kind of Taxpayers: Company Annual aggregate turnover in the Last Financial Year is |

Filing GST Return Frequency: |

|

Exceeds 5 Crore |

One time in Six Months |

|

Upto 5 Crore |

Annually |

We provide a summary of the three main circulars published by CBIC following the conference, as well as some of the meeting's highlights. Here are a few more things to keep in mind:

- The National Anti-Profiteering Authority's term has been extended for another year.

- Before the meeting, there was a lot of discussion on whether or not petroleum products should be included in the scope of GST, but no decision was made.

- Compensation Cess has been extended till the year 2026. Compensation Cess Decision : A presentation was made to the Council on the compensation scenario, in which it was stated that the revenue collected from the Compensation Cess in the period beyond June 2022 to April 2026 would be used to repay borrowings and debt servicing undertaken to bridge the gap in 2020-21 and 2021-22. Various options, as recommended by different committees/forums, were offered in this context.

Circular No. 159/15/2021-GST dated 20.09.2021:

The scope of the intermediary was clarified in this circular.

- The intermediary case can only be used if at least three parties are engaged.

- There must be two supplies, one for the main supply and one for the supplemental supply. It is also clear that a person who provides main supply to another person on a principal-to-principal basis is not deemed a supplier of intermediary service.

- The person providing the intermediary services should have the persona of an agent/broker or someone comparable.

- This does not apply to principal-to-principal contracts or subcontracts.

- Even in the case of a securities sale or acquisition, one of the parties must be situated outside of India.

E-commerce Operators to pay taxes on services

- E-Commerce Operators are being made liable to pay tax on the following services provided through them:

- Restaurant services provided through it with some exceptions w.e.f. 1st January, 2022.

- Transport of passengers, by any type of motor vehicles through it w.e.f. 1st January, 2022.

Clarifications with regard to the GST rate on goods and Services

Goods / Items |

GST Rate |

|

Laboratory reagents and other goods falling under heading 3822 |

12% |

|

Scented sweet supari and flavoured and coated Elaichi falling under heading 2106 |

18% |

|

Paper and paperboard containers, whether corrugated or non-corrugated |

18% |

|

Fresh/dried nuts |

5% / 12% |

|

Pure henna powder and paste (that have no additives) |

5% |

|

Brewers’ Spent Grain (BSG), Dried Distillers’ Grains with Soluble [DDGS] and other such residues, falling under HS code 2303 |

5% |

|

Tamarind seeds fall under heading 1209 |

Nil for seeds used for sowing, otherwise 5% |

|

External batteries sold along with UPS systems/inverter |

28%, other than lithium-ion batteries |

|

Carbonated fruit beverages of fruit drinks and carbonated beverages with fruit juice |

28% and cess of 12% |

|

Pharmaceutical goods falling under heading 3006 |

12% |

|

UPS/inverter |

18% |

Services |

|

|

Overloading charges at toll plazas |

Exempt |

|

Admission to amusement parks with rides, etc. |

18% |

|

Admission to facilities that have casinos |

28% |

|

Renting of vehicles by state transport undertakings and local authorities is now covered by the expression ‘giving on hire’ |

Exempt |

|

Grant of mineral exploration and mining rights |

18% |

|

Alcoholic liquor for human consumption is not food and food products’ for the entry prescribing the 5% GST rate on job work services in relation to food and food products. |

NA |

|

Services by cloud kitchens/central kitchens are now covered under ‘restaurant service’ |

5% |

|

Ice cream by parlours |

18% |

|

Coaching services to students provided by coaching institutions and NGOs under the central sector scheme of ‘Scholarships for students with Disabilities” |

Exempt |

Circular No. 160/16/2021-GST dated 20.09.2021:

A few things have been covered in this circular:

1. Debit Note

The invoice date was not used to determine the date for claiming Input Tax Credit on Debit Notes. This has changed, and you can now refer to the debit note date, which gives you additional time to claim the ITC.

2. E-Invoice

When a tax invoice is generated in accordance with rule 48(4) of the CGST Rules, there is no need to carry a physical copy; instead, the person can generate a QR code with an integrated IRN.

3. Inverted Duty Structure Refund

The section 54(3) restriction on claiming a refund of accrued ITC will apply solely to items that are subject to some form of export duty and not to others.

Circular No. 161/17/2021-GST: 20.09.2021,

- This clarification pertains to service exports. Under the CGST Act, a company formed in India and its subsidiary incorporated under the laws of another nation will now be deemed independent individuals, allowing them to benefit from GST-related benefits. Foreign enterprises are subject to similar rules. This clears up the ambiguity and consideration of the same person/entity in Explanation 1 of section 8.