Table of Contents

Frequently Asked Questions (FAQs) on Basic concepts of GST

Q.: How will imports be taxed under GST?

Answer: The Additional Excise Duty or CVD, which are now known as the Special Additional Duty or SAD, being levied on imports are subsumed under GST. As per explanation to clause (1) of article 269A of the Constitution, IGST are going to be levied on all imports into the territory of India. Unlike within the present regime, the States where imported goods are consumed will now gain their share from this IGST paid on imported goods.

Q.: What are the most important features of the Constitution (122nd Amendment) Bill, 2014?

Answer: Some of the salient features of the Constitution Bill are as follows -

- Conferring simultaneous power upon Parliament and also theState Legislatures to form laws governing goods and services tax;

- Subsuming of assortedCentral indirect taxes and levies like Central Excise Duty, Additional Excise Duties, Service Tax, Additional impost commonly referred to as tariff, and Special Additional Duty of Customs;

- Subsuming of State Value Added Tax/Sales Tax, Entertainment Tax (other than the tax levied by the local bodies), Central nuisance tax(levied by the Centre and collected by the States), Octroi and Entry tax, also includes luxury Tax, purchase tax, and, tax leviable on lottery, betting and gambling;

- Levy of Integrated Goods and Services Tax on inter-State transactions of productsand services;

- GST shall be levied on supply of all goods and services, excluding liquor for human consumption. Petroleum and petroleum products shall be subject to the levy of GST on a later date notified on the adviceof the products and Services Tax Council;

- Compensation to the States for loss of revenue arising on account of implementation of the productsand Services Tax for a period of 5 years;

- Creation of products and Services Tax Council to look at issues regarding goods and services tax and make recommendations to the Union and therefore the States on parameters like different rates, taxes, Cess and surcharges shall be subsumed, list of exemption and threshold limits, etc. The Council shall function under the Chairmanship of the Union government minister and can have all the State Governments as Members

Q.: What are the foremost features of the proposed registration procedures under GST?

Answer: The main features in respect of the registration procedures under GST are as follows -

- Existing dealers: Existing VAT/Central excise/Service Tax payers won'tshould apply afresh for registration under GST.

- New dealers: they are required to file a single application for obtaining registration under GST through online mode.

- The identification numberare going to be PAN based and can serve the aim for Centre and State

- Unified application to both tax authorities.

- Each dealer to beunique ID GSTIN.

- Deemed approval within three days.

- Post registration verification in risk-based cases only.

Q. : What are the foremost features of the proposed returns filing procedures under GST?

Answer: some of the main features in respect of the returns filing procedures under GST are as follows -

- Common return would serve the aimof both Centre and government.

- There are eight forms provided for within theGST business processes for filing for returns. Most of the typical tax payers would be using only four forms for filing their returns. The above-mentioned returns are provided in respect of supplies, purchases, monthly returns and annual return.

- Small taxpayers: small taxpayers who have opted composition scheme shall need tofile return on quarterly basis.

- Filing of returns shall be completely online. All taxes also canbe paid online.

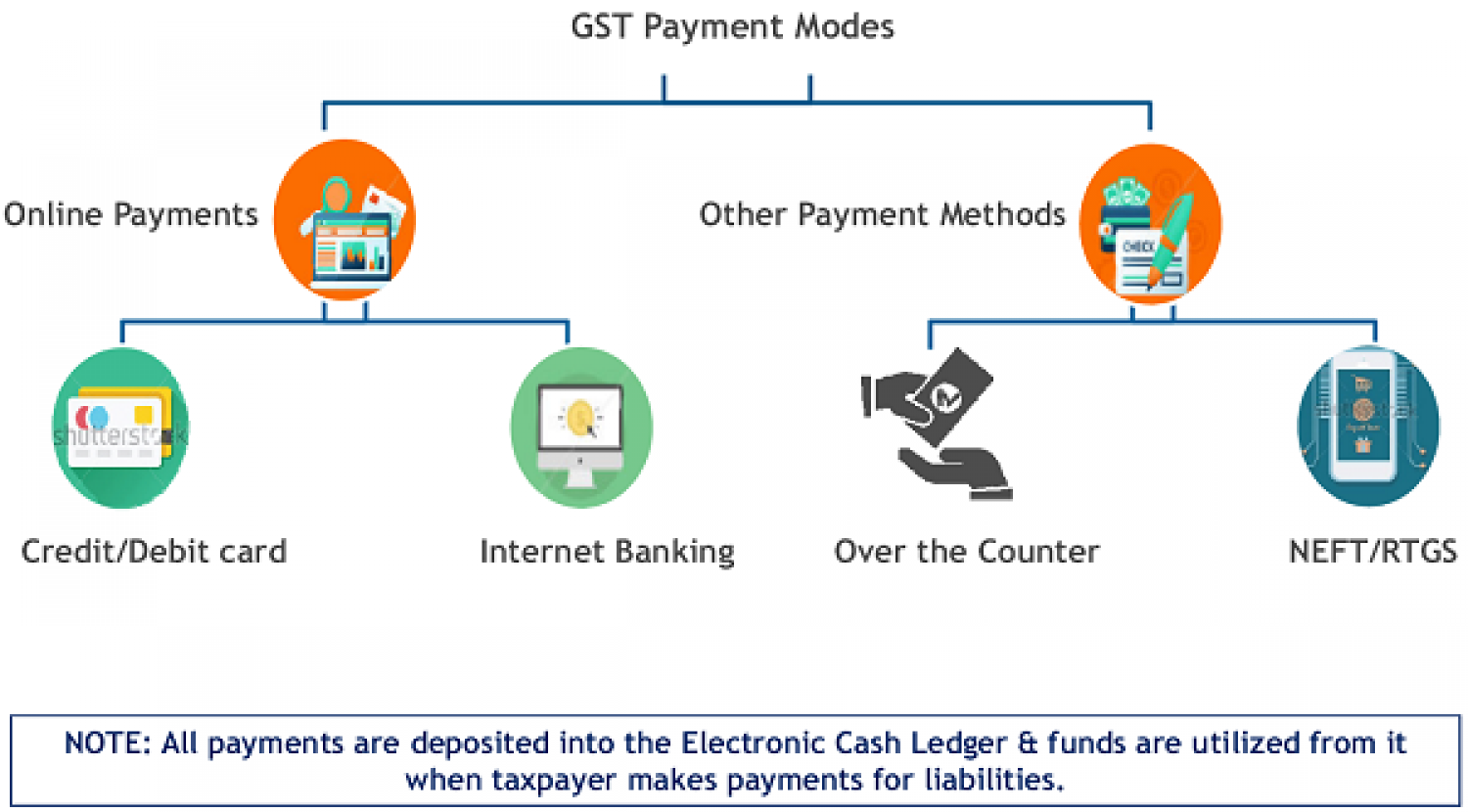

Q. : What are the main features of the proposed payment procedures under GST?

Answer: Some of the main features in respect of the payments procedures under GST are as follows -

- Completely electronic payment process, involving zero usage of paper.

- Single point interface for challan generation- GSTN

- simple payment – payment may be made through online banking, Credit Card/Debit Card, NEFT/RTGS and thru cheque/cash at the bank

- Common challan form with auto-population features

- Generation of a single challan as well as a single payment instrument.

- Common set of authorized banks

- Common Accounting Codes

Q.: what number GSTR-Filings are present there, in general?

Answer: In total there are 19 differing kinds of GST Returns at the present, based on, the kind of business, origin (residential/non-residential), turnover, monthly, annual, etc. the essential GST Returns that require to be filed by all the normal/regular taxpayers regularly are-

- GSTR-1: this is often the monthly Sales Return Filing that reflects the main points of all the outward supplies of the taxpayer.

- GSTR-2A: this can be the auto-populated read-only draft of all the Purchases made by the taxpayers during a tax period. this can be auto-populated from the sales returns GSTR-1 filed by all the suppliers.

- GSTR-2A. GSTR-3B: this is often the filing through which the taxpayer discharges all his tax liabilities, by paying cash or adjusting the ITC. this can be a consolidated summary of the monthly Sales, Purchases & ITC.

- GSTR-9: this is often the annual return that must be filed at the top of each year because the consolidated summary of GSTR-1, GSTR-3B, GSTR-2A, & ITC claims or demands.

- GSTR-9C: this is often the part where the taxpayers have to get their accounts audited by a CA & the audit report together with the reconciliation statement is submitted on the GST Portal.

Q. : What is reconciliation?

Answers: Reconciliation under GST means nothing but the matching of varied reports to spot & remove any mismatches or errors present.

Reconciliation ensures that the records match from both the client & seller end, making the transactions authentic & correct to the most effective of their knowledge.

This way there shall be no false or hidden transactions within the Return Filings. the foremost common reconciliations are those of, GSTR1 & GSTR-3B, GSTR-2A & Purchase Books, Annual Reconciliation, GSTR-1 & e-Way Bill data.

Q.: What are e-Invoices?

- e-Invoices are the normally generated invoices that requireto be authenticated on the Invoice Registration Portal.

- Post successful authentication, the invoice is assigned with a singularIRN (Invoice Registration Number) & a QR code and therefore the invoice becomes an e-Invoice.

- After the implementation of E-Invoicing System, the authority will provided and will consider only the e-invoices as valid.

Q. : What are e-Way Bills?

- e-Way Bills are mandatory documents to be carried by the transporter of productsworth Rs. 50,000 &/or more, while transporting such goods both inter & intra-state.

- e-Way Bills are generated supportedInvoices & are invoice supporting documents. it's the invoice details, item details & transporter details furnished.

Q. : What is the Reverse Charge Mechanism?

- Reverse Charge Mechanism under GST implies thatthe taxes must be paid by the recipient of products on to the govt.

- In the traditionalsystem, the recipient pays the tax liabilities to their supplier who then pays this tax to the govt by filing their GSTR-1 & GSTR-3B.

- Under special circumstances like, if the supplier could be anon-registered person, Reverse Charge is applicable & the recipient must pay the GST on to the govt.

Q.: What is Input Tax Credit? a way to claim Maximum Credit?

- Input diminution or ITC is that the tax that the taxpayer has paid at the time of purchase of products or Services for creating goods during a particular tax period.

- For say, a taxpayer Mr. Amar pays a tax of Rs. 50,000 on the acquisition of leather for his Shoe Business.

- Till the time, the final product is sold, Mr. Amar incurred aliability of Rs. 1 Lakh, within the same tax period. Then he can claim for ITC of Rs. 50,000 that he paid earlier & he can adjust it with their liabilities.

- After which Mr. Amar will only must pay Rs. 50,000. A taxpayer is eligible to claim the amount equivalent to the ITC by making their Reconciliation error-free, clean & thorough

- With RJA's Auto-reconciliation feature, this shall be a no brainer for the taxpayer.

More read:GST Return compliances calendar- Nov 2020

Q.: What are GST APIs? In what way, does these APIs help the Businesses with their GST Return Filings?

- GST APIs are a government initiative to produce online GST Services to taxpayers to create their work simpler, through site-to-site integrations & increase compliance with the GST System.

- RJA is one among government-appointed GST Suvidha Providers, that gives the users with seamless, most relevant & top-notch GST Solutions to Businesses.

- RJA provides facilities associated with GST Return Filings, e-Way Bills, E-Invoicing, Reconciliation, Annual Returns, etc, to both Tax Practitioners & Businesses.

- RJA provides solutions for multiple generic & customized ERPs, Tally SAP, Marg, Oracle, etc.

Q. : What are Tax Rates under GST? what percent age Tax rates are there at present?

- Goods under GST System are bifurcated & categorized into categories, as per which the taxes on them shall be levied. These categories actually decide the Tax Rates of the products.

- Different classes of productsconstitute different tax rates. For say, luxury goods comprise higher rate (28%) & essential goods make up the low one (as low as 5%).

- Commonly there are 0%, 5%, 12%, 18% & 28%. Some other rate of taxes are also levied in respect of Fuel, Alcohol, Gems & Precious stones, etc.

Q.: What is the Composition Scheme under GST?

- It may be ascheme given by the govt for little taxpayers, relieving them from the tedious tasks of filing GST frequently & collecting GST from small Businesses without actually troubling them.

- Composition Scheme made compliance simpler for littleBusinesses & helped the govt. in maintaining the revenue inflow.

- This reduces the burden of high tax liabilities for tiny

- Taxpayers under the Composition Scheme needn'tfile their GSTR-1, GSTR-3B & GSTR-9.

- Instead, they haveto file GSTR-4 which could be a quarterly filing of taxes & GSTR-9A which is that the annual filing for this Scheme.

- It has all the small printof the quarterly filings.