Table of Contents

Changes in Input Service Distributer (ISD) Concept & Definition: Union budget 2024

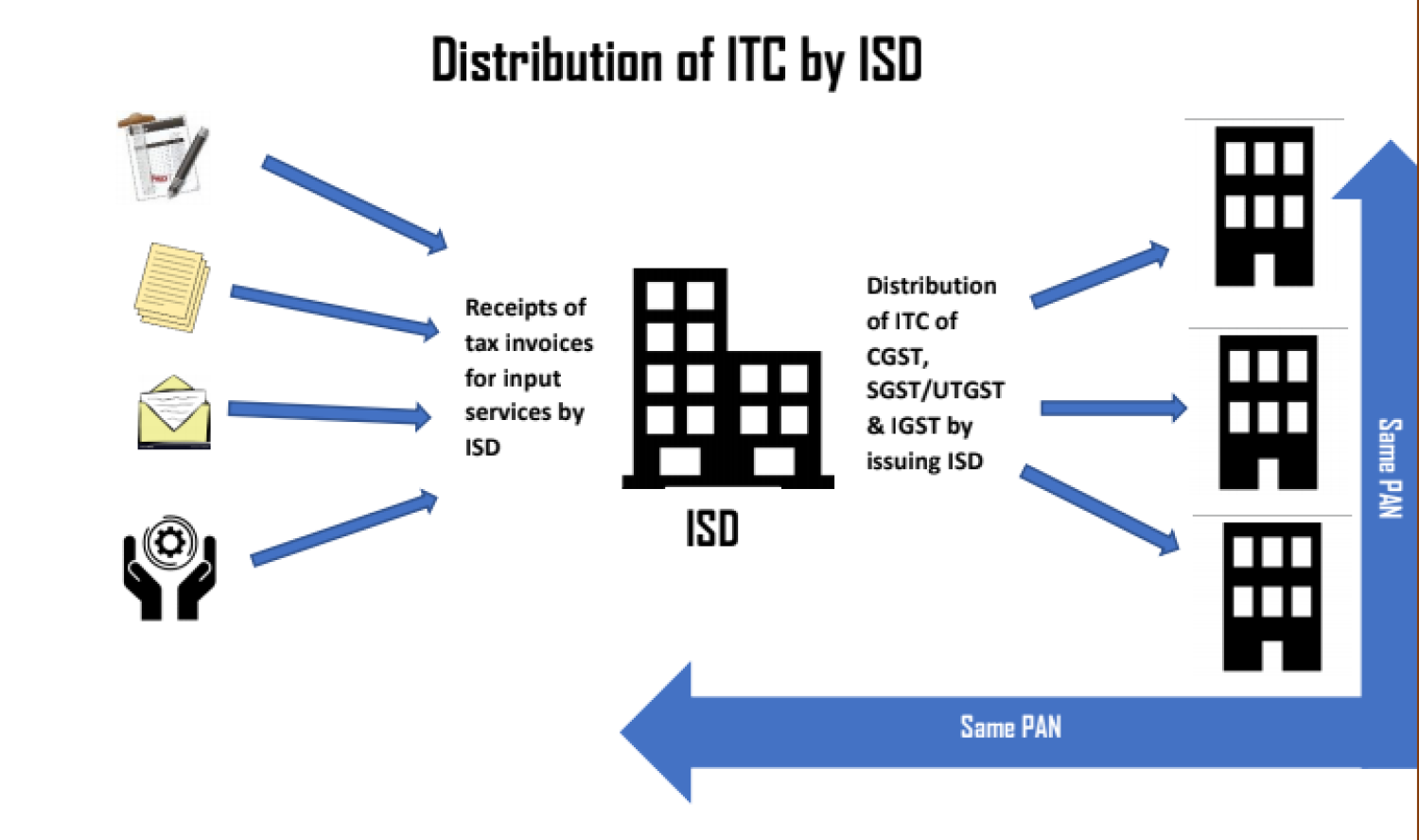

- Registration as input service distributer (ISD) & Distribution of Input Tax Credit is proposed that to to necessary every person receives GST invoices for or on behalf of other branches having separate Goods and Services Tax Identification Number.

- It is crucial for all multi location enterprises entities assess whether any other branch get invoice on behalf on another branches & to decide requirement of distribute of input tax credit as input service distributer.

- Multi location entities which is located more than one place should started the preparation compliance with provision to avoid sudden without any serious thought changes in their all process.

It “s included following steps

- Registration of input service distributer (ISD) is respective applicable relevant state (if not registered) or union Territory.

- Expense wise is analysis of input tax credit which is input tax credit distributed to other branches. Confirm the Identify of GST Vendors from whom distributed input tax credit is received.

- Provided Goods Services Tax Identification Number as input service distributer (ISD) to such GST vendor and needed to confirm the vendors provide the name of invoice of input service distributer only

- Transfer & Accounting as such input tax credit to be recognize of input service distributer Books. Input service distributer invoice to be issued & reported in GST Return GSTR -6.

- Recipient branches to identification of their input tax in their books of accounts and Goods Service Tax Return (GSTR-3BI). Further ensure that required Reconciliation between input service distributer & input Tax credit receipt

- Input tax credit in respect inverse charge also to be distributed as common credit. If some attributable to another Goods Service Tax Identification Number such distributor would be only for Reverse Charge Mechanism paid by any other different person/registered branch in same state as that of input service distributer.

- Credits on common expenses, were compulsorily required to be distributed under Input service distributor mechanism & by cross charging there is short/ excess distribution of credits. So Goods Service Tax Taxpayers required to be careful on opting for cross-charge. While valuing cross charges, Sale / turnover ratio could be considered so that it could be proved that there is no short or excess claim of Input Tax credit.

- The way of distribution would now be provided which means of rules to be as prescribed. Recently, the input tax credit is distributed to those branches to which expenses is solely attributable and if attributable to multiple branch based on turnover, It remains to be seen if this GST ITC Distribution mechanism is continued.

- Input service distributer invoice contain particular specific particulars which used for distribution of input tax credit to other branches. Central goods service tax can be distributed as Central Goods and Services Tax or integrated goods service tax, and IGST as IGST or Central Goods and Services Tax.

- The definition of a ISD has been changed in the GST Law to make Input service distributor registration mandatory, if office of goods or services Supplier receives tax invoices towards receipt of input services for or on behalf of distinct persons. The management & distribution of input tax credit will improve the effectiveness of the GST system.

- The industry had asked for clarification on how head office-provided branch offices will be taxed for external services including banking, security, and advertising. The positive aspect of this change is that it can protect earlier cross-charges from disputes because it is applicable going forward.

- Long-term clarity in the taxation of these services is the ultimate objective of the shift, but in order to comply with compulsory compliance requirements, certain adjustments will need to be made. "Businesses would need to gear up for making appropriate changes in processes, including technology changes, appropriate billing locations, communications with vendors, tracking of usage of expenses, etc., to ensure compliance with this mandated obligation,"