Table of Contents

- Gst Registration For Non-resident Taxable Individual (nrtp)

- Gst Registration For Foreigners

- What Are The Benefits Of Getting Gst Registration?

- Significant Guidelines For Taxpayers Applying For Foreigners Gst Registration

- Gst Registration Procedure For Non-resident Indians

- Provisional Registration Updates

- Final Registration

- Non-resident Taxable Individual Registration Requirement

- Goods And Services Tax Deposit For Non-resident Taxpayers

GST Registration For Non-Resident Taxable Individual (NRTP)

GST Registration For Foreigners

GST is an abbreviation for Goods and Services Tax. The Goods and Services Tax (GST) is an indirect tax that came into effect across India on July 1, 2017. GST has consolidated many indirect taxes into a single law, the GST Law. The Indian GST Law is a comprehensive, destination-based tax, multi-stage.

What does GST registration for foreigners?

Foreigners GST registration is required for non-resident taxable individuals who make taxable supplies in India. With India evolving as an economic hub, many NRI’s are eager to establish businesses in India. As a result, if a non-resident taxable person engages in transactions involving the supply of goods or services, or both, he must apply for GST registration.

As a result, an individual living abroad or a foreign business, or an organisation supplying foods or services in India is considered to be a non taxable person who must follow all of the regulations outlined in the Goods and Services Law Act. The non-resident taxable person should assign a nominee in India to carry out the GST compliance needs on behalf of them. Foreigners must acquire GST registration five days before starting their business.

What are the Benefits of getting GST registration?

• Unified taxation system: GST registration is a unified platform that has absorbed all other taxes, including service tax registrations, VAT registration. All indirect taxes are consolidated under a single GST registration.

• Ease of doing business: There are no longer various taxes such as Additional Custom Duty, the Central Sales Tax, Luxury Tax, Purchase Tax, & so on because GST handles taxes on goods and services. This has made business easier for taxpayers.

• Reduced tax liability: With a higher annual turnover limit, the taxes that must be paid are lower than in the case of VAT. goods and services has also significantly increased the tax base, lowering overall tax liability and making businesses more compliant.

Significant Guidelines for Taxpayers Applying for Foreigners GST Registration

The applicant's name must be entered exactly as it appears on the passport.

-

At least 5 days prior to start of the business, the applicant should apply for GST registration on the common portal using form GST REG-09.

-

In the case of a business entity incorporated or formed outside India, unique number or a tax identification number (No. by which the respective govt recognises entity) or Permanent account number (if applicable) must be submitted along with the application.

-

Application must be verified via EVC or properly signed.

Non-Resident Taxable Individual (NRTP)

The word 'non-resident taxable person' is defined in the GST Law as any person who occasionally engages in transactions involving the supply of goods or services, or both, whether as owner, agent, or in any other capacity, but who does not have a fixed place of business or residence in India.

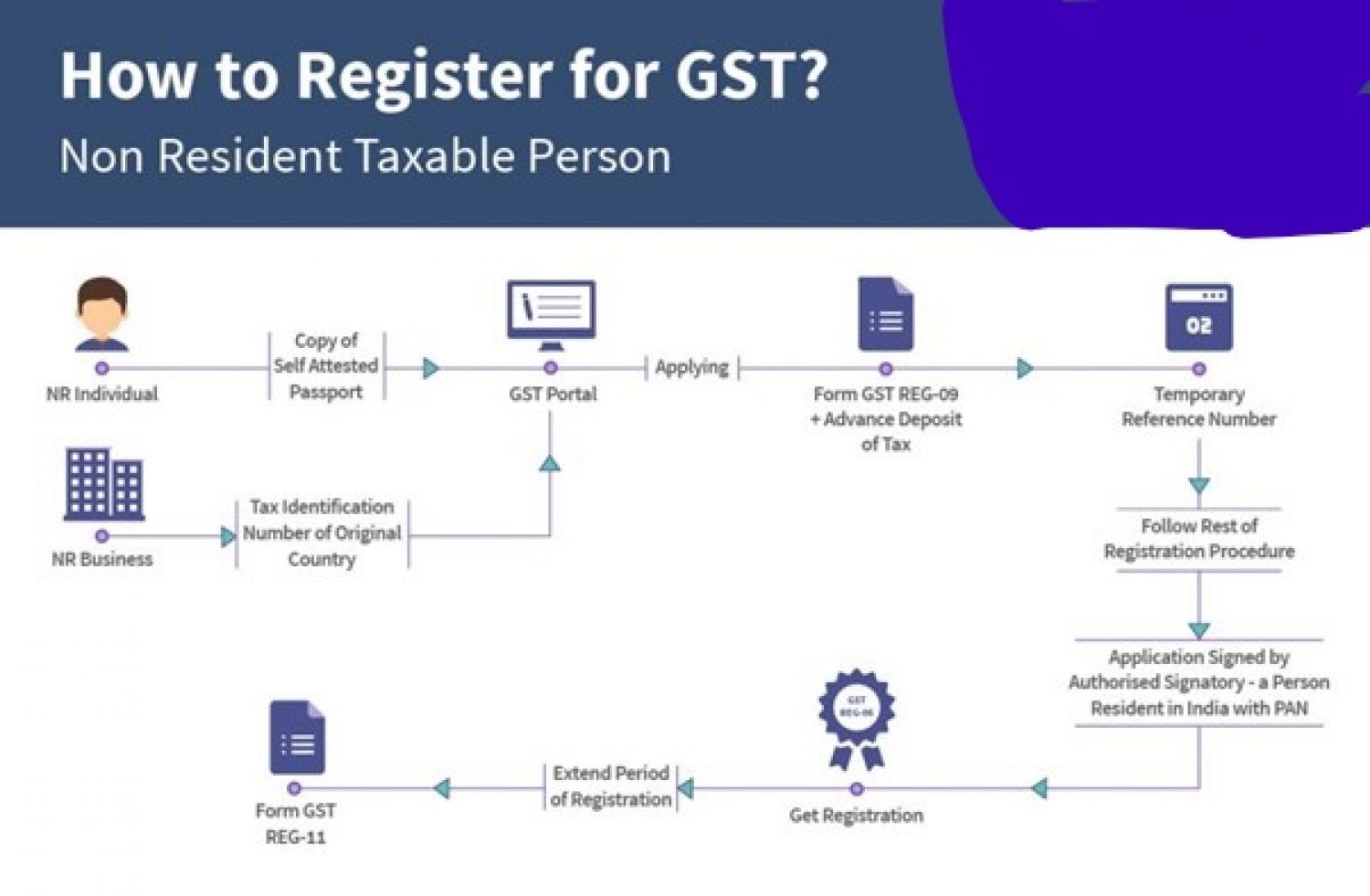

GST Registration Procedure for Non-Resident Indians

Non-residents find India to be a very appealing market in which to invest and do business. If you are a non-resident and intend to start a business in Canada, you must register with GST. . In this blog, we will go over the process of GST registration for non-residents as well as the necessary forms.

Provisional Registration Updates

• A non-resident taxable person will submit an application for registration electronically using the FORM GST REG-09, along with a self-attested copy of his valid passport.

• FORM GST REG-09 application must be properly signed or verified via EVC.

• Application shall be file at least 5 days before the start of business.

• If it is a foreign business entity (established or incorporated outside India), the registration application must be accompanied by its tax identification number from that Nation (similar to our Permanent account number) and its Permanent account number(if it has one).

• An advance tax deposit (estimated) shall be also be file with the application.

Final Registration

Final Registration is made in the following manner-

• If the individual wants to register under GST, he will make an application electronically using the FORM GST REG–26. Each and every information must be provided within three months.

• If the information provided is accurate and complete, the ultimate GST registration will be provided in FORM GST REG-06.

• If the information provided is incorrect, the officer will give a show-cause notice using FORM GST REG-27.

• If the information given is incorrect, the officer will issue a show-cause notice using FORM GST REG-27. After an opportunity to be heard, the provisional registration will be cancelled using the FORM GST REG-28.

• If the applicant's response is acceptable, the show cause notice can be revoked by issuing an order using the FORM GST REG- 20.

• A non-registration resident's application must be signed by his authorised signatory, who must be a person resident in India with a valid PAN.

Note: EVC stands for Electronic Verification Code, and it is a new type of electronic verification that is based on the Aadhar card. All forms submitted to the GST Portal must be signed or verified using EVC.

Non-Resident Taxable Individual Registration Requirement

Section 24 of the GST Act establishes a mandatory registration requirement for non-resident taxable persons with no threshold limit. As a result, Non-Resident Taxable Persons are not eligible for the minimum threshold limit of Rs. 20 lakh/ 10 lakh. As a result, any non-resident who meets the definition of a Non-Resident Taxable Person must obtain GST Registration, regardless of whether the business engages in a one-time transaction or frequent taxable transactions.

Documents required for GST registration

• Proof of principal place of business

o For own business- Document proving ownership of the premises, such as the most recent tax bill, the municipal khata, or a copy of the electricity bill.

o For rented or leased premises: a copy of the valid rent or lease agreement, as well as any document supporting the lessor's ownership of the premises, such as a property tax receipt, a municipal khata copy, or an electricity bill.

o For premises not covered above, a copy of the consent letter along with a document proving the consenter's ownership of the premises, such as a municipal khata or a copy of the electricity bill. The same documents can be uploaded even for shared properties.

Identity Verification

-

It is required to file a soft copy of the non-resident taxable person's passport along with the VISA details. In the case of a business entity that is incorporated or established outside of India, the application for registration should be submitted along with the tax identification No or the unique no that is used by the Govt of that country to identify the entity, or the Permanent account number if it is available.

o In the case of a company/society/LLC/FCNR, etc., a person with the authorization certificate who holds the attorney power.

o A scanned copy of the company's incorporation certificate is registered outside India or in the country.

o A scanned copy of the foreign country's licence, if one is available.

o If available, a scanned copy of the clearance certificate issued by the Government of India.

Proof of Bank Account

The opening section of the bank passbook in the name of the business that includes the Account number, name of the account holder, MICR, IFSC code, as well as branch details, copies of the first page of the bank passbook or one page of the bank statement,

Procedure for a Non-Resident Taxable Person to Register

• Every person who meets the criterion of a Non-Resident Taxable Person must register for GST at least five days before they begin commencement business.

• In order to register for Goods and Services Tax, Non-Resident Taxable Individual will need to furnish its home country's Tax ID or Unique Number of its.

- NRTP need not to have a PAN of India and it can use its valid passport instead.

- Application for registration need not be like normal applicants. Application can be submitted in simplified form ie REG-09.

- Further in the case of a high-sea sale; as per the GST Law provisions every person who supplies from the territorial waters of India shall have to obtain registration in the coastal state or Union territory nearest to appropriate baseline.

• For example, if a high-sea sale occurs on the Haldia beach, the Goods and services tax registration must be done in West Bengal.

• In the case of Non-Resident Taxable Person (NRTP) GST registration, the Common Portal generates a temporary reference No online at first. The objective of this temporary no is to allow him to deposit tax in his electronic cash ledger ahead of time, after which an acknowledgment will be issued.

- Non-filling of electricity bill receipt is not a ground of rejection of GST Registration application

Goods and services tax deposit for non-resident taxpayers

What is a GST deposit for Non-resident taxpayers?

Under the GST, non-resident taxable people and casual taxable persons must pay a registration deposit of a specific amount.

The GST registration deposit will be equal to the anticipated tax liability during the registration's validity period. If a non-resident taxable person requests an extension, he must pay the tax in advance based on the anticipated tax burden for the extended period.

An application reference No will be generated after the GST registrations are filed, and this number will be used to pay the advance tax.

The taxpayer's electronic cash ledger is credited when tax is paid, and then certificate is issued.

GST Advance Tax Payment by a Non-Resident Taxable Person

- GST Advance Tax Payment by a Non-Resident Taxable Person Non-resident taxable persons are needed to pay an advance GST deposit under the GST Provisions. This advance GST tax payment must be in an amount equal to such person's expected tax due for the term for which registration is sought.

- The GST registration deposit will be equal to the anticipated tax liability during the registration's validity period. If a non-resident taxable person requests an extension, he must pay the tax in advance based on the anticipated tax burden for the extended period.

- An application reference number will be generated after the GST registrations are filed, and this number will be used to pay the advance tax.

- The taxpayer's electronic cash ledger is credited when tax is paid, and then certificate is issued.

• Any tax that is overpaid will be refunded to the NRTP at the end of the GST registration period, upon filing of final returns.

• The non-resident taxable person can prolong the GST registration period, which is initially applied by the NRTP,. For the same, An application in the form GST REG-11 must be submitted online on the GST Common Portal for this purpose.

Other Business Transactions

Apart from Non-Resident Taxable Individual (NRTP), GST regulations apply to a variety of other transactions involving non-residents, which including:

Renting of Immovable Property in India For example, if an Non-Resident Indian’s owns an immovable property in India that is used for business reasons or commercial then GST regulations will apply to that transaction.

• Non-residents provide consulting services to Indian residents. GST may be imposed to such transactions under the import rule & regulations.

• GST laws may also apply to numerous other transactions involving Non-Resident Indian’s, PIOs, Expatriates, OCIs, Foreign Companies, & other Non-Residents, depending on the facts.

NRIs, Expats, as Well as other Non-Residents may find the above material useful when they have questions about GST provisions in India, such as:

• What are the GST law for Non - resident indians, OCIs, Foreign Businesses, and Foreign Citizens?

• I am a non-resident alien In India, I own an immovable property that I rent out. Is it true that the GST law applies to such a transaction?

• What are the GST rules & processes for foreign Company & non-residents ?

• I am a non-resident Indian (NRI), employee of a foreign Company or Expatriate. In India, I'd want to do some business transactions. Is the GST applicable? What are the rules and regulations in relation to that?

• Does GST deal with non, such as foreign corporations NRIs and OCIs?

• I work for a Foreigner company situated out of India. I provide consulting services to the organisation. Is GST applicable, and if so, what are the provisions?