Table of Contents

INPUT TAX CREDIT

- GST is the indirect tax that is imposed on the services and goods on the basis of the primary value addition. Hence, the imposing of the tax is totally based on the value addition at the single stage of the chain of supply until the finished product reached the final consumer. In this kind of system of tax, to invalidate the cascading effect on the tax,

- it exists a way to set of taxes paid acquisition of the basic material, parts, services, plant and machinery, consumables, and so on. It is used for manufacturing goods and services. The part used to of set to the tax liability is known as the input tax credit. We cover the concept of Input under the GST in detail.

What is the Input Tax Credit?

- In the GST, each person that comes under the supply chain that comes in the process of controlling, getting the GST tax, and remitting the amount collected have to complete the GST registration.

- Input tax credits help to avoid the double taxing and the cascading effect of the and Input tax credit is given to adjust the tax paid on the acquisition of the basic materials, consumables and the services and goods that helped in the producing and supply and the sales of the goods and services.

- After using the ITCM, organizations are able to net neutrality in the prevalence of the tax and makes sure that the input tax part doesn’t invade into the cost of the supply of services and goods or cost of the creating.

Eligibility for Claiming Input Tax Credit

A person who has the GST registration can claim the ITC on the basis of the right documents and filling the form of the GST- returns. If you want to claim the ITC then you must have the following documents ready.

- A bill issued by the supplier as per the GST rules for the invoice; or’

- A debit note which expressed by the suppliers;

- An entry of the bills and any similar documents;

- An ISD credit note or ISD invoice or any other document is expressed by the Input Service Distributor.

Further, the below conditions are also important to fulfill for claiming the ITC.

- A person is in the authority of a tax bill or the debt expressed by the registered suppliers and the other tax-related documents.

- A person or taxpayer has collected registered suppliers and other taxpaying documents.

- The tax imposed regarding the supply has been actually paid to the account of the suitable government, in the case or through the utilization of the obtainable ITC.

- A person or a taxpayer must have to fill the important GST filings.

Goods & Services Not Eligible for Input Tax Credit

In the GST, the ITP is not accessible regarding the below services or goods:

Motor vehicles, excluding when they are giving in the respect of the business or used for the imposing taxable services such as:

- transit of traveler

- transit of virtue

- Giving training on fling, driving, navigating such as the vehicles.

- An additional supply of kind of vehicles or conveyance

Supply of the services and/or goods respecting to outdoor catering, food and beverages, health services, cosmetic, beauty treatment, and plastic surgery without were inward supply of services or goods or a category is used by the several registered taxable person for creating an outward taxable inventory of the same division of the services

- Association of the health, fitness center, and club.

- Lease a club, health insurance, excluding where it is carving obligatory for an executive to give kind of services.

- The advantages of the traveler are continued to executives on holidays such as home travel events and leave

- Services and/or goods got by the primary in the building of the immovable property, excluding machinery and plant excluding in which it is an input service for the supply of the work contract services.

- Services and goods got by the taxable in which the tax has been paid beneath the composition scheme.

- Services and goods which are used for the personal utilization

- The goods that are stolen, lost, written off, or disposed of by the way of gift or free scheme.

- Tax paid after finding of fraud, persistent inaccuracy, or suppression

- Tax paid for the discharge of delay or seized goods

- Tax paid for the discharge of impound goods

- Utilization of CGST and SGST Input Tax Credit

GST Input Tax Credit Preference

- The SGST and CGST ITC will be attention to the electronic credit books of the person or taxpayer which is organized by the GST Network. The price of the ITC in the electronic credit books can be used for the payment of the CGST and the remaining price, if any, can be used for the payment of the IGST.

- The price of the ITC on the account of the CGST on the EC book can’t be used for the payment of the SGST.

- In addition, it’s required to note the amount of the output tax that can be created by using the ITC. Any amount on the account of interest and penalty is important to be created out of the price available in the computerized cash books of the person or taxpayer.

- A simple guide to CGST, SGST, and IGST, if you need to understand the difference.

- A simple guide to electronic cash ledger and procedure for making GST payment.

The utilization of IGST Input Tax Credit

It is also credited to the computerized cash books of the person or taxpayer, under the head of IGST, organized by the GST Network. The price of the ITC applicable on the account of the IGST must first be used on the way of payment of the IGST and the pausing amount, if any, in the case in which taxpayer has any CGST ITC applicable on the account, it must be the 1st used for the amount of the CGST and the remaining price, if any, can be used for the price of IGST

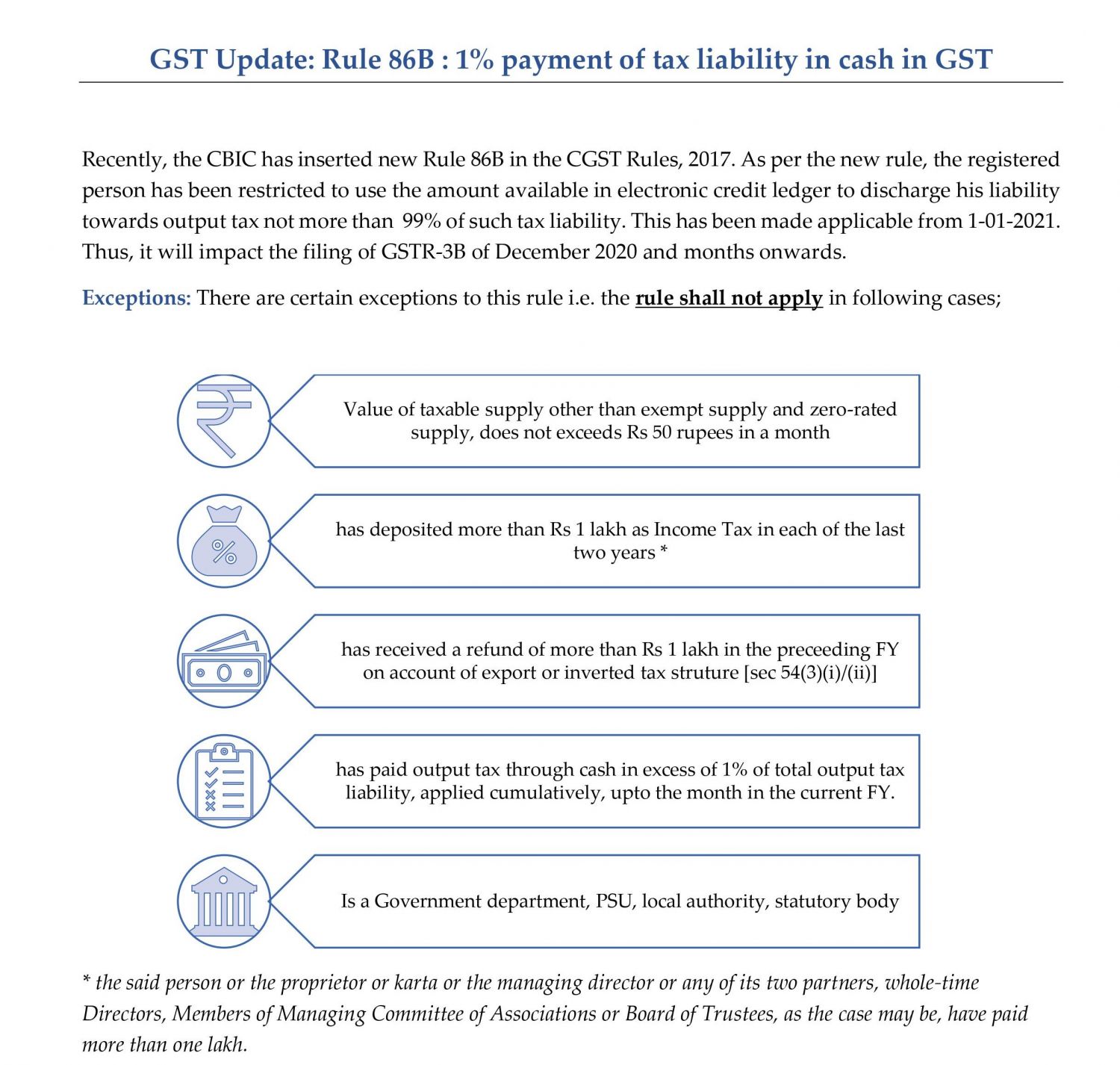

Implications of Rule 86B on biz and working capital

- Having complied with the above constraints and exemptions presented by Rule 86B, it is completely obvious that the above-mentioned rule applies only to large taxpayers. There will be no impact on micro and small enterprises.

- The motto behind the emergence of this rule is to regulate the issue of counterfeit invoices for the use of counterfeit input tax credits to discharge the liability. Furthermore, it constrains fraudsters from having high turnover without financial credibility.