Table of Contents

No Input Tax credit available on Canteen Services provided to Employees

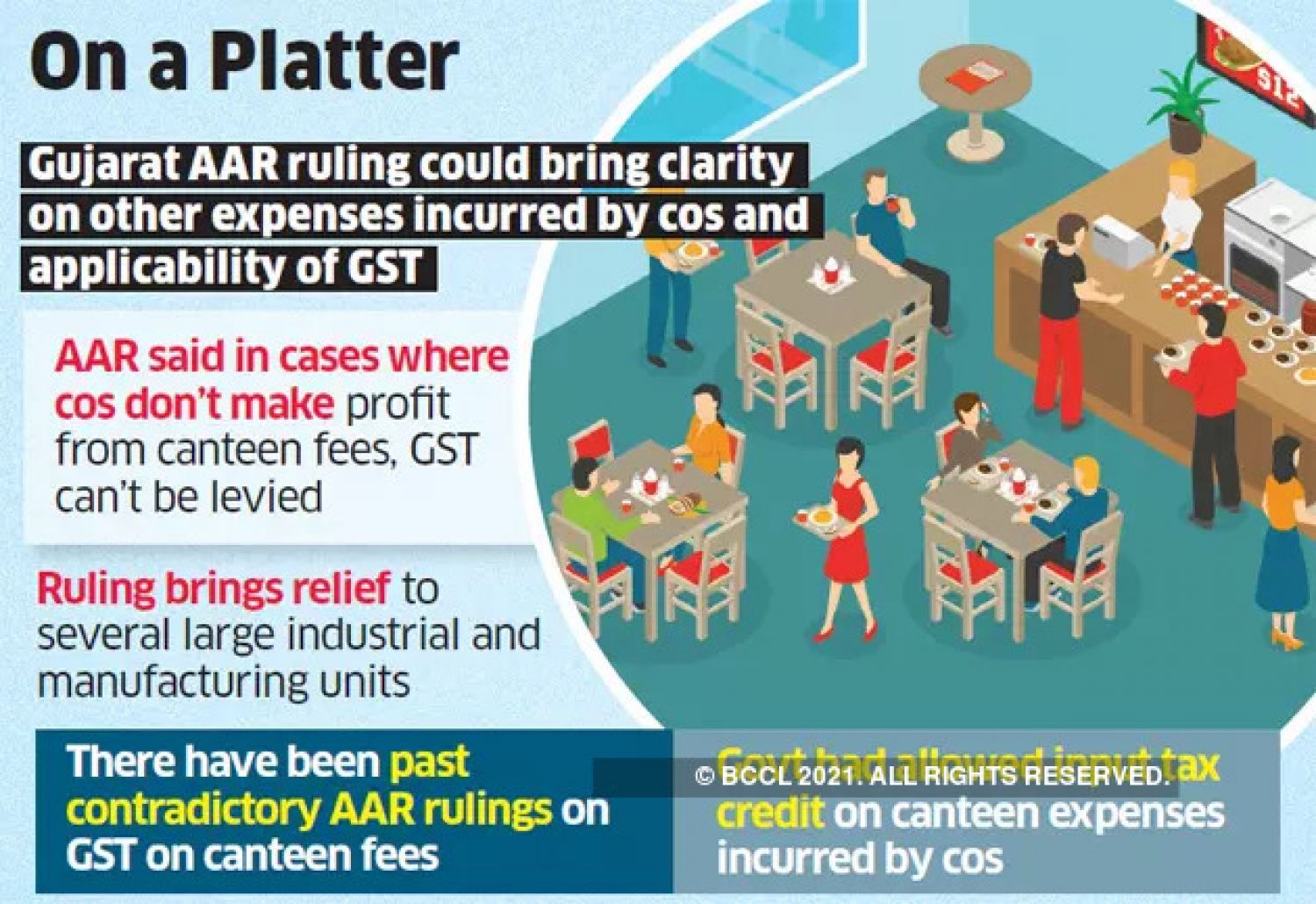

M/s Tata Motors Ltd. (Applicant) has requested clarification on whether ITC will be applicable on GST levied by the service provider on canteen services given to factory personnel, and whether the ITC will be limited to the cost spent by the Applicant.

In furthermore, it has been asked if GST will be charged on the nominal sum received by the applicant for employee use of the cafeteria. [Advance Ruling No. GUJ/GAAR/R/39/2021 dated July 30, 2021]

The Gujarat Authority of Advance Ruling observed that the 2 clauses in Section 17(5)(b)(i) and 17(5)(b)(iii) of the CGST Act, which governs the supply of goods and services, are not related by the punctuation used at the end of the provisions. "Colons and semicolons are two types of punctuation," according to the concept, and "Semicolons are used to unite two independent clauses/subclauses, or two complete thoughts that might stand alone as entire sentences."

Furthermore, it was observed that the Input Tax Credit on Goods and Services Tax paid on Canteen Facility is barred credit u/s 17(5)(b)(i) of the Central Goods and Services Act, 2017 and hence inadmissible. On the amount that represents employee canteen charges, the M/s Tata Motors Ltd. is not subject to the Goods and Services Tax.

It should be noted that the M/s Tata Motors Ltd. (Applicant) canteen arrangement is handled by a Third-Party Canteen Service Provider, from whom the Appellant receives a modest monthly payment. The expense of Third-Party Canteen Service is solely borne by the M/s Tata Motors Ltd. and is thus included in company's cost.

Our Remarks

- Hon'ble Kerala Authority of Advance Ruling in Caltech Polymers Pvt. Ltd. held that if the company's canteen services are covered under "outward supply" under Section 2(83) of the Central Goods and Services Act, 2017, GST will be payable on food expenses collected from employees.

- According to a CBIC press release dated July 10, 2017, giving explanation on GST on Gifts, supplies made by an employer to an employee under the conditions of a contractual employment agreement would not be subject to GST.

In conclusion it can be say that ITC not allowed on canteen charges even though it is obligatory under any other law & GST is not payable on employee recovery of canteen charges.