Table of Contents

GST Taxpayers May be permitted to submit Revised GST Returns with effect from Apr 2025

At present, there is no provision for filing revised goods and Services Tax Returns under GST, barring minor corrections in GST Invoice details & information uploaded on goods and Services Tax portal. Indian Industry has been demanding this new facility & a petition in this reference is before the honorable Supreme Court.

GST taxpayers will be able to make corrections to their goods and Services Tax returns, including the GST Computation. As GST taxpayer are looking at allowed to updated change returns as per requirement under GST.

This will make filing returns much easier and minimize the likelihood of litigation in cases when a taxpayer has made a mistake or overlooked a detail but does not intend to avoid taxes. The New GST facility of revised Returns is already available under income tax.

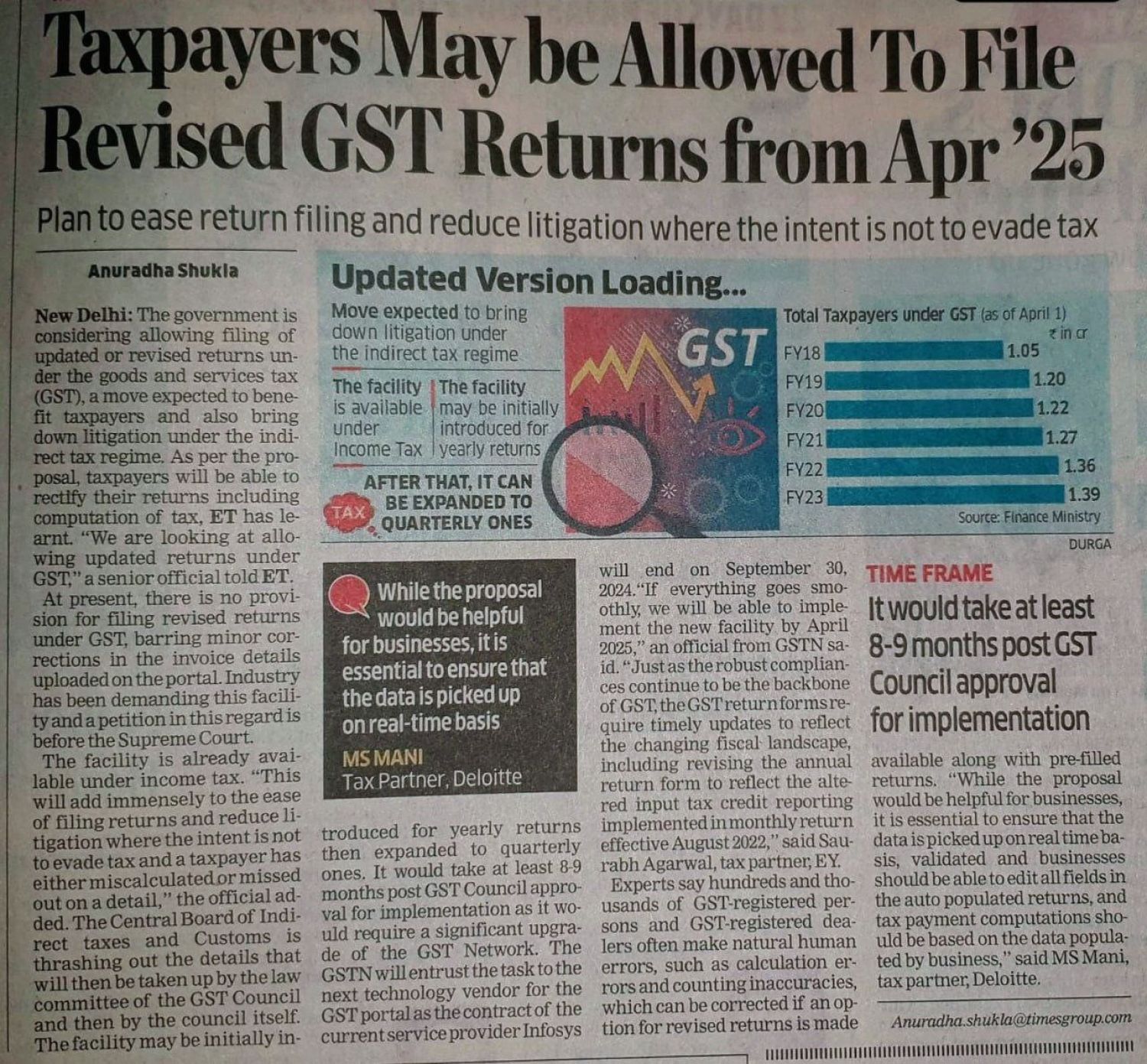

The GST Council's lawful committee and the council itself will then address the details, which are now being worked out by the Central Board of Indirect Taxes and Customs. First, the option might be made accessible for annual returns, and later on, for quarterly ones. It would take at least eight to nine months to implement when the GST Council provides its approval since the GST Network would need to be significantly improved.