Table of Contents

Pay GST on bookings of train or air tickets hotel cancellation charges

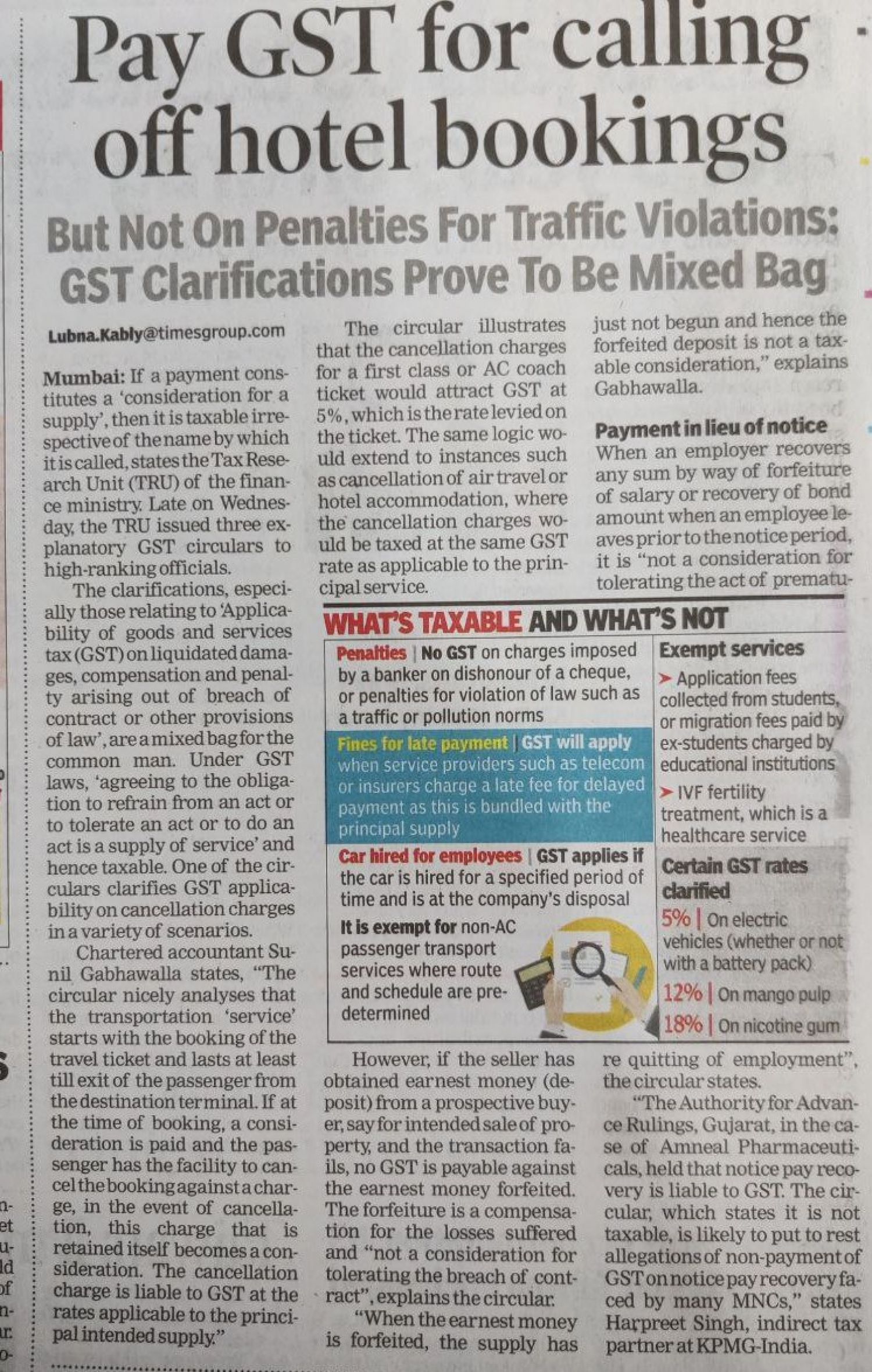

Finance ministry Tax Research Unit (TRU) issued 3 circulars along with clarifications or explanations as far as the Goods and Services tax levy is concerned.

In accordance with CBDT circular, GST levy in cases where payments arise from contract breaches. Person will be liable to pay GST on cancellation of hotel, transport, or entertainment event bookings,

This only occurs if the service must be cancelled and there is a service charge. This is so that the expenses associated with ensuring that the service is provided to the person as well as the costs associated with discontinuing the supply can be considered. Thus, they are all taken into account as payment for the promised supply.

When a seller receives a deposit from a buyer for a specific transaction, such as the sale of real estate, the deposit is forfeited in those circumstances, and no GST is charged to the buyer because the forfeiture is a kind of compensation for the losses incurred rather than a consideration.