Table of Contents

Compulsory e-Invoice Details & New Harmonized System of Nomenclature (HSN) Code Requirements:

Here are main basic points related to 2 update related to e-Way bills- New requirement of Changes in e-Waybill Generation/ issuing in GST

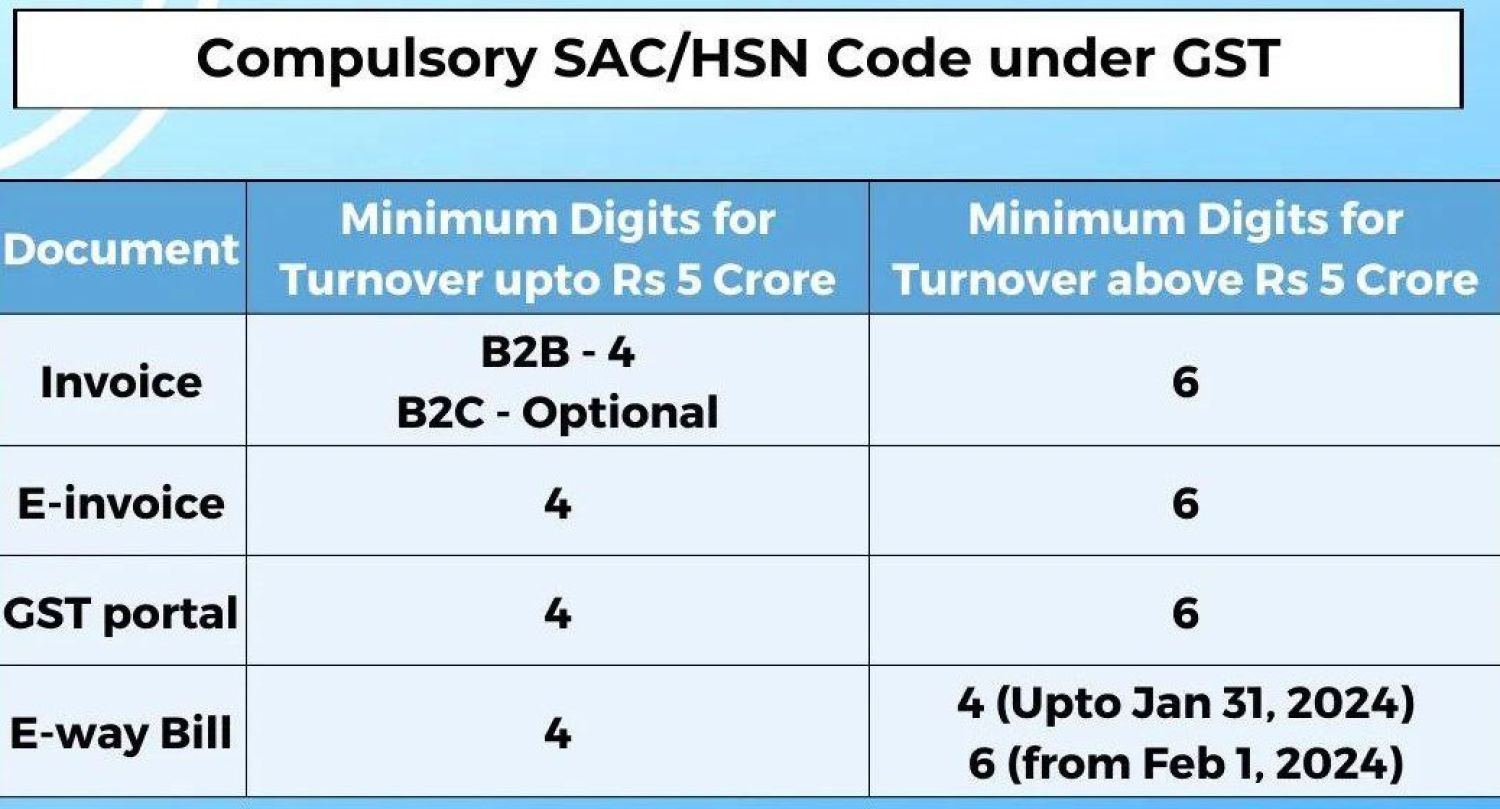

HSN code is Compulsory in GSTR 1 for B2B exempt supply, depending on the AATO of the GST taxpayer in the earlier FY. The minimum No of digits of Harmonized System of Nomenclature code to be reported in GSTR 1 are as follows:

- New Harmonized System of Nomenclature (HSN) Code Requirements for e-Waybills: Effective from 1st Feb, 2024, there are new requirements for the Harmonized System of Nomenclature (HSN) codes used in e-Waybills.

- For all the Company or businesses with an AATO greater than INR 5 Cr, a 6-digit Harmonized System of Nomenclature (HSN) code will be required. If the AATO is more than INR 5 Cr., then 6 digits of HSN code are required for both B2B and B2C supplies.

- For businesses with an annual aggregate turnover less than INR 5 Cr, a 4-digit Harmonized System of Nomenclature (HSN) code will be sufficient. If the AATO is up to Rs. 5 crore, then 4 digits of HSN code are required for B2B supplies, and 2 digits of HSN code are optional for B2C supplies.

- Compulsory e-Invoice details for e-Waybill generation: Starting from March 01, 2024, it will be compulsory to provide e-Invoice details in order to generate an e-Waybill. This means that businesses will need to have an e-Invoice before they can generate an e-Waybill.

- Supplies made to Special Economic Zone (SEZ) units or developers, deemed exports, and exports are exempt from reporting HSN codes in GSTR1

Supplies of goods that are exempt from GST or nil-rated are also exempt from reporting HSN codes in GSTR1, Supplies of services that are exempt from GST or nil-rated are required to report only the Service Accounting Code (SAC) in GSTR1

In conclusion -Harmonized System of Nomenclature (HSN) Code length:

· Four digit HSN codes were allowed earlier, but they are no longer accepted by the e-invoice system.

· Six digit HSN codes are Compulsory for all the Company / firm /businesses with an aggregate turnover of INR 5 Cr. or more in any FY from 2017-18 onwards.

- But, there are few exceptions & exemptions to this GST rule, such as supplies made to exports, deemed exports, special economic zone (SEZ) units or developers, etc. As per the GST law, export of services is exempt from HSN reporting in GSTR1. This means that the supplier of export of services does not need to mention the Harmonized System of Nomenclature (HSN) code of Service in their GSTR1 return,

- In light of new advisory, it’s Compulsory for all GST taxpayers to file table 12 HSN code in GSTR 1 & Aggregate turnover shall be Criteria to file the No of digits in Harmonized System of Nomenclature (HSN) code.

Mandatory Harmonized System of Nomenclature (HSN) code:

- B2B 4 digits up upto INR 5 cr T.O

- B2C optional upto INR 5 cr T.O.

- Above INR 5 cr T.O. HSN mandatory for all kind / types of supplies with 6 digit