SALIENT FEATURES OF NEW PROPOSED GST SYSTEM IN INDIA :

In keeping with the federal structure of India, it is proposed that the GST will be levied concurrently by the central government (CGST) and the state government (SGST). It is expected that the base and other essential design features would be common between CGST and SGSTs for individual states. The inter-state supplies within India would attract an Integrated GST (IGST), which is the aggregate of CGST and the SGST of the destination state. Lately, the Government of India has introduced GST (Goods and Services Tax), with effect from July 1st, 2017. The important goal of GST is to "enable digitalization and automation of the whole chain" i.e. all the business processes surrounding GST will be automated to the extent possible while enabling all documents to be processed electronically. If you are latest to GST, here is many of several essential characteristics of GST that you should know about-

System of Input Tax Credit

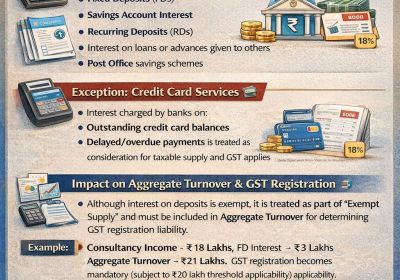

One of the most popular features of the GST in India is an input tax credit. If the producer or service provider has already paid input tax on the purchase, the same can be deducted from their overall output tax liability. Input and performance invoices must be matched to claim the tax credit. This helps to eliminate the cascading tax effect or the conventional 'tax-on-tax' regime. It also helps to minimise tax avoidance.

System of GST Composition scheme

Small and medium-sized companies with annual sales of up to Rs. 1 crore or Rs. 75 lakhs in the designated state can also freely opt for a composition scheme. Under this system, companies can pay a fixed GST rate of 1% on their turnover. But even those companies cannot then benefit from the advantage of the input tax credit. Businesses need to choose whether to use a composition scheme or an input tax credit functionality.

Four-Tier Tax Framework

GST has a four-tier tax structure of 5 percent, 12 percent, 18 percent, and 28 percent. Both goods and services can only be charged in accordance with this tax structure. Most of those basic goods, such as food products, do not have a GST. Enhanced visibility and cheaper goods and services are two of the main benefits of this 4-tier model.

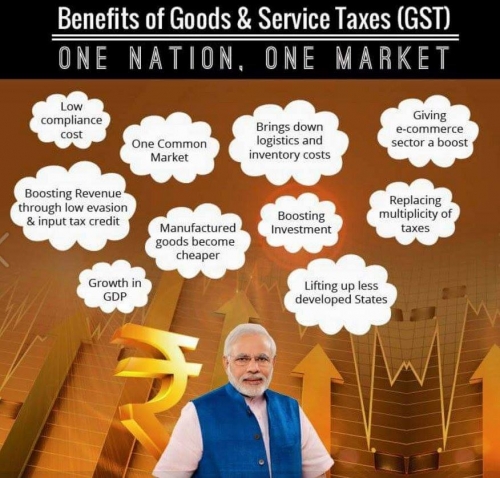

One nation Tax Concept of the single indirect tax system

GST was implemented as a single unified financial reform. Many existing indirect centres and state taxes, such as Central Value Added Tax, Special Additional Duty of Customs, Service Tax, and VAT, have been abolished and transformed into a single tax. The removal of these indirect taxes not only made tax enforcement simpler for corporations but also contributed to making many of the goods and services more accessible to customers.

other features GST system

The following are the salient other features of the proposed GST system:

- The power to make laws in respect of supplies in the course of inter-state trade or commerce will remain with the central government. The states will have the right to levy GST on intrastate transactions, including on services.

- The administration of GST will be the responsibility of the GST Council, which will be the apex policy-making body for GST. Members of the GST Council will comprise central and state ministers in charge of the finance portfolio.

- The threshold for levy of GST is a turnover of Rs. 1 million. For a taxpayer who conducts business in a northeastern state of India the threshold is Rs. 500,000.

- The central government will levy IGST on the inter-state supply of goods and services. The import of goods will be subject to basic customs duty and IGST.

- GST is defined as any tax on the supply of goods and services (other than on alcohol for human consumption).

- Central taxes such as central excise duty, additional excise duty, service tax, additional customs duty, and special additional duty, as well as state-level taxes such as VAT or sales tax, central sales tax, entertainment tax, entry tax, purchase tax, luxury tax, and octroi will be subsumed in GST.

- A provision will be made for removing the imposition of entry tax/ octroi across India.

- Entertainment tax, imposed by states on movies, theatre, etc., will be subsumed in GST, but taxes on entertainment at panchayat, municipality, or district level will continue.

- Stamp duties, typically imposed on legal agreements by states, will continue to be levied.

- The key benefits associated with GST are:

- Offers a wider tax base, necessary for lowering tax rates and eliminating classification disputes

- Eliminates the multiplicity of taxes and their cascading effects

- Rationalizes the tax structure and simplifies compliance procedures

- Automates compliance procedures to reduce errors and increase efficiency

There are many characteristics of the GST, and they are already acting as a game-changer for the Indian economy. Although there is still a long way to go, businesses, customers and the government have already begun to witness the benefits that are projected to grow more in the potential.

GST would be levied on the basis of the destination principle. Exports would be zero-rated, and imports would attract tax in the same manner as domestic goods and services. In addition to the IGST in respect of supply of goods, an additional tax of up to 1% has been proposed to be levied by the central government. The revenue from this tax is to be assigned to the origin states. This tax is proposed to be levied for the first two years or a longer period, as recommended by the GST Council.

With GST, it is anticipated that the tax base will be comprehensive, as virtually all goods and services will be taxable, with minimum exemptions. GST would bring in a modern tax system to ensure efficient and effective tax administration. It will bring in greater transparency and strengthen monitoring, thus making tax evasion difficult. While the process of implementation of GST unfolds in the next few months, it is important for industry to understand the impact and opportunities offered by this reform. GST will affect all industries, irrespective of the sector. It will impact the entire value chain of operations, namely procurement, manufacturing, distribution, warehousing, sales and pricing.

A lot of GST transactions is expected to involve a considerable measure of electronic exchange transfers, which could tend to become troublesome, when there is no adequate software support – a proper utility software tool that can coordinate with GSTIN.

We at Rajput Jain & Associates are happy to announce the launch of a platform –www.carajput.com (GST filling and reconciliation solution) that can integrate with any ERP platform – be it Oracle, SAP, BaaN, Infor, Microsoft ERP or even custom solutions. Simply stated, it leverages the power of your existing ERP to help you accomplish much more without the need to upgrade a bit of the current version of your ERP platform.

With a user-friendly interface coupled with several power-packed features, – www.carajput.com is a GST centric utility software tool that is aimed to ensure seamless tax filing, apart from helping you accomplish a host of tax-related transactions – anywhere, anytime. This in turn helps to streamline your operational workflows, eliminate waste, and generate considerable business value.