Table of Contents

Tax & Statutory Compliance Calendar for Oct 2022

|

S. No. |

Statue |

Purpose |

Compliance Period |

Due Date |

Compliance Details |

|

1 |

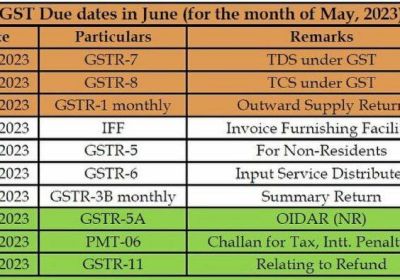

Goods and Services Tax |

GSTR -5 |

Sep-2022 |

20-Oct-22 |

GSTR-5 is to be filed by a Non-Resident Taxable Person for the previous month. |

|

2 |

Goods and Services Tax |

GSTR-7- TDS return under GST |

Sep- 2022 |

10-Oct-22 |

GSTR 7 is a return to be filed by the persons who are required to deduct TDS (Tax deducted at source) under GST. |

|

3 |

Goods and Services Tax |

GSTR-8- TCS return under GST |

Sep- 2022 |

10-Oct-22 |

GSTR-8 is a return to be filed by the e-commerce operators who are required to deduct TCS (Tax collected at source) under GST. |

|

4 |

Goods and Services Tax |

GSTR-3B-State-B |

Sep- 2022 |

24-Oct-22 |

“Timeline of filing of GSTR-3B for the taxpayer with Aggregate turnover up to INR 5 crores during the previous year and who has opted for Quarterly filing of return under QRMP. |

|

5 |

Goods and Services Tax |

GST CMP-08 |

Sep, 2022 |

18-Oct-22 |

Form GST CMP-08 is used to declare the details or summary of self-assessed tax payable by taxpayers who have opted for a composition levy. |

|

6 |

Goods and Services Tax |

GSTR - 3B |

Sep-2022 |

20-Oct-22 |

"1. GST Filing of returns by a registered person with aggregate turnover exceeding Rs. 5 Crores during the preceding year. |

|

7 |

Goods and Services Tax |

GSTR -5A |

Sep-2022 |

20-Oct-22 |

GSTR-5A is to be filed by OIDAR Service Providers for the previous month. |

|

8 |

Goods and Services Tax |

GSTR-1-QRMP |

Sep-22 |

13-Oct-22 |

GSTR-1 of a registered person with turnover less than INR 5 Crores during the preceding year and who has opted for quarterly filing of return under QRMP. |

|

9 |

Goods and Services Tax |

GSTR-1 |

Sep-22 |

11-Oct-22 |

"1. GST Filing of returns by a registered person with aggregate turnover exceeding INR 5 Crores during the preceding year. |

|

10 |

Goods and Services Tax |

GSTR -6 |

Sep-22 |

13-Oct-22 |

Due Date for filing return by Input Service Distributors. |

|

11 |

Income Tax |

TDS / TCS liability deposit |

Sep-22 |

7-Oct-22 |

Due date of depositing TDS/TCS liabilities under Income Tax Act, 1961 for the previous month. |

|

12 |

Income Tax |

TDS Liability Deposit |

Jul-Sep, 2022 |

7-Oct-22 |

​Due date for deposit of TDS when Assessing Officer has permitted quarterly deposit of TDS under section 192, 194A, 194D, or 194H. |

|

13 |

Income Tax |

TCS Certificate |

Jul-Sep, 2022 |

30-Oct-22 |

​Quarterly TCS certificate in respect of tax collected by any person for the quarter ending September 30, 2022. |

|

14 |

Income Tax |

Income Tax return |

FY 2021-22 |

31-Oct-22 |

“Timelinefor filing of return of income for the assessment year 2022-23 if the assessee (not having any international or specified domestic transaction) is |

|

15 |

Income Tax |

TDS Certificate |

Sep-22 |

15-Oct-22 |

"Timeline for issue of TDS Certificate for tax deducted under section 194-IA, 194-IB, and 194M in the month of August 2022. |

|

16 |

Income Tax |

Form 24G |

Sep-22 |

15-Oct-22 |

"Timeline date for furnishing form 24G by an office of the government where TDS/TCS for the month of September 2022 has been paid without the production of a challan. |

|

17 |

Income Tax |

Audit of accounts in case of Companies eligible for weighted Deduction |

Financial Year 2021-22 |

31-Oct-22 |

Submit a copy of the audit of accounts to the Secretary, Department of Scientific and Industrial Research in case the company is eligible for weighted deduction under section 35(2AB) [if the company does not have any international/specified domestic transaction]. |

|

18 |

GST |

GSTR-3B-State-A |

Sep-22 |

22-Oct-22 |

“Timeline of filing of GSTR-3B for a taxpayer with Aggregate turnover up to INR 5 crores during the previous year and who has opted for Quarterly filing of return under QRMP. |

|

19 |

Income Tax |

TDS Return |

Jul-Sep, 2022 |

31-Oct-22 |

​Quarterly statement of TDS deposited for the quarter ending September 30, 2022. |

|

20 |

Income Tax |

TCS Return |

Jul-Sep, 2022 |

15-Oct-22 |

​Quarterly statement of TCS deposited for the quarter ending September 30, 2022. |

|

21 |

Income Tax |

Form No. 15G/H |

Jul-Sep, 2022 |

15-Oct-22 |

Upload declarations received from recipients in Form No. 15G/15H during the quarter ending September 2022. |

|

22 |

Income Tax |

TDS Challan cum Statement |

Sep-2022 |

30-Oct-22 |

"Timeline for furnishing of challan-cum-statement in respect of tax deducted under section 194-IA, 194-IB, 194-M, in the month of September 2022. |

|

23 |

Income Tax |

Form No. 3CEAB |

Financial Year 2021-22 |

31-Oct-22 |

Intimation by a designated constituent entity, resident in India, of an international group in Form no. 3CEAB for the accounting year 2021-22. |

|

24 |

Income Tax |

Audit Report u/s 44AB |

Financial Year 2021-22 |

31-Oct-22 |

Audit report under section 44AB for the assessment year 2022-23 in the case of an assessee who is also required to submit a report pertaining to international or specified domestic transactions under section 92E. |

|

25 |

Income Tax |

FORM NO. 3CEB |

Financial Year 2021-22 |

31-Oct-22 |

Report to be furnished in Form 3CEB in respect of the international transactions and specified domestic transactions. |

|

26 |

Income Tax |

FORM NO. 3CEJ |

Financial Year 2021-22 |

31-Oct-22 |

Due date for e-filing of the report (in Form No. 3CEJ) by an eligible investment fund in respect of arm's length price of the remuneration paid to the fund manager (if the assessee is required to submit a return of income on October 31, 2022). |

|

27 |

Company Law |

Form-8 |

Financial Year 2021-22 |

29-Oct-22 |

Statement of Account & Solvency by all LLPs. |

|

28 |

Company Law |

AOC-4 |

Financial Year 2021-22 |

29-Oct-22 |

Form AOC 4 is used to file the financial statements for each financial year with the ROC. |

|

29 |

Company Law |

DIR-3 |

Financial Year 2021-22 |

15-Oct-22 |

"Every Director who has been allotted DIN on or before the end of the financial year, and whose DIN status is ‘Approved’, would be mandatorily required to file form DIR-3 KYC before 30th September of the immediately next financial year. Such due date is further extended till 15th October 2022." |

|

30 |

Company Law |

MSME Return |

Apr-Sep, 2022 |

30-Oct-22 |

Half-yearly return with the registrar in respect of outstanding payments to Micro or Small Enterprise. |

|

31 |

Labour Law |

Provident Fund / ESI |

Sep-22 |

15-Oct-22 |

Due Date for payment of Provident fund and ESI contribution for the previous month. |