|

S. No.

|

Statue

|

Purpose

|

Compliance Period

|

Timeline

|

Compliance Details

|

|

1

|

Labour Law Compliance

|

PF / ESI Return

|

March-2022

|

15- April-2022

|

Timeline for payment of PF & ESI contribution for the Last month.

|

|

2

|

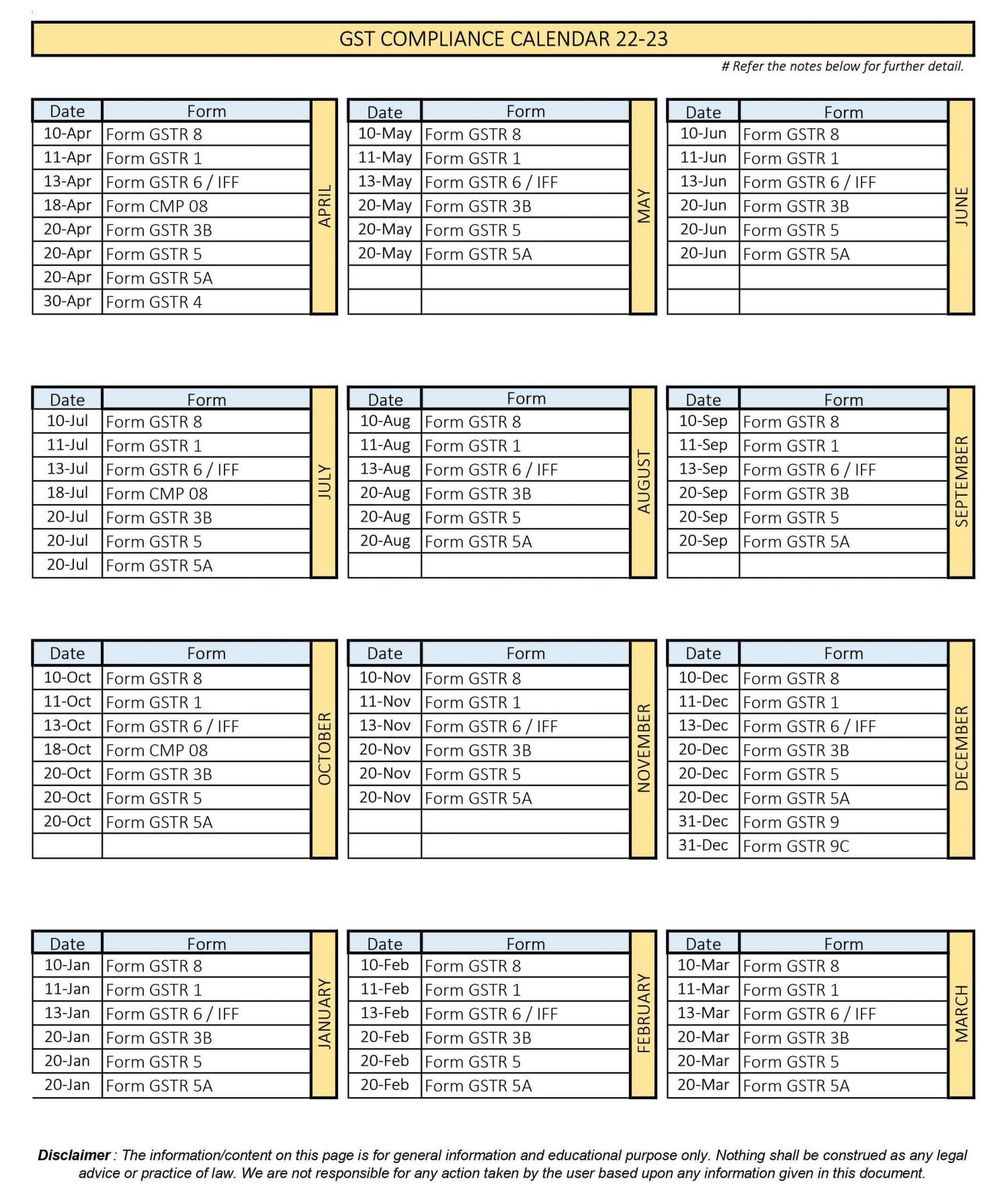

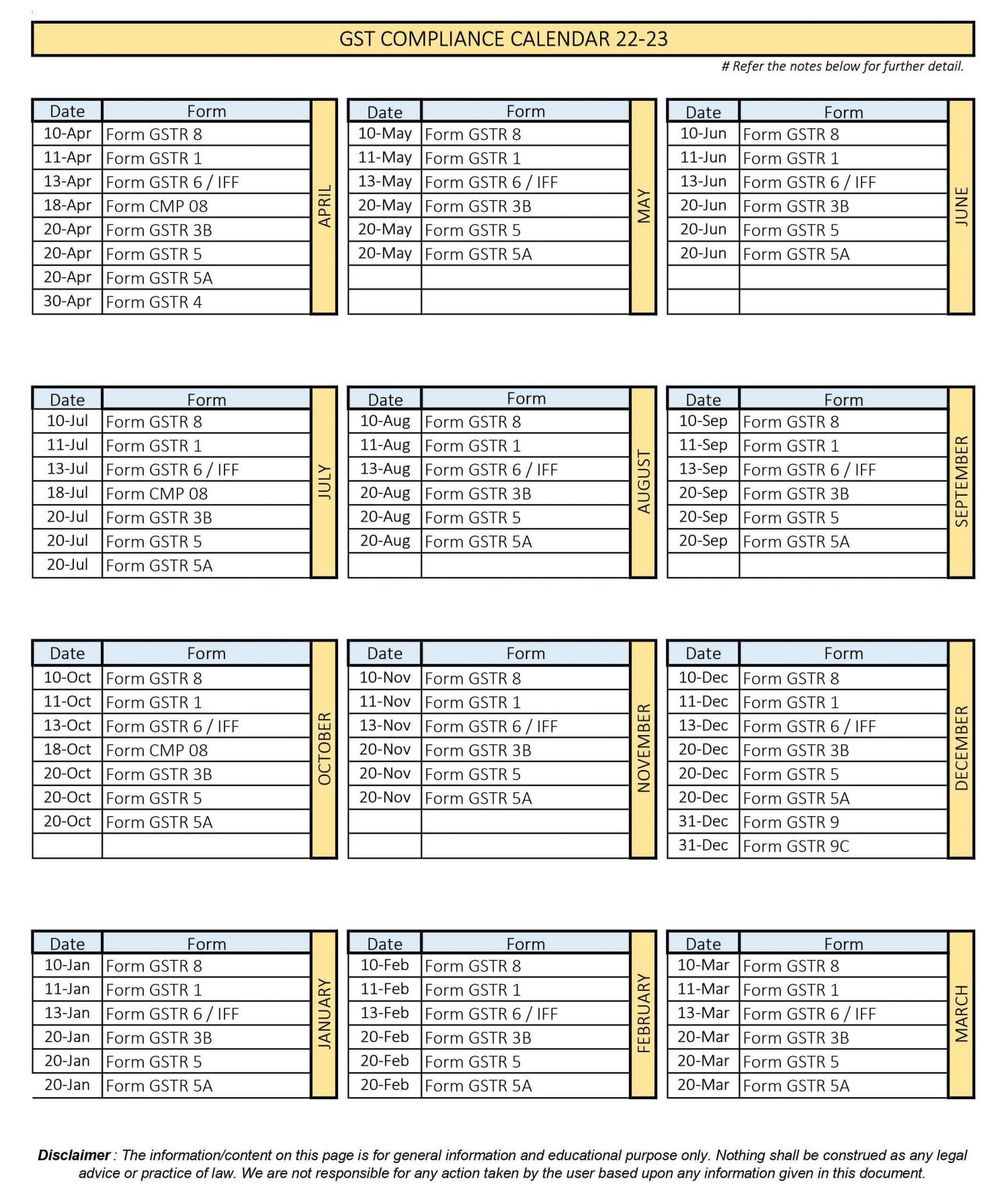

Goods and services Tax Compliance

|

GSTR -7 TDS return under GST

|

March-2022

|

10- April-2022

|

GSTR 7 is a return to be filed by persons who is required to deduct Tax deducted at source under GST.

|

|

3

|

Goods and services Tax Compliance

|

GSTR -1 QRMP Return

|

Jan - March-2022

|

13- April-2022

|

Quarterly return for registered person with turnover less than Rs. 5 Crores during preceding year and who has opted for quarterly filing of return under QRMP.

|

|

4

|

Goods and services Tax Compliance

|

GSTR - 3B Return

|

March-2022

|

20- April-2022

|

1. GST Filing of returns by registered person with aggregate turnover exceeding Rs. 5 Crores during preceding year.

2. Registered person, with aggregate turnover of less then Rs. 5 Crores during preceding year, opted for monthly filing of return under QRMP.

|

|

5

|

Goods and services Tax Compliance

|

GSTR- 8 TCS return under GST

|

March-2022

|

10- April-2022

|

GSTR-8 is a return to be filed by the e-commerce operators who are required to deduct TCS (Tax collected at source) under GST.

|

|

6

|

Goods and services Tax Compliance

|

GSTR -6 Return

|

March-2022

|

13- April-2022

|

Timeline for filing return by Input Service Distributors.

|

|

7

|

Goods and services Tax Compliance

|

GSTR -1 Return

|

March-2022

|

11- April-2022

|

"1. GST Filing of returns by registered person with aggregate turnover exceeding Rs. 5 Crores during preceding year.

2. Registered person, with aggregate turnover of less than RS. 5 Crores during preceding year, opted for monthly filing of return under QRMP".

|

|

8

|

Goods and services Tax Compliance

|

GSTR--5A Return

|

March-2022

|

20- April-2022

|

GSTR-5A to be filed by OIDAR Service Providers for the Last month.

|

|

9

|

Goods and services Tax Compliance

|

GST CMP – 08 Return

|

Jan - March-2022

|

18- April-2022

|

Timeline of filing of GST CMP-08 for dealers who opted for composition scheme.

|

|

10

|

Goods and services Tax Compliance

|

GSTR—5 Return

|

March-2022

|

20- April-2022

|

GSTR-5 to be filed by Non-Resident Taxable Person for the Last month.

|

|

11

|

Goods and services Tax Compliance

|

GST ITC -04 Return

|

Jan - March-2022

|

25- April-2022

|

GST ITC-04 is to be filed to provide details of goods sent to Job Worker or received back.

|

|

12

|

Goods and services Tax Compliance

|

GSTR -3B QRMP Return

|

Jan - March-2022

|

20- April-2022

|

Timeline for filling GSTR - 3B return for the quarter of Jany to Mar 2022 for the taxpayer with Aggregate turnover up to Rs. 5 crores during the previous year and who has opted for Quarterly filing of return under QRMP.

|

|

13

|

Income Tax Compliance

|

Tax Deducted at Source Challan cum statement

|

March-2022

|

30- April-2022

|

Timeline for Filling of challan-cum-statement in respect of tax deducted under section 194-IM, 194-IB, 194-IA in the month of March, 2022.

|

|

14

|

Income Tax Compliance

|

Quarterly return of Non-deduction of Tax Deducted at Source

|

Jan - March-2022

|

30-April-2022

|

Quarterly return of non-deduction at source by a banking company from interest on time deposit in respect of the quarter ending March 31, 2022.

|

|

15

|

Income Tax Compliance

|

Tax Deducted at Source/TCS liability deposit

|

March-2022

|

30- April-22

|

Timeline of depositing Tax Deducted at Source /TCS liabilities under Income Tax Act, 1961 for the Last month.

|

|

16

|

Income Tax Compliance

|

TDS liability deposit

|

Jan - March-2022

|

30- April-22

|

Timeline for deposit of TDS for the period January 2022 to March 2022 when Assessing Officer has permitted quarterly deposit of TDS under section 192, section 194A, section 194D or section 194H.

|

|

17

|

Income Tax Compliance

|

Income Tax Form 15G/15H

|

Jan - March-2022

|

30- April-22

|

A self-declaration form for seeking non-deduction of Tax Deducted at Source on specific income as annual income of the tax assessee is less than the exemption limit. Upload declarations received from recipients in Form No. 15G/15H during the quarter ending March 2022.

|

|

18

|

Income Tax Compliance

|

Equalisation Levy Deposit

|

March-2022

|

30- April-22

|

Equalisation Levy is a direct tax, which is withheld at the time of payment by the service recipient where the annual payment made to one service provider (Non-Residents only) exceeds Rs. 1,00,000 in one financial year for the specified and notified services.

|

|

19

|

Income Tax Compliance

|

Income Tax Form No. 61

|

March-2022

|

30- April-22

|

?Timeline for e-filing of a declaration in Form No. 61 containing particulars of Form No. 60 received during the period October 1, 2021, to March 31, 2022

|

|

20

|

Income Tax Compliance

|

Income Tax Form 24G

|

March-2022

|

7- April-22

|

?Timeline for deposit of Tax deducted by an office of the government for the month of March, 2022. However, all sum deducted by an office of the government shall be paid to the credit of the Central Government on the same day where tax is paid without production of an Income-tax Challan.

|

|

21

|

Income Tax Compliance

|

Income Tax Form 15CC

|

Jan - March-2022

|

15- April-22

|

Quarterly statement in respect of foreign remittances (to be furnished by authorized dealers) in Form No. 15CC for quarter ending March, 2022.

|

|

22

|

Income Tax Compliance

|

Income Tax Form 3BB

|

March-2022

|

15- April-22

|

?Timeline for Filling statement in Form no. 3BB by a stock exchange in respect of transactions in which client codes been modified after registering in the system for the month of March, 2022.

|

|

23

|

Income Tax Compliance

|

Tax Deducted at Source Certificate

|

March-2022

|

14-April-22

|

Timeline for issue of Tax Deducted at Source Certificate for tax deducted under section 194-IA, 194-IB, and 194M in the month of Feb 2022.

|