PROCESS OF STRIKING-OFF- A PRIVATE LIMITED COMPANY –

There really is a goal behind starting every company that will always run the company, although not all companies end up the same way. The company is founded to do a business, but sometimes the business venture does not succeed or the project for which the company is formed does not materialise. Once the business is formed, there is some enforcement that needs to be done and, of course, it adds to the company's expense. We are conscious that there is a certain method for integrating a business, for running a business, and there is even a specific procedure for closing a business. Therefore, in such cases, the management or shareholders may try to close the company.

These are the ways a private limit company can close:

- Voluntary Winding Up

- Compulsory Winding Up

- Striking Off (Fast Track Exit)

The much more practical or simplest way to close a company is by eliminating its name from the company register. There are more processes and time involved in the voluntary winding up option. The Striking-Off choice summary is below.

Basics Concepts - Company Striking Off / Closure Fast-track

Kind of company can get strike off under the scheme

Below mention company can get strike off whether it’s a

- Public company

- Section 8 company

- Private company

- One-person company

Note: When a dormant company then the application can be made for striking of company

What are ways to Company Striking Off / Closure Fast-track a company?

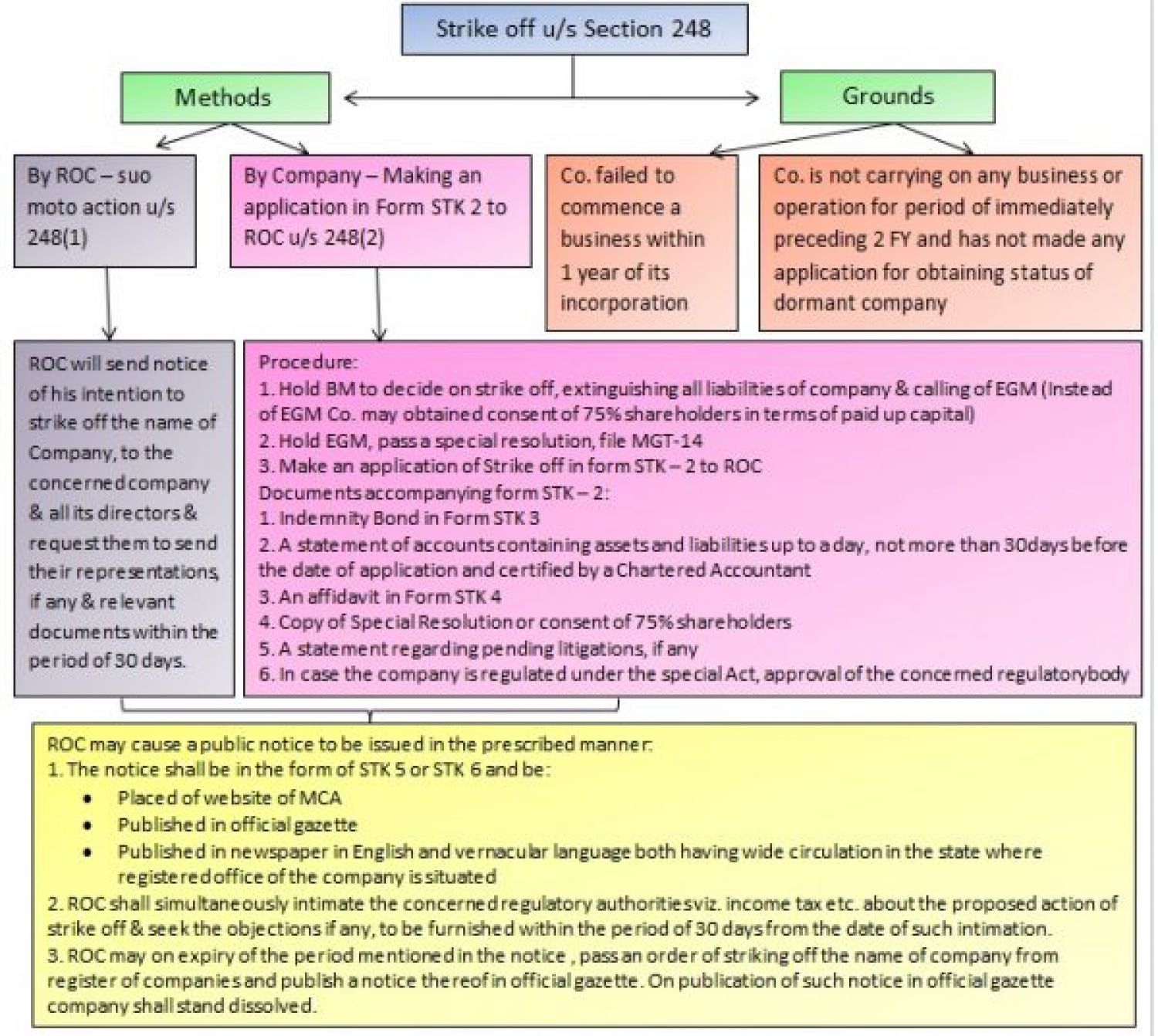

A company can get Striking Off / Closure Fast-track in 2 Ways:-

A) By company itself as Voluntary Striking off

B) By Registrar of Companies

Note that section 8 company cannot get Striking Off / Closure Fast-track voluntary.

Strike-off grounds

The strike-off provision may be enforced on the following basis:

- the company did not commence its business within 1 Year of its formation,

- The company has not been conducting any business or operation with in the previous 2 financial years for which it has not pursued Dormant Company status under Section 455 of the Act.

List of Companies Which is Non-Qualifying Companies under the Scheme

The below companies do not qualify for the provision of strike off:

- Companies registered under Section 25 of the Companies Act, 1956 or Section 8 of the Act.

- Companies delisted on account of non-compliance with listing regulations, listing agreements,s or any other statutory laws.

- Companies which hasn’t furnished the follow-up instructions on any report under section 208 of the Act.

- Vanishing companies.

- Companies which hasn’t yet responded to notices of select provisions.

- Listed companies.

- If the prosecutions related to the above two provisions are pending in a Court of law.

- Companies against which any case for the prosecution is pending in a Court of law.

- Companies that have been listed for inspection or investigation – if such directive is being carried out/pending/completed but the prosecutions concerning such inspection or investigation are pending in the Court of law.

- Companies, whose application for compounding is pending before the competent authority for compounding the offenses committed by it or any of its officers in default.

- Companies accepting any public deposits which are outstanding.

- Companies having any charges which remain to be satisfied.

Meaning of Company Dormant

In simple terms, the word dormant means inactive or inoperative. Comparably, if it has been licensed under the Companies Act for a potential project or to possess an asset or intellectual property but is not undertaking any significant accounting transactions, a company is listed as dormant.

A. Pre-requisites

Subject to specific conditions, the Registrar of Companies (ROC) can strike down a company upon requirement:

i. The Company has not begun business since its establishment or does not have any business activities at the date of submitting the application in the preceding 2 financial years.

ii. All the statutory laws, viz., were complied with by the said company like RBI/FEMA, ROC, GST/Service Tax, income tax, etc.

iii. At the time of the application for striking-off, Company must have not any Assets & Liabilities included in the Audited financials Statements, specifically in the balance sheet. In other words, the balance sheet must only include liabilities as share capital and losses as assets.

B. Key points which should be considered

Since the financial statement of companies can only have Capital as Liability and Loss as Asset at the time of the striking-off applications, the management must therefore take the activities below before making the striking-off application;

- Cancellation of the registration of regulations and laws, viz. GST, PAN, TAN, etc. PT.

- Must be settled all the statutory dues or outstanding creditors(if any)

- Realize or write off, if any, the outstanding debtors,

- Termination of vendor agreements or employee

- Must Closure of the Bank Accounts of the Company

C. Documents required of Company Strike off.- Checklist for Strike Off

- Required the Statement of Final Accounts – To be signed by the auditors & should not be older than thirty days of the application date

- The affidavit from the Director in STK-4

- BOD Resolution for making an application of Company Strike off.

- An Indemnity Bond by the Directors in STK-3

- All the Company Shareholders Consent Letter

Fees associated with E-forms: Filing of E-form MGT-14 has Associated ROC fees, E-form STK-2 has fees of Rs 10,000/-

D. Time Estimated of Company Strike off.

An online method is Company Strike off. Must also search the Indian Company strike off the list from MCA

An application for removal of the business name / Strike Off Company having been made with MCA.along with the specified fees in Form STK-2. If the application is submitted with the MCA on Form STK-2, it can take between 3 and 6 months for approvals to take place.

The procedure of withdrawing an incorporated or registered company from the list of companies held by the state registrar may be done smoothly and the application for strike-off may be made by the active company (subject to the above conditions) and by the dormant company as well.