Table of Contents

Tax & Statutory Compliance Calendar for February 2023

|

S. No. |

Statue |

Objective of compliance |

Period of Compliance |

Timeline |

Particular of Compliance |

|

1 |

Labour Law |

PF / Employees' State Insurance Scheme |

January 2023 |

15- February -2023 |

Timeline for payment of Provident fund and Employees' State Insurance Scheme contribution for the previous month. |

|

2 |

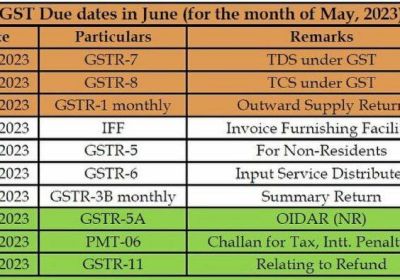

Goods and Services Tax |

GSTR-7- Tax deducted at source return under Goods and Services Tax |

January 2023 |

10- February-2023 |

GSTR 7 is a return to be filed by the persons who is required to deduct Tax deducted at source under Goods and Services Tax. |

|

3 |

Goods and Services Tax |

Invoice Filling Facility |

January 2023 |

13- February -2023 |

Invoice Filling Facility of registered person with turnover less than Rs. 5 Crores during the preceding year and who has opted for quarterly filing of return under Quarterly Returns with Monthly Payment . |

|

4 |

Goods and Services Tax |

GSTR-1 |

January 2023 |

11- February -2023 |

"1. Goods and Services Tax Filing of returns by a registered person with aggregate turnover exceeding Rs. 5 Crores during the preceding year. |

|

5 |

Goods and Services Tax |

GSTR -5A |

January 2023 |

20- February -2023 |

GSTR-5A is to be filed by Online Information Database Access and Retrieval services Providers for the previous month. |

|

6 |

Goods and Services Tax |

GSTR -6 |

January 2023 |

13- February -2023 |

Timeline for filing return by Input Service Distributors. |

|

7 |

Goods and Services Tax |

GSTR-8- Tax collection at source return under Goods and Services Tax |

January 2023 |

10- February -23 |

GSTR-8 is a return to be filed by the e-commerce operators who are required to deduct Tax collected at source under Goods and Services Tax. |

|

8 |

Goods and Services Tax |

GSTR -5 |

January 2023 |

20- February -2023 |

GSTR-5 is to be filed by Non-Resident Taxable Person for the previous month. |

|

11 |

Goods and Services Tax |

GSTR - 3B |

January 2023 |

20- February -2023 |

"1. Goods and Services Tax Filing of returns by a registered person with aggregate turnover exceeding INR 5 Crores during the preceding year. |

|

12 |

Goods and Services Tax |

Timeline of Payment of Tax |

January 2023 |

25- February -2023 |

Timeline of payment of Goods and Services Tax liability by the registered person whose aggregate turnover was less than Rs. 5 Crores during the preceding year and who has opted for quarterly filing of return. |

|

13 |

Income Tax |

Tax deducted at source Certificate |

January 2023 |

14- February -2023 |

Timeline for issue of Tax deducted at source Certificate for tax deducted under sections 194-IA, 194-IB, and 194M in the month of December 2022. |

|

14 |

Income Tax |

Tax deducted at source Certificate |

Oct-Dec, 2022 |

15- February -2023 |

​Quarterly Tax deducted at source certificate (in respect of tax deducted for payments other than salary) for the quarter ending December 31, 2022. |

|

15 |

Income Tax |

Form 24G |

January 2023 |

15- February -2023 |

​Timeline for Filling of Form 24G by an office of the Govt where Tax deducted at source/ Tax collection at source for the month of January 2023 has been paid without the production of a challan. |

|

16 |

Income Tax |

Tax deducted at source / Tax collection at source Liability Deposit |

January 2023 |

7- February -23 |

Timeline of depositing Tax deducted at source / Tax collection at source liabilities under Income Tax Act, 1961 for the previous month. |

*Note 1: Opting for Quarterly Returns with Monthly Payment Scheme- Timeline for filling GSTR - 3B with Annual Turnover up to 5 Crore in State A Group (Chhattisgarh, Madhya Pradesh, Gujarat, Tamil Nadu, Telangana, Andhra Pradesh, Maharashtra, Karnataka, Goa, Kerala, Daman &, Lakshadweep, Puducherry, Andaman, and the Nicobar, Diu, and Dadra & Nagar Haveli Islands).

**Note 2: Opting for Quarterly Returns with Monthly Payment Scheme- Timeline for filling GSTR - 3B with Annual Turnover up to 5 Crore in State B Group (Punjab, Uttarakhand, Bihar, Himachal Pradesh, Sikkim, Haryana, Rajasthan, Arunachal Pradesh, Uttar Pradesh, Nagaland, Manipur, Mizoram, West Bengal, Jharkhand, Odisha, Tripura, Meghalaya, Assam, Jammu and Kashmir, Ladakh, Chandigarh, Delhi)