Table of Contents

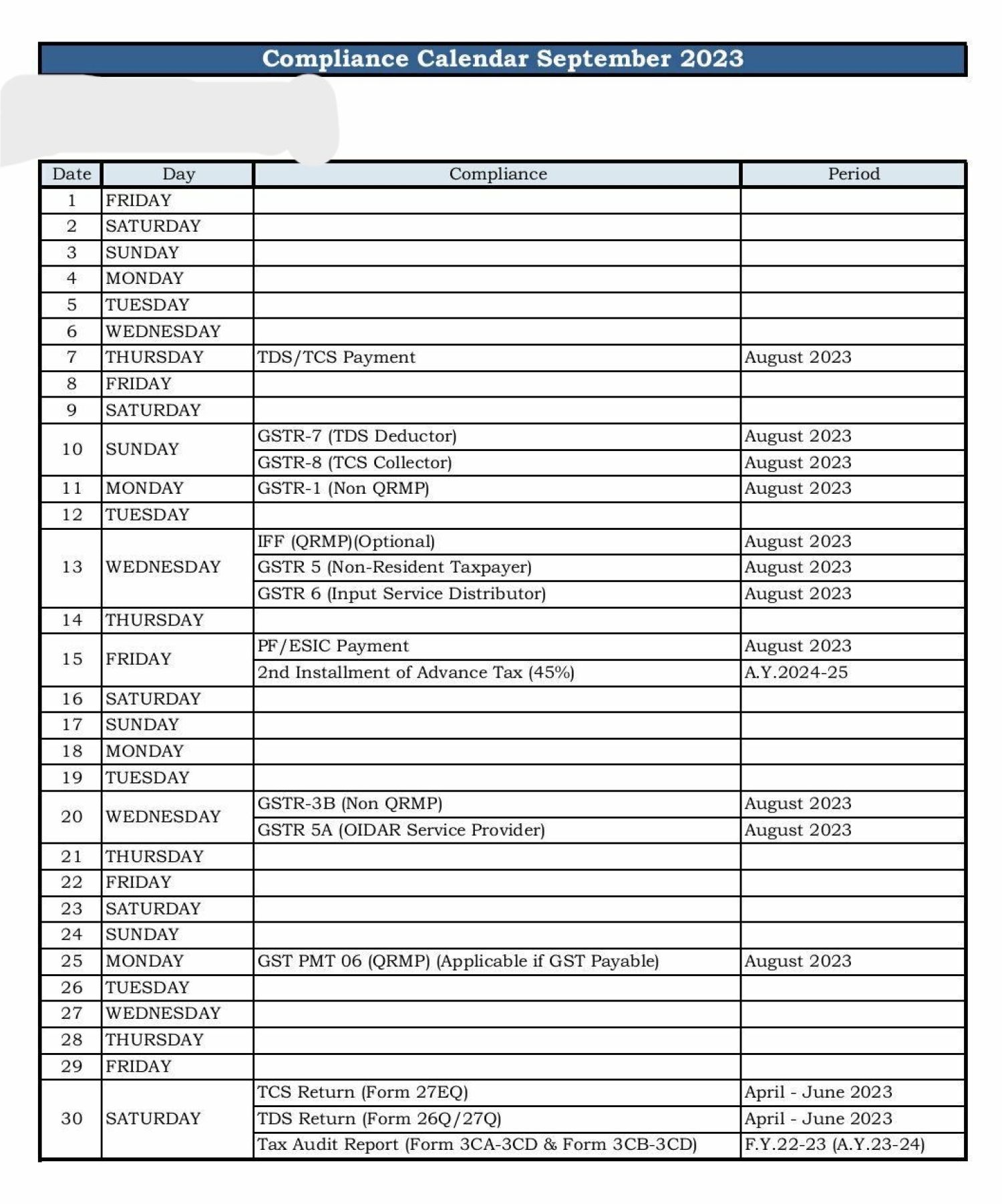

Taxation & Statutory Compliance Calendar for Sept 2023

Important dates in Sept 2023 for compliance under GST & Income tax & Other Law

|

S. No. |

Statue |

Purpose |

Compliance Period |

Due Date |

Compliance Details |

|

1 |

Income Tax |

Tax Deducted at Source / Tax Collected at Source Liability Deposit |

Aug-23 |

7-Sep-23 |

Timeline of depositing Tax Deducted at Source / Tax Collected at Source liabilities under Income Tax Act, 1961 for previous month. |

|

2. |

Income Tax |

TDS Certificate |

Aug-23 |

14-Sep-23 |

Timeline for issue of Tax Deducted at Source Certificate for tax deducted under section 194-IA, 194-IB, 194M and 194S in the month of July 2023. Note: Applicable in case of specified person mentioned under section 194S. |

|

3. |

Income Tax |

Form 24G |

Aug-23 |

15-Sep-23 |

​Timeline for furnishing of Form 24G by an office of the Government where Tax Deducted at Source / Tax Collected at Source for the month of Aug, 2023 has been paid without the production of a challan. |

|

4. |

Income Tax |

Advance Tax |

Financial Year 2023-2024 |

15-Sep-23 |

​​Second instalment of advance tax for the AY 2024-2025. |

|

5. |

Income Tax |

Form No. 3BB |

Aug-23 |

15-Sep-23 |

​​Timeline for furnishing statement in Form no. 3BB by a stock exchange in respect of transactions in which client codes been modified after registering in the system for the month of Aug, 2023. |

|

6. |

Income Tax |

Tax Deducted at Source Challan cum Statement |

Aug-23 |

30-Sep-23 |

Timeline for furnishing of challan-cum-statement in respect of tax deducted under section 194-IA, 194-IB, 194-M and 194S in the month of Aug, 2023. Note: Applicable in case of specified person as mentioned under section 194S. |

|

7. |

Income Tax |

Audit report u/s 44AB​ |

Financial Year 2022-2023 |

30-Sep-23 |

​​Timeline for filing of audit report under section 44AB​ for the AY2023-2024 in the case of a corporate-assessee or non-corporate assessee (who is required to submit his/its return of income on October 31, 2023)​ |

|

8. |

Income Tax |

Form No. 9A |

Financial Year 2022-2023 |

30-Sep-23 |

​​​​Application in Form 9A for exercising the option available under Explanation to section 11(1) to apply income of previous year in the next year or in future (if the assessee is required to submit return of income on Nov 30, 2023). |

|

9. |

Income Tax |

Form No. 10 |

Financial Year 2022-2023 |

30-Sep-23 |

​​​​​​​​Statement in Form no. 10 to be furnished to accumulate income for future application under section 10(21) or section 11(1) (if the assessee is required to submit return of income on Nov 30, 2023). |

|

10. |

Income Tax |

Tax Collected at Source Return |

Apr-Jun, 2023 |

30-Sep-23 |

​Quarterly statement of Tax Collected at Source deposited for the quarter ending June 30, 2023.Note: The Timeline of furnishing Tax Collected at Source statement has been extended from June 30, 2023 to Sept. 30, 2023 vide Circular no. 9/2023, dated 28-06-2023. |

|

11. |

Income Tax |

Tax Deducted at Source Deposit |

Apr-Jun, 2023 |

30-Sep-23 |

​Quarterly statement of Tax Deducted at Source deposited for the quarter ending June 30, 2023. Note: The Timeline of furnishing Tax Deducted at Source statement has been extended from June 30, 2023 to Sept. 30, 2023 vide Circular no. 9/2023, dated 28-06-2023. |

|

12. |

Goods and Services tax |

GSTR-7- Tax Deducted at Source return under GST |

Aug-23 |

10-Sep-23 |

GSTR-7 is a return to be filed by the persons who is required to deduct TDS (Tax deducted at source) under GST. |

|

13. |

Goods and Services tax |

GSTR-8- Tax Collected at Source return under GST |

Aug-23 |

10-Sep-23 |

GSTR-8 is a return to be filed by the e-commerce operators who are required to deduct TCS (Tax collected at source) under GST. |

|

14. |

Goods and Services tax |

GSTR-1 |

Aug-23 |

11-Sep-23 |

1. GST Filing of returns by registered person with aggregate turnover exceeding RS. 5 Crores during Last year. |

|

15 |

Goods and Services tax |

IFF (Invoice Furnishing Facility) |

Aug-23 |

13-Sep-23 |

Invoice Furnishing Facility of registered person with turnover less than Rs. 5 Crores during preceding year and who has opted for quarterly filing of return under QRMP. |

|

16 |

Goods and Services tax |

GSTR -6 |

Aug-23 |

13-Sep-23 |

Timeline for filing return by Input Service Distributors. |

|

17 |

Goods and Services tax |

GSTR - 3B |

Aug-23 |

20-Sep-23 |

1. GST Filing of returns by registered person with aggregate turnover exceeding RS. 5 Crores during Last year. |

|

18 |

Goods and Services tax |

GSTR -5 |

Aug-23 |

20-Sep-23 |

GSTR-5 to be filed by Non-Resident Taxable Person for the previous month. |

|

19 |

Goods and Services tax |

GSTR -5A |

Aug-23 |

20-Sep-23 |

GSTR-5A to be filed by OIDAR Service Providers for the previous month. |

|

20 |

Goods and Services tax |

Timeline of Payment of Tax |

Aug-23 |

25-Sep-23 |

Timeline of payment of Goods and services Tax liability by the registered person whose aggregate turnover was less than RS. 5 Crores during Last year and who has opted for quarterly filing of return. |

|

21 |

Company Law |

DIR-3 KYC(Know Your Customer) |

|

30-Sep-23 |

Every individual holding DIN as on 31st March of a F.Y. is required to file this form to the central government to validate and confirm the Know Your Customer details existing in the MCA21 database. |

|

22 |

Company Law |

AOC-4 (OPC) |

Financial Year 2022-2023 |

27-Sep-23 |

E-Form AOC 4 contains details of all the financial transactions and monetary details of the company for the respective financial year. |

|

23 |

Labour Law |

ESI/ PF |

Aug-23 |

15-Sep-23 |

Timeline for payment of PF & ESI contribution for the Last month. |

*Note 1: Opting for Quarterly Returns with Monthly Payment (QRMP) Scheme- Timeline for filling GSTR - 3B with Annual Turnover up to 5 Crore in State A Group (Chhattisgarh, Maharashtra, Telangana, Andhra Pradesh, Madhya Pradesh, Gujarat, Daman & Diu, , Karnataka, Goa, Kerala, Tamil Nadu, Dadra & Nagar Haveli , Puducherry, Andaman and the Nicobar Islands, Lakshadweep).

**Note 2: Opting for Quarterly Returns with Monthly Payment (QRMP) Scheme- Timeline for filling GSTR - 3B with Annual Turnover up to 5 Crore in State B Group (Himachal Pradesh, Punjab, Uttarakhand, Chandigarh, Haryana, Rajasthan, Nagaland, Manipur, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Mizoram, Odisha, Jammu and Kashmir, West Bengal, Jharkhand, Tripura, Meghalaya, Assam, Ladakh, Delhi).