Table of Contents

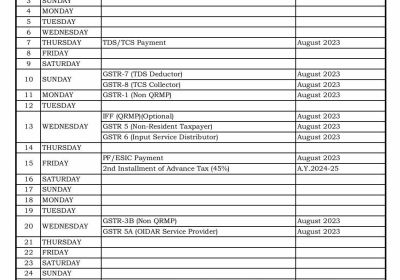

Tax and Statutory Compliance Calendar for May 2023

|

S. No. |

Under the law |

Objective |

Period of Compliance |

Timeline Date |

Details of Compliance |

|

1 |

Goods and services Tax Act |

GSTR - 3B |

April 2023 |

20-May-23 |

1. Goods and services Tax Filing of returns by registered person with aggregate turnover exceeding Rs. 5 Cr. during Last year. |

|

2 |

Goods and services Tax Act |

GSTR-7- TDS return under Goods and services Tax Act |

April 2023 |

10-May-23 |

GSTR 7 is a return to be filed by the persons who is required to deduct Tax deducted at source under Goods and services Tax Act. |

|

3 |

Goods and services Tax Act |

GSTR-8- TCS return under Goods and services Tax Act |

April 2023 |

10-May-23 |

GSTR-8 is a return to be filed by the e-commerce operators who are required to deduct Tax collected at source under Goods and services Tax Act. |

|

4 |

Goods and services Tax Act |

GSTR-1 |

April 2023 |

11-May-23 |

1. Goods and services Tax Filing of returns by registered person with aggregate turnover exceeding Rs 5 Cr during Last year. |

|

5 |

Goods and services Tax Act |

Invoice Furnishing Facility |

April 2023 |

13-May-23 |

Invoice Furnishing Facility of registered person with turnover less than Rs. 5 Cr. during Last Year and who has opted for quarterly filing of return under Quarterly Returns with Monthly Payment. |

|

6 |

Goods and services Tax Act |

GSTR -6 |

April 2023 |

13-May-23 |

Timeline Date for filing return by Input Service Distributors. |

|

7 |

Goods and services Tax Act |

GSTR -5 |

April 2023 |

20-May-23 |

GSTR-5 to be filed by Non-Resident Taxable Person for the previous month. |

|

8 |

Goods and services Tax Act |

GSTR -5A |

April 2023 |

20-May-23 |

GSTR-5A to be filed by Online Information Database Access and Retrieval services Service Providers for the previous month. |

|

9 |

Goods and services Tax Act |

Due date of Payment of Tax |

April 2023 |

25-May-23 |

Timeline date of payment of Goods and Services tax liability by the registered person whose aggregate turnover was less than Rs. 5 Cr. during last year and who has opted for quarterly filing of return. |

|

10 |

Income Tax |

Tax deducted at Source/ Tax Collected at Source Liability Deposit |

April 2023 |

7-May-23 |

Timeline of depositing Tax deducted at Source/ Tax Collected at Source liabilities under Income Tax Act, 1961 for previous month. However, all sum deducted/collected by an office of the government shall be paid to the credit of the Central Govt on the same day where tax is paid without production of an Income-tax Challan. |

|

11 |

Income Tax |

TCS Deposit |

Jan-March, 2023 |

15-May-23 |

​Quarterly statement of Tax Collected at souse deposited for the quarter ending March 31, 2023. |

|

12 |

Income Tax |

Form No. 3BB |

April 2023 |

15-May-23 |

Timeline for furnishing statement in Form no. 3BB by a stock exchange in respect of transactions in which client codes have been modified after registering in the system for the month of April, 2023. |

|

13 |

Income Tax |

Form 24G |

April 2023 |

15-May-23 |

Timeline for furnishing of form 24G by an office of the government where TDS/TCS for the month of April, 2023 has been paid without the production of a challan |

|

14 |

Income Tax |

TDS Certificate |

March 2023 |

15-May-23 |

Timeline for issue of Tax deducted at Source Certificate for tax deducted under section 194-IA, 194-IB, 194M and 194S in the month of March, 2023. Note: Applicable in case of specified person as mentioned under section 194S. |

|

15 |

Income Tax |

Form No. 49C |

Financial Year 2022-23 |

30-May-23 |

​Submission of a statement (in Form No. 49C) by non-resident having a liaison office in India for the financial year 2022-23. |

|

16 |

Income Tax |

TDS Challan cum Statement |

April 2023 |

30-May-23 |

Timeline for furnishing of challan-cum-statement in respect of tax deducted under section 194-IA, 194-IB, 194-M and 194S in the month of April, 2023. Note: Applicable in case of specified person as mentioned under section 194S. |

|

17 |

Income Tax |

TCS Certificate |

Jan-March, 2023 |

30-May-23 |

​Issue of Tax collected at source certificates for the 4th Quarter of the Financial Year 2022-23. |

|

18 |

Income Tax |

TDS Return filing |

Jan-March, 2023 |

31-May-23 |

​Quarterly statement of Tax deducted at Source deposited for the quarter ending March 31, 2023. |

|

19 |

Income Tax |

Form No. 61A |

2022-23 |

31-May-23 |

​Due date for furnishing of statement of financial transaction (in Form No. 61A) as required to be furnished under sub-section (1) of section 285BA of the Act respect for financial year 2022-23. |

|

20 |

Income Tax |

Form No. 61B |

2022 |

31-May-23 |

​Due date for e-filing of annual statement of reportable accounts as required to be furnished under section 285BA(1)(k) (in Form No. 61B) for calendar year 2022 by reporting financial institutions. |

|

21 |

Income Tax |

Application for permanent account number Allotment |

Financial Year 2022-23 |

31-May-23 |

​Application for allotment of permanent account number in case of non-individual resident person, which enters into a financial transaction of Rs. 2.50 Lakhs or more during financial year 2022-23 and hasn't been allotted any permanent account number. |

|

22 |

Income Tax |

Applcation for permanent account number Allotment |

Financial Year 2022-23 |

31-May-23 |

Application for allotment of permanent account number in case of person being managing director, director, partner, trustee, author, founder, karta, chief executive officer, principal officer or office bearer of the person referred to in Rule 114(3)(v) or any person competent to act on behalf of the person referred to in Rule 114(3)(v) and who hasn't allotted any permanent account number​. |

|

23 |

Income Tax |

Form 9A |

Financial Year 2022-23 |

31-May-23 |

​Application in Form 9A for exercising the option available under Explanation to section 11(1) to apply income of previous year in the next year or in future (if the assessee is required to submit return of income on or before July 31, 2023). |

|

24 |

Income Tax |

Form no. 10 |

Financial Year 2022-23 |

31-May-23 |

​Statement in Form no. 10 to be furnished to accumulate income for future application under section 10(21) or section 11(1) (if the assessee is required to submit return of income on or before July 31, 2023)​. |

|

25 |

Company Law |

LLP Form 11 |

Financial Year 2022-23 |

30-May-23 |

Every limited liability partnership shall file an annual return, along with all the documents which are required to be or attached to such annual return, duly authenticated with the Registrar in limited liability partnership Form No. 11. |

|

26 |

Company Law |

PAS 6 |

Oct-March, 23 |

30-May-23 |

PAS 6 is filed by To be filed by unlisted public company for reconciliation of share capital audit report on half yearly. |

|

27 |

Labour Law |

Providend Fund / Employees' State Insurance |

April 2023 |

15-May-23 |

Timeline for payment of Provident fund and Employees' State Insurance contribution for the previous month. |

*Note 1: Opting for Quarterly Returns with Monthly Payment Scheme- Timeline Date for filling GSTR - 3B with Annual Turnover up to 5 Crore in State A Group (Goa, Kerala, Madhya Pradesh, Chhattisgarh, Karnataka, Gujarat, Maharashtra, Tamil Nadu, Telangana, Andhra Pradesh, Puducherry, Andaman, Daman & Diu, Lakshadweep Dadra & Nagar Haveli and the Nicobar Islands).

**Note 2: Opting for Quarterly Returns with Monthly Payment Scheme- Due Date for filling GSTR - 3B with Annual Turnover up to 5 Crore in State B Group (Uttarakhand, Haryana, Sikkim, Himachal Pradesh, Punjab, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Rajasthan, Uttar Pradesh, Bihar, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Odisha, Jammu and Kashmir, Ladakh, Chandigarh, Delhi).