Table of Contents

Company Registration Services

A company that is formed by two or more individuals under Company Act 2013 is known as company registration or company incorporation. Entrepreneurs look forward to the establishment of a company undergoing proper law proceedings. Company registration services can take more than 7 days whether it is a public or private limited company.

MINIMUM REQUIREMENT FOR PRIVATE COMPANY REGISTRATION

There are certain minimum requirement provisions to be considered before taking up the registration. These are -

- Minimum 2 members are required for incorporation of the company.

- At least 2 directors provide their names in MOA at the time of registration.

- Private companies are provided relaxation, as the minimum capital requirement has been removed.

- Directors giving their name in MOA should be in receipt of DSC and DIN.

- All the members, including directors, are in receipt of their respective PAN Card/Aadhaar card.

- The maximum number of members that can be in a private company is 200 members.

STEP BY STEP PROCESS OF NEW COMPANY REGISTRATION

- DIGITAL SIGNATURE CERTIFICATE – The company is required to register on the MCA portal and file the form for obtaining the DSC since the same is mandatorily required for all the subscribers of MOA and AOA to have DSC.

- DIRECTOR IDENTIFICATION NUMBER – Once the DSC is obtained, all the directors providing their name in MOA should be in receipt of DIN. Any director not in receipt of DIN at the time of registration is required to apply for the same by providing ID and address proof.

- NAME RESERVATION – After successful registration into the MCA portal, the company is required to go on the SPICE platform and fill the RUN form. They are required to provide at least 6 names for their company, in order of priority. The name provided should not be similar or identical to the name of any existing company. The name allotted by the Registrar will be reserved for a period of 30 days.

- PREPARATION OF DOCUMENTS – The company then needs to formulate MOA, AOA of the company. These documents are accompanied by the declaration of Directors and the details and proof of registered office.

- AUTHENTICATION AND FILING OF CHARTER DOCUMENTS – Once the above documents are ready, the directors are required to stamp them properly with the common seal of the company and upload the same on the SPICE portal.

- FILLING THE DETAILS OF MEMBERS – The company is required to file the information regarding the directors along with their DIN number and of members who subscribe to the MOA and AOA along with their membership number.

- FEE PAYMENT – After providing all the information in the SPICE portal, the company needs to recheck its details and confirm the same. After confirming, they will be directed to the payment gateway, where they are required to pay requisite fees applicable either by debit or credit card, or net banking, or UPI.

- SCRUTINIZATION OF DOCUMENTS – After receiving the application, the Registrar will scrutinize the documents to check the correctness and fairness of the documents submitted.

- ISSUE OF CERTIFICATE OF INCORPORATION – Once the Registrar is satisfied with the authentication of the application and the documents, the company is notified about the same, and a Certificate of Incorporation is issued by post to the registered office of the company.

- REGISTRATION OF BANK ACCOUNT DETAILS – Once the entity receives the certificate of incorporation, they can open a bank account in the name of their firm, using MOA, AOA, and the PAN card details.

CA Rajput has assisted many entrepreneurs by providing hassle-free and prompt company registration services in India. We comprise an expert team of solicitors and lawyers who by utilizing their expertise help resolve various issues related to company registration services in Delhi and business formation queries. For the company registration, you need to have a minimum or a maximum number of partners and directors, shareholder’s details should list the minimum capital which is required for company registration.

Apart from that, Company registration services in India require DIN (Director Identification Number, Digital Signature Certificate with the partner’s consent while applying for it and submission of documents like MOU and DOA. After getting the company’s name registered, one needs to obtain approval from ROC on the fees, obtaining TAN drawing up a memorandum of association, drawing up articles of association and government duty payment, eligible persons for subscribing to the memorandum, registration fee payment to ROC, obtaining a receipt of company incorporation and obtaining commencement certificate form ROC mandatory for the public companies for initiating business operations.

Startup Registration- Company Registration

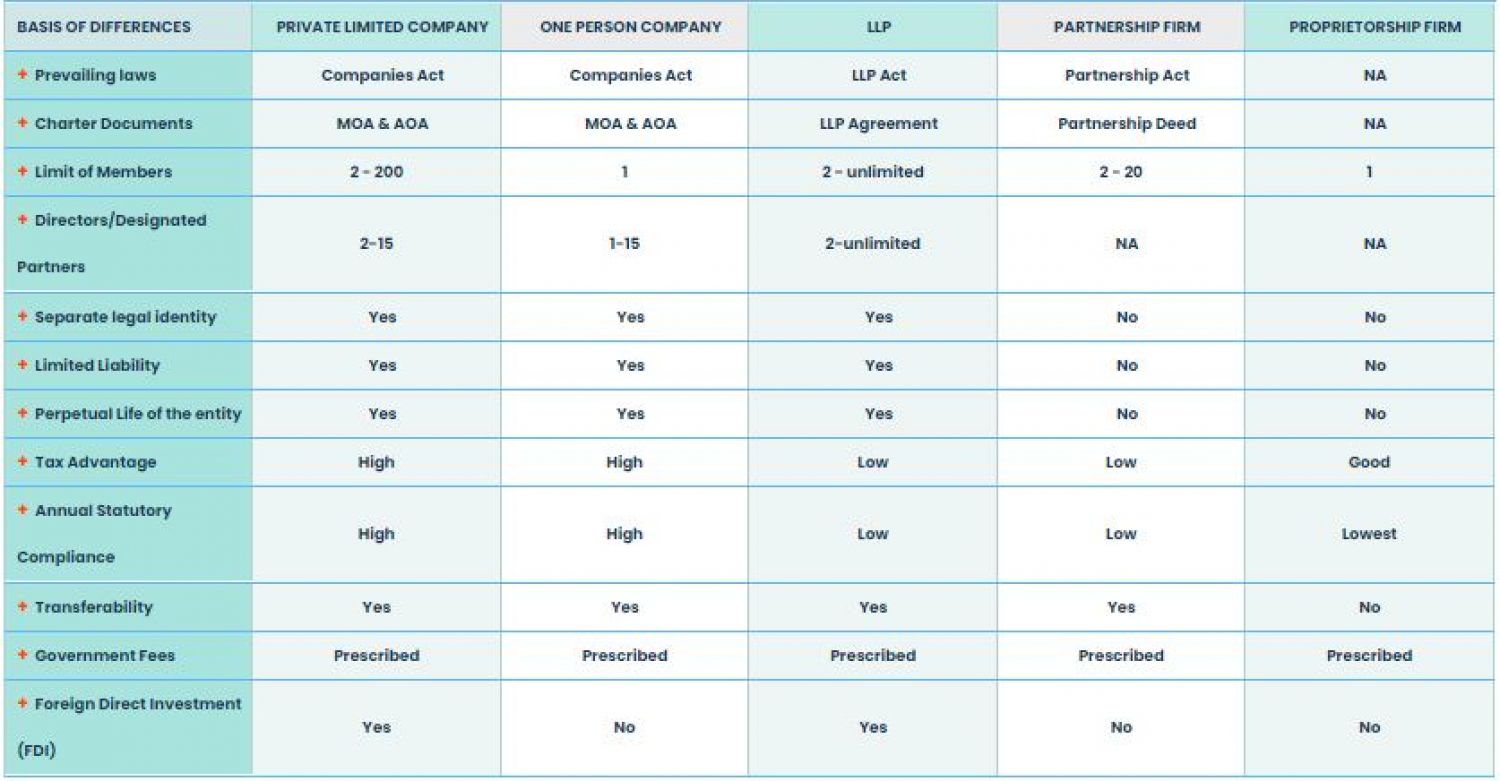

First & foremost requirement of start-up registration is to choose the favorable business structure and to register a company name in India. Option of correct business structure will positively impact many related factors from our business name to company liability for our business, we can help in filling income taxes return & payment of statutory dues. Financial & operational success of originations also depends on business structure, accordingly online company registration in India process can be followed as per company needs.

We help you submit the required documents to the authority for easing up the process of company registration services in Delhi.

The requirement of company registration

Auditor Appointment for Newly Incorporated Private Limited Company

Compliance Check List on Post Incorporation Compliances of Company

Regards

Rajput Jain & Associates