Merger and Amalgamation is a restructuring tool available to Indian conglomerates aiming to expand and diversify their businesses for various reasons whether it is to gain competitive advantage, reduce costs, or availing of tax benefits. A merger means an arrangement whereby one or more existing companies merge their identity into another existing company or form a distinct new entity. Any proposal of merger or amalgamation begins with the process of due diligence which is a very essential step in carrying out the whole merger or amalgamation. Presently, the High Court enjoys powers of sanctioning merger or amalgamation matters under section 394 of the Companies Act, 1956 but once merger sections covered under the Companies Act, 2013 gets notified then this power of sanctioning merger or amalgamation will be exercised by the National Company Law Tribunal (NCLT). Company Law in India is undergoing a complete change but the provisions relating to mergers covered under the Companies Act, 2013 are yet to be notified.

COMPANIES ACT, 2013

The new act has different provisions in relation to different types of restructuring processes as follows:

- Compromise or arrangements under section 230 & 231of the Act;

- Amalgamation including demergers falls within section 232 of the Act;

- An amalgamation of small companies within section 233 of the Act;

- An amalgamation of foreign companies under section 234 of the Act.

Generally, the memorandum of association of both the companies should be examined to check the availability of companies’ power to amalgamate clause. Then, the stock exchange of both the merging and merged companies should be informed about the merger proposal (if a listed company). The draft merger proposal to be approved by the Board of Directors. Once the same is approved by respective boards, each company shall make an application to the high court of the state where the registered office is situated so that companies can follow the further procedures as per sections 230 to 234 of the Companies Act, 2013.

BASIC TERMS OF MERGER & AMALGAMATION

- Merger: Where assets and liabilities of one company are transferred to another and the first company loses its existence.

- Amalgamation: Where two or more companies merge into a third new company and the existing company loses its existence.

- Horizontal Merger: A merger occurring between companies producing similar products, goods and offering similar services.

- Vertical Merger: When two or more companies that are complementary to each other, join together.

- Conglomerate Merger: It means a merger between unrelated businesses.

- Reverse Merger: It is the opportunity for the unlisted companies to become public listed companies without opting for an initial public offer. In this process, the private company acquires the majority shares of the public company, with its own name.

- De-Merger: In this, a single business is broken into components, either to operate on their own, to be sold, or to be dissolved.

1. SECTION-230- POWER TO MAKE COMPROMISE AND ARRANGEMENT

*An application under Section 230 for compromise/arrangement/amalgamation, have to disclose the following to the NCLT:

- The latest financial position of the company and the Latest auditor’s report;

- Any investigation and proceeding against the company;

- Reduction of share capital, if any included in the scheme;

- Scheme of Corporate Debt Restructuring consented by not less than 75% of secured creditors.

*Notice of proposed meeting required o be sent to All Creditors / Members/debenture holders (at their registered address), Central Government, Income Tax Authority, RBI, SEBI, ROC, Respective Stock Exchanges, Official Liquidator, CCI, Sectoral Regulators or Authorities which are likely to be affected.

*Notice shall also provide an option to vote through postal ballot;

*Only those shareholders can raise an objection to the scheme who holds not less than 10% of the shareholding;

*Only those creditors can raise an objection to the scheme who holds 5% of the total outstanding debt;

*The Tribunal may provide the order for exit option to dissenting shareholders based upon the valuation by Registered valuer;

*Certificate from Statutory Auditor that accounting treatment complies with prescribed accounting standards;

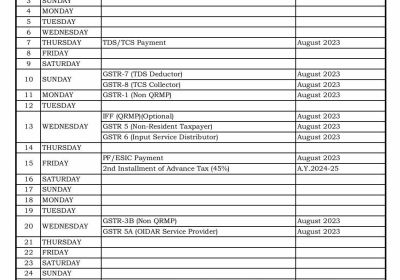

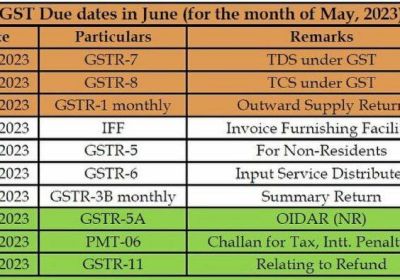

*Every company has to file a yearly statement with ROC until the completion of the scheme, certifying that compliance is as per an order of Tribunal;

2. SECTION-231- POWER OF TRIBUNAL TO ENFORCE COMPROMISE OR ARRANGEMENT:

- Supervision of Compromise or Arrangement scheme;

- To make modifications in the scheme of compromise or arrangement;

- Suo-motto power to order winding up if the company is unable to pay its debt.

3. SECTION-232- PROCEDURE OF MERGER & AMALGAMATION:

STEPS –[SECTION 232(1)]-

Filing an application to the Tribunal in Form AMG.1 along with Notice of admission supported by an affidavit for the order of meeting under section 230 for sanctioning of the scheme of compromise or arrangement.

- If a meeting is proposed to be called then the company shall order a meeting of the creditors or class of creditors or members or class of members to be called, held or conducted in the manner as the Tribunal directs.

- The notice of meeting pursuant to the order of the Tribunal to be given in the manner as provided shall be in Form AMG 4 and advertisement of notice in Form AMG. 2.

- A notice of the meeting shall also be sent to Central Government, SEBI, RBI, and other regulatory authorities in Form AMG. 5.

- The report shall state accurately the number of creditors or class of creditors or the number of members or class of members, as the case may be, who was present and who voted at the meeting either in person or by proxy, their individual values, and the way they voted. The report shall be in FORM NO. AMG.6

[SECTION 232 (2)]-

Circulation of the following documents for the meeting:

- The proposed draft scheme adopted by the directors of merging companies;

- Confirmation of filing the draft copy of the scheme with the Registrar;

- Valuation Report, if any;

- Report adopted by the directors of the merging companies explaining the effect of the compromise;

- Supplementary accounting statement if the last annual accounts of any of the merging companies relate to a financial year ending more than six months before the first meeting of the company summoned for the purposes of approving the scheme.

[SECTION 232 (3)]-

The Tribunal may by order sanction the Scheme of merger or amalgamation in Form AMG. 10, if satisfied that the procedure specified in sections 232(1) & 232(2) has complied or the Tribunal can make provisions for the following matters by giving subsequent orders:

- To transfer the whole or any part of the undertaking property or liabilities to the Transferor company to the Transferee Company;

- To allot or appropriate any shares, debentures or other like instruments under the merger or amalgamation by the Transferee Company to or for any person;

- Dissolution, without winding-up of any Transferor company;

- The continuation of any legal proceedings by or against any Transferor company or Transferee company;

- The provisions for any persons who are dissent from the scheme of merger or arrangement;

- The allotment of shares of the Transferee company to the non-resident shareholder shall be in the manner specified in the order;

- Transfer of employees of the Transferor company to the transferee company;

- Such incidental, consequential and supplemental matters as are deemed necessary to secure that the merger or amalgamation is fully effective and carried out;

The Companies Act, 2013 requires that all companies must obtain an auditor’s certificate and shall also file with the Tribunal that the scheme is in conformity with the accounting standards.

[SECTION 232 (4)]-

If the Tribunal order to transfer any property or liabilities then those properties and liabilities shall be transferred to the Transferee Company by the Transferor Company.

[SECTION 232 (5)]-

Filing a certified copy of the order with the Registrar for registration within thirty days of the receipt of the certified copy of the order.

[SECTION 232 (6)]-

The scheme shall indicate clearly the Appointed Date from which it shall be effective.

[SECTION 232 (7)]-

A statement certified by a Company Secretary or Chartered Accountant or Cost Accountant in practice indicating whether the scheme has complied with the orders of the Tribunal every year until the completion of the scheme shall be filed in Form AMG.11.

[SECTION 232 (8)]-

If any of the company contravenes the provisions of this section shall be punishable with fine, not less than Rs. 1, 00,000/- may extend to Rs. 25, 00,000/- and every officer in default shall be punishable with fine, not less than Rs. 1, 00,000/- may extend to Rs. 3, 00,000/- or imprisonment which may extend for a term of 1 year or with both.

4. SECTION-233- MERGER & AMALGAMATION OF CERTAIN COMPANIES:

[Section 233(1)]

It a merger between two or more companies or between holding and its wholly owned subsidiary company subject to the following conditions:

- A notice of the scheme is to be given in Form AMG.12 for inviting objections or suggestions from Registrar or Official Liquidator;

- Approval of scheme after receiving objections/suggestions by members at a general meeting holding at least 90% of the total number of shares;

- Filing of declaration of solvency in Form AMG. 13 by the merging companies with the registrar;

- Approval of scheme by 9/10th in value of the creditors or class of creditors in the general meeting convened by giving 21 days notice along with the scheme

[Section 233(2)]

Filing a copy of the approved scheme in Form AMG. 14 along with the report of the result with the Central Government, Registrar and Official Liquidator.

[Section 233(3)]

If there is no objection to the Registrar or Official Liquidator then Central Government after registering the same will issue the confirmation in Form AMG.15.

[Section 233(4)]

If there is any objection to the Registrar or Official Liquidator, communicate this to Central Government within 30 days.

[Section 233(5)]

After receiving the opinion of the Central government that the scheme is not in the public interest or creditors’ interest, file an application before Tribunal within 60 days to consider the scheme.

[Section 233(6)]

After receiving an application from Central Government if Tribunal is of the opinion to consider the scheme again, it may direct accordingly to modify the scheme or confirm the scheme bypassing such order.

[Section 233(7)]

The confirmation order of the scheme issued by the Central Government or Tribunal shall be filed with the Registrar in Form AMG.16 and after registering it will issue a confirmation to the companies.

[Section 233(8)]

Dissolution of Transferor company without process of winding up after registration of scheme with the Registrar.

[Section 233(9)]

Effects after Registration of Scheme:

- Transfer of property or liabilities of the Transferor company to the transferee company ;

- Charges of Transferor company shall become charges of Transferee Company;

- Legal proceedings of Transferor company shall continue by or against Transferee company and;

- If any amount unpaid by dissenting shareholders shall become a liability of Transferee company.

[Section 233(10)]

The transferee company shall not hold shares in its own name or in name of its subsidiary or associate company and if there will be any such shares they will stand cancelled or extinguished on the merger or amalgamation.

[Section 233(11)]

The transferee company shall file an application along with such fees as may be specified on the revised authorized capital.

[Section 233(12)]

The provisions under this section shall apply as it is to the companies referred in section 230 or in section 232.

[Section 233(13)]

The Central Government may provide for merger or amalgamation of companies in such manner as may be prescribed.

[Section 233(14)]

Companies covered under this section may use the provisions of section 232 for the approval of any scheme.

5. FAST TRACK MERGER

The Companies Act, 2013 provides a fast track merger for small companies or holding and subsidiary companies.

Fast track Merger process involves approval from the following person:

- Creditors or class of creditors;

- Members or class of members;

- Registrar of companies;

- Official Liquidator;

- High Court.

In this type of merger, there is no need to make an application to NCLT for finalizing the scheme`, in spite of this only 90% of each class of members and creditors must approve the scheme and the rest of the procedure is the same section 233.

Process of merger & amalgamation

- It must ensure that the companies under amalgamation should have the power in the object clause of their Memorandum of Association to undergo amalgamation though the absence may not be an impediment, but this will make matters smooth.

- A draft scheme of amalgamation shall be prepared for getting it approved in a Board meeting of each company.

1. Format of Application

Application to the tribunal for Merger & Amalgamation will be submitted in form no. NCLT-1 along with following documents: Rule 3(1)

a) A notice of admission in Form No. NCLT-2

b) An affidavit in form no. NCLT-6

c) A copy of Scheme of C&A (Merger & Amalgamation)

d) A disclosure in form of affidavit including following points Section 230(2)

– All material facts relating to the company, such as

i. the latest financial position of the company,

ii. the latest auditor’s report on the accounts of the company and

iii. the pendency of any investigation or proceedings against the company

– Reduction of the share capital of the company, if any, included in the compromise or arrangement

e) Any scheme of Corporate Debt Restructuring consented to by not less than seventy-five per cent. of the secured creditors in value, including

i. A Creditor’s Responsibility statement in Form No. CAA-1.

ii. safeguards for the protection of other secured and unsecured creditors;

iii. report by the auditor that the fund requirements of the company after the corporate debt restructuring as approved shall conform to the liquidity test based upon the estimates provided to them by the Board;

iv. where the company proposes to adopt the corporate debt restructuring guidelines specified by the Reserve Bank of India, a statement to that effect; and

v. a valuation report in respect of the shares and the property and all assets, tangible and intangible, movable and immovable, of the company by a registered valuer.

f) The applicant shall also disclose to the Tribunal in the application, the basis on which each class of members or creditors has been identified for the purposes of approval of the scheme.

2. Calling of Meeting by Tribunal:

Upon hearing of the application Tribunal shall, unless it thinks fit for any reason to dismiss the application, give such directions/order as it may think necessary in respect meeting of the creditors or class of creditors, or of the members or class of members, as the case may be, to be called, held and conducted in such manner as prescribed in rule 5 of CAA Rules, 2016 as follow:

i. Fixing the time and place of the meeting or meetings;

ii. Appointing a Chairperson and scrutinizer for the meeting or meetings to be held, as the case may be and fixing the terms of his appointment including remuneration;

iii. Fixing the quorum and the procedure to be followed at the meeting or meetings, including voting in person or by proxy or by postal ballot or by voting through electronic means;

iv. Determining the values of the creditors or the members, or the creditors or members of any class, as the case may be, whose meetings have to be held;

v. Notice to be given of the meeting or meetings and the advertisement of such notice.

vi. Notice to be given to sectoral regulators or authorities as required under subsection (5) of section 230;

vii. The time within which the chairperson of the meeting is required to report the result of the meeting to the Tribunal; and

viii. Such other matters as the Tribunal may deem necessary.

3. Notice of Meeting: The Notice of the meeting pursuant to the order of the tribunal to be given in Form No. CAA-2. Rule 6

The person entitled to receive the notice shall be sent individually to each of the Creditors or Members and the debenture-holders at the address registered with the company. Section 230(3)

A person authorized to send the notice:

- Chairman of the Company, or

- If tribunal so direct- by the Company or its liquidator or by any other person

Modes of Sending of notice:

- By Registered post, or by Speed post, or by courier, or

- By e-mail, or by hand delivery, or by any other mode as directed by the tribunal

Documents to be sent along with notice:

The notice of meeting send with (i) Copy of Scheme of C&A and (ii) Following below mentioned details of C&A if not included in the said scheme:

a. Details of the order of the Tribunal directing the calling, convening and conducting of the meeting:-

- Date of the Order;

- Date, time and venue of the meeting.

b. Details of the company including:

- Corporate Identification Number (CIN) or Global Location Number (GLN) of the company;

- Permanent Account Number (PAN);

- Name of the company;

- Date of incorporation;

- Type of the company (whether public or private or one-person company);

- Registered office address and e-mail address;

- Summary of the main object as per the memorandum of association; and main business carried on by the company;

- Details of the change of name registered office and objects of the company during the last five years;

- Name of the stock exchange (s) where securities of the company are listed, if applicable;

- Details of the capital structure of the company including authorised, issued, subscribed and paid-up share capital; and

- Names of the promoters and directors along with their addresses.

c. Relationship in case of Combined Application: if the scheme of compromise or arrangement relates to more than one company, then the fact and details of any relationship subsisting between such companies who are parties to such scheme of compromise or arrangement, including holding, subsidiary or of associate companies.

d. Disclosure about the effect of M&A on material interests of directors, Key Managerial Personnel (KMP) and debenture trustee

e. Details of Board Meeting:

- The date of the board meeting at which the scheme was approved by the board of directors

- The name of the directors who voted in favour of the resolution,

- The name of the directors who voted against the resolution and

- The name of the directors who did not vote or participate in such resolution

f. Explanatory Statement disclosing details of the scheme of compromise or arrangement including:

- Parties involved in such compromise or arrangement;

- Appointed date, effective date, share exchange ratio (if applicable) and other considerations, if any;

- Summary of valuation report (if applicable) including basis of valuation and fairness opinion of the registered valuer, if any, and the declaration that the valuation report is available for inspection at the registered office of the company;

- Details of capital or debt restructuring, if any;

- The rationale for the compromise or arrangement;

- Benefits of the compromise or arrangement as perceived by the Board of directors to the company, members, creditors and others (as applicable);

- Amount due to unsecured creditors.

g. Disclosure about the effect of the Merger & Amalgamation (C&A) on: Section 230(3)

- Key Managerial Personnel;

- Directors;

- Promoters;

- Non-Promoter Members;

- Depositors;

- Creditors;

- Debenture holders;

- Deposit trustee and debenture trustee;

- Employees of the company:

- Shareholders of the Company

h. A report adopted by the directors of the merging companies explaining the effect of compromise on each class of shareholders, key managerial personnel, promoters and non-promoter shareholders laying out, in particular, the share exchange ratio, specifying any special valuation difficulties;

i. Below Mentioned Details: Following below mentioned details

- Investigation or proceedings, if any, are pending against the company under the Act.

- Details of approvals, sanctions or no-objection(s), if any, from regulatory or any other governmental authorities required, received or pending for the proposed scheme of compromise or arrangement

- A statement to the effect that the persons to whom the notice is sent may vote in the meeting either in person or by proxies, or where applicable, by voting through electronic means

- A copy of the valuation report, if any Section 230(3)

j. Details of availability of documents: Details of the availability of the following documents for obtaining an extract from or for making or obtaining copies of or for inspection by the members and creditors, namely

- Latest audited financial statements of the company including consolidated financial statements;

- Copy of the order of Tribunal in pursuance of which the meeting is to be convened or has been dispensed with;

- copy of scheme of Merger & Amalgamation ( C&A);

- Contracts or agreements material to the Merger & Amalgamation ( C&A);

- The certificate issued by the Auditor of the company to the effect that the accounting treatment, if any,

- Proposed in the scheme of Merger & Amalgamation ( C&A) is in conformity with the Accounting Standards prescribed under Section 133 of the Companies Act, 2013; and

- Such other information or documents as the Board of Management believes necessary and relevant for making the decision for or against the scheme;

k. Some Other documents: Where an order has been made by the Tribunal under section 232(1), merging companies or the companies in respect of which a division is proposed, shall also be required to circulate the following:

- The draft of the proposed terms of the scheme drawn up and adopted by the directors of the merging company;

- Confirmation that a copy of the draft scheme has been filed with the Registrar;

- The report of the expert with regard to valuation, if any;

In the case of Kirloskar Electricals Co. Ltd., the Court held that various clauses of Section 394(1) of the Companies Act suggest that both the transferor and the transfer company shall make an application to the Court and under section 391-394 of the Companies Act, 1956 for sanction of the scheme of Compromise or arrangement involving the amalgamation of the Companies.

In the case of Mohan Exports Ltd. V/s Tarun Overseas Pvt. Ltd., it was held that if both the Companies are under the jurisdiction of the same High Court, a Joint petition may be made.

Scheme of Corporate Debt restructuring as referred to in section 230(2)(c) means “a scheme that restructures or varies the debt obligation of a company toward its creditors”.

It is hereby clarified that the service of notice of the meeting shall be deemed to have been affected in case of delivery by post, at the expiration of forty-eight hours after the letter containing the same is posted

Explanation – For the purposes of these rules it is clarified that-

(a) the term ‘interest’ extends beyond an interest in the shares of the company and is with reference to the proposed scheme of compromise or arrangement.

(b) the valuation report shall be made by a registered valuer, and till the registration of persons as valuers is prescribed under section 247 of the Act, the valuation report shall be made by an independent merchant banker who is registered with the Securities and Exchange Board or an independent chartered accountant in practice having a minimum experience of ten years.

the valuation report shall be made by a registered valuer, and till the registration of persons as valuers is prescribed under section 247 of the Act, the valuation report shall be made by an independent merchant banker who is registered with the Securities and Exchange Board or an independent chartered accountant in practice having a minimum experience of ten years.

Regards

Rajput Jain & Associates