Table of Contents

- What Is Change In Threshold Limit Of Small Company Definition?

- Change In Definition Of A Small Company Via Increased Paid-up Share Capital & Turnover

- What Is Main Feature Of A Small Company

- Change In Threshold Limit Of Small Company

- Below Are Not Considered Small Companies

- Advantages Of change In Threshold Limit Of Small Company

What is Change in threshold limit of small company definition?

Small Company many advantages over mediam & large companies, a small business promotes entrepreneurship, employment, and jobs while also being simpler to manage.

Change in definition of a Small Company via Increased paid-up share capital & turnover

- Ministry of Corporate Affairs has increased paid-up share capital and turnover limit to qualify as a Small Company as defined U/s 2(85) of the Companies Act, 2013.

- Now, paid-up share capital limit has been increased from INR 2 crores to INR 4 Cr. & Turnover limit from INR 20 Cr. to INR 40 Cr.

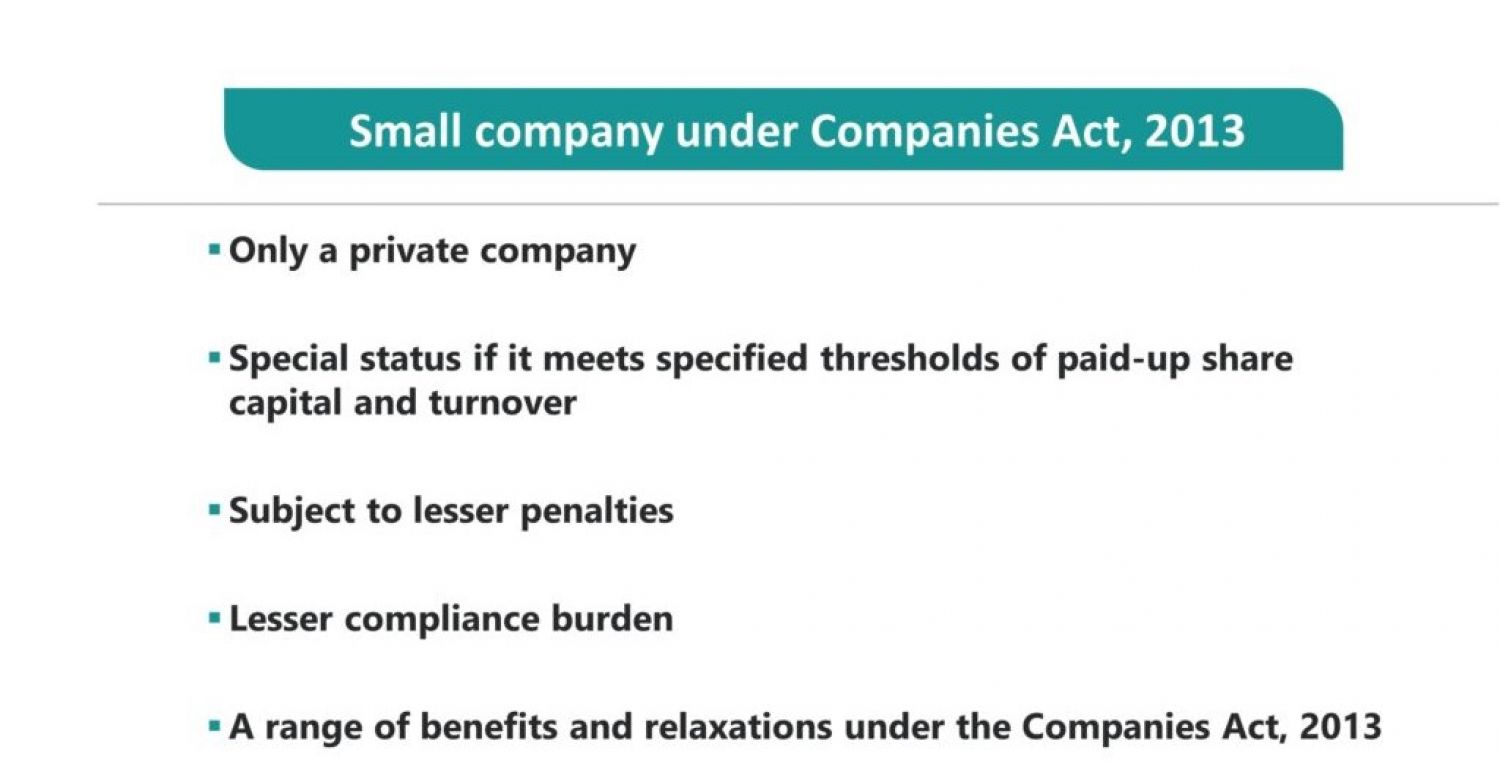

What is main feature of a Small Company

The below Characteristics can classify as an small companies.

- Very limited area of operation

- Low employee strength

- Single location

- Low revenue and profitability

Change in threshold limit of small company

As per new amended Company act a small company is not a public company. In case paid-up share capital less than or equal to INR 4 Cr or higher amount specified but not higher than INR 10 CR. As per new definition & threshold, a small company is one that has INR 4 Cr or less in paid-up capital, and its turnover is less than or equal to INR 40 Cr.

This changes in new definition of a small company comes u/s 2(85) of the Companies Act, 2013. Before this amendment, basic threshold at less than or equal to less than or equal to ₹2 crore turnover and INR 50 lacs in paid-up capital.

Ministry of Corporate Affairs through Notification dated 15th Sept. 2022, has change the Companies (Specification of Definitions Details) Rules, 2014 to increase the threshold limit for a small company i.e. turnover of not exceeding INR 40 Cr ( Earlier, This limit was Rs. 20 Cr) & paid-up capital of not exceeding INR 4 Cr ( Earlier, This limit was INR 2 Cr),

Below are not Considered Small Companies

All companies can not be come in the category of small company due to different reasons. Some such categories of companies are listed below.

- A subsidiary company or a holding

- Any company that has been registered under section 8 of the Companies Act

- A company/ body corporate that is being governed by some special act

Most of the startups company in India come under type of small companies. This is due to their not having an annual sales that is higher than INR 20 Cr. & a paid-up capital of over INR 10 Cr.

Advantages of Change in threshold limit of small company

Below are few advantages of decrease in compliance burden as a change of the revised definition of small companies under Company act for small companies are as mention here under:

- Small company auditor is not needed to report on the adequacy of the internal financial controls & this operating effectiveness in the auditor’s report.

- Benefit of preparing & filing an abridged Annual Return.

- Small company having Lesser penalties,

- Prepare cash flow statement is not required as part of financial statement.

- Small company holding of only 2 board meetings in a year.

- Compulsory rotation of auditor not needed.

- Small company of annual Return can be signed by CS, or in case Small company is no CS than by any Director of the Small company.

What are Implications of Change in Status of small company?

MCA has notified the Companies (Accounting Standard) Rules, 2021 & this Rules deals with situations when the non- small company/ small company status of a company changes

|

Situations |

Non- small company to small company |

small company to non- small company |

|

Basic Requirement |

Clause 5 of the Companies (Accounting Standard) Rules 2021 states that when a non- small company becomes an small company, it shall not avail any small company exemption/relaxation in the accounting standards until the company remains small company for 2 consecutive Financial periods. |

Annexure A Clause 1.2 of the Companies (Accounting Standard) Rules 2021 Normal Instructions to the Rules states that when a company that was previously meeting the small company definition not longer meets the small company definition, all the relevant AS & requirements shall become applicable from the existing period. The amount for the respective period of the Last year required not be revised/restated merely due to the reason of it having ceased to become an small company. Company shall disclose the fact that it was an small company. in the previous period and it had availed an small company relaxations/ exemptions shall be disclosed in the notes to the Company’s financial statements. |

Small Company are not considered public companies under the Companies Act. Their fully paid-up capital for shares is no more than 2 crores or a higher specified amount no exceeding ten crores.