OTHERS

Prime Minister Employment Generation Programme (PMEGP)

RJA 21 Oct, 2021

Prime Minister Employment Generation Programme (PMEGP)-Eligibility, Features PMEGP scheme was founded in 2008 by merging two schemes that were in operation till 31.03.2008 namely Prime Minister’s Rojgar Yojana (PMRY) and Rural Employment Generation Programme (REGP) for generation of employment opportunities through establishment of micro enterprises in rural as well ...

NRI

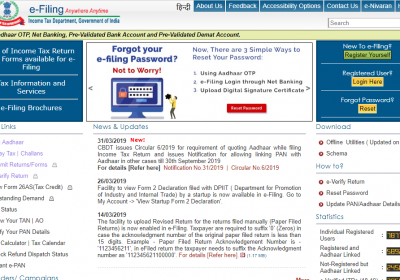

FAQ/Guidelines on Aadhaar-based PAN distribution

RJA 19 Oct, 2021

FAQ on Aadhaar-based PAN distribution What's the PAN? Answer: PAN, or Permanent Account Number, is a special 10-digit alphanumeric code. The Income Tax Department issues PAN in compliance with the Income Tax Act & Regulations. Financial institutions and agencies are also required to have PAN. What is Instant PAN ...

INCOME TAX

Validity of Partnership remuneration disallowed U/s 40A(2)(a)

RJA 16 Oct, 2021

Validity of Partnership remuneration disallowed U/s 40A(2)(a) Problem based on provisions of Sections 40(b)(v) & 40A(2)(a) of the Income Tax Act, 1961. LETS see the applicability of provision of applicable of section. SECTION 40(b)(v) of income tax provides that: Remuneration to Partners exceeding the limit prescribed ...

Goods and Services Tax

Pre deposit for GST appeal should be paid via cash ledger only

RJA 15 Oct, 2021

Orissa Honorable High court: Pre deposit for filing appeal under GST to be paid Via cash ledger only & adjustment not allowed from credit ledger Fact In case of Jyoti Construction v. Deputy Commissioner of CT & GST, Jajpur (Orissa) petitioner was a partnership firm doing the business of ...

ROC Compliance

Non-Filing of E-Form INC-20A- Consequences

RJA 15 Oct, 2021

Commencement of Business E-Form INC-20A Filing Brief Introduction Form INC-20A is basically a declaration form that's to be filed by the directors of the corporate at the time of commencement of business. The declaration form should be verified by ...

ROC Compliance

All About Form MGT-9 & its Filling requirement

RJA 14 Oct, 2021

All About Form MGT-9 & its filling requirement Brief Introduction At the end of each financial year, companies in India should file an annual return. There are numerous amendments associated with the filing of annual returns. There has also been lots ...

ROC Compliance

How to apply DIN before Company formation

RJA 14 Oct, 2021

DIN Allotment Prior to Incorporation of Company Brief Introduction DIN or the Director Identification Number is basically a unique identification number, that is compulsorily be obtained by all the directors. It's similar to an identity proof of a director. DIN is allotted by&...

AUDIT

Importance of Internal Audit in India

RJA 08 Oct, 2021

Importance of Internal Audit Checking the internal system is that the most frequent task. Several types will be distinguished here: audit, operational audit, compliance audit (compliance audit), audit of knowledge technology (information systems), audit within the field of environmental ...

Income tax return

Impact of Delay in filing Income tax returns

RJA 08 Oct, 2021

Impact of Delay in Filing Income Tax Returns The most important obligation for any tax payer is to file their income tax on time, on or before the due date. Whenever income tax returns are submitted late, the taxpayer misses a lot of benefits. Apart from the smaller exemptions, the ...

Form 15CA & 15CB Certificate

Form 15CA & 15CB Submission Process has been redesigned

RJA 07 Oct, 2021

Form 15CA & 15CB Submission Process has been redesigned The Income-tax Dept has introduced an entirely new re-engineered Form 15CA and Form 15CB submission process based on past year's feedback from numerous corporates and professionals across India. These alterations will optimise & simplify the Form's preparation, assignment, submission, ...

FEMA

Complete Coverage about FEMA Returns with RBI Forms

RJA 07 Oct, 2021

FEMA Returns with RBI, Forms for Foreign Company, Forms for Import Export Business FEMA Returns with RBI Forms for Foreign Company S. No. Particulars of Form Purpose of Form Periodicity Letter of Comfort Format for Letter of Comfort for LO/BO Before establishing LO/BO Report to ...

Income tax return

FREQUENTLY ASKED QUESTION ON INCOME TAX RETURN:

RJA 03 Oct, 2021

FREQUENTLY ASKED QUESTION ON INCOME TAX RETURN: Q.: What Are the Benefits of Filing Income Taxes? In recent years, the Government of India has taken restrictive action in enforcing the Income Tax Law by linking various benefits for prompt tax filers, which has resulted in low Income Tax filing Compliance ...

TDS

Frequently Asked Questions(FAQ’s) on TAN

RJA 03 Oct, 2021

Frequently Asked Questions(FAQ’s) on TAN Ques-1: How am I supposed to get my TAN number online? Ans. You can register for a TAN number of websites; you need to visit the local TIN-NSDL site by clicking on .https://carajput.com/services/tan-registration.Php Now, clicks New TAN ...

Limited Liability Partnership

Conversion of firm to Limited liability Partnership

RJA 02 Oct, 2021

SUMMARY OF CONVERSION OF FIRM TO LLP At first, the applicant is required to have a Digital Signature Certificate, to authorize all the documents online. It is mandatory for all the partners to hold a digital signature. After obtaining DSC, the designated partners are required to apply for a DPIN (...

GST Registration

key changes in new gst amendment w.e.f. 1st Jan 2022

RJA 01 Oct, 2021

Important Change in Compliances for New GST Registrants From 1st Jan 2022 From 1st January your GSTR-1 filing could be blocked As per CBIC's newest advisory, GSTR-1 filing will be blocked as of January 1, 2022, if a monthly GSTR-3B return filer has not submitted GSTR-3B for the previous month. ...

NGO

FAQ's on NGO's Tax benefits & Tax Incentives

RJA 29 Sep, 2021

FAQ's on NGO's Tax benifits & Tax Incentives Q.: What is the difference between Section 12A and Section 12AA? Everything you need to know about Sections 12A and 12AA If certain circumstances are met, a trust, society, or section 8 company can apply for registration under Section 12A of ...

FEMA

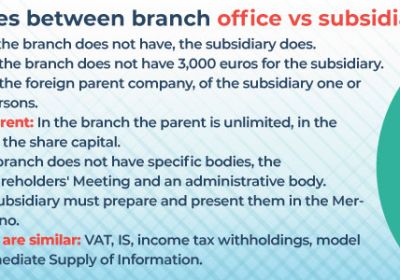

COMPARISON BETWEEN BRANCH OFFICE & COMPANY

RJA 26 Sep, 2021

COMPARISON BETWEEN BRANCH OFFICE & COMPANY Branch Office: It implies an institution founded by parent company to perform the similar business operations at different locations. one in every of the common strategies of the businesses to expand their business at the national ...

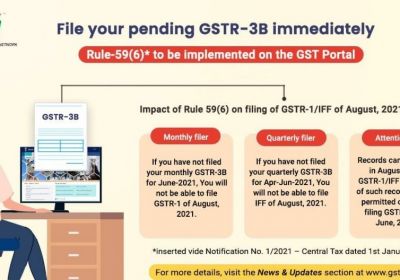

GST Filling

New Restrictive GST Rule Implementation of Rule-59(6) is a useful tool for taxpayers & tax officers

RJA 26 Sep, 2021

GSTN advises tax payers to register their pending GSTR 3B as early as possible after the implementation of Rule 59(6) on the GST Portal on 1st September. The Goods and Service Tax Network (GSTN) has issued an advise on the implementation of Rule 59(6) of the CGST Rules, 2017 on the ...

RBI

RBI warns of KYC fraud. Here’s what you should do.

RJA 26 Sep, 2021

RBI warns of KYC fraud. Here’s what you should do. ·The Reserve Bank of India (RBI) has issued a warning to the public against frauds perpetrated in the name of KYC updation. ·The RBI said in a statement that it has received complaints and information regarding ...

COMPANY LAW

FAQ’s on Winding Up of Private Limited Company

RJA 25 Sep, 2021

FAQ’s on Winding Up of Private Limited Company Why is liquidation important? Liquidation is important for the subsequent reasons- After the completion of the liquidation process, the directors as well as the other company officials bear no liability against any stakeholder. If&...

IBC

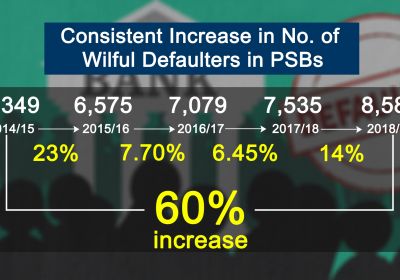

Wilful Defaulters under IBC 2016

RJA 24 Sep, 2021

WILLFUL DEFAULTERS UNDER IBC 2016 BRIEF INTRODUCTION It has been proposed that, as the promoters of defaulting companies have been vested with the right to bid for their own businesses, the same acts as a blockage in the insolvency proceedings. However, wilful defaulters or those borrowers who have diverted ...

IBC

GST & MCA on Insolvency Code Under IBC Code

RJA 24 Sep, 2021

GST & INSOLVENCY CODE It appears that the economy poised for certain substantial gains, arising from the structural reforms, being applied by the govt. Over the years, The ET Awards ceremony has provided the right platform for government and industry to come back ...

Financial Services

FAQ's on Start-Up Fund Raising

RJA 24 Sep, 2021

FAQS ON START-UP FUNDING Q.: What is Business financial Services ? Ans.: Business financial Services Business Financial Services is a term that refers to the services offered by the finance industry. Business Financial Services is another term for companies that deal with money management. Banks, investment banks, insurance companies, credit ...

Goods and Services Tax

WRITING OFF OF UNREALIZED EXPORT BILLS

RJA 23 Sep, 2021

WRITING OFF OF UNREALIZED EXPORT BILLS BRIEF INTRODUCTION Exports are available with various incentives in India like refund of taxes paid with regard to export, various duty-free scripts, Duty Drawbacks etc. However, these incentives would be available, provided the realization of consideration in respect of export&...