Table of Contents

SUMMARY OF CONVERSION OF FIRM TO LLP

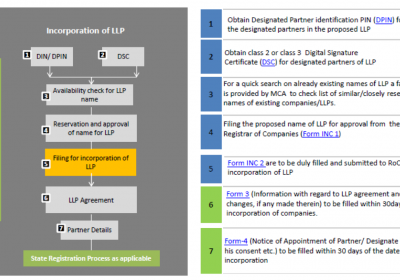

- At first, the applicant is required to have a Digital Signature Certificate, to authorize all the documents online. It is mandatory for all the partners to hold a digital signature.

- After obtaining DSC, the designated partners are required to apply for a DPIN (Designated Partner Identification Number). It is a onetime identification number and do not require any renewal.

- After this, apply for name approval on the RUN application, and the name so reserved shall be valid for a period of 90 days.

- Finally, the applicant is required to file LLP Form 17, LLP Form 2 and LLP form 3 related to conversion. The following documents are required to be submitted, along with the form –

-

- A statement providing the consent of all the partners for conversion of their firm.

- A statement providing information regarding the assets and liabilities of the firm, duly certified by a practising Chartered Accountant.

- Audited copy of the latest Income Tax Return filed by the firm.

- A statement containing the list of all the secured creditors along with their consent.

- Any other supporting document as may be required.

- The Lease deed or Ownership Documents of the property, where the registered office of the Firm is located.

- Dule authorized NOC from the owner of the premises, where such premise is taken on lease, along with the utility bills of not older than 2 months.

- Copy of the NOC received from the regulatory authority governing the firm.

- Details of the LLP along with their objects, partner

- Documents evidencing the identity of the partners like – their Voter ID, Aadhaar card, PAN card etc.

Differences Between LLP and Partnership Firm

PARTICULARS |

LIMITED LIABILITY PARTNERSHIP |

PARTNERSHIP FIRM |

|

GOVERNING ACT |

LIMITED LIABILITY PARTNERSHIP ACT, 2008 |

INDIAN PARTNERSHIP ACT, 1932 |

|

REGISTERING AUTHORITY |

REGISTRTAION IS GRANTED BY THE MINISTRY OF CORPORATE AFFAIRS |

REGISTRATION IS GRANTED BY THE REGISTRAR OF FIRMS. |

|

LIABILITY OF PARTNERS |

LIABILITY OF THE PARTNERS IS LIMITED TO THE EXTENT OF THEIR CAPITAL CONTRIBUTION IN THE LLP. |

LIABILITY OF THE PARTNERS IN UNLIMITED, AND CAN BE EXTENDED TO THEIR PERSONAL ASSTES AS WELL. |

|

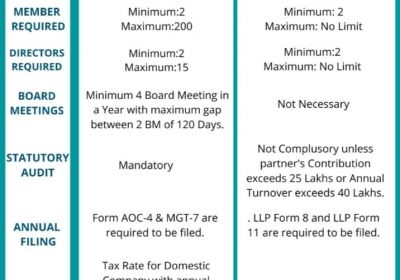

NUMBER OF MEMBERS |

|

|

|

AGREEMENT BETWEEN PARTNERS |

LLP AGREEMENT IS COMPULSARY TO BE REGISTERED AND THE SAME SHALL GOVERN THE DAY-TO-DAY OPERATIONS AND MANAGEMENT OF THE LLP. |

PARTNERSHIP DEED IS NOT MANDATORY TO BE REGISTERED. |

|

TRANSFERABILITY OF SHARES |

SHARES CAN TRANSFERRED, AFTER OBTAINING THE CONSENT FROM ALL THE PARTNERS IN AN LLP. THE SAID PROCESS IS VERY EASY AND LESS TIME CONSUMING. |

SHARES CAN BE TRANSFERRED AFTER THE CONSENT FROM ALL THE PARTNERS IN A PARTNERSHIP. HOWEVER, THE PROCESS IS VERY LENGHTY AND CUMBERSOME. |

|

COMPLIANCE REQUIREMENT |

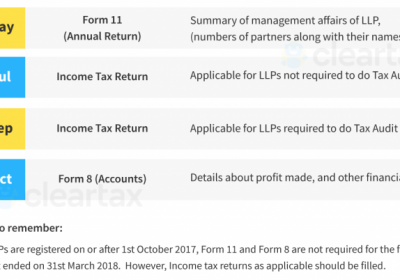

LLP IS REQUIRED TO MANDATORILY FILE THEIR ANNUAL RETURN WITH THE MINISTRY OF CORPORATE AFFAIRS. |

THERE IS NO SUCH REQUIREMENT AS TO FILING OF ANNUAL RETURN. |

|

COST OF REGISTRATION |

LLP REGISTRATION COST AROUND RS 8000. |

PARTNERSHIP REGISTRATION COSTS AROUND RS 2200. |

|

CONVERSION |

LLP CANNOT BE CONVERTED BACK TO PARTNERSHIP BUT THE SAME CAN CINVERT INTO A PRIVATE LIMITED OR PUBLIC LIMITED COMPANY EASILY |

PARTNERSHIP FIRMS CAN CONVERT INTO An LLP OR PRIVATE LIMITED COMPANY; HOWEVER, THE PROCESS IS QUITE LENGHTY AND COSTLY. |

FAQ’s on Conversion Of Partnership Firm to LLP

Q.: What is the main prerequisite for conversion of a firm?

It is provided, that for the conversion of a firm, there is a prerequisite to obtain the consent of all the partners of the firm, regarding the conversion of their firm.

Q.: What is the provision regarding the number of partners to be available in the converted LLP?

It is provided that at the time of conversion, the partners there in the firm, shall become the partners of the LLP, and not new partner be admitted, or an existing partner leave, at the time of conversion.

Q.: How many names can be reserved in the RUN application?

In the RUN application, the applicant can apply for reservation of maximum of 6 names of their choice and the names be provided in the order of preference.

Q.: What are the provisions related to the name of an entity?

The following provisions be taken care of while reserving the name of an entity -

-

- The name shall not be disallowed by any rules of intellectual property in India.

- The name shall not be identical or similar to the name of any other existing entity.

- The same shall not be against any public policy.

- The name shall not be disregarded by the Central Government.

Q.: What does capital contribution mean in an LLP?

Capital contribution refers to the amount of capital contributed by each of the partners in the LLP.

Q.: What are the eligibility criteria for becoming a partner of an LLP?

The following person shall be eligible to become a partner in an LLP -

-

- The said person is a major i.e., he has attained the age of 18 years.

- The person be not disqualified under the law.

- The said person shall not be charged with any criminal offence.

- The person be a person of sound mind, and shall not be an insolvent person.

Q.: At what point of time, can the partners of LLP be changed, in case of conversion from firm?

It is provided, that in case of conversion, the LLP can change the number of partners only once the whole process of conversion is completed, and the LLP receives the certificate of registration.