Table of Contents

DIN Allotment Prior to Incorporation of Company

Brief Introduction

- DIN or the Director Identification Number is basically a unique identification number, that is compulsorily be obtained by all the directors. It's similar to an identity proof of a director.

- DIN is allotted by a straightforward procedure, which involves, filling of a specified form and submitting the same along with required documents and fees on the MCA Portal.

- Today during this article we'll discuss that if someone who wishes to be a Director can apply for DIN Application before Incorporation of the corporate or not? So, allow us to see the main points.

What is DIN requirement?

DIN is allotted to someone who wishes to become a director in a particular Company. As per provisions of the companies Act DIN is mandatory for any director. Following are the fundamental provisions regarding DIN as per Companies Act, 2013-

• A director should intimate DIN to all the businesses he's a director in.

• Also, the company in which a director joins, shall intimate the ROC about the DIN of the said director. The failure to submit DIN can result in levy of a penalty of Rs.25000-Rs.1,00,000/-

• No person can take more than one DIN.

• It is mandatory to say DIN in any return, information or particulars that contain relevance a director.

Who are Eligible Persons for DIN application?

- As mentioned above, one and all who wants to become the director of an organization needs to Obtain DIN.

- As per provisions of the Act, any company should inform its first directors together with the incorporation application. With the incorporation application, an organization can apply for a maximum of three directors.

- So, in step with this there are two possible scenarios, when an individual needs DIN –

- If someone wants to become the first Director during a Company.

- When an individual wants to become director in a very Pre-Existing Company.

- In first situation the application of Directorship are going to be before incorporation of the corporate.

- Now, we'll discuss the procedure of obtaining DIN in first case.

Procedure of DIN application

- The one that wishes to become first director of the corporate needs to apply for DIN through SPICe. SPICe stands for Simplified Procedure for Incorporating an organization. It's mandatory for a brand new company to use DIN through this type, i.e. INC-32(SPICe).

- In case of newly incorporated entity, the same shall file the names of the proposed first directors in the Form INC-34 (SPICe). The person must attach following documents together with Application for DIN:-

• Proof of Address

• Proof of Identity

• Photographs

DIN Allotment Approval

- After submission of documents and payment of required fees the applying are going to be verified. Once the applying is verified and approved, DIN are allotted. As per provisions of the Act, application needs to be processed within 1 month.

- In case there's any change required within the particulars on a later stage then, the person must file DIR-6 e-form.

- The proofs supporting the desired change should be submitted. Applicant must provides a certificate from a practising CA/CWA/CS in whole time practice or Director of the corporate.

- Such an application is required to be digitally signed by the applicant, in order to authenticate the same.

Read more about: Summary procedure for winding up of companies

DIN Application before Incorporation of Company

- From the above discussion we will say that one can apply DIN before Incorporation of the corporate.

- However, such instance can happen only if the person is proposed together of the primary directors of the corporate.

- Therefore, we will interpret that law doesn't allow anyone to require DIN and keep it. Because when someone applies DIN, he can copulate only by mentioning the company’s name (either new or existing). Just in case of a new company only 3 names will be given as first directors. So, for 1 company at the most only 3 people can apply for DIN before Incorporation of the corporate.

- Any person who isn't becoming a part of any company (either new or existing) cannot apply for DIN.

Conclusion

- In summary DIN is an identification number is valid on condition that one is related to a corporation. a person can apply for DIN before incorporation of a corporation and become first director of the corporate.

- The procedure to be followed to apply for DIN before incorporation of company is additionally discussed.

- The names of persons being mentioned in the Incorporation application of an company can only apply for DIN allotment as per the procedure discussed above.

- The procedure is entirely online and simple to follow. Out Team at RJA are pleased to help you within the same.

Popular Articles :

- Become an Independent Directors- Roles, Applicability And Duties

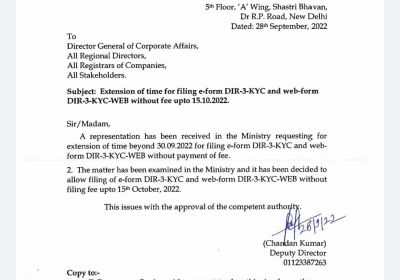

- DON`T LOSE YOUR DIRECTORSHIP -ENSURE YOUR KYC COMPLETED