Table of Contents

Form 15CA & 15CB Submission Process has been redesigned

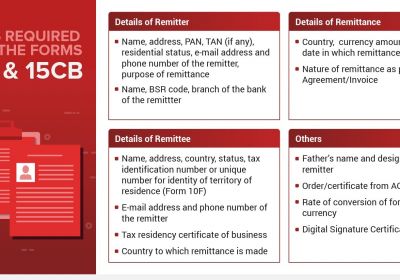

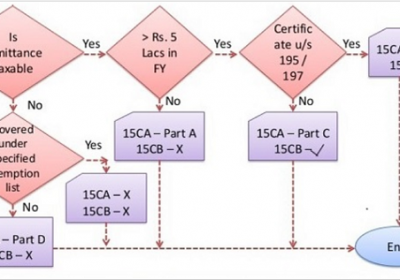

The Income-tax Dept has introduced an entirely new re-engineered Form 15CA and Form 15CB submission process based on past year's feedback from numerous corporates and professionals across India. These alterations will optimise & simplify the Form's preparation, assignment, submission, and verification processes throughout its entire filing cycle.

The significant important transformations are as follows:

- Now the Taxpayers are no longer required to assign the same CA for multiple 15CA/CB submissions during the financial year. The appointment of a CA for Form 15CB is a one-time event for a specific Financial Year.

- A CA can initiate Form 15CB for a specific Remittee & Remitter without requiring the taxpayer to complete Part-C of Form 15CA and assign it to the CA for the entire year but after completing Single Assignment for the financial year. The previous practise of various acceptance/rejection for each form has been eliminated to make the overall procedure more simplify.

- Instead of using work list For Your Action, the CA can now access the File Income Tax Forms feature to file Form 15CB.

- Since October 4th, the Offline/Bulk Mode of the submission process has been activated. The Java-based Offline Utility allows the user to create XML files. The Offline Services can be available under the "Download" part of the "Income-tax Forms" page of the portal, and can be uploaded to the site for further filings. For now, the new Online Procedure is disabled for updation as per the new process and will be enabled shortly.

Forms at the Drafts / Work lists phases that haven't been accepted or Pending acceptance or not filed by the 3rd of October and couldn't able to filed under the previous process can't be filed now. For theses, we are suggesting you fill them out using the offline utility according to the revised process and re-upload them. Kindly be aware that the functionality of Offline Utility is not to be used to upload forms that have been manually submitted under Department Circular.

The detailed process flow and the required documents are available on the e-filing portal under "News & Updates" (Click "View all" under News & Updates).

Complete Guidance on uploading of Manually submitted Form 15CB & Form 15CA

Popular blog:-

- Basic Provision of Form 15CB & 15CA

- Complete Understanding about Form 15CA, Form 15CB

- New Form 15CA & 15CB Submission Process redesigned

- Certificate Form 15CA CB for making payments abroad

- Form 15cb To Be Issued For Payment To NRI

- How to file e-form 15ca & 15cb-process

- New rules for form 15ca/cb under rule 37bb

- Form-15cb-to-be-issued-for-payment-to-non-resident-for-using-immovable-property-situated-in-india