Prime Minister Employment Generation Programme (PMEGP)-Eligibility, Features

PMEGP scheme was founded in 2008 by merging two schemes that were in operation till 31.03.2008 namely Prime Minister’s Rojgar Yojana (PMRY) and Rural Employment Generation Programme (REGP) for generation of employment opportunities through establishment of micro enterprises in rural as well as urban areas.

PMEGP is a central sector scheme administered by the Ministry of Micro, Small and Medium Enterprises (MoMSME).

SUBSIDY RATES

|

Category |

Urban area |

Rural area |

|

General |

15% |

25% |

|

Special (SC/ST/OBC Minority, Ex-service men, physical handicap, NER ,hill and border area, women) |

25% |

35% |

|

Population |

above 20000 |

20000 |

BANK LOAN AND BENEFICIARY CONTRIBUTION OF PROJECT COST

|

CATEGORY |

BANK LOAN |

CONTRIBUTION |

|

General |

90% |

10% |

|

Special (SC/ST/OBC Minority, Ex-servicemen, physical handicap, NER ,hill and border area, women) |

95% |

5% |

|

|

|

|

CONDITION OF QUALIFICATION

|

|

SERVICE |

MANUFACTURING |

|

VIII PASS |

ABOVE 5 LAKH |

ABOVE 10 LAKH |

|

BELOW VIII |

BELOW 5 LAKH |

BELOW 10 LAKH |

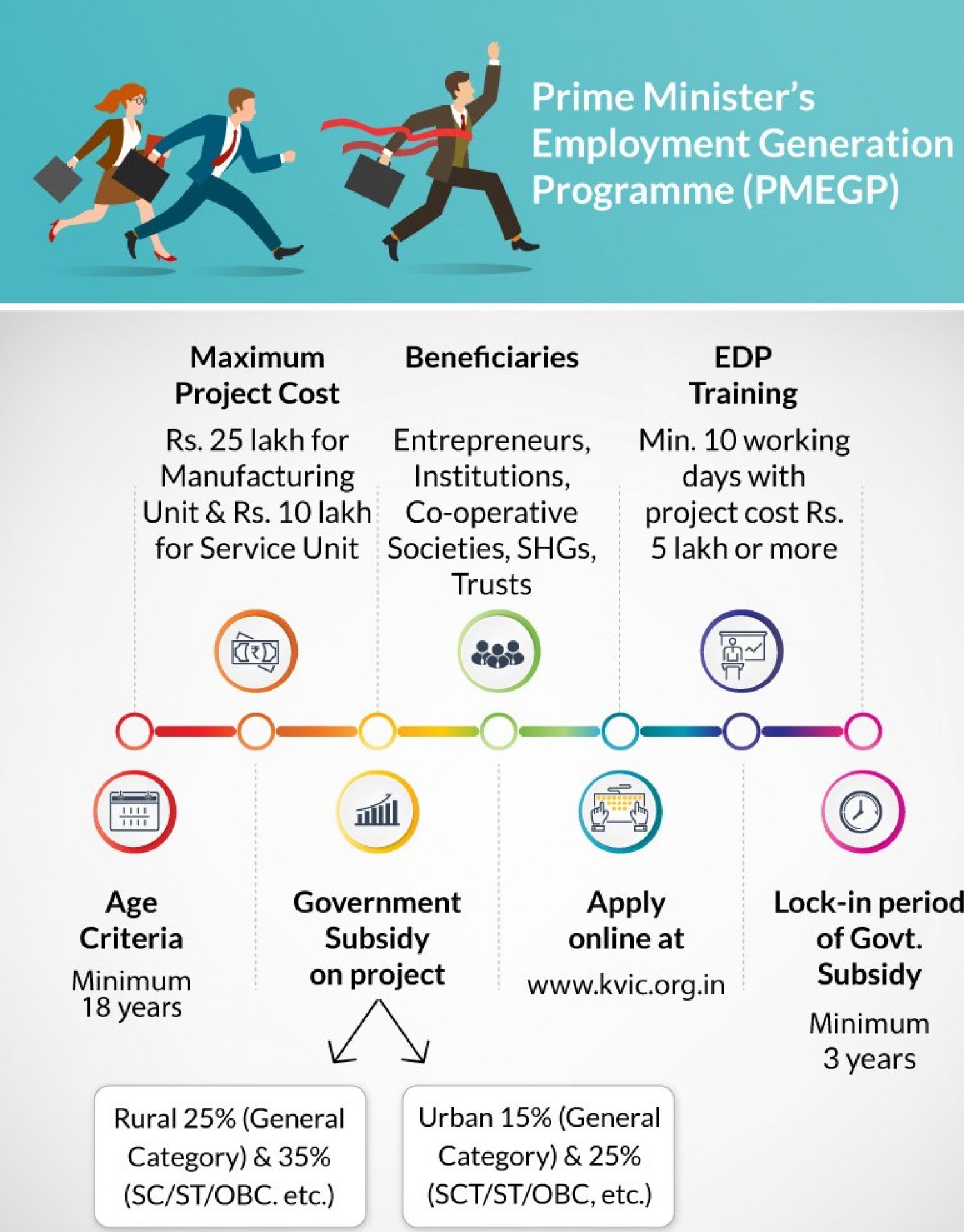

Other details: age 18 year unit

Unit: only for new unit setting

TYPE OF ACTIVITIES COVERED BY THE SCHEME AND MAXIMUM PROJECT COST

|

service sector activities |

PROJECT COST UP TO 10 LAKHS |

|

manufacturing activities |

PROJECT COST UP TO 25 LAKH |

SAMPLE PROJECT COST OF 10 LAKH UNIT SERVICE SECTOR UNIT

|

BUILDING/SHED |

RENTED |

|

EQUIPMENTS |

5,00,000.00 |

|

WORKING CAPITAL |

5,00,000.00 |

|

TOTAL |

10,00,000.00 |

SAMPLE PROJECT COST OF 25 LAKH UNIT MANUFACTURING UNIT

|

LAND |

OWN |

|

BUILDING/SHED |

5,00,000.00 |

|

MACHINERY |

10,00,000.00 |

|

WORKING CAPITAL |

10,00,000.00 |

|

TOTAL |

25,00,000.00 |

EXAMPLE OF MANUFACTURING ACTIVITIES

- Concrete block and tile making

- Candle making

- Paper cup/plate making

- Steel/wooden furniture making

- Food processing units

- Garment manufacturing

- Soap/detergent making

- All other manufacturing projects

EXAMPLE OF SERVICE SECTOR ACTIVITIES

- Beauty Parlour /hair saloon

- Computer repair Centre

- Tent service

- Road side Dhaba

- Shuttering unit

- Mobile repair shop

- Auto workshop

- All other services

AGENCY FOR IMPLEMENTATION

|

KVIB |

KHADI AND VILLAGE INDUSTRY BOARD OFFICES AT EACH DISTRICT AND H.Q. AT EACH STATE |

|

KVIC |

KHADI AND VILLAGE INDUSTRY COMMISSION. H.O. AT MUMBAI AND STATE OFFICE AT EVERY STATE |

|

DIC |

DISTRICT INDUSTRIAL CENTRE OFFICES AT EACH DISTRICT AND H.Q. AT EACH STATE.

|

HOW TO APPLY ONLINE

|

LOGIN TO WEBSITE |

KVICONLINE.GOV.IN GO TO PMEGP |

|

FILL APPLICATION FORM |

BASIC INFORMATIONS - ADHAAR NUMBER - AGENCY SELECTION - PHONE NO. - UNIT ADDRESS - BANK NAME WITH IFSC CODE - PROJECT COST ETC. |

DOCUMENTS TO BE UPLOADED

- Project profile/project report

- Population certificate

- Adhaar card

- Special category certificate

- Photo

- Qualification certificate

TRAINING FOR EDP

EDP training steps

- Download UDYAMI app in your phone

- Click on PMEGP loan beneficiaries

- Enter your register phone number

- Enter OTP

- Click on start the training

- There are total xi mudules of minimum 60 hours

- After completion update profile

- Generate EDP certificate

UNIT'S PHYSICAL INSPECTION

- Inspection will be held after three years

- 100% units will be covered

- Private agency based at Mumbai engaged by KVIC for inspection

- Unit should be in working for subsidy adjustment against the loan

PRECAUTIONS AFTER SANCTION

- Ensure that the bank file a claim for subsidy immediately after loan disbursement.

- Verify that the bank is not charging interest on the loan in equity with the subsidy amount.

- Ensure that the bank file a claim for subsidy adjustment on the completion of three years of sanction.

ADDITIONAL IMPORTANT POINTS

- 60 point condition to qualify

- 3 year rent can be included in project cost

- Land cost is not included in project cost

- On expansion up to 1 cr 15% subsidy available

- Negative list industry not eligible

|

Scheme for providing financial assistance to set up new enterprises under PMEGP |

|||

|

Name of Scheme |

Prime Minister’s Employment Generation Programme (PMEGP)

|

Credit Guarantee Trust Fund for Micro & Small Enterprises (CGT SME)

|

Interest Subsidy Eligibility Certificate (ISEC)

|

|

Scheme Description |

The scheme has been implemented by the Khadi and Village Industries Commission (KVIC), which serves as the national nodal body. State KVIC Directorates, State Khadi and Village Industries Boards (KVIBs), District Industries Centres (DICs), and banks operate the scheme at the state level. In such circumstances, KVIC channels government subsidies through selected banks, with the funds eventually being disbursed directly to the recipients / entrepreneurs' bank accounts. |

In order to implement the Credit Guarantee Scheme for Micro and Small Enterprises, the Ministry of Micro, Small and Medium Enterprises and the Small Industries Development Bank of India (SIDBI) collaborated to form the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). The Government of India and SIDBI both contribute to the CGTMSE corpus. The Trust Fund guarantees 75 percent of the loan amount to the bank. |

The Interest Subsidy Eligibility Certificate (ISEC) Scheme is a crucial tool for khadi institutes to financing their programmes. It was developed to help fill the gap between actual financial requirements and the availability of cash from budgetary sources by providing financing from banking institutions. |

|

Scheme Guidelines |

Details about the scheme Download - PMEGP |

Details about the scheme Download - CGT SME |

Details about the scheme Download - ISEC |

|

Whom to contact |

State Director, KVIC

|

1) CEO, CGT SME |

Dy. CEO, KVIC |