Table of Contents

FREQUENTLY ASKED QUESTION ON INCOME TAX RETURN:

Q.: What Are the Benefits of Filing Income Taxes?

In recent years, the Government of India has taken restrictive action in enforcing the Income Tax Law by linking various benefits for prompt tax filers, which has resulted in low Income Tax filing Compliance in India over the past decades. The benefits of filing taxes include, but are not limited to, the following.

- Make it easier to obtain loans.

- Avoid paying penalties and embarrassment.

- Receive a refund for any excess tax payments.

- Foreign VISA Stamping is no longer a problem with the filing of IT returns.

- Increase your creditworthiness in preparation for future loans.

- Be a good citizen to help India grow while also providing peace of mind for you and your family.

Q.: What are the drawbacks of not filing an income tax return?

It's the law, but it wasn't fully enforced in India until recently. On November 8th, 2016, the Government of India took serious steps to increase tax filing compliance to new heights.

The disadvantages on failing to file your tax return on time are as follows.

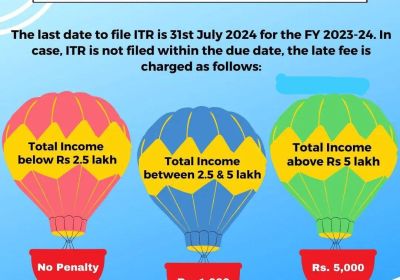

- Starting with the 2018-2019 assessment year, those who fail to file their income tax returns (ITR) on time will face a $10,000 fine (AY).

- A fine of $5,000 will be imposed on those who submit their returns after the due date.

- Small taxpayers with a total income of less than Rs. 5 lakh face a penalty of Rs. 1,000.

- 1,000 for failing to file their ITRs on time.

- Failure to file on time may result in a slew of other penalties and restrictions.

- Penalties imposed under Section 271F

- Interest on unpaid taxes under Section 234A.

- It is not possible to revise a late return.

- Tax refund from the IT Department with no interest.

- Restriction on the use of losses as a credit against future earnings.

Q.: What are the required documents to file my income tax return?

While it varies on your income sources, for the most part, it's as simple as filling out your Form-16. To optimism deduction and accuracy, see the list below!

- A copy of the previous year's tax return > in order to declare any losses and other information.

- Bank statements > to refer to the interest paid on your loans, balances, and so on.

- Your TDS certificates > must include taxes already paid to the IT Department.

- Your Deductions / Savings Certificates / Donations > to include deductions

- Disability certificates in your family > to include deductions

- An interest statement indicating the amount of interest paid to you, possibly from a bank or the post office.

- Have balance sheets, profit and loss account statements, and other required audit reports if you have a business income/loss.

Q.: What am I overlooking However, my employer wants to file on my behalf for a small fee.?

- Employers provide salary and other tax data to tax filers so that they can file in bulk. Because of the way they do business, they frequently fail to engage with you in properly understanding your tax profile, resulting in the loss of deductions and exemptions.

- Furthermore, mismatches between Form 26AS and your tax deductions (both salary and other sources of income) result in IT notices. IT notice resolution could cost you a lot of money, and you could wind up paying too much tax since you didn't examine all of your deductions.

Q.: Do you have a Tax Consultant near me?

- RJA has a pan-India presence with recognized accounting/Taxation firms to facilitate local reach via cutting-edge technologies.

- Yes, we are a Local Tax Consultant in your area.

- We have CA Partners all over the country.

Q.: What if I am an NRI in the United States?

We can assist you whether you are an Indian resident working in a foreign country or a Non-Resident Indian working in India or a foreign country such as the United States.

Q.: TDS is deducted by my company. Is it still required for me to file my tax return? What is the best way for me to pay my taxes to the government?

Yes, you must file. There's a distinction to be made between submitting a tax return and deducting TDS. You file a tax return to show that you've paid all of your taxes. The IT return will also assist you in obtaining a visa or obtaining a loan.

Q.: How can I make a tax payment to the government?

On the official website of the IT Department, you can make a direct contribution to the government. Net banking and Challan 280 are also acceptable methods of payment.

Q.: Can I file income tax returns for years that I didn't file?

Yes. You can file IT returns for all of the years that have already passed.

Q.: Is it essential to enclose any papers with the income tax return?

- Return forms on income tax (ITR) are known as less form attachments. It implies that taxpayers are not required to submit any supporting documentation (such as TGS certificates, investment proofs etc.). Whether you file your return electronically or manually, you do not need to attach these documents.

- However, you must keep these documents in the correct order with you at all times. In certain cases, such as an investigation, evaluation, or audit, you may be required to submit these to the authorities.

Q.: How will I be repaid if I have paid too much tax?

- When you file your IT Return, you can request a refund for any excess taxes you owe. Your refund will be credited to the bank account you specify via ECS transfer.

- Please double-check that your bank details (IFSC code, account number, etc.) on the ITR form are correct.

Q.: Is it necessary to file an income tax return if I have no taxable income?

- Even if you do not have any positive income, you must file a return on time. If you have a loss in any fiscal year, you may want to carry it forward to offset the positive income in subsequent years.

- This will be permitted only if you file your IT return on time and include a description of the loss.

What makes RJA unique from other ?

- RJA is India's most advanced online tax system for filling ITR & they used to file original, belated, revised AY 2021-22 filing in presence of Pan India.

- To create a true self-serve tax filing experience, we worked with the most important CA organizations in India.

- Our pricing approach is transparent and Self-Service Income Tax Filings; we charge a minimal cost for Expert Assisted Plans; we do not modify the price based on your income levels, and we guarantee you the best and lowest pricing. RJA is the only income tax filing system that includes an Audit Checker to help reduce IT notices.

Q.: What are the various ITR Deductions that are available?

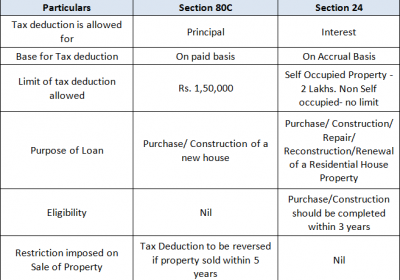

- Deduction under Section 80C

The amount paid or deposited in PF, PPF, LIC premiums paid, NSC (National Savings Certificate), ULIP, principal repayment of a home loan, education fees, term deposit in the bank, Senior Citizen savings scheme deposit, and so on.

- Deduction under Section 80D

Individuals and HUF can claim it for medical insurance and preventive health checkups.

- Deduction under Section 80E

Individuals may be eligible for an 80E deduction for the repayment of interest on a loan secured for higher education.

- Deduction under Section 80EE

This section allows for an additional deduction, such as interest paid on a home loan paid in instalments.

- Deduction under Section 80G

Donations to specific funds or charitable institutions are eligible for the deduction under Section 80G.

Q.: Is it necessary to file an income tax return if my employer deducts 100% TDS?

Deduction of TDS & filing of an income tax return are not the same thing. A tax return is filed to prove that you have paid all of your taxes.

Q.: What is the best way for me to pay my tax debt to the Government?

Taxpayers can pay their taxes immediately on the Income Tax Dept's website via Net-banking & challan 280.

Q.: What exactly is ITR-V?

You will receive an ITR V document after filing your income tax return. You must print it, sign it & send it to the Income Tax Dept. within 120 days of filling of your return.

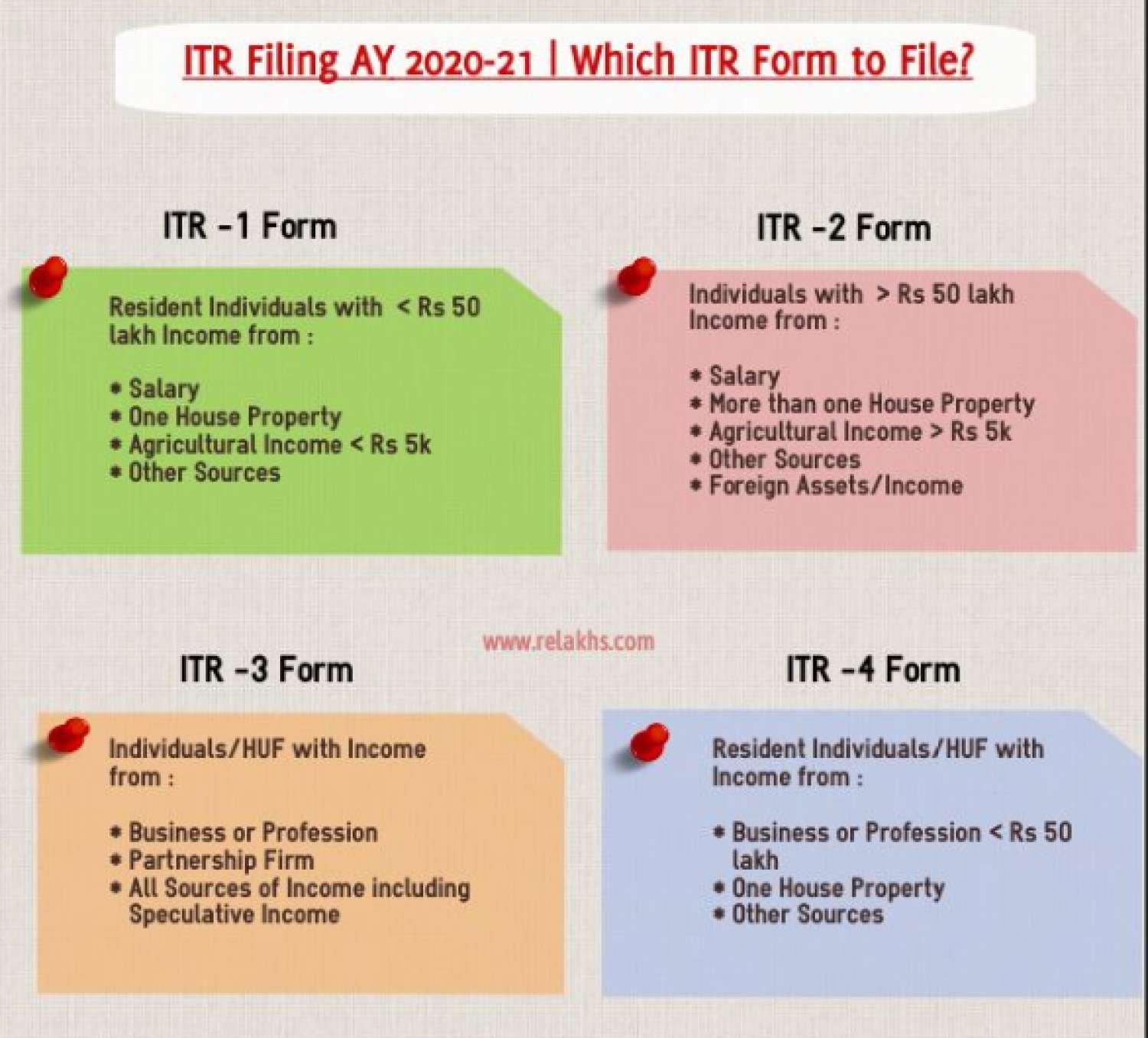

Q.: Is it possible to submit an ITR-1 with agricultural income that is tax exempt?

ITR 1 can be submitted if agricultural income is less than Rs 5000. If the agricultural revenue exceeds Rs 5000, However, an ITR 2 must be required to be filed.

Q.: How do I get a refund on my income tax?

The excess tax paid can be claimed as a income tax refund through the filing of an income tax return. The amount will be refunded to the taxpayer via an ECS transfer in the current situation. It is necessary to double-check & ensure that bank information like as account No & IFSC code is correctly entered on the ITR form.

Q.: Which form do I need to file for file my income tax return?

- We should not be worry that tax payers get confused while filing their income tax returns.

- ITR 1, ITR 2, ITR 2A, ITR 3, ITR 4, ITR 4S, ITR 5, ITR 6 and ITR 7 are the Different forms for filing income tax returns.

- The appropriate respective form required to be chosen based on the taxpayer's eligibility. RJA can assist you if you are filing an income tax return & require assistance.

Q.: How can I file my income tax return if I don't have a Form 16?

You can file your income tax return even if you don't have Form 16 after follow the follow the salary slip & other salary details records.

Q.: Is it necessary to enclose any papers with my income tax return?

No, You do not need to file any extra documents in addition to your income tax return documents, However on the other hand you may be request by authorities for the purposes of investigation or assessment etc.

Q.: Do I have to file an income tax return even if I have no taxable income?

Income tax return must be filed before the due date since it can be carried forward to the following year for adjustment against the profit in later years Even if there is a loss in the FY. Only if you file your income tax return before the deadline can you carry it forward your loss.

Q.: Is it possible for someone to file my income tax return on my behalf?

- You should not share your PAN or password information in order to avoid fraud. For income tax return filing, you can seek the assistance of chartered accountants and CA firms.

- We have a dedicated team of chartered accountants for this purpose.

Why RJA?

- Simply send us your bank statement and cash transaction information, and we'll prepare the financial statements. Your ITR will be filed in two working days.

- We make your interactions with the government as easy as possible by handling all of the paperwork. We will also provide you with complete transparency about the process so that you can set realistic expectations.

- If you have any questions about the process, please contact our team of experienced business advisors. However, we will make every effort to dispel any doubts you may have.

Your complete satisfaction.

- Proper tax return preparation by a CA Expert.

- All pertinent documents pertaining to your filed return.

- Complete assistance with your tax return questions.

- Return of revenue tax submitted on time.

RJA ensures this through services.

- Valid permanent account numbers or tax deduction account numbers are quoted by Assesse.

- Advance tax, self-assessment tax, and tax deducted at source (TDS) specifics are in accordance with taxpayer documents.

- During the transcription and transmission of the return on income, accurate data entries are displayed.

- Assesse receives a hard copy and acknowledgement of submitted e-Returns.

- Throughout the process, assesse information is kept confidential, and any information shared with the public is done with the assesse's or assessing officer's agreement.

Also read Needed to file Income Tax return of Bitcoin profit earned

Rajput Jain & Associates Associate will understand your business requirements and help you in ITR related issues. With the experience we have gained and learn from several years with hundreds of clients who have started their successful business ventures in all parts of India and as well in Foreign Countries