Impact of Delay in Filing Income Tax Returns

The most important obligation for any tax payer is to file their income tax on time, on or before the due date. Whenever income tax returns are submitted late, the taxpayer misses a lot of benefits. Apart from the smaller exemptions, the tax payer will also have to pay a fine. The practise of filing a late tax return should be avoided by taxpayers. The following are the implications of a tax payer's failed to submit a return of income on time:

Central Board of Direct Taxes has framed Income Tax laws governing the taxes to be levied on the taxable income of all persons who are Firms, LLP, Body of individuals, Association of Persons, HUF’s, Individuals, Companies, and any other juridical person. Every individual who qualifies as the resident of India is required to pay tax on the taxable income. Every FY, Tax payers are required to file Tax Returns in adherence to the laid down guidelines & rules.

An ITR is a form used to file information about your income and tax to Tax dept. The tax liability of the taxpayer is calculated based on the income earned. As per the tax laws laid down in India, it is compulsory to file ITR if your income is more than the basic exemption limit. Applicable income tax rate is pre decided for tax payers & any kind of delay in submitted Income tax returns will attract late filing penalty fees.

Due date of filing Income tax returns for AY 2021-22

Central Board of Direct Taxes, Government of India has extended the due date for filing Income tax returns & different kind of audit reports for Assessment Year 2021-22 as below:

|

filling submitting under the Head |

Applicable Revised Due date |

|

Income tax returns filing by tax payers not covered under audit |

31-12-2021 |

|

Income tax returns filing for Tax audit cases |

15-02-2022 |

|

Income tax returns filing for Transfer Pricing |

28-02-2022 |

|

Income tax returns filing of Belated/Revised Return for FY 20-21 |

31-03-2022 |

|

Furnish Audit Report |

15-01-2022 |

|

Furnish Audit Report for Transfer Pricing cases |

31-01-2022 |

What is the Consequences of Delay in filing Income tax return?

Under Section 234F of the Income Tax Act 1961was introduced on 1st April 2017. The provisions of this section become applicable if:

- In case Assessee has not submitted Income tax returns as per the provisions of under Section 139

- In case Assessee has delayed submitted of Income tax returns on or before respective filling due dates

Income tax provision of under section 234F applicable to all kind of persons like AOP, BOI, Individual, HUF, Firms, LLP, Companies, etc in case the Income tax return is filed after given applicable due dates applicable. This section has applicable filling late fee with an a specific objective to male ensure timely filing of Income Tax Returns.

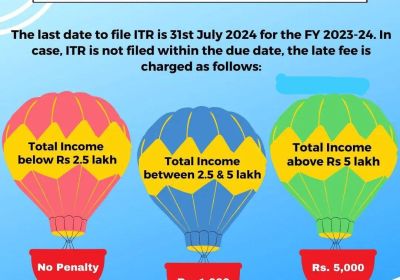

Applicability of Late Fees payable U/s 234F of Income tax Act 1961:

1. In case the total Income of the Assessee is more than Rs. 5,00,000/-

- Rs. 5k – Income tax return filed on or before 31st Dec in AY

- Rs. 10k – Income tax return filed after 31st Dec in AY

2. In case the Total Income of the Assessee is less than Rs. 5,00,000/-

Maximum Amount of Fee payable is Rs. 1k

Besides the late filing fee, Income tax Assessee also faces following consequences due to delayed filing of income tax returns:

- Delayed Refunds ( if applicable)

- Interest on the delay of filing return

- Unable to set off losses

Advantage of timely Submitting of Income tax returns

With timely filing of Income tax returns, the Assesses can avail the following advantages:

- Claim Tax Refund

- Avoid Penalty & Prosecution

- Quick Visa Processing

- Carry forward of losses

- Easy Loan Approvals

Frequently Asked Questions on ITR

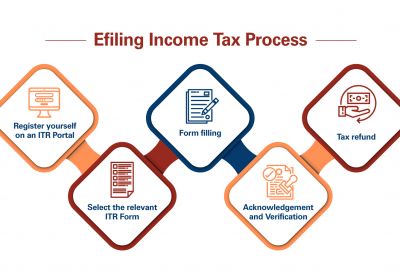

Q1. How to submit your income tax Return

It's never been easier to file your income tax taxes. All you'll need is your Form 16 to get started. To file your return, go to Cleartax and log in - it only takes seven minutes!

Q2.What if we will miss the Income tax timeline?

If a taxpayer fails to file his return by the deadline, he can file a late return. A late return must be filed by the end of the relevant assessment year or before the assessment is completed, whichever comes first. If the assessee fails to file his return on or before the due date for the current assessment year, a belated return can be filed at any time before the 31st of January 2022.

Q3.What is the deadline for filing the Individuals' return for FY 2020-21, i.e. AY 2021-22?

The deadline for filing individual income tax returns has been extended from July 31, 2021 to December 31, 2021.

Q4. Will I be charged interest under section 234A if I file my return in September 2020 for the AY 2020-21?

If the tax liability exceeds Rs.1,000,000, interest will be assessed under section 234F from the original due date, which is July 31, 2020.

Q5. Have you submitted your ITR ?

Have you received the tax refund you requested while filing your ITR for Fiscal Year 2020-21? Was the amount you received less than what you claimed? If you answered yes, don't worry; you're not alone; several individuals have had their tax refunds decreased.

- This is due to an error in the new income tax portal, which has resulted in reduced tax refunds for taxpayers.

- Although the TDS amount is shown in the 26AS statement, many taxpayers do not receive the full amount of refund sought in the ITR. The amount of the refund credited to the client matches exactly what is stated in the prefill data on the income tax department website. The TDS amount stated in the 26AS should ideally be taken into account when the Income Tax Department processes the ITR. We are optimistic that the department will settle this issue soon."

- Apart from TDS/ TCS details, the Budget 2020-21 introduced a new Section 285BB in the I-T Act to revamp Form 26AS to a 'Annual Information Statement,' which would contain comprehensive information of specified financial transactions, tax payment, demand/ refund, and pending/completed proceedings undertaken by a taxpayer in a particular financial year that must be mentioned in income tax returns.

- The Income Tax Department introduced the revised Form 26AS in May of last year, which includes information on high-value financial transactions made during a financial year, enabling voluntary compliance and e-filing of I-T returns.