Table of Contents

COMPARISON BETWEEN BRANCH OFFICE & COMPANY

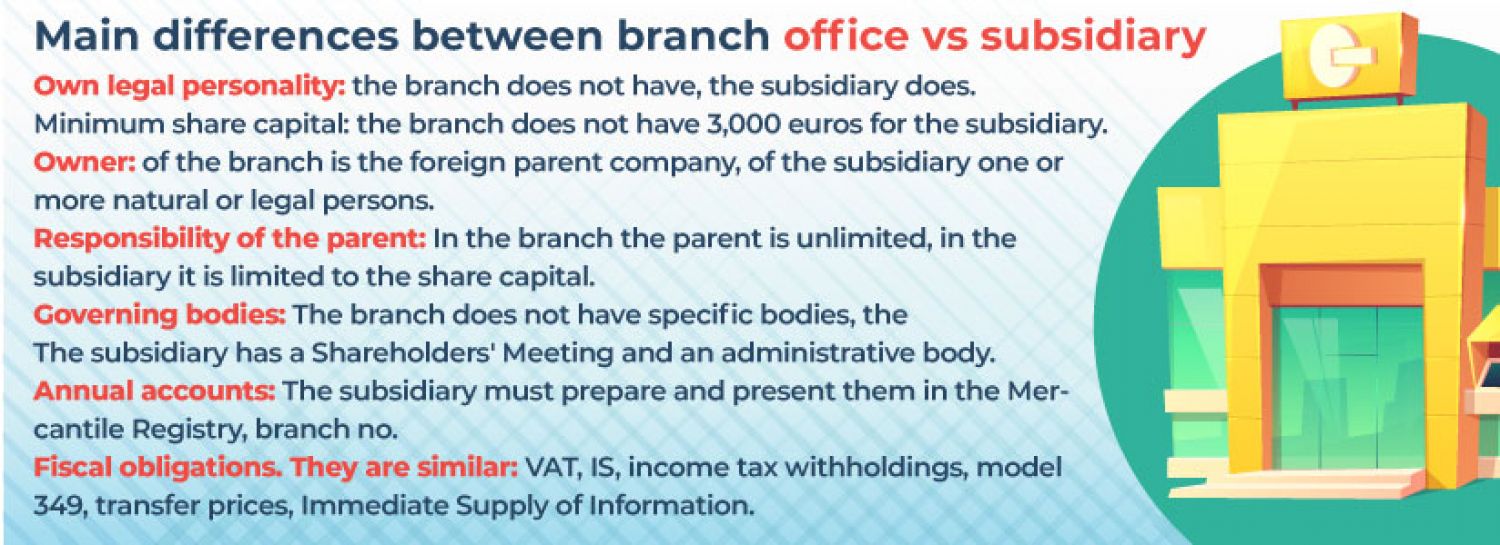

Branch Office: It implies an institution founded by parent company to perform the similar business operations at different locations. one in every of the common strategies of the businesses to expand their business at the national or international level, is to line up branches, at different places. Branches are a component of the parent organization, which are opened to perform the identical business operations as performed by the parent company to extend their reach.

Subsidiary Company: It is known because the company whose fully or partially interest is held by another Company

| POINT OF DIFFERENCE | BRANCH OFFICE | SUBSIDIARY COMPANY |

| APPROVING AUTHORITY | RESERVE BANK OF INDIA AND MINISTRY OF CORPORATE AFFAIRS | MINISTRY OF CORPORATE AFFAIRS |

| REGISTRATION REQUIREMENTS | NET WORTH OF FOREIGN COMPANY MUST BE ABOVE $100000THE FOREIGN HEAD OFFICE SHALL HAVE A PROFITABLE TRACK RECORD OF 5 YEARS |

MINIMUM NO. OF DIRECTORS: 2 IN CASE OF PRIVATE AND 3 IN CASE OF PUBLIC; MINIMUM NO. OF SHAREHOLDERS: 2 IN CASE OF PRIVATE AND 7 IN CASE OF PUBLIC; REGISTERED OFFICE: THE REGISTERED OFFICE SHALL BE SITUATED WITHIN INDIA IN ANY STATE; NAME: THE NAME OF THE SUBSIDIARY COMPANY MAY OR MAY NOT BE SAME AS OF ITS HOLDING COMPANY. |

| REGISTRATION IN INDIA | COMPANIES INCORPORATED OUTSIDE INDIA ENGAGED IN DIFFERENT ACTIVITIES CAN SETUP A BO IN INDIA WITH SPECIFIC APPROVAL OF RESERVE BANK OF INDIA (RBI). |

· A BODY CORPORATE FORMED AND REGISTERED UNDER COMPANIES ACT, 2013. IT IS ADVISED TO BE A PRIVATE LIMITED COMPANY HAVING A CLOSELY HELD SHAREHOLDING. · THE ENTITY SHOULD HAVE A DISTINCT AND LEGAL STATUS APART FROM ITS SHAREHOLDERS. |

| LIABILITIES | LIABILITIES EXTEND TO PARENT ORGANIZATION. | LIABILITIES LIMITED TO SUBSIDIARY COMPANY. |

| REPORTS TO | HEAD OFFICE | HOLDING COMPANY OR SHAREHOLDERS |

| BUSINESS ACTIVITIES | BRANCH CONDUCTS THE SAME BUSINESS AS OF PARENT ORGANIZATION | SUBSIDIARY MAY OR MAY NOT CONDUCT SAME BUSINESS AS PARENT ORGANIZATION |

| SEPARATE LEGAL ENTITY | YES, AS FAR AS MCA FILINGS AND TAXATION ARE CONCERNED. | YES |

| OWNERSHIP | THE PARENT ORGANIZATION HAS 100% OWNERSHIP INTEREST IN THE BRANCH | THE PARENT ORGANIZATION HAS MORE THAN 50% OWNERSHIP INTEREST IN THE SUBSIDIARY |

| WHETHER INVOICING FROM INDIA ALLOWED? | YES | YES |

| RENEWAL OF REGISTRATION REQUIRED? | GENERALLY, NO BUT IN SOME CASES, RBI GIVES APPROVAL FOR 2-3 YEARS. | NO |

| EXCHANGE CONTROL |

· OUTFLOW: REMITTANCE OF PROFITS AFTER PAYMENT OF TAX · INFLOWS: ALLOWED AS TRANSFER FROM HO |

· OUTFLOW: ALLOWED AS DIVIDEND, ROYALTY, SERVICE OR TECHNICAL FEE · INFLOWS: ALLOWED AS EQUITY OR LOANS |

| WHETHER EXPATRIATES ALLOWED TO WORK ON PAYROLLS OF ROLLS OF INDIAN ENTITY? | YES | YES |

| CAN ANY NUMBER OF PROJECTS BE EXECUTED? | YES | YES |

| PRIOR APPROVAL FROM RESERVE BANK OF INDIA | YES | NO |

| PAYMENT OF DIVIDEND TO ITS SHAREHOLDERS | NO | YES |

| SUBMISSION OF ANNUAL CERTIFICATE WITH RBI | YES | NO |

| CONDUCTING BOARD MEETING AND MEMBERS MEETING ON YEARLY BASIS | NO | YES |

| ANNUAL COMPLIANCES WITH ROC AND INCOME TAX | YES | YES |

PROCEDURE

ESTABLISHMENT OF BRANCH BY FOREIGN ENTITIES

A body corporate incorporated outside India (including a firm or other association of individuals), desirous of opening a branch Office (BO) in India must obtain permission from the banking concern depository financial institution, banks, banking concern, banking company under provisions of FEMA 1999. The applications are considered by depository financial institution under two routes:

- Automatic Route: Where principal business of the foreign entity falls under Sectors where 100 per cent Foreign Direct Investment (FDI) is permissible under the automated route.

- Government Route: Where principal business of the foreign entity falls under the Sectors where 100 per cent FDI isn't permissible under the automated route.

Applications from entities falling under this category and people from Non – Government Organizations / Non – Profit Organizations / Government Bodies / Departments are considered by the Federal Reserve Bank, after making consultation with the Ministry of Finance, Government of India.

Also, read the related Blogs:

The following additional criteria are considered by the depository financial institution while sanctioning Branch Offices of foreign entities:

-

Past Performance

- For Branch Office — a profit making log during the immediately preceding five financial years within the home country.

- For Liaison Office — a profit making memoir during the immediately preceding three financial years within the home country.

- Net Worth i.e. [total of paid-up capital and free reserves, less intangible assets as per the most recent Audited record or statement certified by a licensed Public Accountant or any Registered Accounts Practitioner by whatever name].

- For Branch Office — not but USD 100,000 or its equivalent.

- For Liaison Office — not but USD 50,000 or its equivalent.

BRANCH OFFICE IN SPECIAL ECONOMIC ZONES

- Banking concern has given general permission to foreign companies for establishing Branch/unit in Special Economic Zones (SEZs) to undertake manufacturing and repair Activities. the final permission is subject to the subsequent conditions:

-

- The above-mentioned entity should be functioning in the sectors, where 100% FDI is permitted;

- such units accommodate part XI of the businesses Act,1956 (Section 592 to 602);

- such unit’s function on a stand-alone basis.

- In case, the entity goes into winding-up of business and there is a need for making remittance of winding-up proceeds, the branch shall approach an advert Category – I bank with the documents as mentioned under “Closure of Liaison / Branch Office” except the copy of the letter granting approval by the Federal Reserve Bank.

BRANCHES OF FOREIGN BANKS

Foreign banks are not required to obtain approval under FEMA in respect of opening branch office in India. Such banks are, however, required to get necessary approval under the provisions of the Banking Regulation Act, 1949, from Department of Banking Operations & Development, Reserve Bank.

APPLICATION

The application for establishing BO / LO in India should be forwarded by the foreign entity through a delegated AD Category – I bank to the Chief General Manager-in-Charge, bank of India, exchange Department, Foreign Investment Division, business office, Fort, Mumbai-400 001, together with the prescribed documents including.

- Certificate of Incorporation / Registration or Memorandum & Articles of Association attested by Indian Embassy / notary within the Country of Registration and the same shall be English Language.

- Latest Audited record of the applicant entity.

- The Branch / Liaison offices established with the Reserve Bank’s approval are going to be allotted a novel number (UIN)

- The BOs / LOs shall also obtain Permanent Account Number (PAN) from the tax Authorities on putting in the offices in India.

PERMISSIBLE ACTIVITIES OF BRANCH OFFICE

- Companies incorporated outside India and engaged in manufacturing or trading activities are allowed to line up Branch Offices in India with specific approval of the banking concern. Such Branch Offices are permitted to represent the parent / group companies and undertake the subsequent activities in India:

- Export / Import of products.

- Rendering professional or consultancy services.

- concluding research work, in areas during which the parent company is engaged.

- Promoting technical or financial collaborations between Indian companies and parent or overseas group company.

- Representing the parent company in India and acting as buying / marketer in India.

- Rendering services in information technology and development of software in India.

- Rendering technical support to the products supplied by parent/group companies.

- Foreign airline / company.

NON-PERMISSIBLE ACTIVITY

- Retail trading activities of any nature isn't allowed for a Branch Office in India.

- A Branch Office isn't allowed to hold out manufacturing or processing activities in India, directly or indirectly.

- Profits earned by the Branch Offices are freely remittable from India, subject to payment of applicable taxes.

APPLICATION FOR UNDERTAKING ADDITIONAL ACTIVITIES OR ADDITIONAL BRANCH / LIAISON OFFICES

Requests for undertaking activities additionally to what has been permitted initially by the banking company is also submitted through the designated AD Category -I bank to the Chief General Manager-in-Charge, depository financial institution of India, interchange Department, Foreign Investment Division, headquarters, Mumbai, justifying the requirement with comments of the designated AD Category – I bank.

Requests for establishing additional BO / LOs could also be submitted through fresh FNC form (Annex 1), duly signed by the authorized signatory of the foreign entity within the home country to the Federal Reserve Bank of India as explained above. However, the documents mentioned in form FNC needn't be resubmitted, if there aren't any changes to the documents already submitted earlier.

- If the number of Offices exceeds 4 (i.e., one BO / LO in each zone viz; East, West, North and South), the applicant should justify the necessity for added office/s.

- The applicant may identify one in all its Offices in India because the Nodal Office, which can coordinate the activities of all Offices in India.

DOCUMENTS REQUIRED

- Registration Certificate of the Foreign Company along with their Articles of Incorporation

- Documents required for foreigner registration

- Passport

- Photograph

- Documents associated with the corporate

(business plan, information/pamphlets about the corporate, office lease agreement, etc.) - Other documents PRN on a case-by-case basis.