Table of Contents

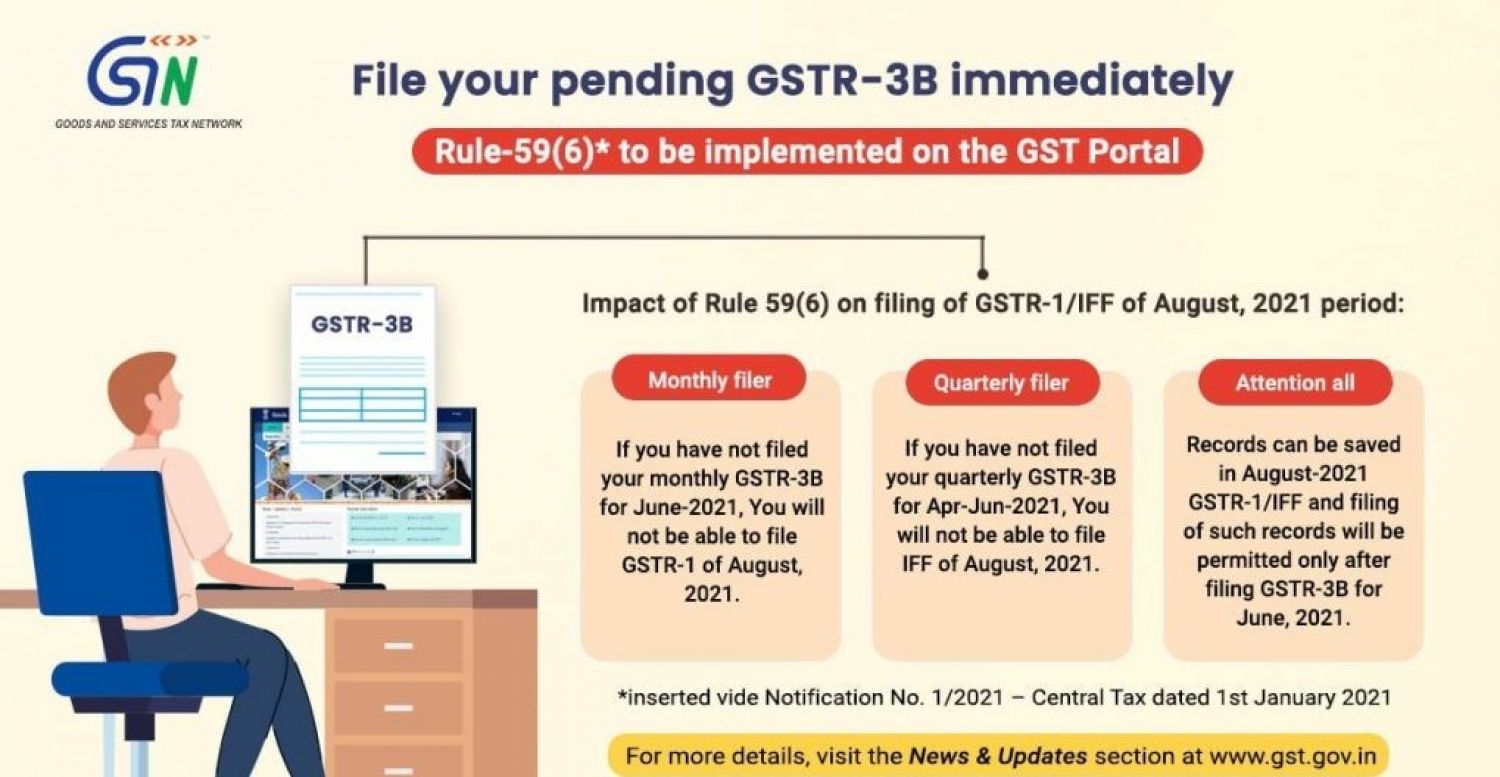

GSTN advises tax payers to register their pending GSTR 3B as early as possible after the implementation of Rule 59(6) on the GST Portal on 1st September.

The Goods and Service Tax Network (GSTN) has issued an advise on the implementation of Rule 59(6) of the CGST Rules, 2017 on the GST Portal. The filing of GSTR-1 is restricted in the following instances under Rule 59(6) of the CGST Rules, 2017:

- If a registered person has not filed a return in FORM GSTR-3B for the previous two months, he will not be able to provide details of outward supplies of goods or services, or both, under section 37 in FORM GSTR-1.

- If a registered person is required to file a quarterly return under the proviso to sub-section (1) of section 39, he is not allowed to file the details of outward supplies of goods or services or both under section 37 in FORM GSTR-1 or use the invoice furnishing facility if he has not filed the previous tax period's return in FORM GSTR-3B.

Non-furnishing of Form GSTR-1 or delayed furnishing of Form GSTR-1 has a significant impact.

- The registered individual will be responsible for late fees, which will be an additional expense.

- If the supplier fails to complete his GSTR-1, his self-assessed tax dues in the liability report in Form GSTR-3B under section 39 will not be auto-populated, potentially resulting in short payments and interest obligations under Section 50 of the CGST Act 2017.

- If GSTR-1 is not filed, the important tax payment details in forms GSTR-2A and GSTR-2B, as applicable, will not be auto-populated for the recipient, and such information will not be appropriately recorded.

- As a result of the above, the recipient of the supply will be unable to claim ITC in his GSTR-3B, as the provisions of Section 36(4) of the CGST Act 2017, which prohibits credit up to 105 percent of matching credit, would interfere and create ambiguity.

This rule will be imposed on the GST Portal. Following the introduction of the aforementioned Rule, the system will check whether the following has been filed or not before filing GSTR-1/IFF for a tax period (From September 1, 2021):

- GSTR-3B for the two most recent monthly tax periods (for monthly filers) or

- GSTR-3B for the most recent quarterly tax period (for quarterly filers), as applicable. The system will prevent GSTR-1/IFF filing until Rule-59(6) is followed.

As a consequence, the GSTN has urged that taxpayers who have not yet completed their pending GSTR-3B, particularly for the period November 2020 and beyond, should do so as soon as possible to avoid any disruption in the filing of GSTR-1/IFF.