Table of Contents

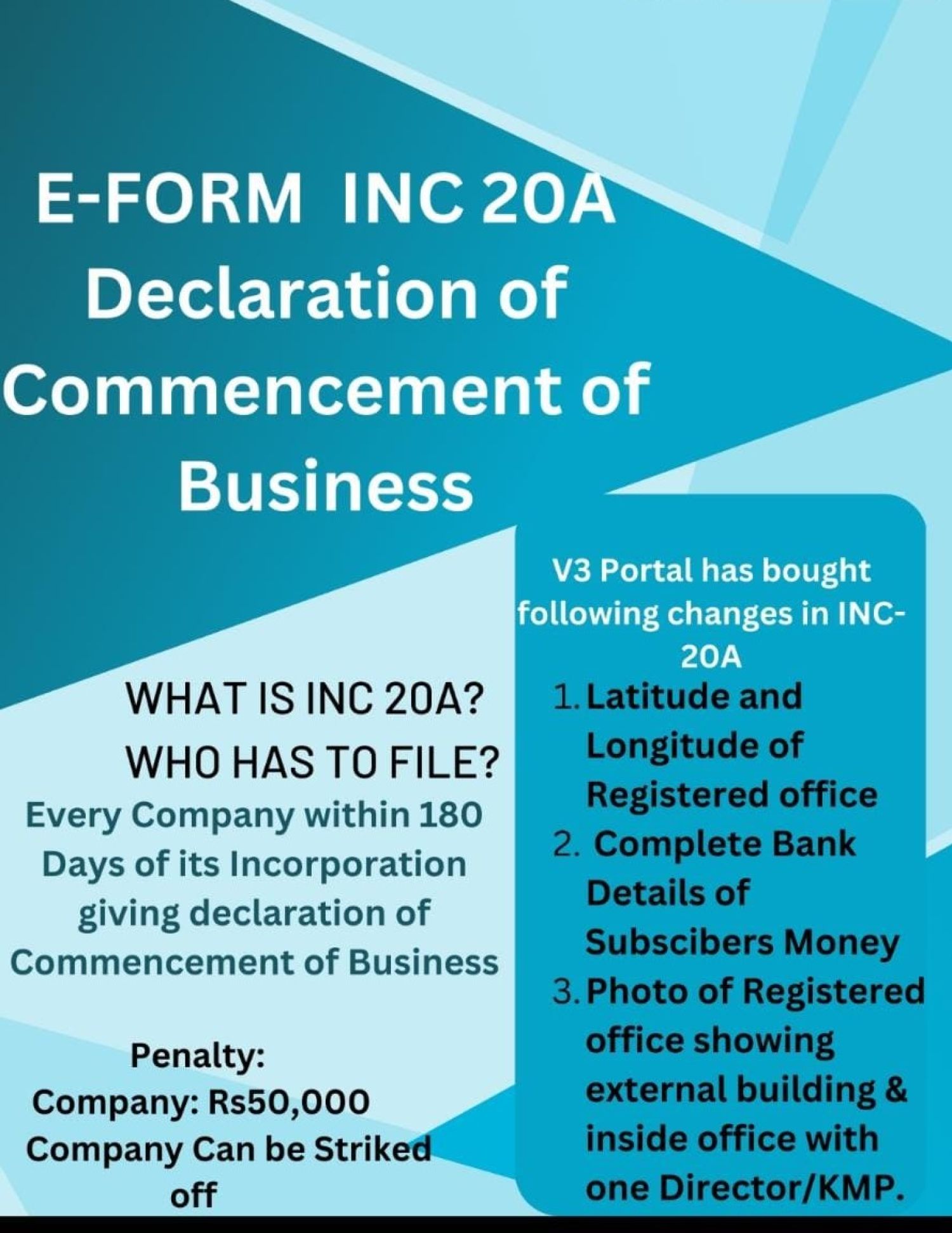

Commencement of Business E-Form INC-20A Filing

Brief Introduction

Form INC-20A is basically a declaration form that's to be filed by the directors of the corporate at the time of commencement of business. The declaration form should be verified by the chartered accountant or cost accountant or company secretary. in line with section 10A of companies act 2013 and Rule 23A of companies (incorporation) Rules, 2014 e-Form INC-20A is required to file for the aim of commencement of business.

The corporate which is incorporated before the commencement of companies (Amendment) Ordinance, 2018 (2nd November 2018) and therefore the businesses incorporated before 2nd November 2018 without share capital needn't file Form 20A. Every company which are required to file Form 20A should file the same with 180 days of incorporation of the corporate.

Prerequisites of E-Form INC-20A

• Directors of the corporate must provide a declaration under section 10A within the type of board resolution.

• A proof of deposit of the paid-up share capital by the subscribers shall also be provided.

• Form 20A must be filed within the 180 days of incorporation of business and an e-form is to be given the concerned Registrar of companies.

• Providing bank statements of the corporate having all credit entries together with the receipts showing subscription money received from all shareholders.

• The form needs to be verified and certified by a chartered accountant, company secretary, or cost accountant before filing it with ROC.

Penalties for Non-Filing of E-Form INC-20A

The penalty of Rs. 50,000/- will be imposed on the corporate in respect of non-filing of the said declaration. Also, each and every officer in default pays a penalty of Rs. 1,000/- for each day of default, up to a maximum of Rs. 1,00,000/-. The corporate name shall even strike off the name of the corporate from the Registrar of Companies if the Registrar has reasonable grounds that the corporate isn't into any business operations even after 180 days of incorporation. the corporate shall not be able to borrow the money and not be able to start a business.

|

Share capital |

Fees (Rs) |

|

Up To 30 days |

2 Times of the normal fees |

|

Above 30 days maximum Up to 60 days |

4 Times of the normal fees |

|

Above 60 days maximum Up to 90 days |

6 Times of the normal fees |

|

Above 90 days maximum Up to 180 days |

10 Times of the normal fees |

|

Above 180 days |

12 Times of the normal fees |

Procedure of Filling of E-Form INC-20A

• Go to the MCA PORTAL

• Click on MCA Services. A dropdown box will appear during which select the option e filing.

• After this, the applicant shall choose the Company forms download

• After this step a window will open and scroll right down to the head “informational services”. There you'll click on Form 20A to download thereupon you'll be able to also download instruction kit also.

• The form is downloaded in a pdf file. After this, open the form and provide the details of Corporate Identification Number of the entity.

After this click on the “Pre-fill” button which can automatically display the name, office address, email id of the corporate

• Next step is to attach the desired documents within the form and fill the declaration by providing DIN.

• After completion of form, the applicant is required to click on Check option, and the system will instantly perform form-level validation.

• After successful validation click on Pre scrutiny.

• Then the form should be digitally signed by the director or authorized person and add DSC of the directors and authorized professional within the form.

• The final step is that again login to MCA Portal under MCA services click on upload e-forms and also the after unloading the document fees payment is completed and SRN is generated.

• The Declaration form is filed.

Filling Fees of E-Form 20A

|

Share capital (Rs.) |

Fees (Rs.) |

|

Less than 1,00,000 |

200 |

|

1,00,000 – up to 4,99,999 |

300 |

|

5,00,000 - up to 24,99,999 |

400 |

|

25,00,000 - up to 99,99,9999 |

500 |

|

1,00,00,000 and above |

600 |

Conclusion - E-form INC-20A

- It is hereby concluded that the E-form INC-20A is must for every entity to be filed in respect of their commencement of business.

- The corporate should file it within 180 days of incorporation as we've got discussed there are huge penalties and other consequences of not filing the said form.

- Avoid penalties of not filing e-form INC-20A.

Popular Articles :