Table of Contents

FAQ's on NGO's Tax benifits & Tax Incentives

Q.: What is the difference between Section 12A and Section 12AA?

Everything you need to know about Sections 12A and 12AA

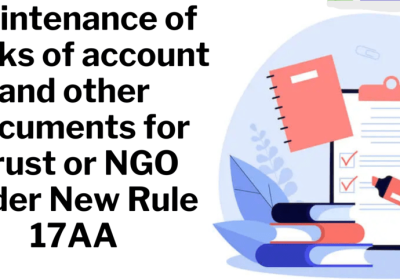

- If certain circumstances are met, a trust, society, or section 8 company can apply for registration under Section 12A of the Income Tax Act to claim an exemption under the Income Tax Act of 1961. Section 12A deals with trust registration, while Section 12AA deals with trust registration through the internet.

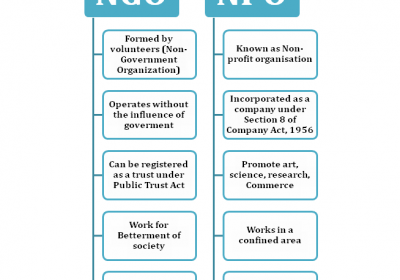

- A Non-Governmental Organization (NGO) is a non-profit organization that is not affiliated with a government or a for-profit corporation. Governments, foundations, enterprises, and private individuals may fund NGOs, which are usually founded by ordinary citizens. Non-governmental organizations (NGOs) are a broad set of organizations that engage in a wide range of activities and assume various forms in different parts of the world. Some may be designated as charitable organizations, while others may be eligible for tax exemption based on the acknowledgment of social goals. Others could be shills for political, religious, or other special interest groups.

Q.: What's the difference between Section 12AA and the recently added Section 12AB?

Section 12 AA |

Section 12AB |

What NGOs are required to do? |

|

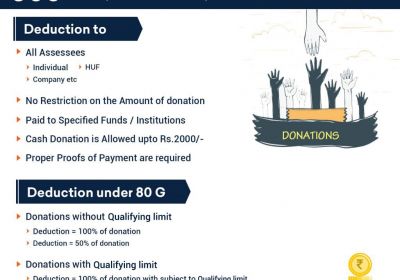

The benefits of section 80G was available to all the NGOs registered under Section 12AA for the exemptions in the donations recieved by the NGOs. These benefits were available on a continuous basis. |

Already registered NGOs u/s 12AA will have to reapply for the same and shall have to obtain new registration u/s 12AB. |

The NGOs are required to reapply before 31st December, 2020 and get new registration u/s 12AA. |

|

Exemptions are valid for Lifetime. |

Already exempted NGOs will have a 5-year validity. While the new registrations will be provided with 3 years provisional registration. |

NGOs shall have to provide evidence to and convince Income Tax authorities of the bonafides of their activities every 5 years (3 years in case of New registrations), in order to retain their tax exemption. |

|

Details required only for overseas contributions/ donations. |

Donor-wise details to be maintained and all donors will have to be given a certificate. |

NGOs will have to maintain Administrative records. |

|

80G benefits available to donors for exempt NGOs on a stable basis. |

80G donations now exposed to uncertainty. |

– |

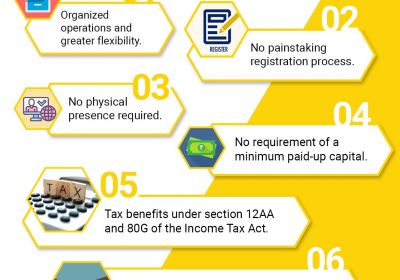

In India, NGO/Charitable Trusts can take advantage of a variety of tax exemption benefits. To be eligible for tax exemptions, a non-profit or charity trust must now register with the income tax under sections 12A, 12AA, and 80G of the Income Tax Act of 1961.

Q.: What is the registration deadline under section 12A/12AA to section 12AB)

|

Sub-clause of clause (ac) of section 12A(1) |

Category of Entity |

Time limit for filing application for registration |

Applicable Form |

Time limit for passing order |

|

(i) |

Trusts or institutions which are having existing registration u/s 12A or 12AA (Migration from section 12A/12AA to section 12AB) |

Within 3 months from 1st April, 2021 i.e. up to 30th June, 2021 |

Form 10A |

Within 3 months from the end of the month in which the application is received |

|

(ii) |

Trusts or institutions which are registered under section 12AB and the period of the said registration is due to expire |

At least 6 months before the expiry of the said period |

Form 10AB |

Within 6 months from the end of the month in which the application was received |

|

(iii) |

New trusts or institutions which have been granted provisional registration under section 12AB (Trusts opting for provisional to final registration for 5 years) |

At least 6 months before the expiry of the provisional registration or within 6 months of commencement of its activities, whichever is earlier |

Form 10AB |

Within 6 months from the end of the month in which the application was received |

|

(iv)

|

Trusts or institutions whose registration has become inoperative due to first proviso to section 11(7) of the Act. Registration u/s 12A or 12AA shall become inoperative from the date on which the trust or institution is granted registration u/s 10(23C) |

At least 6months before the commencement of the assessment year from which the said registration is sought to be made operative

|

Form 10AB |

Within 6 months from the end of the month in which the application was received |

|

(v) |

Trusts or institutions who has adopted or undertaken modifications of the objects which do not conform the conditions of registration |

Within a period of 30 days from the date of adoption or modification |

Form 10AB |

Within 6 months from the end of the month in which the application was received |

|

(vi) |

In any other case (including fresh provisional registration) |

At least 1 month before commencement of the previous year relevant to assessment year from which the said registration is sought |

Form 10A |

Within 1 month from the end of the month in which the application is received |

Q.: What is the registration validity period under section 12AB?

If a trust or institution already has a registration under section 12AA, it must apply for registration under section 12AB online by June 30, 2021, using Form 10A. The registration u/s 12AB will be valid for 5 years. Provisional registration, on the other hand, will be issued for three years.

For this aim, the CBDT issued Notification No. 19/2021 on March 26, 2021, requiring all trusts, societies, and institutions registered under sections 12A and 80G to obtain new registration.

Q.: What is the registration procedure under Section 12AB?

Step 1: Use your login credentials and password to access the Income Tax India E-Filing Portal.

Step-2: Under the E-File menu, go to “Income Tax Forms” and pick Form 10A/ 10AB, if applicable.

Step 3: Fill in the required information in the form using the option "Prepare and Submit online."

Step 4: Join the required documents to Form 10A/10AB.

Step 5: Use digital signatures or EVC to submit the form.

Step-6: Upon receipt of an application in Form No. 10A or 10AB, as applicable, the PCIT or CIT must process the application within the timeframe specified: -

If the applicant is already registered under section 12AA, or if the applicant has applied for provisional registration and filed Form No. 10A, an order granting registration will be issued in writing in Form No. 10AC. On successful registration, a 16-digit alphanumeric Unique Registration Number (URN) will be assigned.

The order granting registration, rejection, or cancellation shall be in Form No. 10AD in cases where Form No. 10AB has been filed.

Q.: Is a digital signature required when submitting Form 10A/10AB?

- Only when the Income Tax Return of the Trust/institution is required to be given with a digital signature, Form No. 10A or 10AB, as the case may be, must be digitally signed.

- In some circumstances, the forms may be submitted with an Electronic Verification Code (EVC)

Q.: Who is responsible for verifying the Form 10A/10AB?

The person who is authorised to check the return of income of a trust or institution u/s 140 of the Income Tax Act must verify Form 10A/10AB.

Q.: What documents are required in addition to Form No. 10A or 10AB?

The list of documents that must be supplied with Form No. 10A/10AB is as follows:

- If the trust/institution is founded or established by an instrument, a self-certified copy of the instrument that created or established the trust/institution is required.

- If the trust/institution is founded or established without the use of an instrument, a self-certified copy of the document demonstrating the trust/creation institution's or establishment.

- A self-certified copy of the company's registration with the Registrar of Companies, the Registrar of Firms or Societies, or the Registrar of Public Trusts, as applicable.

- If the applicant is registered under the FCRA, a self-certified copy of the registration.

- A self-certified copy of an existing registration order issued under section 12A, 12AA, or 12AB, as applicable.

- A self-certified copy of an order rejecting an application for registration under section 12A, 12AA, or 12AB, as applicable;

- Copies of annual accounts for the three years immediately preceding the year in which the application is lodged in the case of existing enterprises.

- For the three years immediately preceding the year in which the said application is made, copies of annual accounts and audit reports u/s 44AB for the three years immediately preceding the year in which the said application is made, where the entity's income includes profits and gains of business as per the provisions of sub-section (4A) of section 11.

- A self-certified copy of the paperwork attesting to the items' adoption or modification

- If the applicant trust or institution is registered on the DARPAN Portal, details of that registration are required.

In addition to the documents listed above, the following documents are required:

- If PAN/Aadhar is available, PAN and Aadhar of all authors, settlors, trustees, members of the Governing Council, members of societies, and shareholders owning at least 5% of the company.

- If you don't have a PAN or Aadhar number, you can: - Voter ID, Passport, or Driver License of the above-mentioned individuals

Q.: Is it possible to revoke a section 12AB approval?

- If the PCIT or CIT notices that Form No. 10A has not been properly completed or that fraudulent or erroneous information or documents have been provided, the PCIT or CIT may cancel the registration in Form No. 10AC.

- However, prior to cancellation, an opportunity to be heard will be provided.

- If a URN is cancelled, it is presumed that it was never authorized or issued.

New Income tax Update :

CBDT Issue notification New ITR-7 Form Applicable for the AY 2023-24