Business Setup in India

Top Reasons for a Foreigner to Start a Business in India

RJA 14 Dec, 2021

Top Reasons for a Foreigner to Start a Business in India India is now regarded as one of the most powerful economic forces in the world. Despite being a developing nation, India's economy has a significant impact on global trade. The majority of the world's main developed countries ...

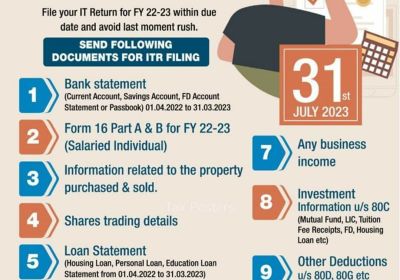

INCOME TAX

How to submit Online Income tax Return

RJA 14 Dec, 2021

How you can file your Income Tax Return without help of Professional/Chartered Accountants. Individuals generally regard filing income taxes as a hardship; yet, due to the lack of accurate data, the advice of a Chartered Accountants or other professional is required. Allow us to inform you that the ...

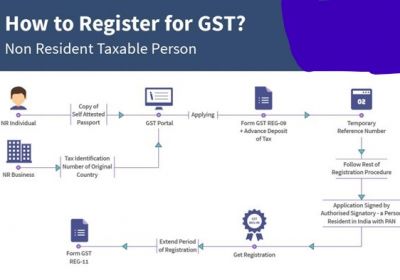

Goods and Services Tax

Provisions for GST Registration for foreigners in India

RJA 13 Dec, 2021

GST Registration For Non-Resident Taxable Individual (NRTP) GST Registration For Foreigners GST is an abbreviation for Goods and Services Tax. The Goods and Services Tax (GST) is an indirect tax that came into effect across India on July 1, 2017. GST has consolidated many indirect taxes into a single law, the ...

INCOME TAX

Frequently Asked Questions related to Tax Audit

RJA 07 Dec, 2021

Frequently Asked Questions related to Tax Audit Q1.: What is the purpose of section 44AB? Ans. According to this provision, taxpayers must perform an audit of their company or profession in order to provide an audit report for taxes purposes. Q2.: Who is in charge of conducting a tax ...

INCOME TAX

Income Tax Treatment on Listing Gains IPO

RJA 07 Dec, 2021

Income Tax Treatment on Listing Gains IPO Many IPOs are priced at a premium, many investors consider recording gains on the first day of trading. This is a good opportunity to achieve significant returns in a short amount of time. Are you aware that there are tax issues that you ...

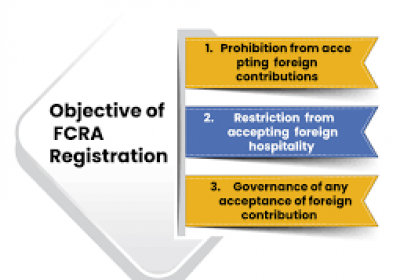

FCRA

FCRA Registration & Compliances for Foreign Contribution Regulations in India

RJA 07 Dec, 2021

FCRA Registration & Compliances for Foreign Contribution Regulations in India The legislation was abolished in 2010 and replaced with the Foreign Contribution (Regulation) Act, 2010 and the Foreign Contribution (Regulation) Rules, 2011, which had two major aims: - To regulate the acceptance and use of foreign contributions or hospitality by specific persons, associations, ...

INCOME TAX

What is Annual information statement?

RJA 07 Dec, 2021

What is Annual information statement? Annual Information Statement is a record of all financial transactions done by you during the FY. AIS is an extensive view of information for a taxpayer available or visible in Form 26AS. AIS is a lot of detailed of financial statement. ...

CFO

How much do I pay for Virtual CFO services in Delhi & NCR?

RJA 07 Dec, 2021

A CFO might be needed: 1. DURING FAST DEVELOPMENT Continuous expansion is a significant predictor of the need for a CFO. Development needs the proliferation of integrated structures, new infrastructure, and funding. The CFO is best positioned to cope with accelerated sales growth due to potentially increased difficulty. They must define ...

Goods and Services Tax

Latest Functionalities made available for GST Taxpayers on GST Portal

RJA 03 Dec, 2021

Latest Functionalities made available for GST Taxpayers on GST Portal GSTN has released module-by-module New functionality for taxpayers on the GST Portal. Numerous different functions for GST stakeholders are added on the GST Portal from time to time. These features apply to a variety of modules, including Registration, Returns, Advance ...

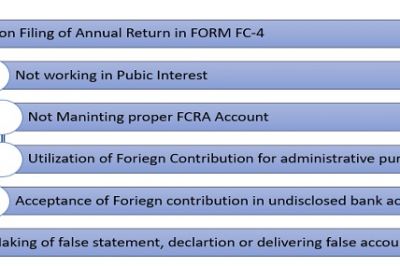

FCRA

About FCRA Registration renewal & Cancellation/Suspension

RJA 30 Nov, 2021

Overview about FCRA Registration renewal FCRA registration certificate's validity has been limited to 5 years under the updated FCRA 2010. It should be remembered that under previous legislation, FCRA registration was virtually permanent until it was revoked. The FCRA 2010 requires organizations to update their registration every five years. Organizations who want ...

Goods and Services Tax

GST issues at the time of Inspection & Search

RJA 30 Nov, 2021

GST issues at the time of inspection: GST officers found various issues at the time of inspection: The GST Registration Certificate number was not displayed at a prominent place inside the office premises. There was a discrepancy between the stock register entry and the actual quantity of stock. The Aadhar ...

Goods and Services Tax

Key reasons for GST Notice from GST Dept.

RJA 29 Nov, 2021

Key reasons for GST Notice from GST Dept With greater GST tax evasion and lower GST revenue, the Indian government has tightened its scrutiny of GST compliance. Notices are frequently sent for a variety of reasons, including tax evasion, non-compliance with rates, late files, missing, incorrect invoices, eWay Bill mismatch, ...

Goods and Services Tax

Govt increases GST on footwear; apparel, effective from January 2022

RJA 23 Nov, 2021

Govt increases GST on footwear; apparel, effective from January 2022 New Delhi, India: The Goods and Services Tax (GST) on finished goods including clothes, textiles, and footwear has been raised by the government. GST rates would rise from 5% to 12% in January 2022, based on the state. the Central Board of Indirect Taxes ...

INCOME TAX

Benefit of Filling of Income tax return if income is less than INR 2,50,000 etc

RJA 21 Nov, 2021

Q1.: Is there any advantage to submitting a income tax return if one's income is less than Rs 2,50,000 / Rs 3,00,000 / Rs 5,00,000? Ans: If Our annual income does not exceed INR 2,50,000/-, Then we do not needed to file a income tax Return. However, as a Tax consultants ...

Business Licence Registration

All About the procedure for Import Export Code

RJA 20 Nov, 2021

Importer-Exporter Code in India It is 10 digit Importer-Exporter Code number allotted by DGFT is a mandatory registration for commercial exporters or importers in India. Apply online and get your Importer-Exporter Coderegistration in less than 3 days Import Export (IE) Code India is a registration with the ...

NRI

Analysis of NRI Fixed Deposits Investing with Tax Implications

RJA 16 Nov, 2021

Analysis of NRI Fixed Deposits Investing with Tax Implications Are you considering about investing in India? Are you worried about the tax implications of being a non-resident alien? The investment prospects in India may be tailored to meet the needs of NRIs, and they can enjoy a hassle-free banking and ...

Limited Liability Partnership

Limited limited Partnership Strike Off (Closure)

RJA 13 Nov, 2021

LLP Strike Off (Closure) E- Form 24 is needed to be filed for striking off the LLP Name under of Rule 37(1)(b) of LLP Rules 2008. Morover, ROC also has power to strike off any defunct Limited limited Partnership after fullfil the requirments himself of the need to strike off &...

Goods and Services Tax

GSTN Issue GST Offline Tools for Download and Prepare GSTR Returns Offline

RJA 12 Nov, 2021

GSTN Issue GST Offline Tools for Download and Prepare GSTR Returns Offline Under GST regime various activities related to GST to be done online like GST registration, GST refunds, GST filing, GST application & lot of other. GST taxpayers must go to the GST site online and fill out the ...

INCOME TAX

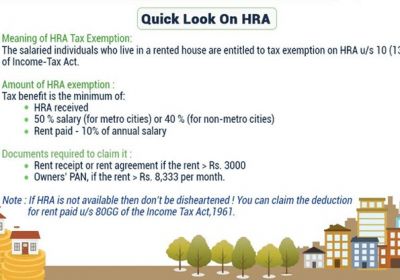

How to claim HRA allowance while Filing Income tax return?

RJA 11 Nov, 2021

How to claim HRA allowance, while Filing Income tax return? HRA is one of the most significant benefits accessible to salaried workers (House Rent Allowance). You can utilise the HRA to partially or totally lower your tax liability if you are a salaried individual who lives in a leased home. ...

TDS

After filing a regular TDS return, we may receive a TDS notice

RJA 11 Nov, 2021

After filing a regular TDS return, we may receive a TDS notice for: Late fee penalty (u/s 234E) Some interest pending amount (u/s 201(1A), 206C(7)) Interest u/s 220(2) Short deduction Or for a variety of other reasons that can be addressed simply by include challan in the ...

OTHERS

What are the Statutory Compliance of Manufacturing Industry?

RJA 07 Nov, 2021

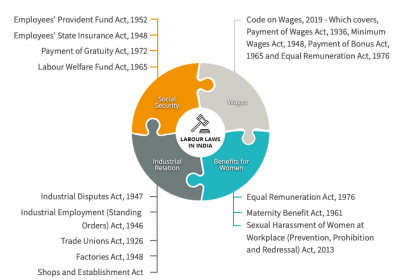

What are the Statutory Compliance of Manufacturing Industry Statutory compliance refers to a company's procedures for adhering to legislation created by the local, state, or federal governments. Manufacturing industries employ a large number of labourers, employees, and workers, who provide a wealth of human resources and potential. As a ...

Goods and Services Tax

Key Analysis of Rate Notifications issued by CBIC

RJA 06 Nov, 2021

Key Analysis of Rate Notifications issued by CBIC 45th GST Council, chaired by the Honorable Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman, will be held in Lucknow on September 17th, 2021. The council's recommendations included some reliefs in view of the COVID pandemic, compensation cess utilisation, GST law ...

Goods and Services Tax

Whether Self-Certification of GSTR-9C really a Good Step?

RJA 06 Nov, 2021

Whether GSTR-9C Self-Certification Really a Good Step? The Finance Act of 2021 implemented amendments to the CGST Act, eliminating the need to provide a CA-certified Reconciliation Statement in GSTR 9C. GST Taxpayers with a revenue / sale receipt more than INR 5 CR in the last FY are needed to submit &...

INCOME TAX

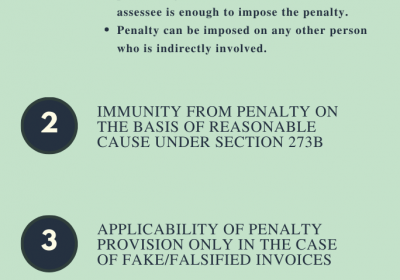

Penalty for false entry or fake invoices -New Section 271AAD

RJA 06 Nov, 2021

Penalty for false entry or fake invoices -New Section 271AAD The Finance Bill 2020 added New section 271AAD under Penalties Imposable - Chapter XXI With effect from 1-04-2020. Section 271AAD "During any proceeding under income tax Act, Without prejudice to any other provisions of income tax Act. &...