Table of Contents

- Fcra Registration & Compliances For Foreign Contribution Regulations In India

- What Is The Meaning Of Foreign Contribution?

- Person Cannot Receive Foreign Contribution In India.

- Fcra Registration

- What Is Eligibility Criteria Under Fcra Registration?

- What Is Eligibility Conditions Under Fcra Prior Permission?

- How To Apply Fcra ?

- What Is Fcra Compliances?

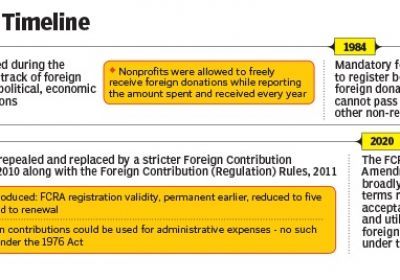

FCRA Registration & Compliances for Foreign Contribution Regulations in India

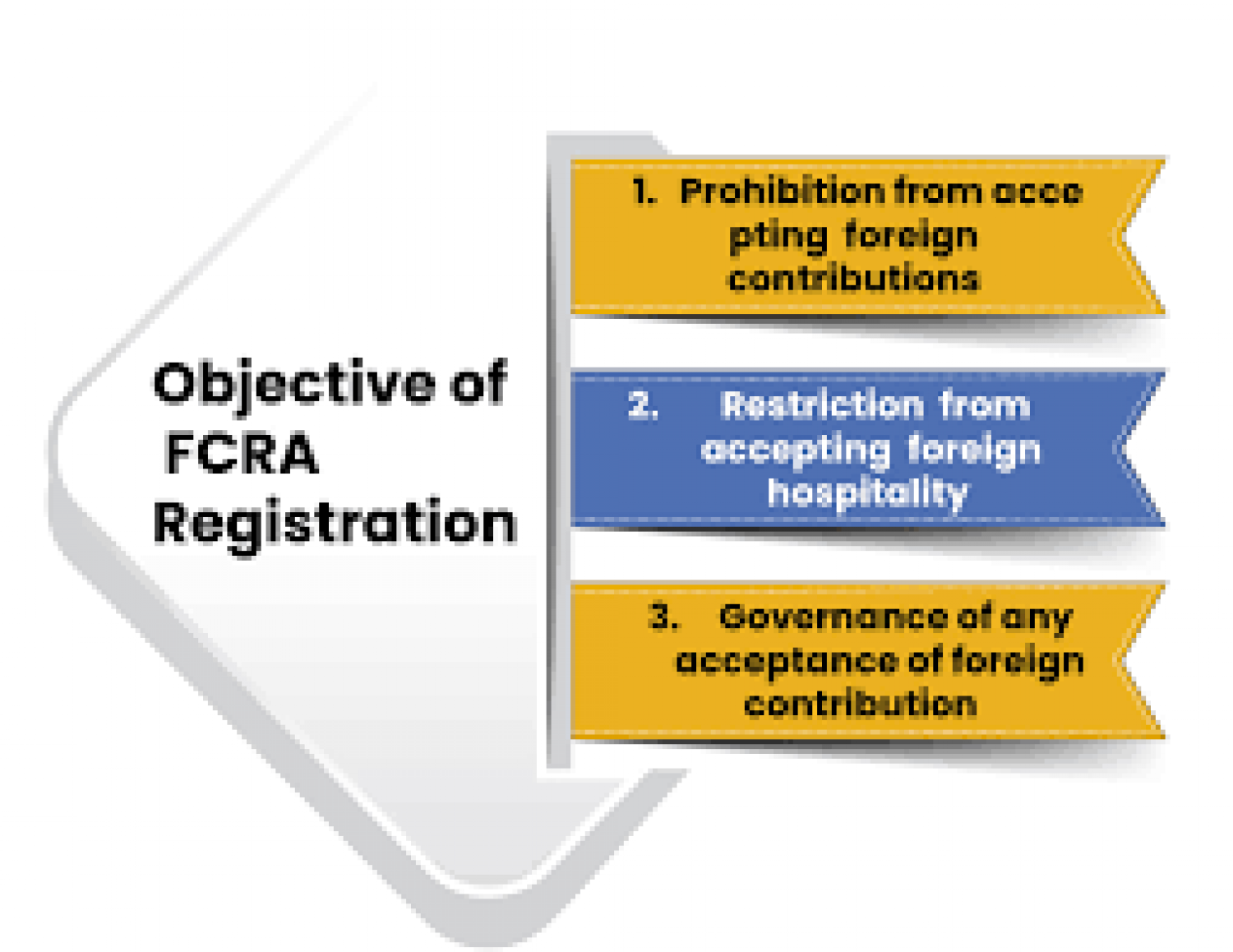

The legislation was abolished in 2010 and replaced with the Foreign Contribution (Regulation) Act, 2010 and the Foreign Contribution (Regulation) Rules, 2011, which had two major aims:

- To regulate the acceptance and use of foreign contributions or hospitality by specific persons, associations, or companies.

- To prohibit such acceptance and use for any activities that are harmful to the national interest.

What is the meaning of foreign contribution?

- A donation, delivery, or transfer of any article, any currency, whether Indian or foreign, any security, or a share of a company made by a foreign government or its agencies, foreign companies or their subsidiaries, MNCs, trusts or societies registered outside India, or foreign citizens to an Indian person is referred to as a foreign contribution.

- However, an article demonstrated as a gift to a person for personal use up to the value of Rs. 1 lakh is not considered a foreign contribution.

- Any interest earned or accrued in India on the aforementioned contribution is likewise considered a foreign contribution.

- Any amount received as a fee, including educational institute fees, or in a business transaction carried out in the ordinary course of business, however, is not subject to the Foreign Contribution Act.

Person cannot receive Foreign contribution in India.

Complete prohibition u/s 3 of FCRA on following mentioned person on receiving Foreign contribution directly or indirectly,

- Judge or Govt servant

- Any media person or media house whether it is a cartoonist, editor, columnist, owner or publisher of newspaper or printer or whether it is NGO or broadcast of any mean of news whatsoever or company engaged in production.

- legislature Member

- election candidate

- any organization of political nature or Political party

No any person can receive Foreign contribution on behalf of political party neither can person who is connected with the political party or transfer such contribution to political party.

FCRA Registration

FCRA Registration are 2 modes of getting the FCRA Registration permission to receive Foreign contribution. 1st is to get the FCRA registration & other one is to get a Prior Permission under FCRA.

What is eligibility criteria under FCRA registration?

- NGO willing to receive Foreign contribution shall be registered under existing statute like Indian Trust Act, 1882 or Societies Registration Act, 1860 or section 25 of Companies Act (now section 8 of Companies Act, 2013) etc.

- NGO shall not be convicted or prosecuted for any offence under any law

- NGO shall be in existence for at least 3 years & shall have spent at least INR 15 lakhs during last 3 years for purpose of economic, social program, educational, definite cultural, religious.

What is eligibility conditions under FCRA prior permission?

- NGO willing to receive Foreign contribution shall be required to be registered under existing statutes like section 25 of Companies Act (now section 8 of Companies Act, 2013) or Indian Trust Act, 1882 or Societies Registration Act, 1860 etc.

- NGO shall submit a commitment letter from donor party which indicating amount of purpose or contribution.

- Non profit originations shall not be prosecuted or convicted for any kind of offence under any other law including FCRA.

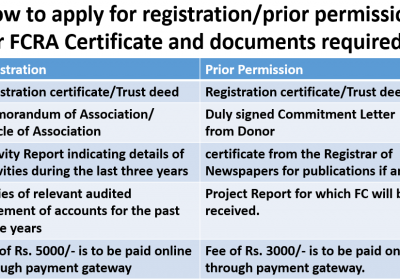

How to apply FCRA ?

- Form FC-3A for registration and Form FC-3B for prior permission shall be submitted online along with a fee of INR 10k in case of registration & INR 5k in case of prior permission

- FCRA Registration is valid for Five Years and it shall be renewed before 6 month of expiry of 5 years’ period in Form FC-3C

- FCRA Bank Account with SBI, Main branch, Aadhar number & a DARPAN Id is Compulsory.

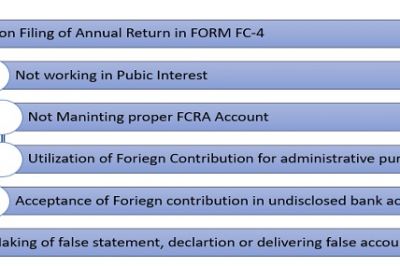

What is FCRA Compliances?

- FCRA Compliances includes Annual return in Form FC-4 along with statement of receipt and payment account & balance sheet duly certified by CA shall be submitted annually online by 31st of Dec every year.

- records & Proper books of account shall be maintained

- Even if there is no utilization or receipt of Foreign contribution, then also required to submission of nil FCRA return is Compulsory for proper compliance under FCRA.

- FCRA Compliance are mandatory in nature & any violation thereof may lead to Imprisonment or penalty or both as per the provisions of the FCRA act. From Bank's Point of View Banks are needed to report 2 kinds of transactions to Govt

-

Below Main Online FCRA Forms are needed to be filed under FCRA 2010

Kind of FCRA Form

Filling Due date

Nature

Purpose

FC-1

(Part-D)

Within 45 days of being nominated

Intimation

If Any Election Candidate has received any Foreign Contribution during 180 days prior to being nominated. There is no minimum amount limit.

(Election candidates are prohibited of taking any Foreign Contribution)

Form FC-1

(Part-B)

31st Dec in the Next year end of the year

Intimation

Providing information about Securities received during the year

FC-1

(Part-B)

31st Dec in next year end of the year

Intimation

Providing information about AOA received during the year

Form FC-1

(Part-A)

Within 30 days of receipt

Intimation

For informing the Govt about receiving large gifts from relatives (Who are Foreign Citizen). This applies to all individuals and HUFs. The cut-off is INR 1,00,000/- in 1 FY.

(Person has to file this intimation for each receipt after crossing INR 1,00,000/- during the FY)

FC-2

14 days in advance

Permission

Persons holding public office should apply in form FC-2 before accepting foreign hospitality. There is no lower cut-off, though a dinner invitation or a lift is exempt.

Form FC- 3

(Part – B)

Not applicable (Normally takes 3 to 6 months to get Prior permission)

Permission

Persons who cannot get FCRA registration should apply for prior-permission.

(Prior permission is linked to specific project of NGOs and for a specified sum of Foreign Contribution. Via Foreign contribution may be received in installments)

FC-3

(Part – A)

Not applicable (Normally takes 4 to 6 months to get registered)

Permission

Persons who want to accept foreign contribution regularly should apply in form FC-3 for registration.

(Normally NGOs having a proven track record of 3 years & have spent INR 10 Lakhs or more for the object of the trust)

Form FC-3

(Part – C)

Ideally 5-6 months before expiry

Permission

The FCRA registration is valid for Five Years only so need to apply for renewal in FC -3 Part C

FC-5

Before transferring such contribution

Permission

Any FCRA registered person who intends to transfer foreign contribution to any unregistered person.

FORM FC-4

(Includes Auditor’s report)

31st Dec Following the end of the year.

Annual Return

Form FC-6 is an annual report on how much foreign contribution has been received and used during the financial year. This includes contribution in money as well as in kind.– To be filed by FCRA registered person or having prior permission persons

FC-6

Within 15 days of change

Intimation

Any FCRA registered person who wants to change Association name or Designated bank account or Utilization Bank Account or more than 50% of Key members.

FCRA Update

- Govt has been decided to extend the validity of Foreign Contribution (Regulation) Act (FCRA) registration certificate up to 31st March, 2022 or till the date of disposal of FCRA renewal application, whichever is earlier.

- FCRA registration is extended till later of 30.9.2022 or till disposal of renewal application where validity extended till 30 June or expiring from Jul-Sep. 2022