Table of Contents

- Llp Strike Off (closure)

- What Are Basic Reasons To Strike Off Of A Limited Liability Partnership ?

- What Are Documents Needed For Strike Off Of Limited Liability Partnership?

- What Are The Basic Conditions For Limited Liability Partnership To Go For Strike Off ?

- What Is The Process For Llp Strike Off ?

- What Is Purpose Roc form 24 ?

- Is The Llp Required To Fill Out An Annual Form Before Filing A Strike-off Application:-

- Llp Act Contains Below Statutory Provisions:

- Is It Essential For The Llp To File The Initial Llp Agreement And Any Amendments To The Llp Agreement (e Form Llp-3) With The Roc Before Filing An Application For Llp Strike Off?

- How We Can Assist With Llp Strike Off?

LLP Strike Off (Closure)

E- Form 24 is needed to be filed for striking off the LLP Name under of Rule 37(1)(b) of LLP Rules 2008. Morover, ROC also has power to strike off any defunct Limited limited Partnership after fullfil the requirments himself of the need to strike off & has reasonable cause.

What are basic reasons to Strike Off of a Limited Liability Partnership ?

Avoid Fines

- If a dormant or non-functioning LLP does not respect the law, the officers of the LLP may face severe fines, penalties, and punishments, including the Directors being barred from creating another LLP in some situations. As a result, it is preferable to officially dissolve an inactive LLP in order to avoid future fines or liabilities.

Faster route of Closure:

- Traditional methods take longer and are more cumbersome procedures, but inactive or non-functioning LLPs can be closed quickly in 3 to 16 days.

No Compliance Burden:

- Because the LLP ceases to exist once it is closed, the promoters or directors are relieved of their compliance responsibilities and the risk of non-compliance.

What are documents needed for strike off of Limited Liability Partnership?

When we going to strike off the Limited Liability Partnership name, an application is needed to be made in e-Form 24 with below documents:

- Authority to Make the Application- Duly signed by all the Partners.

- Acknowledgement of latest Income tax return- Self Explanatory.

- Detailed Application- Mention full details of Limited Liability Partnership plus reasons for closure.

- A statement of account disclosing nil assets & NIL liabilities which is certified by a CA in practice made up to a date not more than 30 days of the date of filing of Form 24.

- Initial Limited Liability Partnership agreement, if entered into and not filed, along with changes thereof.

- Filling An affidavit signed by the designated partners, either jointly or severally

What are the basic conditions for Limited Liability Partnership to go for Strike off ?

- Limited Liability Partnership should have completed all ROC filings till date of making an application for strike off.

- The LLP should be inoperative at least for 1 entire FY.

- Limited Liability Partnership should not have any debt unpaid.

What is the process for LLP strike off ?

Step_1: Limited Liability Partnership shall hold meeting of Partners for approval for striking of a name of the LLP.

Step_2: Limited Liability Partnership shall take Consent of all the partners for such strike off.

Step_3: If Limited Liability Partnership is governed by any other authority than shall take approval from them.

Step_4: After taking approval the Limited Liability Partnership shall file a From of application in LLP form 24 to Registrar of Companies.

Step_5: After receiving an application, Registrar of Companies shall publish a public notice. Any objection to the proposed strike off shall be sent within 30 days.

Step_6: After the necessary period has passed after the notice was published in the notification, the Registrar of Companies will strike off the name and the Limited Liability Partnership will be dissolved.

Note: If a Limited Liability Partnership (LLP) is struck off, all Designated Partners' liability continues and may be enforced as if the LLP had never been dissolved.

What is purpose ROC Form 24 ?

MCA Form 24 is used to file an application with the ROC to have the LLP's name struck off.

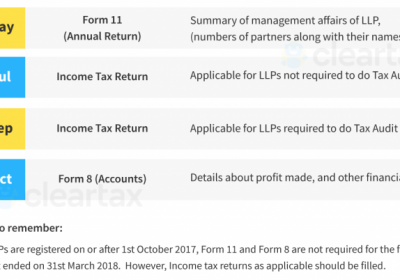

Is the LLP required to fill out an annual form before filing a strike-off application:-

LLP Act contains below statutory provisions:

Strike-off provisions are found in Rule 37(1)(b) of the LLP Rules 2008. According to this rules, there are no exceptions to the filing of e-form LLP- 8/ 11 for the strike-off of an LLP. As a result, every LLP must file an annual report before being struck off.

Is it essential for the LLP to file the initial LLP Agreement and any amendments to the LLP Agreement (E form LLP-3) with the ROC before filing an application for LLP strike off?

- There is no exception from submitting an LLP agreement in e-form LLP 3 with the ROC under LLP laws. As a result, it is required to file an LLP Agreement with the ROC prior to filing an application for strike-off. However, as a result of the LLP Amendment Rules, the situation in 2017 has altered. "LLP file e-form 24 contained with copy of the initial LLP agreement,

- if entered into but not filed, along with revisions thereof in circumstances where the LLP has not initiated business or commercial operations since its incorporation," according to an excerpt from the Amendment Rules.

How we can assist with LLP Strike Off?

- LLP Review: We will examine the LLP's activities and assess whether it is eligible for strike-off under the FTE Scheme of the Companies Act, 2013, allowing for a more straightforward approach. The screening procedure would take two to three business days to complete.

- Document Preparation: After that, we'll provide you a timeframe; paperwork for LLP Strike Off will take 5 to 7 working days, depending on the LLP.

- Application for Strike Off & LLP Closure: An application for strike off and LLP closure will be sent to the ROC, which will normally approve the application in about three months. and avoid potential future fines or liabilities.