Table of Contents

- 1. During Fast Development

- 2. New Products, Markets, Or Services

- 3. For Merger And Amalgamation, Outside Investors And Debt Facilitation

- 4. When Profitability Is Not A Satisfactory Degree And You Do Not Know Why

- 5. As Tax Planning Has Become Complex

- 6. Represents Your Approach If Strategic Planning Is A Priority,

- 7. Need For A Growth And Implement Policy Business Partner; Provide Implementation And Oversight

- 8. Need To Have More Transparency Of Potential Cash Flows

- 9. The Need To Always Better Grasp The Profitability

- 10. You Lack Detailed Financial Input, Is Crucial To Decision Sound Business Without Detailed Financial Data

- How Much Do I Pay For Virtual Cfo Services In Delhi And Other Cities?

A CFO might be needed:

1. DURING FAST DEVELOPMENT

Continuous expansion is a significant predictor of the need for a CFO. Development needs the proliferation of integrated structures, new infrastructure, and funding. The CFO is best positioned to cope with accelerated sales growth due to potentially increased difficulty. They must define innovation and development and the context of capital acquisition.

In order for the company to expand faster, the CFO must analyze the overall financial situation of the organization, industry dynamics to adopt the right approaches, and increase cash flow and earnings.

For sectors with regular transitions involving drastic shifts in capital management and businesses with fast growth or ambitious M&A strategies, external CFOs have become an essential tool. External hires are highly respected for their expertise in M&A, global networks, critical thinking and strategic perspective. Many CFOs with development experience have worked in specialized service companies such as investment banking, accounting, or private equity for a significant part of their careers

2. NEW PRODUCTS, MARKETS, OR Services

The future is more uncertain than ever before. Disruptive technologies, changing business conditions and modern leadership styles demand transition and adaptability. As a result, the CFO looked at him as a transition expert.

The CFO makes it easier to find new prospects and develops the goods and markets of the client, capitalizes and prepares for potential development, generates and expresses the business success narrative efficiently.

The CFO will address the main questions that revolve around the right location and the pacing of the extension.

Also Read :

- What's Better: online CFO or inhouse fulltime CFO services

- Key ideas & prospects for CA’s practice to develop

- Upgrade your business, redesign your finance mechanism

3. FOR MERGER AND AMALGAMATION, OUTSIDE INVESTORS AND DEBT FACILITATION

If a company is planning for a merger and takeover, a committee is needed to assess a possible transaction. For certain cases, that will be outsourced and the company will still conduct due diligence on financial and regulatory matters.

The CFO must view the results of the due diligence team in order to adapt the terminology to the findings. The CFO will be able to express these results to a prospective borrower or lender. The CFO should be well trained to predict problems in order to shorten the process.

4. WHEN PROFITABILITY IS NOT A SATISFACTORY DEGREE AND YOU DO NOT KNOW WHY

Managing prices, increasing efficiency, and evaluating price approaches are three areas that the CFO can increase profitability. Better decisions will be taken around the business by increasing the awareness of productivity. Through the oversight and management of financial services, the CFO can keep the CEO, the Board and investors aware of past and current financial reports.

The CFO must dig closely to measure the productivity of workers in order to decide if there are bottlenecks or slowdowns in operations. Financial reports from the CFO provide the CEO with a clear summary and comparison of the net income from revenues and operational expenses.

5. AS TAX PLANNING HAS BECOME COMPLEX

Corporate reputation is dependent on its ability to plan and report correct annual statements and to comply with its tax obligations. It could be time to recruit a CFO if the organization is unable to do so. High net worth corporations are frequently faced with complicated tax laws and regulations. The CFO works as a trainer and helps:

· Consider changes to the law and which rulings will have benefits.

· Analyze the tax advantages of investment, capitalization, and incentives for M&A.

· Provide advice on the financial connection between founders, creditors, and the businesses they control.

· Increase current tax positions.

· Create and retain assets.

You May Also like The Following Blogs:

6. REPRESENTS YOUR APPROACH IF STRATEGIC PLANNING IS A PRIORITY,

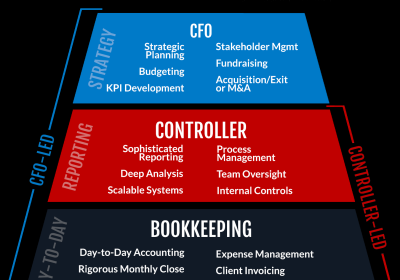

An organization has to invest strategically in its personnel and infrastructure to sustain corporate processes such as budgeting, estimating, and long-term planning. A successful CFO recognizes this and can balance its position as a business strategist.

7. NEED FOR A GROWTH AND IMPLEMENT POLICY BUSINESS PARTNER; PROVIDE IMPLEMENTATION AND OVERSIGHT

In the end, the CEO is at the forefront of creating a strategic plan. Nevertheless, the CFO is a central player in the preparation phase by extending the plans of the CEO. The CFO should guarantee that the financial requirements of the plan are not unreasonable or too dangerous.

A successful CFO would be the right hand of the CEO, ready to help and push him or her to lead the company. The CFO must report company results and concerns to the Board of Directors. They should exchange important knowledge and ideas with their colleagues to promote dialogue and decision-making, and to subordinates to ensure productivity and to keep them engaged.

CEOs and boards would want CFOs not only to have timely and reliable financial reports but also to work with them in shaping the company's strategy.

The CFO is more informed on the budgets, procedures, and risk control required to fulfill the CEO's strategic strategy. The CFO may outline the specifics of the strategic plan, check it, review its feasibility, and advise on potential changes to the plan in order to achieve the desired outcome.

CFOs are an invaluable friends of the CEO and frequently serve on the board, bridging the divide between day-to-day activities and the overall strategy of the business.

If the execution is complicated, the CFO can take over the strategic planning task.

8. NEED TO HAVE MORE TRANSPARENCY OF POTENTIAL CASH FLOWS

If you need someone to take care of your company resources because the income is not will, you need a CFO. This involves the assessment of the particular investment plan and the type of assets to be listed.

The CFO must make reliable predictions, analyze the terms, create and implement the payment structure and segment the consumers, suppliers, and inventory.

9. THE NEED TO ALWAYS BETTER GRASP THE PROFITABILITY

The price approach is an example of how margins can be influenced. Your business members may be ignorant of the combined effect of potentially thousands of price decisions made on a regular basis. Lack of consistency in demand execution can be more detrimental over time than a poorly defined pricing policy. The pricing policy can be a big lever for the widening of profit margins and further control of execution.

10. YOU LACK DETAILED FINANCIAL INPUT, IS CRUCIAL TO DECISION SOUND BUSINESS WITHOUT DETAILED FINANCIAL data

Decision-making is focused on instincts and intestines. This may also contribute to disputes within a company where each has their own personal view of 'the facts.' Lack of knowledge may be crucial statistics on cash flow, working capital, or liquidity modeling. You may lack the understanding of demographic, industrial, and regulatory changes that could have a direct effect on your sector. Or you are unable to produce the financial reports needed by the banks, vendors, lenders, creditors, and associates. You may need a CFO for each of these cases.

CEOs are encouraged to get a finance professional in place who knows how to fix challenges and manage the company financially. CFOs are well placed to help create a business that is financially stable and to generate value for its members.

You don't even have to invest in a full-time CFO right now. In the first place, anyone who comes in one or two days a week could be enough.

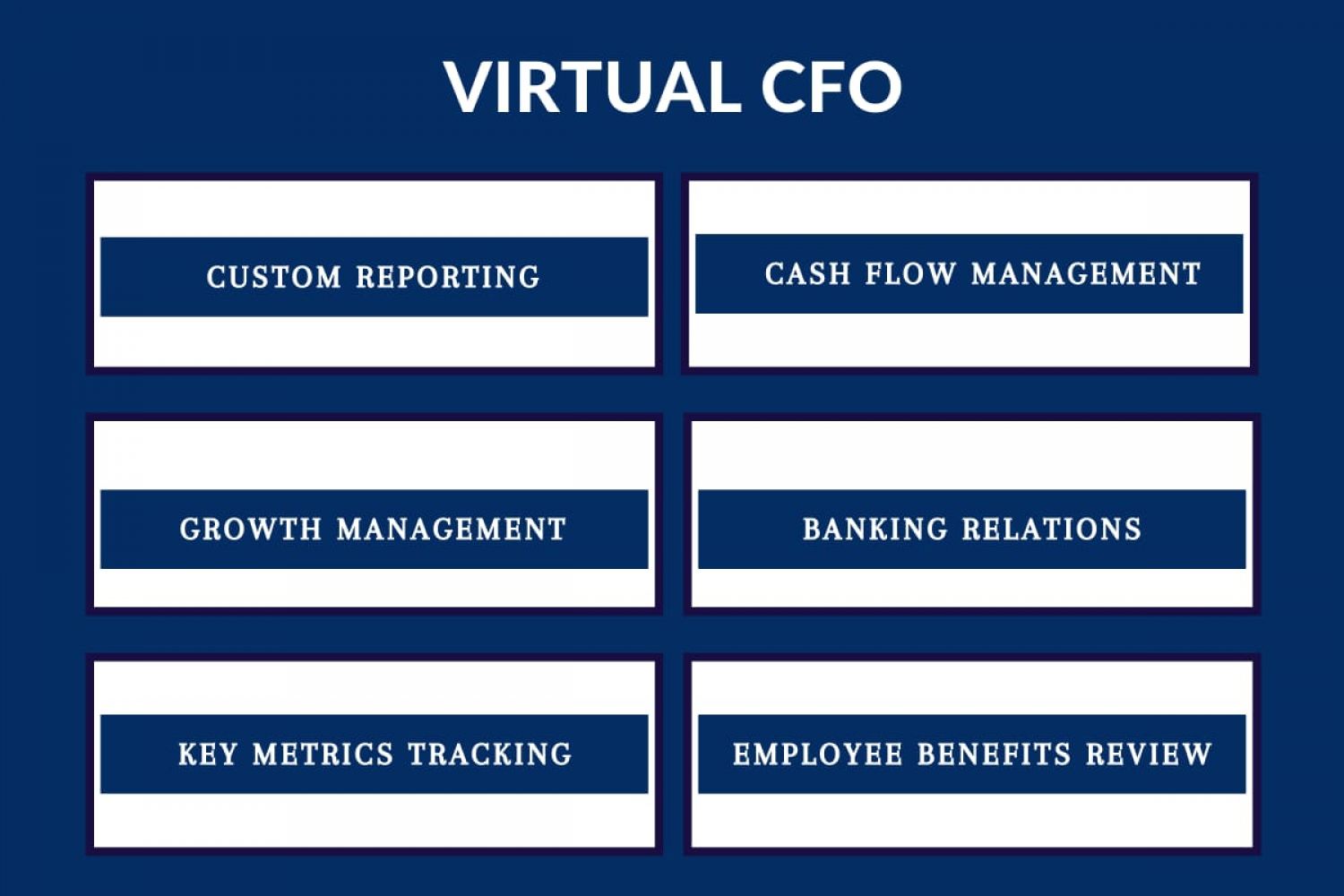

How much do I pay for Virtual CFO services in Delhi and other cities?

You're interested in hiring a virtual CFO for your business? Please go no further than CFO Products. Compared to a full-time supplier of CFO services, Automated CFO rates are lower. While recruiting a larger company can only cost you a lot, we're offering you our best Virtual CFO services in India at the fairest price. Our structured Automated CFO pricing is customized to the company's requirements. We add all the advantages of a virtual CFO with simplicity and usability at a reasonable price. We also offer a free report that will let you know where your company is now!

We offer advice on how to consistently track and evaluate your market growth and earnings. Our team of professionals will be able to support and steer you out of any unforeseen financial situation. Our Virtual CFO Services is located in Delhi and provides Virtual CFO Services in Noida, Chandigarh, Gurgaon, Mumbai, and Varanasi other parts of India.

Popular Article :