Table of Contents

- Different Kind Of Statutory Compliance To Be Complied By The Industries :

- Applicability Of The Apprentices Act, 1961

- Applicability Of The Child Labour Act, 1986

- Applicability Of The Industry Dispute Act, 1947

- Applicability Of The Minimum Wages Act, 1948

- Applicability Of Trade Unions Act, 1926

- Applicability Of The Factories Act, 1948

- Applicability Of Workmen’s Compensation Act,1923

- Applicability Of Employees’ Provident Funds Statutory Compliance To Be Followed By Industries

- Eligible Employees Under Employees’ Provident Funds:

- The Contract Labour (regulation & Abolition) Act,1970

- Applicable Statutory Labour Compliance Checklist

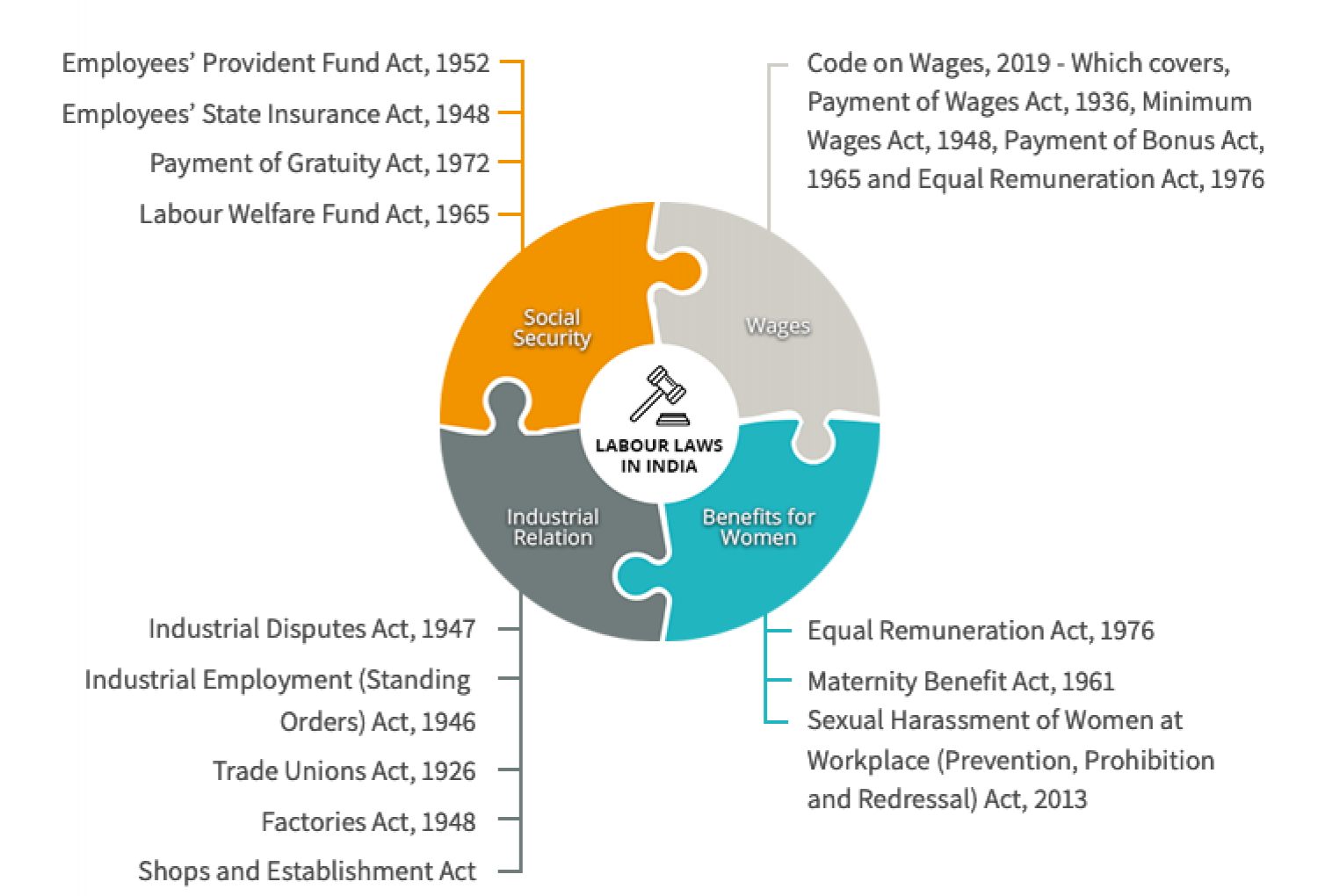

What are the Statutory Compliance of Manufacturing Industry

Statutory compliance refers to a company's procedures for adhering to legislation created by the local, state, or federal governments. Manufacturing industries employ a large number of labourers, employees, and workers, who provide a wealth of human resources and potential. As a result, it becomes critical for manufacturing companies to protect the interest of their employees.

Different Kind of Statutory Compliance to be complied by the Industries :

- The Minimum Wages Act, 1948

- The Apprentices Act, 1961

- The Child Labour Act, 1986

- Trade Unions Act, 1926

- The Factories Act, 1948

- Workmen’s Compensation Act,1923

- The Industrial Dispute Act, 1947

Applicability of The Apprentices Act, 1961

This Act deals with the individual going under training or in the course of training.

Eligibility

A person is not qualified to be hired as an apprentice in any recognised trade unless he or she has undergone apprenticeship training in that trade.

- is not less than 14 years of age

- satisfies such physical fitness and standards of education as may be specified

Before beginning an apprenticeship programme, you must sign an apprenticeship training contract.

| Sl. No | Section/ Rule | Requirement in brief | Periodicity/ Date of Compliance |

| 3. THE APPRENTICES ACT, 1961 & THE APPRENTICES RULES, 1991 | |||

| 1. | U/s 8 | No. of apprentices – After assessment, such number of apprentices as assessed by the Apprenticeship advisor, are to be engaged. | |

| 2. | U/s 4 | Registration of contract of apprentices. | As and when appointed |

| 3. | U/s 15(2) | No apprentice shall be allowed to work overtime except with the approval of Apprenticeship Adviser. | |

| 4. | U/s 2, Rule 10 | Record and Returns :- | |

| Form No.APP-I | Within 15 days from the date of registration of contract. | ||

| Form No.APP-IV | Within 7 days of joining. | ||

| Form No.APP-2 | Half yearly | ||

| Form No.APP-3 | Half yearly | ||

| 5. | Rule 14 | Maintenance of Index Card in Form I | File duplicate copy of the Card to the State Apprenticeship Advisor Within 15 days from the date of registration of the contract of apprenticeship |

| 6. | Maintenance of record of practical Personnel Training in Form 1 (A) | File a copy to the State Apprenticeship Advisor at the end of half year | |

| 7. | Maintenance of register of apprentices in Form 2 | ||

| 8. | Submission of half yearly report in Form 4 | ||

| 9. | Submission of Form 5 to the state Apprenticeship Advisor | On engagement of apprentice | |

| 10. | Submission of Form 6 to the state Apprenticeship Advisor about the progress of apprentice. | Once in every quarter | |

Applicability of The Child Labour Act, 1986

The Child Labor Prohibition and Regulation Act of 1986 must be strictly followed by the industries. Children under the age of fourteen should not be employed in the industry, and there should be no employment for dangerous work.

Applicability of The Industry Dispute Act, 1947

The Industry Dispute Act, 1947 governs the relationship between an employer and an employee. This Act's goal is to maintain industrial peace and harmony by establishing apparatus and procedures for investigating and resolving industrial disputes through discussions.

Applicability of The Minimum Wages Act, 1948

This Act is a law aimed to establish statutory minimum wage rates in the workplace. This Legislation provides the minimum wages that must be paid or provided to workers.

| Sl. No | Section/ Rule | Requirement in brief | Periodicity/ Date of Compliance |

| 9. THE MINIMUM WAGES ACT, 1948 | |||

| 1. | U/s 3 | Employees not covered under wage agreement should be paid minimum wages as prescribed by Government for the scheduled employment including contract labour. | Always |

| 2. | U/s 18 | Maintenance of register and records giving such particulars as may be prescribed. | Always |

| 3. | LAR 8.3.1 Rule 21(4) | Maintenance of Register of fines in Form I | |

| 4. | LAR 8.3.2 Rule 21(4) | Maintenance of Register of deductions in Form II | |

| 5 | Rule 21(4-A) | Submission of Annual Return in Form III | Not later than 1st February following the end of the year to which it relates |

| 6 | Display of Notice in Form XIII | ||

| 7 | Different class of worker (Company's Employee and Contracted Labour) maintained differently | Always | |

| 8 | U/s 12 | Payment of Minimum Wages | Always |

| Note:- | |||

| Rule 21 2-A ii of the Minimum Wages (Central) Rules, 1948 states that total amount of deductions shall not exceed 50% of such wages in any case. | |||

Applicability of Trade Unions Act, 1926

Trade Unions Act, 1926 addresses the establishment of a trade union by employees to represent their working conditions or to propose a demand to the employer.

Trade Unions Act, 1926 discusses the concept of collective bargaining, which allows employees to bargain with employers over wages, working conditions, benefits, and pay.

Applicability of The Factories Act, 1948

The Factories Act, 1948 covers worker health, safety, working hours, leave, and welfare, as well as factory inspections, hazardous processes in factories, the employment of minors (children and adolescents), and penalties for violating the Act's provisions.

Working hours are restricted to 9 hours per day and 48 hours per week, with a particular provision for women working before 6 p.m. and after 7 a.m.

| Sl. No | Section/ Rule | Requirement in brief | Periodicity/ Date of Compliance |

| 10. THE FACTORY ACT, 1948 | |||

| 1 | U/s 6 | Approval of Factory plan before start of manufacturing process ( Form 1 ) | As and when required |

| Renewal of factory License ( Form 3 ) | |||

| Annual Return (Form 21) | |||

| Report on Accidents and Dangerous Occurences (Form 34) | As and when happens | ||

| 2 | Statutory Health Check up for Employees (Health Register in Form 7) | ||

| 3 | Notice for change of:- | Within 7 days of taking charge. | |

| Manager | |||

| Occupier | |||

| 4 | U/s 7-A | General duties of the occupier to ensure the safety of the workers. | Always |

| 5 | U/s 7-B | General duties of the manufacturer as regards articles used in the factory | Always |

| 6 | U/s 10 | Is there any certifying Surgeons? | As and when required |

| 7 | CHAPTER 3 & 4 | Relating to Health and Safety Aspects. | Always |

| 8 | U/s 40-B | Safety health officers in case the factory ordinarily employs 1000 or more than 1000 workers | Always |

| 9 | Chapter VI | Working Hours for Adults | Not more than 48 Hrs in a week |

| 10 | U/s 61 | Notice of periods of Working hours of Adults. | To be displayed inside the factory. |

| 11 | U/s 62 | Register of Adult Workers to be maintained be the manager of the factory. | Always |

| 12 | U/s 41-B | Compulsory disclosure of information regarding Hazardous process. | Within a period of 30 dys of commencement |

| Note:- | |||

| U/s 63- Hours of work should correspond with notice U/s 61 and Register U/s 62 | |||

Applicability of Workmen’s Compensation Act,1923

- Workmen’s Compensation Act,1923 governs the compensation granted to workers who are injured in the course of their employment or contract occupational diseases.

- Workmen’s Compensation Act,1923 was enacted to provide compensation to workers as a means of aiding their treatment.

| Sl. No | Section/ Rule | Requirement in brief | Periodicity/ Date of Compliance |

| WORKMAN’S COMPENSATION ACT,1923 | |||

| 1. | U/s 3 | Employer is liable to pay compensation for accidents arising out of and during the course of employment | Immediately |

| 2. | U/s 4 & 4A | Compensation to be calculated as prescribed under the Act. In case of fatal accident, the same is necessary to be deposited with the Commissioner. | Within one month |

| 3. | U/s 16 | Return as to compensation | When required by the State Govt. |

| 4 | Report of serious bodily injuries/fatal accidents in case of non ESI employees in Form EE | Within 7days of the incident | |

| 5. | Display of the abstract of the Act in Form 36. | ||

Applicability of Employees’ Provident Funds Statutory Compliance to be followed by Industries

ESI & EPF - Legal Compliance & Forms used

All Commercial Establishment/ Business Entity with twenty or more than twenty employees are Compulsory to be members of the Employees’ Provident Funds.

Commercial Establishment/ Business Entity means:

- Every Commercial establishment which is a factory engaged in any industry specified in Schedule I of Employees’ Provident Funds Act.

- Any other Commercial establishment

- Such classes of Commercial establishments which the Center Govt may notify (even in the case, where number of employees is less than twenty.

Eligible Employees under Employees’ Provident Funds:

Compulsory:

- In case employees who drawing less than Rs. 15000/- per month.

Optional:

- When Assistant Provident Funds commissioner grand permission to the employees take salary excessed INR 15k per month.

Kind of Benefits to employees:

- One time investment does not needed

- It will made Deductions on every month from the employee’s salary itself.

- Huge Saving sum of money in long period of time at retirement time.

- it can help the employee During an emergency time.

What are maximum Withdraw Permission

If you withdraw the corpus 1 year before retirement, you can withdraw the maximum amount of 90 percent of the whole corpus.

The latest EPF withdrawal guidelines have also taken into account the possibility of job loss. 75 percent of the collected EPF corpus can be withdrawn 1 month after leaving the job, according to these laws. After 2 months of unemployment, the remaining 25% can be withdrawn.

| EMPLOYEES’ PROVIDENT FUND AND MISCELLANEOUS PROVISIONS ACT AND EMPLOYEES’ FAMILY PENSION SCHEME, 1971 | |||

| Employees Provident Fund Scheme,1952 | |||

| Employees’ Family Pension Scheme,1971 | |||

| Employees’ Deposit Linked Insurance Scheme,1976 | |||

| Sl. No | Section/ Rule | Requirement in brief | Periodicity/ Date of Compliance |

| 1 | U/s of EPF Act | Family Pension Fund Challan No.9 | Within 15 days of next month |

| PF inspection charges Challan No.2 | Within 15 days of next month | ||

| PF contribution to IGFCC PF Trust | Within 15 days of next month | ||

| PF contribution to BBPF | Within 15 days of next month | ||

| 2 | Para 15(4) | FPF Form No.4 | Last day of the next month |

| Return of new joinees during the month | |||

| 3 | Para 15(2) | EPF Form No.5 | Last day of the next month |

| Return of member leaving service during the month. | |||

| 4 | Para 15(4) | EPF Form No.6 | Last day of the next month |

| Return of Contribution for the month | |||

| 5 | Para 14 | FPF Form No.7 | Before 30th April |

| Yearly contribution statement of member | |||

| 6 | Para 15(4) | FPF Form No.8 | Before 30th April |

| Annual Statement of Contribution | |||

| 7 | Para 36(2)(a&b) of EPF Scheme | Consolidated list of new members to be intimated in Form 5 and the members leaving in Form 10 | Monthly within 15 days |

| 8 | Para 40(2) of EPF Scheme | Consolidated statement for recoveries made from the wages of each employee | Within 25 days of next month |

| 9 | Para 38(2)(3) of EPF Scheme | Monthly statement in Form 12 and Annual Return in Form 6-A of contribution statement to be sent as per the provisions of the scheme. | Within 25 days |

| 10 | Para 36-A of EPF Scheme | Particulars of ownership in Form 5-A | Within 15 days of change in ownership |

| 11 | Para 36(4) of EPF Scheme | Inspection note book for recording the observation by Commission | Always |

| 12 | U/s 1 | Applicability – to obtain Employer Code Number | One time – obtained |

| 13 | Para 26 of Scheme | To ensure that every Employee to be made member of PF/FPF | Within stipulated time |

| i) Company’s employee | |||

| ii) Contract Labour | |||

| 14 | U/s 6 | To ensure payment of contribution to EPF for contract labour by the contractor and in case of Company Employee. | Within 15 days of the next month to the month relating to . |

| 15 | Issuance of Form 3 (Contribution card) to employees. | ||

| 16 | Payment of Provident Fund Contribution Within 15 days of every month. | ||

| 17 | Maintenance of duplicate copy of monthly abstract. | ||

| 18 | Maintenance of duplicate copy of consolidated Annual Contribution Statement. | ||

| 19 | Transfer of the amount of accumulation to the employee`s account of the provident fund of the establishment in which he is re-employed within 30 days. | ||

| 20 | U/s 8-A | Recovery of moneys due from the employers and the contractors. | |

| 21 | Chapter VIII of EPF Scheme | Withdrawl of Provident Fund Money for the Purpose. | In such Form |

THE CONTRACT LABOUR (REGULATION & ABOLITION) ACT,1970

Below are the THE CONTRACT LABOUR (REGULATION & ABOLITION) ACT,1970 mention here under :

| Sl. No | Section/ Rule | Requirement in brief | Periodicity/ Date of Compliance |

| 4. THE CONTRACT LABOUR (REGULATION & ABOLITION) ACT,1970 | |||

| 1. | U/s 7 | Registration of the factory to engage contractor | Before employing any contractor in the establishment |

| 2. | U/s 12 & 13 | Licence to the Contractor and its renewal Form-7 | Contractor must obtain the licence before starting work at the establishment and the same should be renewed 30 days prior to its expiry. |

| Rule 29 | |||

| 3. | U/s 29 Rule 74 | Maintain the Register of Contractors in Form-12 | Always |

| 4. | Rule 82(1) | Half yearly Returns by Contractors in Form 24 | Within 30 days |

| 5. | Rule 82(2) | Annual Return by the Principal Employer in Form No.25 | By 15th February |

| 6. | U/s 21 | Ultimate responsibility of payment of wages to the contract labour is that of principal employer. | Always |

| Checking of compliances of Payment of bonus to eligible contract employees at the time of payment of the wages | |||

| *(Payment of wages must be in presence of the Company’s authorised representative, who must certify the amount of wages to all contract labour every month.) | |||

| 7. | U/s 29 Rule 78 | Registers to be maintained by the Contractor | Always |

| Muster roll, Wages register,Deduction register, Overtime Register. | |||

| · (To check the following records of the Contractors-Registration of workmen, Employment Card, Attendance/Wage Register, Wage Slip, Deduction, Fine, Advance, Overtime.) | |||

| 8 | Checking of compliances of Contract employees covered by PF | By 15th of the next month | |

Applicable Statutory Labour Compliance Checklist