Table of Contents

After filing a regular TDS return, we may receive a TDS notice for:

- Late fee penalty (u/s 234E)

- Some interest pending amount (u/s 201(1A), 206C(7))

- Interest u/s 220(2)

- Short deduction Or

- for a variety of other reasons that can be addressed simply by include challan in the statement. It is a cost-free, time-saving, and simple solution to add challans online.

Steps for adding a TDS challan to an existing TDS challan via online rectification

Challan can be added to the statement by online traces editing. The processes for adding a challan are as follows:

Step-I go to Login to TDS traces web site i.e. www.tdscpc.gov.in

Step-II Thereafter go to “Request for correction” under Defaults menu, here provide required details, then submit the request

Step-III then visit “track correction request” under the TDS site at Defaults menu

Step-IV Now perform KYC validation using standard KYC or DSC, in which you submit the usual statement token number, challan, and deductee information, and a 'authentication code' is generated that is only valid for that day.

Step-V then pick "Add challan to statement" from the "kind of correction" selection according to your needs. You will be presented with a list of challans in your statement; click "add challan" and select the challan you wish to add.

Step-VI : To continue, click "submit for processing," and you'll be given a token number as confirmation. This token number can be used to track the progress of an online rectification request.

Also read

- TDS Deduction Rate Chart for (AY 2023-2024) FY 2022-2023

- TCS Rate Chart & Overview - TCS Vs 206C(1)(1F)(1H) v. TDS Vs 194Q

- New TDS deduction No cash transactions exceeding 1 Crore -Section 194N

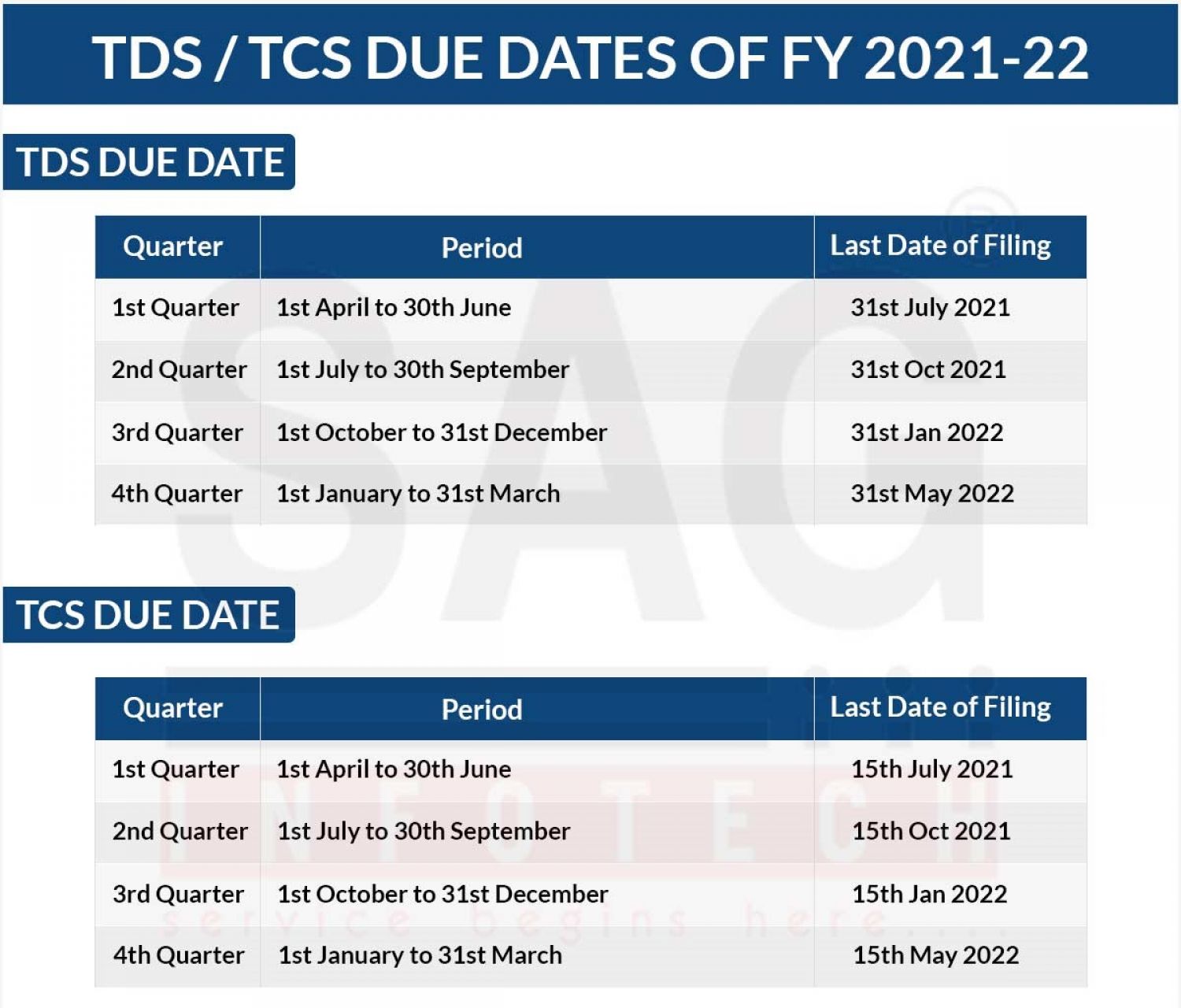

- Extention of TDS/TCS statement filing Date

- Read More about key features of TCS on goods sale section-206c

- COMPLIANCES OF TAX DEDUCTED AT SOURCES(TDS)

- TDS & TCS Rate chart for FY 2024-25

- Comprehensive study about TDS & TCS chapter