Table of Contents

NRI Income Tax Filing Checklist for FY 2024-25 (AY 2025-26)

Step 1: Essential Documents Checklist

To begin your filing process, NRIs should gather the following documents:

-

PAN Card and valid visa or proof of overseas residency

-

Bank statements (NRE, NRO, savings) for April 2024 – March 2025

-

Interest certificates, capital gains reports, and dividend statements

-

Investment proofs (e.g., under Sections 80C, 80D, 80G) if claiming deductions

-

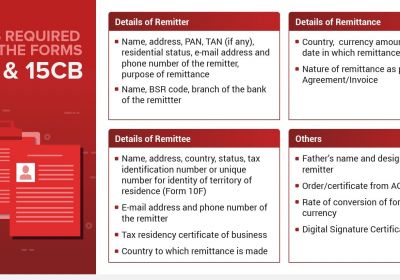

Tax Residency Certificate (TRC) and Form 10F for DTAA benefit claims

-

Form 16 for salaried NRIs (if applicable)

Step 2: Key Points to Remember

-

NRE/FCNR account interest is exempt from tax but must still be reported.

-

Use ITR-2 (ITR-1 is not applicable to NRIs).

-

Ensure Aadhaar is linked to PAN and a bank account is validated on the Income Tax Portal.

-

Dividend income is taxed at a flat 20% under Section 115A unless reduced by DTAA.

-

Section 87A rebate (₹12,500) is not available to NRIs.

Step 3: Common Mistakes to Avoid

-

Failing to report Indian income on which TDS has already been deducted

-

Ignoring errors in AIS/TIS – Always raise a disagreement if mismatched

-

Not disclosing Indian assets or liabilities if total income exceeds ₹1 crore

-

Using incorrect or outdated email IDs or mobile numbers on the IT portal

Step 4: Determining Your Residential Status

You will be treated as an NRI if:

-

You stayed in India for less than 182 days in the FY AND

-

You stayed in India for less than 60 days in the FY AND

-

Your total stay in India during the preceding 4 years was less than 365 days

Accurate residential status is crucial to determine taxability and benefits under Indian tax law.

Step 5: Understand the Deemed Residency Rule

If you:

-

Are an Indian citizen

-

Earn more than ₹15 lakh from Indian sources

-

Are not liable to tax in any other country

Then, you will be treated as Resident but Not Ordinarily Resident (RNOR) under Indian tax laws. This means global income is not fully taxable, but certain Indian-sourced incomes are.

Conclusion

Filing taxes as an NRI requires careful planning and accurate reporting. Disclose all sources of income, understand your residential status, and avoid common mistakes to ensure smooth compliance. Always consult a tax advisor or chartered accountant for personalized advice, especially when claiming DTAA benefits, managing large investments, or handling multiple income sources