Table of Contents

Overview about FCRA Registration renewal

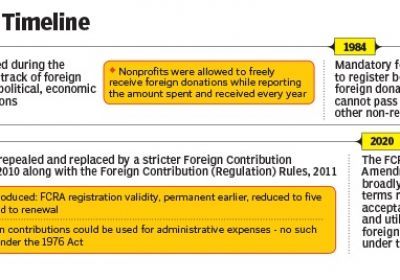

- FCRA registration certificate's validity has been limited to 5 years under the updated FCRA 2010. It should be remembered that under previous legislation, FCRA registration was virtually permanent until it was revoked.

- The FCRA 2010 requires organizations to update their registration every five years.

- Organizations who want to extend their registration certificate will do so six months before it expires by filling out Form FC-3C online.

- Existing registrations under the FCRA, 2010, will expire after the five-year term from the date of grant of registration has expired, and they will no longer be able to receive international donations. In this situation, the association would have to reapply for registration.

Investigation at the time of FCRA Renewal

- The process for FCRA renewal is outlined in Section 16 of the FCRA Act of 2010, which must be completed every five years. However, the aforementioned provision does not grant the department the authority to conduct an investigation when processing the renewal application,

- FCRA Dept. can conduct audits and inspections at any time under sections 20 and 23, respectively. However, in both sections 20 and 23, the Central Government must have a valid cause to start an investigation or audit.

- Thus, the FCRA Amendment Act of 2020, enacted on September 29, 2020, states that the central government has the authority to make inquiries and satisfy itself as to Section 12(4) conformity before FCRA renewal.

- It's worth noting that Section 12(4) is the law that governs authentication at the time of registration. To put it another way, the government can conduct similar investigations before renewing FCRA registration.

- As a result of the proposed amendment, the extension process has been identical to the registration or prior permission process.

Postponed of Renewal Application

- If an NGO does not apply for renewal by the deadline, its registration will be revoked. However, if appropriate explanations for not sending the renewal application are given, the department could be willing to overlook the delay. A pending renewal application may be sent up to one year after the FCRA Certificate expires.

- The validity of a person's certificate of registration shall be deemed to have ceased from the date of completion of the term of five years from the date of grant of registration if no application for renewal of registration is issued or such application is not followed by the required fee, according to Rule 12(6) of the FC(R) Rules 2011.

- For example, if no application is made or is not followed by the renewal charge, the validity of the registration certificate granted on November 1, 2016, will be considered to have lapsed as of October 31, 2021.

FCRA Registration Cancellation/Suspension

If officials believe that a licensed company is not acting by the legislation and that its license should be revoked, they will do so by sending a notice to the concerned entity.

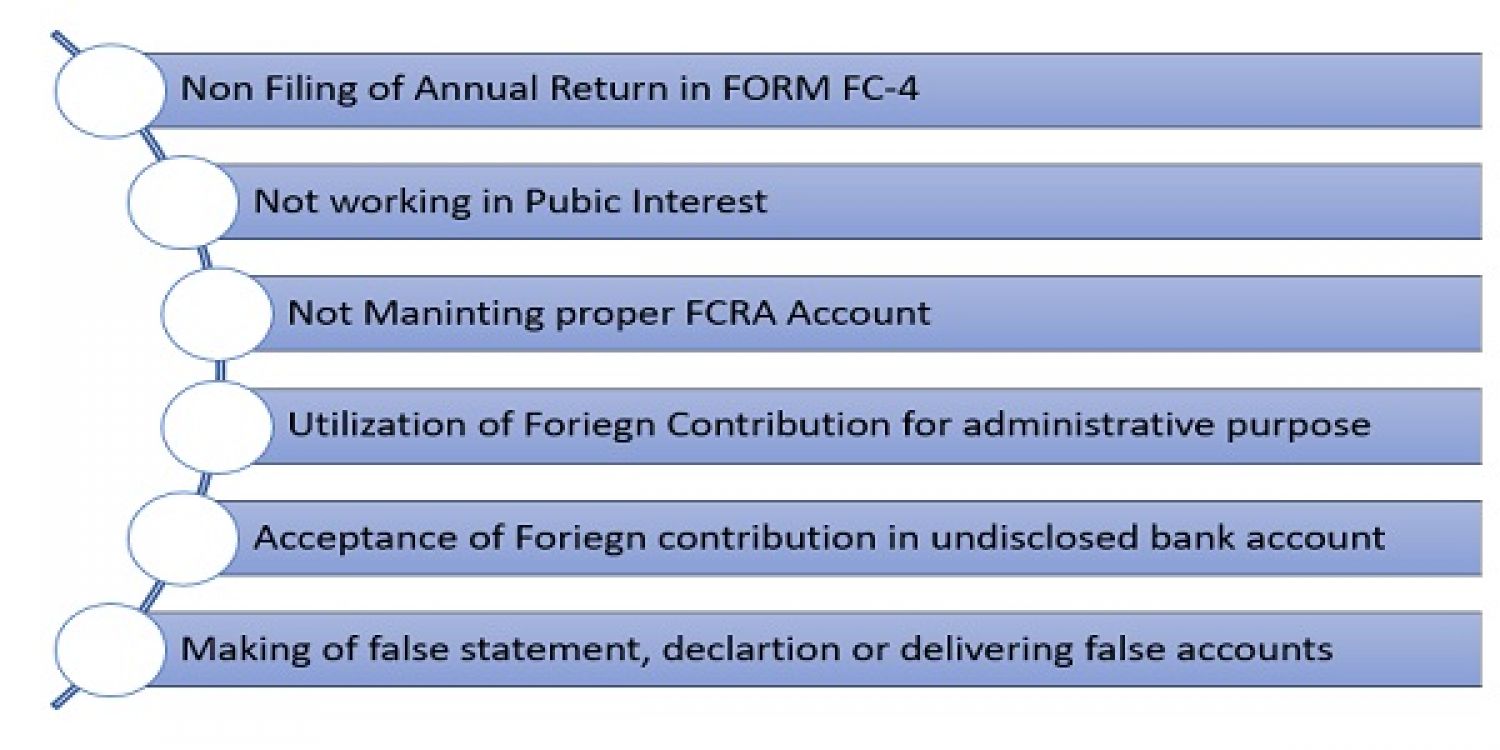

The below are some of the factors to remember before terminating the license:

- The Foreign Contribution (Regulation) Act is not being followed by the NGO.

- An agency fails to file an annual return by the deadline

- If some allegation of wrongdoing in activities is brought against such an organization, and the allegation is shown to be valid,

- Contributions obtained are not used to achieve the entity's key goal or the intent specified in the FCRA registration application.

Things to stay away from during the FCRA

- Never combine domestic or personal account receipts with an international donation.

- If you've applied for the FCRA program, don't change your opinion

- Should not use ATM or debit cards. The Foreign Contribution Bank usually does not have an ATM or debit card. In the meantime, if you have one, do not use it to make any cash payments.

- If you want to get the most out of your perks, avoid cash withdrawals.

- Don't put the Foreign Contribution money into some kind of savings or liquid fund. Mutual funds, investing, and so on

- If you're on a world trip, stay away from foreign hospitality.

- Do not use FC for any form of a personal or administrative function.

- May not accept foreign contributions if your FCRA registration is on hold, canceled, or approval has not been given.

- Foreign contributions can never be accepted in any bank account other than an FC account.

- Never skip any of Section 18 annual returns that are needed.

Furthermore, avoiding any of these blunders would aid in the smooth operation of your firm or confidence.

FCRA Update

Govt has been decided to extend the validity of Foreign Contribution (Regulation) Act (FCRA) registration certificate up to 31st March, 2022 or till the date of disposal of FCRA renewal application, whichever is earlier.

Post by Rajput Jain & Associates:

- Our team (RJA) of experts can provide all the assistance in FCRA registration & related inquiries in India for Indian residents and as well as a foreign company.

- Legal and various types of document works are involved in FCRA registration-related queries in India other than approvals from the Government of India.

- We can assist you in FCRA registration for your company or individuals in India and get vital documents and approvals from the government.

- For any information/queries, you can contact us. Our team of experts can provide all the assistance related to FCRA Registration: Website- Click here Email id- singh@carajput.com

Popular Articles :

- FAQ;s on FCRA

- FAQs on obtain prior permission from FCRA authorities

- FCRA Returns Forms & Related Documents required under FCRA Act