Table of Contents

- Importer-exporter Code In India

- Validity Of Import And Export Code

- Benefits Of importer-exporter Code In India

- Exemption From The Ie Code Application

- List Of Documents Needed For Import And Export Code Application

- Issuance Of An Import Export Code

- Foreign Trade Dept To De-activate Import Export Code Not Updated After Jan 01, 2014

- Non updated Import Export Code Will Be Deactivated By The Dgft

- Faq's On importer-exporter Code In India

Importer-Exporter Code in India

- It is 10 digit Importer-Exporter Code number allotted by DGFT is a mandatory registration for commercial exporters or importers in India. Apply online and get your Importer-Exporter Coderegistration in less than 3 days

- Import Export (IE) Code India is a registration with the Indian Customs Department for import and export companies that import and export commodities from India. The Directorate General of Foreign Trade (DGFT), Ministry of Commerce and Industries, Government of India, issues the IE Code.

- An application for the IE Code must be submitted to the Directorate General of Foreign Trade, together with all required supporting documentation. DGFT will issue the entity's IE Code in 15 - 20 working days or less after the application is submitted.

Validity of Import and export Code

- IE Code registration is a one-time registration that is good for the rest of your life. As a result, updating, submitting, and renewing IE Code registration will be a breeze. It remains in effect until the business ceases to exist or the registration is withdrawn or relinquished. Furthermore, unlike tax registrations such as GST or PF, the importer or exporter is not required to complete any filings or adhere to any other compliance requirements such as annual filing.

- All companies and LLPs should receive an IE code after incorporation because it is a one-time registration that requires no additional compliance.

Benefits of Importer-Exporter Code in India

- Importer-Exporter Code registration allows vendors to enter the worldwide market by allowing them to register with online e-commerce operators.

- Customs and export promotion schemes such as the Merchandise Export from India Scheme (MEIS), the Service Export from India Scheme (SEIS), & others are available to organizations.

- Since there are no compliance obligations after registration, running a firm is relatively simple.

- The procedure for acquiring IEC is simple and may be completed with only a few basic documents.

Exemption from the IE Code Application

A business must have an Import Export Code in order to import any type of goods. The following individuals, however, are exempt from obtaining an IE Code:

- Import and export by the central government, its agencies, and undertakings for defence purposes or other specified lists are covered by the Foreign Trade Act (exemption from the application of Rules in certain cases) Order from 1993.

- Import and Export of Personal Use Goods

List of Documents Needed for Import and export Code Application

Below are documents needed for making an Import and export Code application in India.

|

PVT LTD Company or LLP or Section 8 Company |

|

|

Proprietorship Firm |

|

|

Hindu Undivided Family (HUF) |

|

|

Partnership firm |

|

|

Trust or Society |

|

Bank Proof

- A cheque without a pre-printed name of the account holder will not be accepted, according to Trade Notice No. 39/2018-19 issued December 12, 2018. In addition,

- The pre-printed check might be for a savings or current account. It should be noted that the above-mentioned papers must be uploaded online in digital format (GIF, JPEG) with a maximum file size of 5MB.

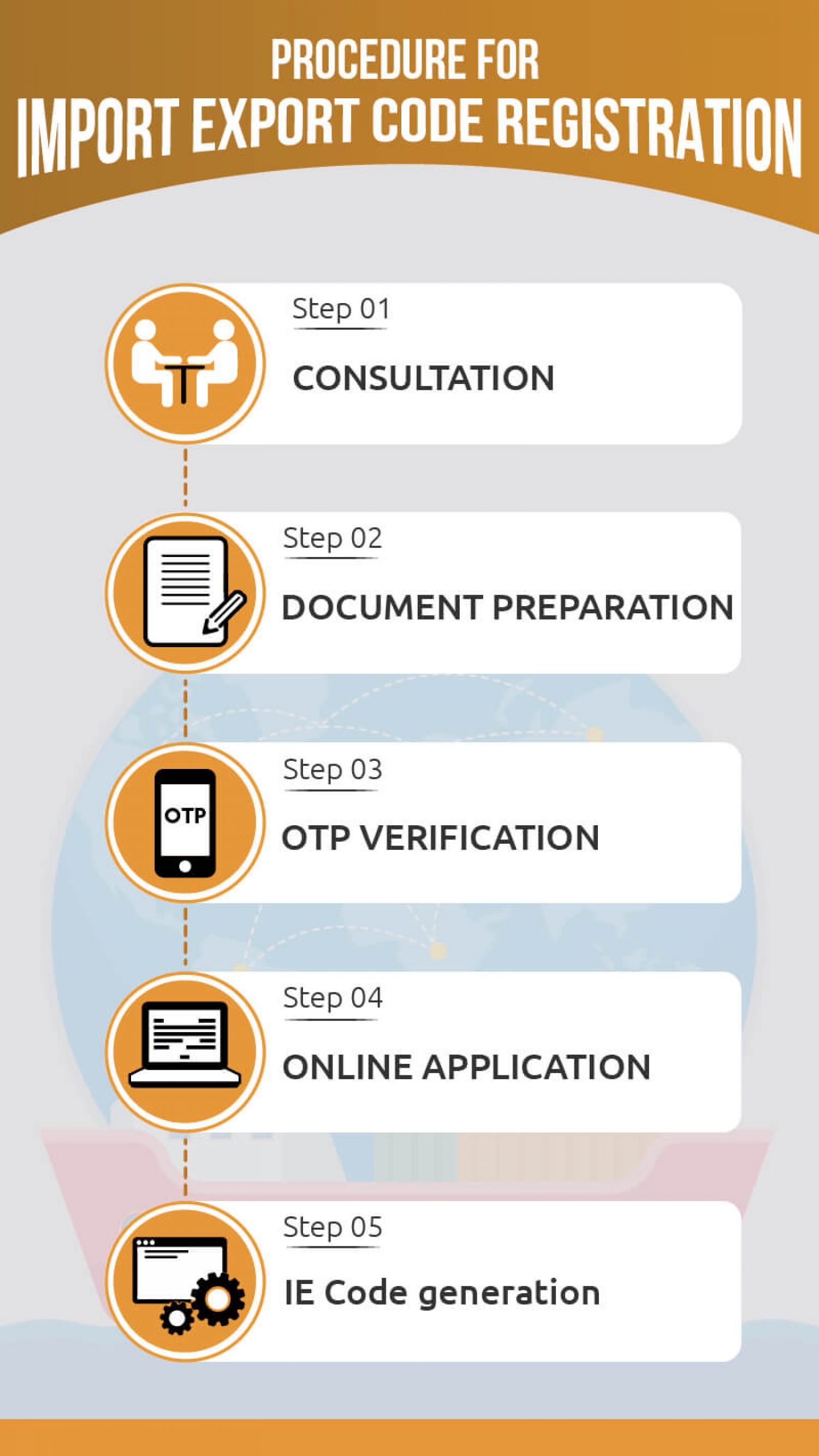

Issuance of an Import Export Code

IEC will be generated automatically once the online application is submitted, together with the required fees and papers. An user will receive notification of IEC allotment through SMS and email, along with a link to download and print the e-IEC. The IE Code certificate will only be available in digital format, which can be obtained from the specified website. After receiving an e-IEC, the holder must immediately update his profile. Furthermore, according to paragraph 2.15 of the Handbook of Procedure, 2015-2020, the profile update must be done at least once a year if any of the details listed in the IEC alter, or if any other situation occurs.

Despite the fact that the import-export code is generated automatically, the Regional Authority will conduct post-verification of the online IEC in accordance with the standards. If any incorrect or incomplete information is provided, the applicant will be subject to penal/criminal action, and his or her IEC will be suspended or cancelled.

Foreign Trade Dept to De-activate Import Export Code not updated after Jan 01, 2014

IECs that have not been updated since January 1, 2014 will be deactivated by the DGFT.

With effect from December 6, 2021, any IECs that have not been updated since January 1, 2014 will be deleted. The following URL provides a list of such non updation of IECs: https://www.dgft.gov.in/CP/?opt=LIEC Concerned IEC holders will have one last chance to update their IEC during this interim period, until December 5, 2021, after which their IECs will be de-activated on December 6, 2021.

Non updated Import Export Code will be deactivated by the DGFT

Any IEC that has submitted an online updation application but is awaiting clearance from the DGFT RA will be exempt from the deactivation list. It should also be noted that every IEC that has been de-activated has the option of being automatically re-activated without the need for any manual action or visits to the DGFT RA.

- Directorate General of Foreign Trade to De-activate Import Export Code not updated after Jan 01, 2014

- It is Compulsary to update your Importer-Exporter Code before 30th June every year, even if no change is there, else deactivation of IEC by DGFT

FAQ's on Importer-Exporter Code in India

Q1.: Is it possible to get more than one IEC for a single PAN?

No, A single IEC can only be issued in conjunction with a single PAN card. If more than one IEC is issued, all of them must be returned to the regional office.

Q2.:Is it mandatory to submit a separate application for each branch?

No, there is no need to submit separate applications for different business locations. This is a registration based on a PAN. As a result, a single registration will cover all of the entities' businesses and branches.

Q3.:Is there any repercussion if you don't have an importer or exporter code?

No, there is no penalty; nevertheless, without IE code, import and export are not feasible.

Q4.: Is it necessary to renew your IEC registration?

Import Export codes are issued with a lifetime validity and do not need to be renewed.

Q5.: Is there any compliance once IEC has been obtained?

No, once the import-export licence registration is obtained, no further compliance is required.

Q6.: Is it possible to change IEC data?

Yes, even after the code has been issued, the IEC information can be changed by supplying the appropriate documentation.