Table of Contents

Analysis of NRI Fixed Deposits Investing with Tax Implications

- Are you considering about investing in India? Are you worried about the tax implications of being a non-resident alien?

- The investment prospects in India may be tailored to meet the needs of NRIs, and they can enjoy a hassle-free banking and investment experience. Investing in NRI (Non-Resident Indian) Fixed Deposits is a risk-free way to save.

- This article explains the several forms of Fixed Deposits available to NRIs, as well as the tax implications of investing in them.

- An NRI creates NRO Fixed Deposit (Non-Resident Ordinary). Or an NRE (Non-Resident External).

Can NRI invest in fixed deposits?

- Fixed Deposits (FDs) are popular not only among Indian residents, but also among non-resident Indians (NRIs). NRIs can open a savings account using their FCNR, NRO, or NRE accounts. The rate of interest is determined by the bank, the amount of the deposit, and the duration of the deposit.

- Every day, the Indian government makes the country more business-friendly. NRIs are finding it tough to sort through the different investment possibilities available to them.

Fixed deposits

Fixed Deposits (FDs) are popular not just among Indian residents but also among non-resident Indians (NRIs). Bank FDs are regarded the safest investment option because they are rarely defaulted on by banks. NRIs can open a savings account using their FCNR, NRO, or NRE accounts. The rate of interest is determined by the bank, the amount of the deposit, and the duration of the deposit.

- Fixed deposits in the NRE account:

You could want to open an NRE account in Indian Rupees. You will not be taxed on the interest you earn, but you may be taxed in your home country. Depending on the duration of the deposit, the interest rate ranges from 5% to 7%.

- Fixed deposits in the NRO account:

You can utilise an NRO account to keep track of your Indian earnings. Rental income or dividends from stocks and mutual funds, for example, could be deposited into the NRO account. After submitting required paperwork, you can remit a maximum of $1 million from your NRO account.

- Fixed deposits in FCNR account:

The FCNR can be opened in any foreign currency. It could last anywhere from one to five years. You will not be taxed on the interest you earn. The deposits at FCNR are unaffected by fluctuations in foreign exchange rates. A/c

Implication on NRO Fixed Deposit :

- An NRI can open an NRE Fixed Deposit account. On a 'former or survivor' basis, it could be a single holding or a joint ownership with another NRI or resident Indian. For NRIs who earn foreign cash abroad, it is a risk-free investing alternative. You can deposit monies in any foreign currency into your NRE account. The deposit, however, will be made in Indian rupees.

- The duration of a fixed deposit can range from one year to ten years. You have the option of choosing the deposit period. The rate of interest is determined by the duration of the loan.

- The principal of an NRE Fixed Deposit, as well as any accrued interest, is readily repatriable in the foreign currency of your choice.

- Non residence Tax liability is not present in case of NRE Fixed Deposit. Interest acured on that deposit is totally exempt from income tax in India.

- Banks provide the option of appointing a resident Indian as a mandate holder for operative purposes when you are away from home.

- NRI FDs are one sort of investment that is completely tax-free.

- To be eligible for interest, NRE fixed deposits must be held for at least one year.

Implication on NRO Fixed Deposit

• An NRI can open an NRO Fixed Deposit in India. It is generally used to save income made in India via investments such as interest or dividends, as well as revenues such as rent or consultation fees. With the earnings received in India, a Fixed Deposit can be formed.

• The interest income through an NRO Fixed Deposit account is subject to the NRI Fixed Deposit tax. TDS is levied on interest generated on NRO fixed deposit accounts. To be eligible for interest, NRO Fixed Deposits must be kept for at least 7 days.

• NRO Fixed Deposits should be set up for longer periods of time. A part of the funds is allowed to be returned upon maturity. Under the current income scheme, you can transfer the interest received on your NRO Fixed Deposit to your NRE Account. It must, however, be notified to RBI along with the relevant paperwork.

Tax Implications on NRI Fixed Deposits Investment

• The Fixed Deposits discussed in this article operate on their own. NRIs are subject to income tax if they make money in India through various sources.

• As an NRI, you must select the best solution for your investment profile. An NRE Fixed Deposit is tax-free, whereas an NRO Fixed Deposit is subject to the NRI tax.

• Interest earned on NRE Fixed Deposits is tax-free in India, however interest earned on NRO Fixed Deposits is subjected to TDS.

NRO Fixed Deposits - Tax Deductions

- Interest on NRO Savings Accounts and NRO Fixed Deposits is entitled to a tax deduction at source (w.e.f Aug 09). TDS is deducted at a rate of 30%, plus any relevant surcharge or cess.

- Every person who receives income on which TDS is deductible must provide his PAN Number to the deductor, failing which TDS will be deducted at the maximum marginal rate or 30% plus applicable surcharge and cess, whichever is higher, as per section 206AA of the Finance (No. 2) Act, 2009, w.e.f. 01.04.2010. The said rule would cover interest on NRO Accounts/Deposits and PIS transactions.

* TDS will be deducted when due and applicable, in accordance with the provisions of the Income Tax Act of 1961 and the Rules promulgated thereunder. TDS will be recovered on savings, current, and demand deposit accounts (s).

Double Taxation Avoidance Agreement (DTAA)

- Double Taxation Avoidance Agreement (DTAA) is a treaty that India has signed with a number of countries. Customers can benefit from a reduced rate of Tax Deducted at Source (TDS) on interest earned in India under the current DTAA provisions.

- Hence by registering for DTAA clients can earn higher yield on their NRO deposits (FD as well as Savings Account).

- NRIs who seek to take benefit of the DTAA benefit must present a 'Tax Residency Certificate (TRC)' to the deductor, according to a recent modification to the Indian Income Tax Act published in the Union Budget 2012. (Bank).

- From April 1, 2012, this applies to all NR customers who seek to take full advantage of the DTAA benefit.

- Tax Authority/Government body in the country where the NRI resides provides the TRC. Customers should consult their country's Tax Department or Finance Ministry, or their Chartered Accountant overseas, for information on how to obtain a TRC. No other document will be accepted in place of a TRC in order to qualify for the DTAA rate for the present year.

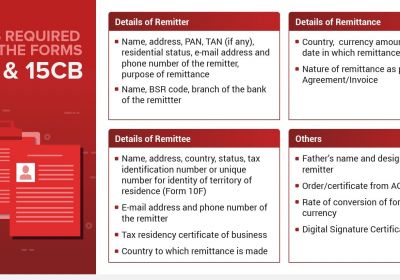

- If you want to take advantage of the DTAA's tax rate deduction, you must submit the required documents:

Documents Required for DTAA Benefit:

- Copy of self-attested PAN Card

- Tax residency certificate from Tax authority

- Complete Form 10F

- DTAA Annexure.

Whenever the TRC does not include all of the information needed by Income Tax Law, the customer must submit Form 10F. If you have previously registered for DTAA benefits or wish to do so, please provide a current copy of all of the above documents in order to receive the DTAA rate for the current financial year; otherwise, the bank will deduct TDS on interest earned on your NRO deposits at 30% plus applicable surcharges and cess.

Now that you've learned about the tax implications of investing in NRI FDs in India, you can decide which choice is best for you. For NRIs, many institutions, such as HDFC Bank, provide competitive interest rates on Fixed Deposits. To open an NRE or NRO Fixed Deposit,