Table of Contents

Income Tax Return filing: Applicable of at higher rates TDS/TCS on non filed the ITR on time (New Section 206AB and Section 206CCA)

A higher rate of TDS for Non-Filer of Income Tax Return has been implemented in Budget 2021.

The Proposed Section:

1. Section 206AB was proposed in the Act as a special provision allowing for a higher rate of an income tax return for TDS for non-filers.

Any sum of income or amount charged or payable or credited by an individual (hereinafter referred to as a deductee) to a designated person will be protected by the proposed section 206AB of the Act.

This provision shall not implement where tax is required to be deducted as per sections 192, 192A, 194B, 194BB, 194LBC, or 194N under Income Tax Act, 1961.

The suggested TDS rate in this section is higher than the following rates,

- 2 Time of rate applicable as per the relevant provision of the Income Tax Act; or

- 2 Time of the rate or rates in force; or

- The 5 percent rate

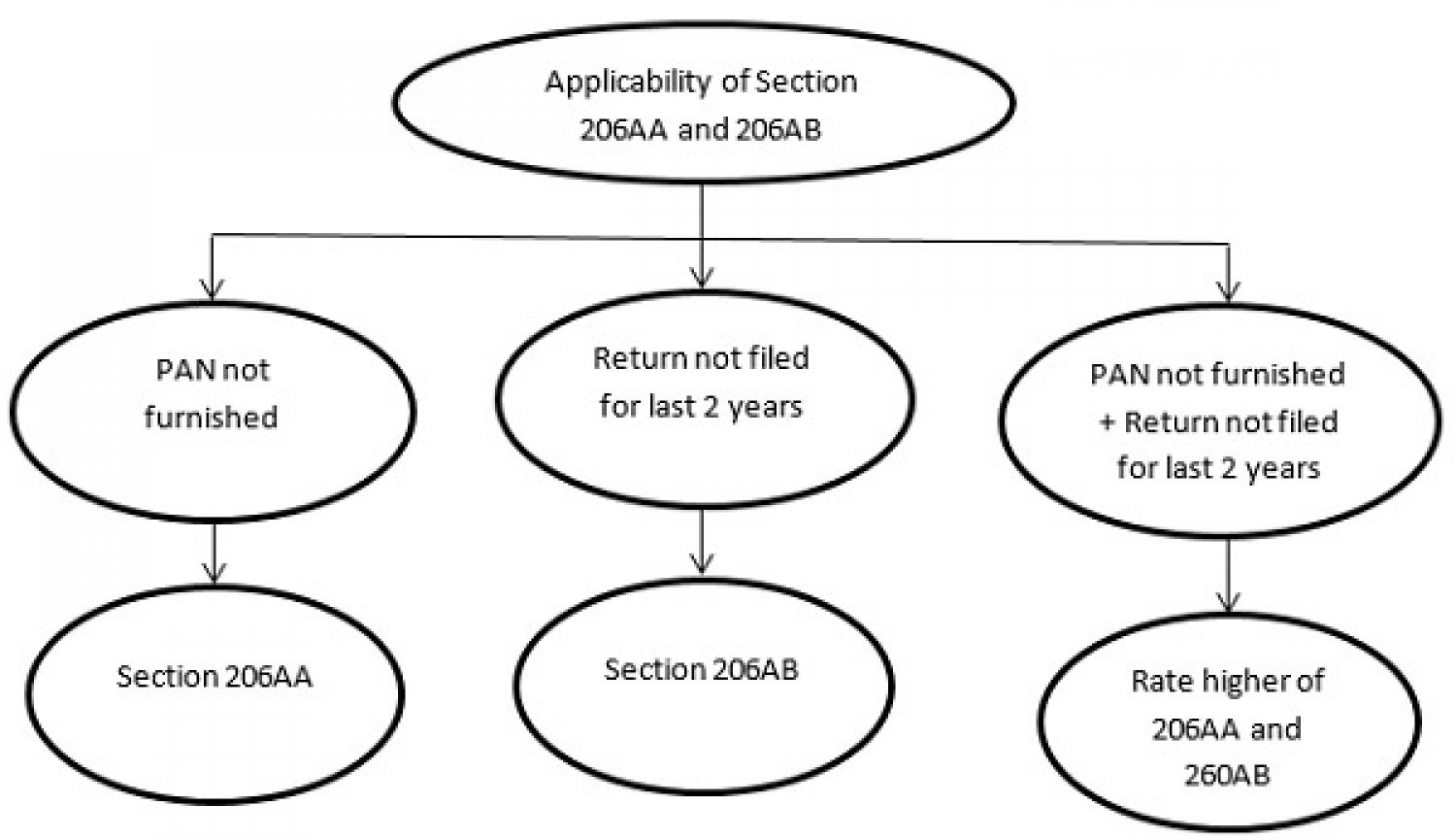

As the provision of section 206AA of the Act is applicable to the specified individual, in addition to the provisions of this section, the tax shall be deducted at a higher rate than the two rates provided for in this section and in section 206AA of the Act.

2. Section 206CCA has been proposed to provide for a higher rate of TCS for non-filers of income tax returns.

Any sum or amount obtained by a person (hereinafter referred to as the collector) from a designated person will be subject to the proposed section 206CCA of the Act.

In this section, the proposed TCS rate is higher than the following rates:-

- 2 time of rate specified in the relevant section of the Income Tax Act or

- The 5 % Rate

As, the provision of section 206CC of the Act is applicable to the specified individual, in addition to the provisions of this section, the tax shall be charged at a rate higher than the two rates provided for in this section and in section 206CC of the Act.

When will this section's (Section 206CCA & Section 206AB) requirement apply?

- The specified person is a person who has not submitted returns of income for any of the two years of assessment year related to the 2 preceding years immediately prior to the preceding year in which tax is expected to be deducted or collected as the case may be.

- Furthermore, the time limit for filing a tax returns per section 139(1) of the Income Tax Act has expired for both of these assessment years.

- There is another requirement that, in his case, the aggregate of tax deducted at source and tax received at source is fifty thousand rupees or more in either of the preceding two years.

- These changes will take into effect from 1st July 2021.

Purpose of (Section 206CCA & Section 206AB) increase in compliance burden

- The purpose of the Government is likely to be to compel consumers themselves to compel their suppliers to comply with the requirements on income tax and to file everyone’s ITR and their commitment to increase compliance with income tax. Even so, it may create a major burden of compliance for taxpayers with a huge number of providers to whom such regulations would apply. We will have to wait and see how the sector reacts to this provision and compile with it.

Conclusion:

In order to have a better knowledge of the newly inserted section, let us first know the applicability of Section 206AA & 206CC in brief as the following -

Above Section 206CC & 206AA shall apply if the person fails to provide the PAN, wherein case the person is responsible for deducting/collecting the tax, as the case may be, is asked to apply the tax rate at the higher of the aforementioned:

|

Tax is required to be collected |

Tax is required to be deducted |

|

(i) at 2 times of the rate specified in the relevant section provision of this Act; |

(i) at the rate specified in the relevant provision of this Act; |

|

(ii) at the rate of 5%: |

(ii) at the rate or rates in force; or |

|

|

(iii) at the rate of 20%: |

TDS Deduction Rate Chart for (AY 2023-2024) FY 2022-2023

TDS & TCS Rate chart for FY 2024-25

TDS Deduction Rate Chart for (AY 2025-2026)

| Nature of transaction | Nature of transaction | Section | Threshold Limit (Rs) | TDS Rate | Applicability to NR | Applicability to Residents |

| Payment of salary | Salary | 192 | Basic exemption limit of employee | Normal Slab Rates | Applicable to NR | Applicable To Resident |

| Premature withdrawal from EPF | Withdrawal from EPF | 192A | Rs. 50,000 | 10% | Applicable to NR | Applicable To Resident |

| Interest on securities | Interest on Securities | 193 | a) Debentures- Rs. 5,000 b) 8% Savings (Taxable) Bonds 2003 or 7.75% Savings (Taxable) Bonds 2018- Rs. 10,000 c) Other securities- No limit |

10% | Not Applicable to Nr | Applicable To Resident |

| Payment of any dividend | Dividend payment | 194 | Rs. 5,000 | 10% | Not Applicable to Nr | Applicable To Resident |

| Interest from other than interest from securities (from deposits with banks/post office/co-operative society) | Interest other than Securities | 194A | a) Senior Citizens- Rs. 50,000 b) Others- Rs. 40,000 |

10% | Not Applicable to Nr | Applicable To Resident |

| Income from lottery winnings, card games, crossword puzzles, and other games of any type (Except Online Gaming) | Winnings from Lottery, Card Games, crossword puzzles | 194B | Aggregate income from lottery winnings, card games, crossword puzzles etc- Rs. 10,000 |

30% | Applicable to NR | Applicable To Resident |

| Income from online games | Income from online games | 194BA | No limit | 30% | Applicable to NR | Applicable To Resident |

| Income from horse race winnings | Income from horse race winnings | 194BB | Rs. 10,000 | 30% | Applicable to NR | Applicable To Resident |

| Payment to contractor/sub-contractor:- | Contractor - I/HUF | 194C | a) Single transaction- Rs. 30,000 b) Aggregate transactions- Rs. 1,00,000 |

1% | Not Applicable to Nr | Applicable To Resident |

| Payment to contractor/sub-contractor:- | Contractor - Others | 194C (Others) | a) Single transaction- Rs. 30,000 b) Aggregate transactions- Rs. 1,00,000 |

2% | Not Applicable to Nr | Applicable To Resident |

| Insurance commission to: a) Domestic Companies b) Other than companies |

Insurance Commission - Company | 194D | Rs. 15,000 | 10% | Not Applicable to Nr | Applicable To Resident |

| Insurance commission to: a) Domestic Companies b) Other than companies |

Insurance Commission - Others | 194D | Rs. 15,000 | 5% |

Not Applicable to Nr | Applicable To Resident |

| Income from the insurance pay-out, while payment of any sum in respect of a life insurance policy. | Life Insurance Pay-out | 194DA | Rs. 1,00,000 | 2% | Not Applicable to Nr | Applicable To Resident |

| Payment to non-resident sportsmen/sports association | Payment to NR Sportsmen/Sports Association | 194E | No limit | 20% + Surcharge & Cess | Applicable to NR | Not Applicable to Resident |

| Payment of amount standing to the credit of a person under National Savings Scheme (NSS) | Payment from National Savings Scheme (NSS) | 194EE | Rs. 2,500 | 10% | Applicable to NR | Applicable To Resident |

| Payment for the repurchase of the unit by Unit Trust of India (UTI) or a Mutual Fund | Repurchase of Unit of UTI/MF | 194F | No limit | This section is omitted with effect from 1st October 2024 | Applicable to NR | Applicable To Resident |

| Payments, commission, etc., on the sale of lottery tickets | Payments, commission, etc., on the sale of lottery tickets | 194G | Rs. 15,000 | 2% | Applicable to NR | Applicable To Resident |

| Commission or brokerage | Commission/Brokerage | 194H | Rs. 15,000 | 2% | Not Applicable to Nr | Applicable To Resident |

| Rent on plant and machinery | Rent on Plant & Machinery | 194-I(a) | Rs. 2,40,000 | 2% | Not Applicable to Nr | Applicable To Resident |

| Rent on land/building/furniture/fitting | Rent on Land/Building/Furniture/Fitting | 194-I(b) | Rs. 2,40,000 | 10% | Not Applicable to Nr | Applicable To Resident |

| Payment in consideration of transfer of certain immovable property other than agricultural land. | Transfer of Immovable Property other than Agri Land | 194-IA | Rs. 50,00,000 | 1% | Not Applicable to Nr | Applicable To Resident |

| Rent payment by an individual or HUF not covered u/s. 194-I | Rent payment by I/HUF other than 194I | 194-IB | Rs. 50,000 per month | 2% | Not Applicable to Nr | Applicable To Resident |

| Payment under Joint Development Agreements (JDA) to Individual/HUF | Payment under JDA to I/HUF | 194-IC | No limit | 10% | Not Applicable to Nr | Applicable To Resident |

| Any sum paid by way of fee for professional services | Professional Fees | 194J | Rs. 30,000 | 10% | Not Applicable to Nr | Applicable To Resident |

| Any sum paid by way of remuneration/fee/commission to a director | Remuneration/Fees/ Commission to Director | 194J | Rs. 30,000 | 10% | Not Applicable to Nr | Applicable To Resident |

| Any sum paid as a fee for technical services | Payment as a Fee for Technical Services | 194J | Rs. 30,000 | 2% | Not Applicable to Nr | Applicable To Resident |

| Any sum paid by way of royalty towards the sale or distribution, or exhibition of cinematographic films | Royalty paid towards Sale or Distribution/Exhibition of Cinematographic Films | 194J | Rs. 30,000 | 2% | Not Applicable to Nr | Applicable To Resident |

| Any sum paid as fees for technical services, but the payee is engaged in the business of operation of the call centre. | Fees for Technical Services | 194J | Rs. 30,000 | 2% | Not Applicable to Nr | Applicable To Resident |

| Payment of any income for units of a mutual fund, for example, dividend | Dividend/Income from Units of MF | 194K | No limit | 10% | Not Applicable to Nr | Applicable To Resident |

| Payment in respect of compensation on acquiring certain immovable property | Compensation on acquiring certain immovable property | 194LA | Rs. 2,50,000 | 10% | Not Applicable to Nr | Applicable To Resident |

| Payment of interest on infrastructure debt fund to Non-Resident | Interest on Infrastructure Debt Fund to NR | 194LB | No limit | 5% | Applicable to NR | Not Applicable to Resident |

| Payment of interest for the loan borrowed in foreign currency by an Indian company or business trust against loan agreement or the issue of long-term bonds | Interest for the loan borrowed in foreign currency by an Indian company | 194LC | No limit | 5% | Applicable to NR | Not Applicable to Resident |

| Payment of interest on bond (rupee- denominated) to FII or a QFI | Payment of interest on bond to FII | 194LD | No limit | 5% | Applicable to NR | Not Applicable to Resident |

| Certain income distributed by a business trust to its unitholder | Certain income distributed by a business trust to its unitholder | 194LBA(1) | No limit | 10% | Not Applicable to Nr | Applicable To Resident |

TDS on the transfer of virtual digital assets Specified persons: Individual or a HUF not having income from business or profession OR Individual or a HUF having sales from business or profession less than |

Transfer of virtual Digital asset | 194S | Specified Persons- Rs. 50,000 Others- Rs 10,000 |

1% | Not Applicable to Nr | Applicable To Resident |

| TDS on certain payment to partner | Certain payment to partner | 194T | Rs. 20,000 | 10% | Not Applicable to Nr | Applicable To Resident |

| Income on investments made by NRI citizen | Income on investments made by NRI citizen | 195 | No limit | 20% | Applicable to NR | Not Applicable to Resident |

| Income (including LTCG) from units of an offshore fund | Income (including LTCG) from units of an offshore fund | 196B | No limit | 10% | Applicable to NR | Not Applicable to Resident |

| Income (including LTCG) from foreign currency bonds or GDR of an Indian company | Income (including LTCG) from foreign currency bonds or GDR of an Indian company | 196C | No limit | 10% | Applicable to NR | Not Applicable to Resident |

| Income (excluding dividend and capital gain) from Foreign Institutional Investors. | Income (excluding dividend and capital gain) from Foreign Institutional Investors. | 196D | No limit | 20% | Applicable to NR | Not Applicable to Resident |